January 2025

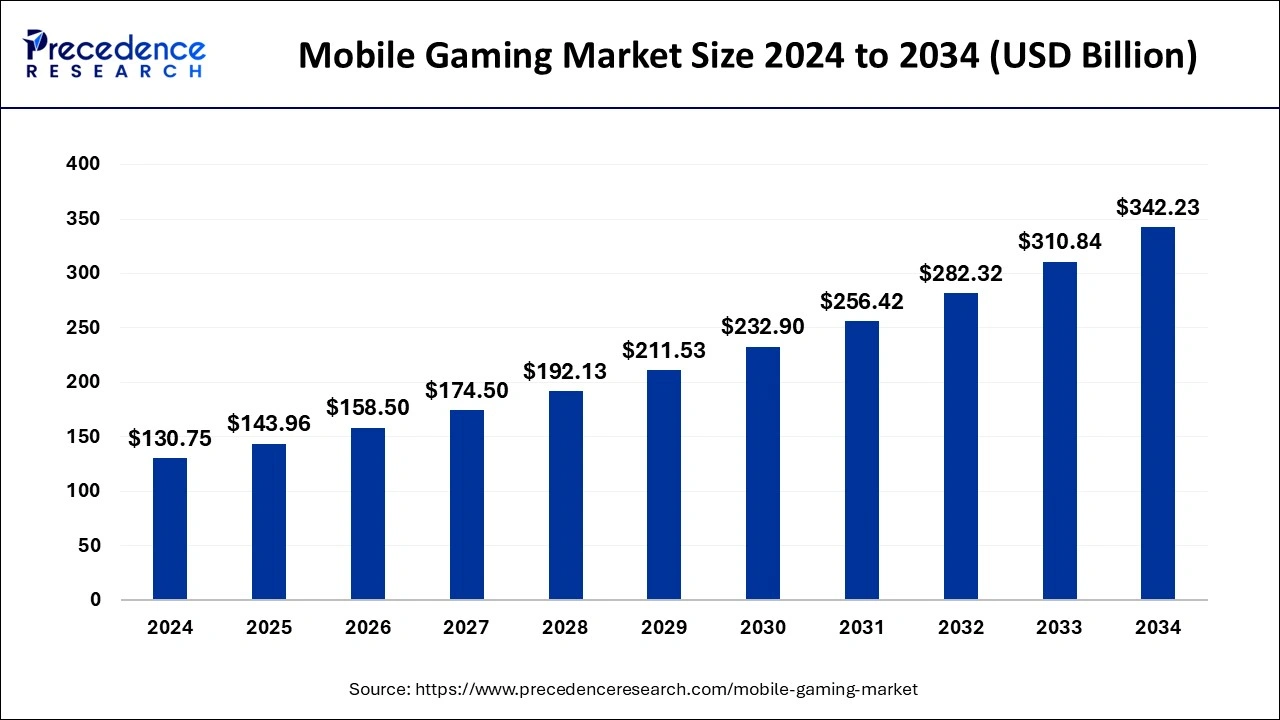

The global mobile gaming market size accounted for USD 130.75 billion in 2024, grew to USD 143.96 billion in 2025, and is expected to be worth around USD 342.23 billion by 2034, registering a healthy CAGR of 13.1% between 2024 and 2034.

The global mobile gaming market size is expected to be valued at USD 130.75 billion in 2024 and is anticipated to reach around USD 342.23 billion by 2034, expanding at a CAGR of 13.1% over the forecast period 2024 to 2034.

The mobile gaming market is experiencing significant growth in a major trend called technology advancement. For immersive gaming experiences, augmented Reality and Virtual Reality technologies are being integrated into mobile gaming in the market. While AR integrates virtual data with the actual world, virtual reality is a computer-generated environment with scenes and objects that appear to be real. Through the use of VR eyewear, players can escape reality by submerging themselves in an alternative gaming world or the actual world. In a game, augmented reality (AR) enhances or modifies some parts of the existing surroundings rather than transporting the player to a different area.

The range of mobile games starts from the simplest ones to the most complex games including AR (augmented reality), 3Ds, among others by utilizing the internet to do brainstorming.

A significant driver of the market's expansion is the expanding use of smartphones and the deployment of cutting-edge game making technologies. Additionally, esports' rising recognition is a significant industry driver. Additionally, consumers will have access to better connection rates as 5G technology spreads, which will increase the market for mobile gaming. Additionally, when people's disposable money rises, they are able to purchase cell phones, which leads to an increase in the number of gamers.

| Report Coverage | Details |

| Market Size in 2024 | USD 130.75 Billion |

| Market Size in 2025 | USD 143.96 Billion |

| Market Size by 2034 | USD 342.23 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.1% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Platform, Age Group, Business Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Internet penetration

Online gaming has become largely practical in the past few years as a result of the raised accessibility of the internet, primarily in emerging nations. Gaming is one of the fastest-growing industries in India's media and entertainment business. One of the top five mobile gaming markets in the world is in this country as it has limitless potential and can be downloaded for free, the Free-to-Play price model is also a popular choice for mobile games. Players can do this so they can test out a game before investing their time or money, and as a result, they usually increase their earnings.

For instance, Pokemon GO is a free game that was played by Americans in 2016 and is expected to reach 67 million players by the year 2020, according to data from Bank of America. This approach may change if new technologies like augmented reality and 5G become accessible. The market for mobile gaming is anticipated to grow also as a result of the widespread adoption of 5G and better download rates.

Monetization challenges

The difficulty of monetizing is one of the major restraint for the mobile gaming market. Although many mobile games can be downloaded for free, they frequently rely on in-app sales or adverts to make money. It can be difficult to strike the perfect mix between user experience and monetization, though. In-app purchases may be viewed as obtrusive or forceful, which adversely affects user satisfaction. In addition, some users could be reluctant to spend money on games, particularly if they feel under pressure to do so. Similar to how advertising can hurt user experience, it can likewise reduce player engagement and reduce revenue for game producers.

The complexity of anticipating revenue streams is another obstacle with monetization. The revenue sources for mobile games can be erratic, making it difficult for game developers to efficiently plan and implement their business strategies. For game makers, especially tiny or new entrants in the industry, this might cause financial instability.

Growing smartphone adoption

The increasing use of smartphones is one of the key potentials for the mobile gaming sector. Mobile games are now more accessible than ever because of smartphones' rising price and availability. Additionally, improvements in smartphone technology have enhanced the overall gaming experience, increasing player engagement and the opportunity for game producers to earn more money. The mobile gaming market has the potential to appeal to a wider audience as more people embrace smartphones, perhaps including new geographic and demographic groups.

The industry for mobile gaming has expanded to become a substantial source of income for game creators with the rise of mobile devices. The market's revenue potential is anticipated to rise as more people continue to use smartphones and mobile gaming is made more widely available.

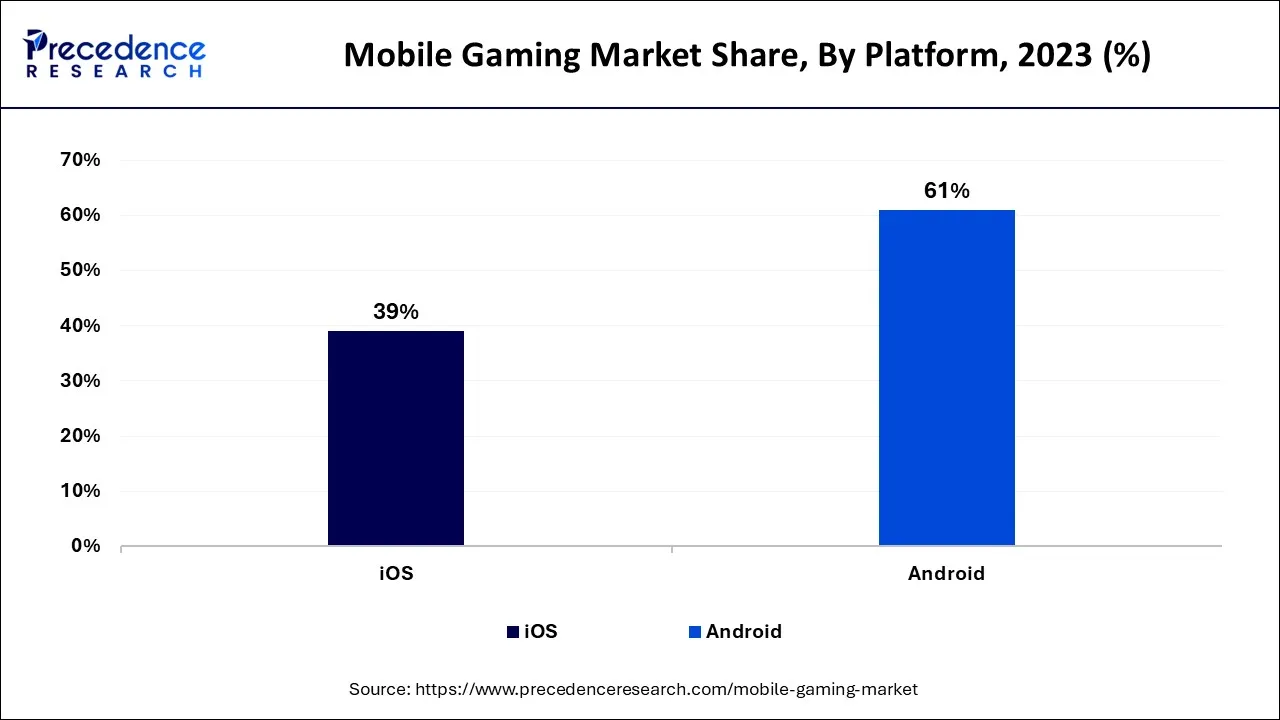

The market segments include retailers depending on the platform for Android, iOS, and other third parties. During the projected period, IOS is anticipated to generate the greatest share. More than one billion active iPhones, according to Apple Inc., is a significant accomplishment for the company and evidence of the phones' enduring popularity and toughness.

In 2023, there were over a million gaming apps available on the App Store. Less than one-third of mobile gaming apps are conventionally paid downloads, with in-app purchases and advertising providing the majority of their revenue. The top games on the App Store include Candy Crush Saga, Clash of Clans, Clash Royale, and casino games, the largest-grossing iOS title.

In 2023, the 22–24 age group had the largest market share due to their stronger use of cutting-edge technologies. Furthermore, because they are technologically savvy and eager to explore new things, the bulk of smartphone users fall into this age group. The introduction of new cellphones with unique capabilities that support sophisticated games has an impact on gamers' involvement because these gadgets provide positive user experiences.

The freemium business model held the maximum share in 2023. The growth is attributed to the additional incentive of making in-game purchases offered by freemium games. In a freemium game, the user must pay to access the extra features like level upgrades even when the basic game edition is fully free to access. The architecture of freemium games is crucial since the player should not feel that a level is either too challenging to advance or too simple to pass. A sizable percentage of the money for freemium game developers comes from advertisements, in-app sales, and virtual item purchases. Additionally, the availability of several payment methods with such businesses enables players to select according to preferences, thereby increasing the revenue from mobile games. For instance, Candy Crush Saga generates income via a freemium business model.

Asia-Pacific are expected to dominate the regional market. During the forecast period, it is expected that Asia-Pacific would grow at a remarkable CAGR. China is the main country responsible for a sizable portion of the region's economy. One of the biggest mobile gaming markets in Asia-Pacific, China, has expanded due to Covid. Mobile games' ability to provide continual enjoyment through cloud-based and offline applications has completely changed the gaming industry. Millions of people are projected to continue to be drawn to the entertainment available on the go, particularly in developing economies like China.

The rapid growth of minigames played without downloading a separate application within mobile applications like WeChat aids in the development of the Chinese gaming market. These minigames are easy to play, usually include important social components, and have gained a lot of popularity across the country. The pragmatism of mobile phones, which was less costly than gaming PCs and occasionally offered Chinese customers with their only internet access, contributed to this boom in part.

Segments Covered in the Report

By Platform

By Age Group

By Business Model

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

December 2024

November 2024