September 2024

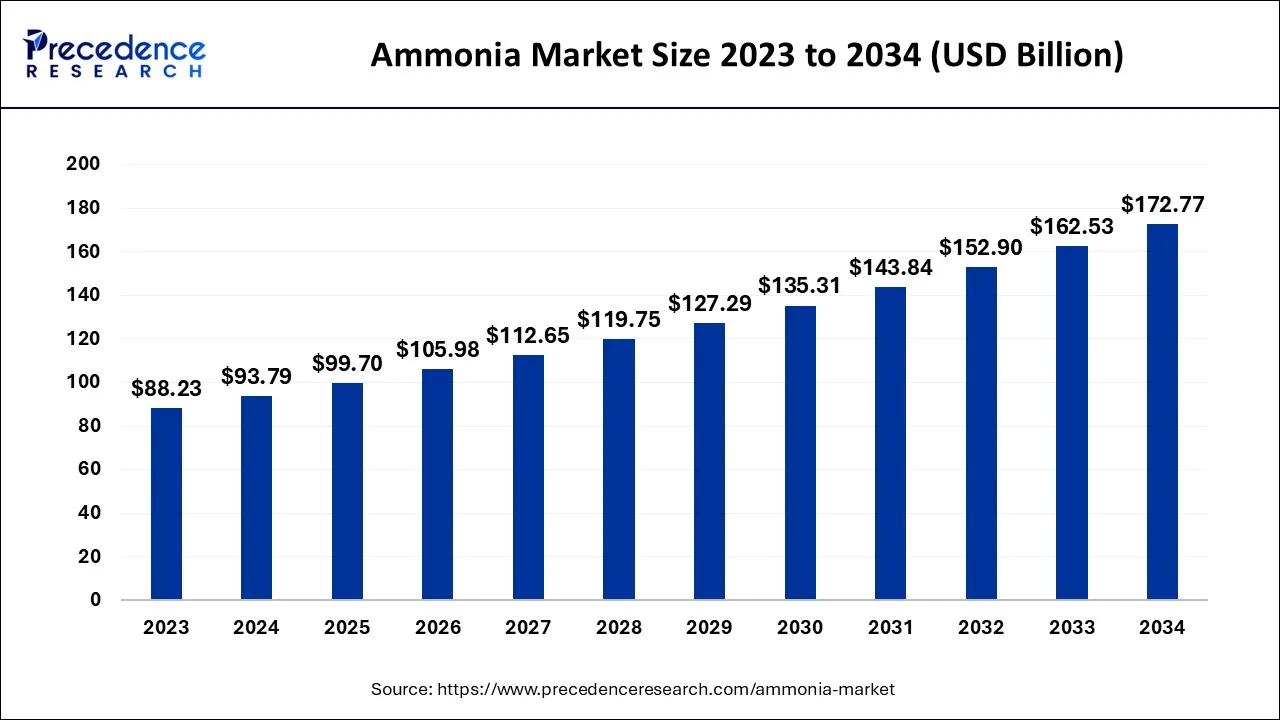

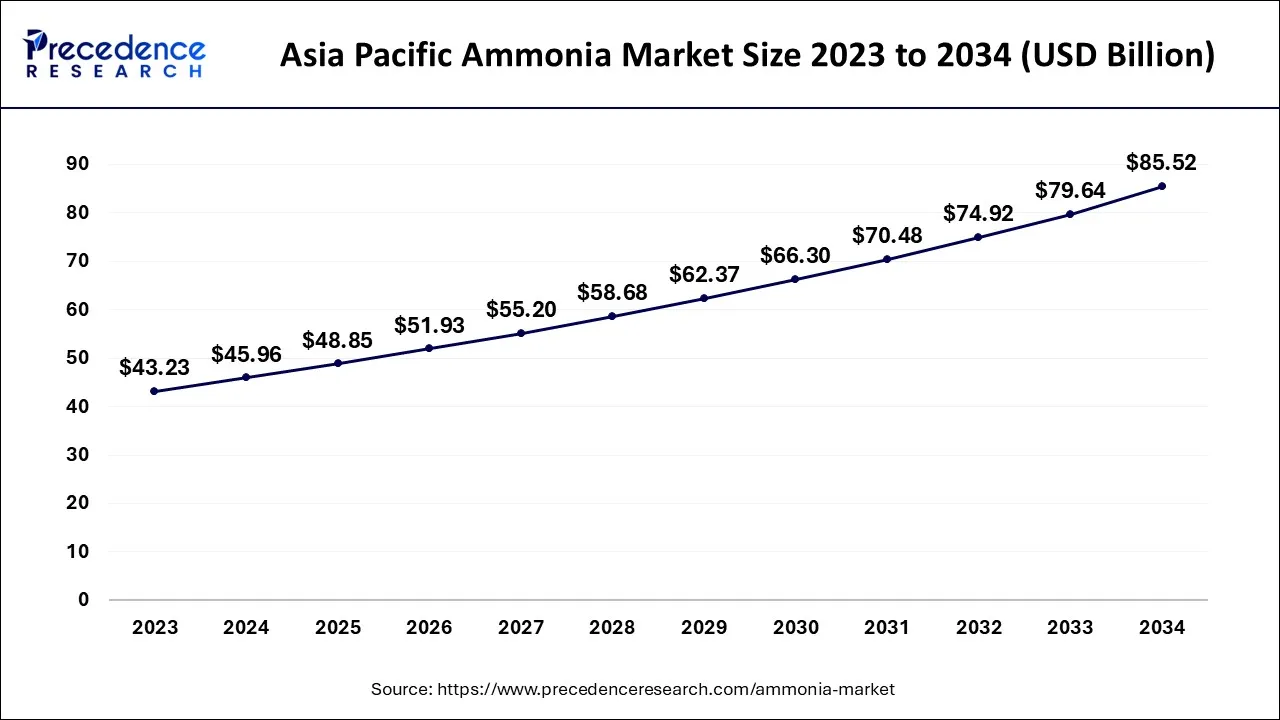

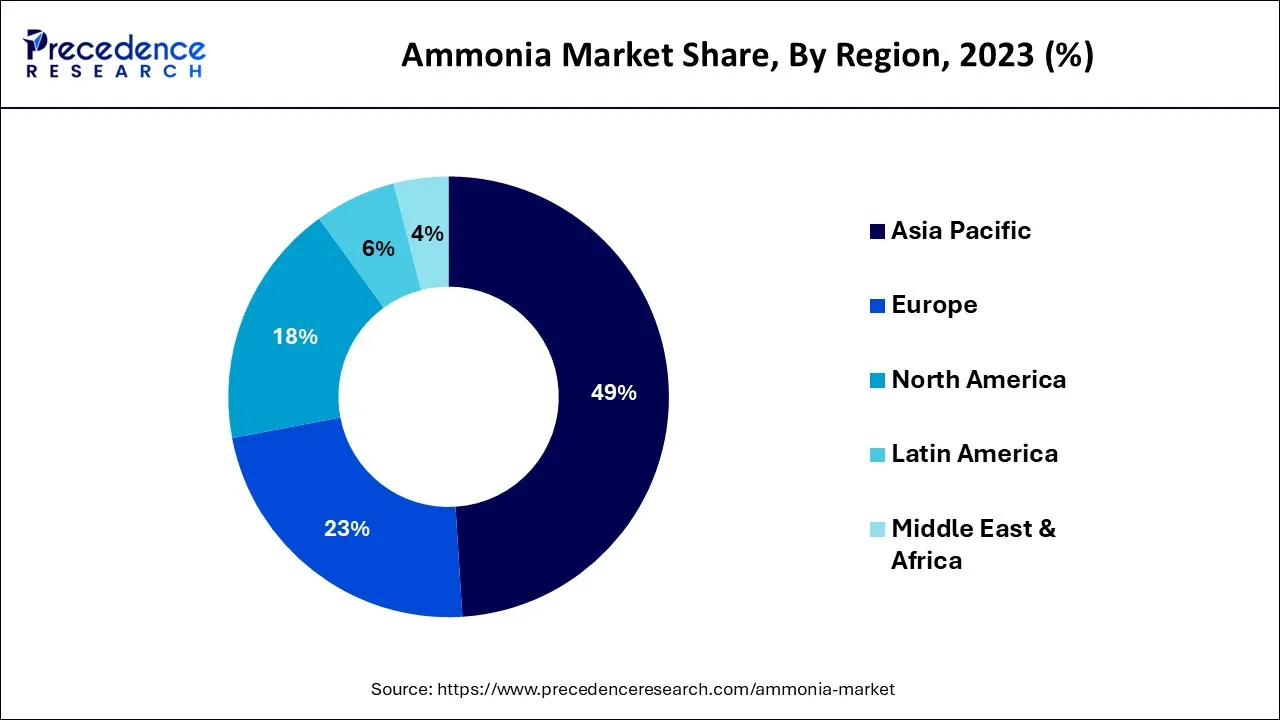

The global ammonia market size is calculated at USD 93.79 billion in 2024, grew to USD 99.70 billion in 2025, and is predicted to hit around USD 172.77 billion by 2034, expanding at a CAGR of 6.3% between 2024 and 2034. The Asia Pacific ammonia market size accounted for USD 45.96 billion in 2024 and is anticipated to grow at the fastest CAGR of 6.41% during the forecast year.

The global ammonia market size is worth around USD 93.79 billion in 2024 and is anticipated to reach around USD 172.77 billion by 2034, growing at a CAGR of 6.3% over the forecast period from 2024 to 2034.

The Asia Pacific ammonia market size is accounted for USD 45.96 billion in 2024 and is projected to be worth around USD 85.52 billion by 2034, poised to grow at a CAGR of 6.41% from 2024 to 2034.

The ammonium market in Asia-Pacific is acknowledged as being the world's largest and fastest expanding in the world. The existence of numerous international companies and the growing demands for agricultural goods in the area are both credited with this expansion. Leading nations in the country's ammonia sector are thought to be India and China. These nations, together with Indonesia, are contributing to the expansion of the ammonia market in the region. Prices have been consistently falling in the market over the last 2 years on a worldwide scale. The widening imbalance between the country's demand and supply is mostly to blame for this. The main cause of the particular market is the additional production as a result of increased production and decreased demand. Lower food and crop costs, dim financial outlooks, erratic power prices, and increasing competition are all factors contributing to this reduced demand. China is the world's top consumer and manufacturer of ammonia. China holds a share of the market of more than 50% in the Asia Pacific. The country's ongoing large-scale manufacturing and use of ammonium are what fuels the increase. China's production capability is expanding quickly as a result of the country's expanding industrial capacity. Such expansion strategies by Chinese businesses are probably going to help the ammonia industry expand over the projected timeframe.

The world's second-largest production and user of ammonium are North America. Ammonia's rise in the United States is being driven by the expansion of the region's finished sectors. Ammonia is mostly used as fertilizer in the agricultural business. In North America, the need for fertilizer is expanding as a result of the region's expanding population and the increasing demand for higher crop yields. The United States is one of the world's top ammonia manufacturers. About 45.50% of the output is utilized in the United States to make nitrogen fertilizer, with the remainder product being used to make synthetic textiles, polymers, resins, and numerous other chemical substances. Since natural gas makes up about 50.50% of the cost of producing fertilizers, its affordability in the nation is anticipated to be a key component in the country's industrial growth.

The fertilizer company's increasing need for ammonia is anticipated to spur industry expansion. The product serves as the foundation for the global nitrogen market. Ammonia is a gas that is colorless, extremely unpleasant, and has a pungent, choke-inducing stench. It creates a solution of ammonium hydroxide which dissolves readily in water. Burns and discomfort may result from the solution. The gas is easily squeezed, and under pressure, it turns into clear, colorless liquids. It is often carried as a compressed fluid in a cylindrical shape. It is also not very flammable, but when subjected to extreme heat, this could explode.

The nation is one of the main manufacturers of goods. Worldwide, it is projected that the product's demand-to-supply ratio would shift toward surplus because generation capacity continues to outstrip consumption, which hurts a negative impact on efficiency levels. This capacity expansion is primarily occurring in areas with low production costs and abundant natural gas supply, such as the Mideast and the United States. In addition, pharmaceutical companies use ammonia significantly to make pharmaceuticals.

Ammonia is a processing aid utilized in the production of a variety of products for fermenting and growth control systems in biotechnology. Ammonia which is extensively utilized in the pharmaceutical business is created when the gas version of ammonium is mixed with water. It is produced for sale using the Haber-Bosch method. Temperature increase, a catalyst, and hot temperatures are all present during the process, which involves a direct interaction between atomic hydrogen and nitrogen. The process can make use of a variety of catalytic materials, including aluminum oxide, magnesium oxide, and iron oxide. It is created in a lab setting by hydrolyzing a metal nitride.

Globally expanding agricultural activity is the main factor boosting the ammonia market. To develop healthily, plants continually need the essential minerals potassium, calcium, nitrogen, magnesium, and sulfur. According to the kind, location, and structure of both plants, the proportion of these minerals varies from plant to plant. Ammonium is often employed as fertilizer because it is thought to be a notable supplier of these nutrients. In the United States, fertilizers accounted for 88% of all ammonia consumption in 2020, according to Mineral Commodity Profiles. This proportion is anticipated to increase over the next few years due to farmers' growing reliance on ammonia to produce excess crop yields.

The main nutrient that plants need to grow robust and increase crop output is nitrogen. Nitrogen, meanwhile, remains a gas and cannot be used for biological or chemical processes. By using the Haber-Bosch procedure, which pulls nitrogen from the atmosphere and transforms it into a solution that plants can ingest, ammonia is rendered useable. Ammonium, which can be used as a direct fertilizer for soil or converted into several Nitrogen fertilizers, is thought to contain a significant amount of nitrogen. Most of the time, ammonia is used as the liquid in each of the chemical's principal uses. Ammonia is among the materials that are essential in the textile industry. In the textile business, ammonia is primarily utilized as a finishing agent for cotton-based materials. Additionally, because ammonia is very soluble in all liquids, it can the ability to give fabric any color.

Over the upcoming years, the ammonium market is expected to grow due to rising textile product demand and government initiatives to boost the textile industry. The government has greatly regulated the usage of ammonia. Thus, the cost of ammonia compounds varies from one country to another due to the intricate production process. Additionally, the oversupply of ammonia producers is restricting the market's expansion. Despite what the manufacturers are capable of producing, they cannot. This aspect is causing pricing uncertainty and will probably slow the ammonia industry's growth during the anticipated time frame.

| Report Coverage | Details |

| Market Size in 2024 | USD 93.79 Billion |

| Market Size by 2034 | USD 172.77 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.3% |

| Largest Market | Asia-Pacific |

| Second Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

In terms of product form, the product's water content dominated the marketplace. Throughout the projected timeframe, the ammonia market is anticipated to grow due to the increasing demand for the substance in end-use applications. The truest form of ammonia, dehydrated ammonia, is devoid of any water molecules. It is a noxious gas that emits choke-inducing vapors and is mostly used as fertilizer. When utilized as a food ingredient, it is compacted into a colorless, clear liquid. 3 sections of hydrogen and a component of nitrogen are used to make it. In its diluted state, the substance is easily used for commercial cleaning tasks and the creation and production of particular compounds.

The liquid form of ammonia is most frequently employed. Major applications include residential and commercial cleaning as well as fertilizers. It is condensed into a fluid and combined with various plant stimulants for use in fertilizer. It reacts with moisture content within the gas phase to produce fertilizer soil that is abundant in ammonia.

Fertilizers containing ammonia are largely utilized in the agriculture sector. With a 42% share of the market during 2023, the recommended fertilizer category dominated the worldwide market. It is regarded as a significant supply of nitrogen, that is crucial for plant growth. Additionally, it is employed in the production of several liquid fertilizer mixtures that include urea, aquatic ammonia, and ammonium salts. Due to its quick reactions with soil moisture, free hydrogen ions, organic matter, and silty clay, ammonia is frequently utilized in agricultural applications. The characteristics that improve the utilization of ammonium in the sector include infiltration rate, land quality & architecture, and method. Textiles, pharmaceuticals, domestic and industrial cleaning, food and drink, metallurgical operations, wastewater and water treatment, polymers, pulp, and paper, & leather are some more potential sectors. Due to its great efficiency, environmental friendliness, cost-effectiveness, lower pipe size, and superior heat transfer capabilities, ammonia is utilized as a refrigerator.

Ammonia cooling systems are a secure and ecological alternative in a world where energy usage methods are being prioritized. It is regarded to be the most environmentally benign coolant among renewable sources. It has no potential to warm the atmosphere or deplete the ozone layer. Compared to certain other chemical refrigeration systems, ammonium also has more efficient heat transfer characteristics. Due to the ability to use refrigerant technology in a shorter area for heat transfer plant building and systems, operational costs are reduced. The majority of ammonia's usage as a coolant is in large industrial and commercial settings.

Segments Covered in the Report

By Product Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

December 2024