January 2025

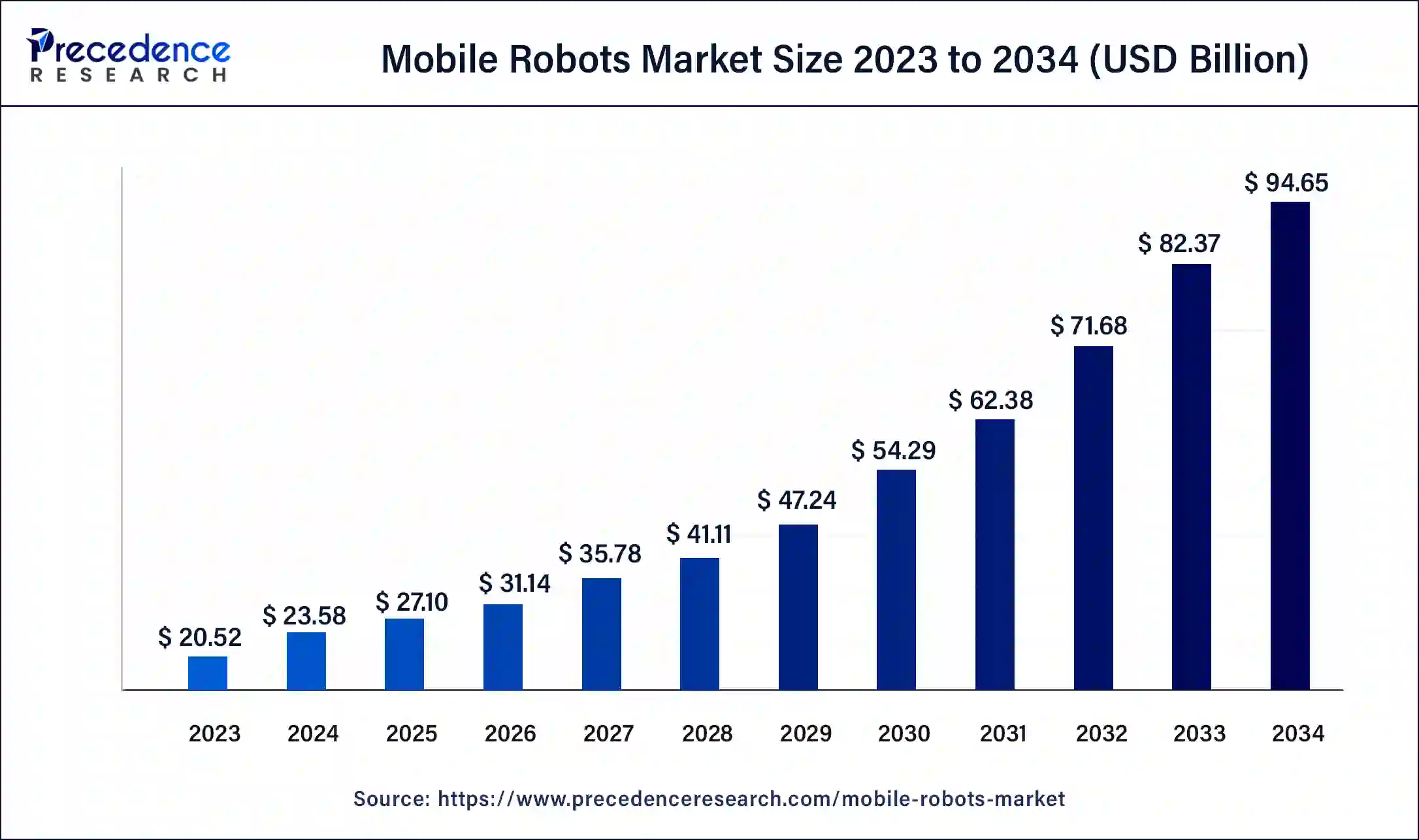

The global mobile robots market size surpassed USD 20.52 billion in 2023 and is estimated to increase from USD 23.58 billion in 2024 to approximately USD 94.65 billion by 2034. It is projected to grow at a CAGR of 14.91% from 2024 to 2034.

The global mobile robots market size is projected to be worth around USD 94.65 billion by 2034 from USD 23.58 billion in 2024, at a CAGR of 14.91% from 2024 to 2034. Innovations in robotics and artificial intelligence are leading to their increasing adoption in industries such as healthcare, manufacturing, and defense, driving growth in the mobile robots market.

Mobile robots are autonomous robots that can work without assistance from human operators in a variety of settings. Robots are considered autonomous when they can make decisions independently around performing tasks. Mobile robots usually have a few standardized components in place, including locomotion, perception, cognition, and navigation systems. These robots make decisions based on algorithms programmed into them. Mobile robots use artificial intelligence and their physical robotic components to perform tasks. Drones, humanoid robots, and underwater robots are some examples of mobile robots.

The mobile robots market is expected to see substantial growth due to the rise in AI and automation across industries such as medicine, surgery, personal assistance, logistics, manufacturing, and security. Advancements in machine learning, computer vision, and language processing are enhancing the capabilities of mobile robots. The healthcare sector, in particular, is contributing to market growth due to advancements in robotic surgery.

High upfront costs and a lack of awareness around mobile robotics are restraining growth in the mobile robots market. The advent of 3D printing and advances in component manufacturing are bringing down mobile robot manufacturing costs. Innovations in artificial intelligence are allowing for the development of more sophisticated mobile robots, providing opportunities for new players in the space.

How is AI Improving the Mobile Robots Market?

Artificial intelligence is transforming mobile robotics in several ways. AI-based technologies such as convolutional neural networks are widely employed in the sector for robots to identify objects and people in the surrounding environment and identifying the most efficient routes to get around them. Natural language processing is also being deployed so that these mobile robots can interact with humans accurately though spoken or written language. Machine learning algorithms also help robots perform tasks faster and more accurately than before.

| Report Coverage | Details |

| Market Size by 2034 | USD 94.65 Billion |

| Market Size in 2023 | USD 20.52 Billion |

| Market Size in 2024 | USD 23.58 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Demand for mobile robots in healthcare and for personal use

The mobile robots market is gaining significant traction in the medical industry with advancements in artificial intelligence, augmented reality, and natural language processing. Hospitals, nursing homes, and healthcare institutions are increasingly using mobile robots to reduce the burden of routine tasks and to streamline workflows in logistics. Mobile robots are used to transport sterile supplies, deliver medication, lab tests, and other supplies to various departments, and send meals to patient wards. By taking over these physically demanding, routine tasks, these robots are preventing injuries among support staff.

The mobile robots market has seen a spike in demand, notably since the Covid-19 pandemic. Companion robots are now becoming a staple in residences, nursing homes, and hospitals to provide engagement for older adults, reducing stress, loneliness, and medical use, ultimately leading to better patient outcomes.

Widespread adoption of defense

Mobile robots market applications are currently extensively used in the military and civil defense domains. Mobile robots are deployed for several tasks, such as search and rescue, reconnaissance, training, mine clearance, and firefighting. Military robots such as drones and bomb-defusal robots are widely used to access remote areas for surveillance. Packbots, designed by Endeavor Robotics, have previously been used in war zones in both Iraq and Afghanistan. They were also used to search through the debris of the World Trade Center after 9/11 in 2001 and, more recently, during the Fukushima nuclear plant disaster. NASA has also frequently collaborated with Endeavor Robotics to use their technology for interplanetary rovers and probes.

High acquisition and maintenance costs

The initial investment necessary for switching to mobile robots is prohibitive. These machines also need to undergo regular maintenance. Companies in the mobile robots market tend to invest substantial amounts of time and money in the research and development of new technologies. This drives up costs for the end-user. While mobile robots provide long-term benefits in terms of productivity and efficiency, companies are hesitant to adopt mobile robotics due to the large initial financial commitments involved. As the technology evolves and scalability improves, a decrease in acquisition and maintenance costs is expected.

Development of the internet of robotic things

The growing popularity of the Internet of Things has given way to innovations such as the development of the Internet of Robotic Things, which combines the Internet of Things with robotics. The Internet of Robotic Things is a proposed global infrastructure that connects robots, enabling the exchange of information through converged clouds and shared services. In the mobile robots market, integration of mobile robots with cloud computing has the potential to reduce update and maintenance costs.

The unmanned aerial vehicle (UAV) segment dominated the mobile robots market in 2023. The segment has seen significant growth due to global conflicts such as the Russia-Ukraine war, which started in 2022 and is still ongoing. The conflict prompted substantial military investment from both sides, focusing more on unmanned aerial vehicles. The recent development of drone-in-a-box technology includes drones that can travel to a certain point and return to a self-charging station upon completion of their tasks. Drone-in-a-box technology has seen several applications in the telecom, space, and maritime industries.

The unmanned ground vehicle (UGV) segment is expected to grow at the fastest rate in the mobile robots market during the forecast period. Latest innovations in artificial intelligence in unmanned ground vehicles are expected to spur demand, especially in the military sector, for use in dangerous environments to deal with biological, chemical, and nuclear threats.

The logistics & warehousing segment dominated the mobile robots market in 2023. The rise of e-commerce in the past decade has led to increased efforts for warehouse optimization. Mobile robots help with the transportation of materials and goods in warehouses and distribution centers, reducing labor costs and improving accuracy. Mobile robots are especially useful in handling hazardous materials like corrosive chemicals, helping maintain worker safety.

The domestic segment is set to grow at the fastest rate in the mobile robots market over the forecast period between 2024 and 2033. The demand for domestic mobile robots to perform tasks such as cleaning is rising. Technological advancements in domestic robots have led to increased sophistication, with machines now equipped with sensors, cameras, and AI-driven software that allow them to navigate home environments. The availability of open-source software development, Internet of Things integration, and a reduction in component costs is expected to spur further demand in this segment.

The hardware segment accounted for the largest share of the mobile robots market in 2023. Continued innovation in mobile robotics has led to increased sophistication in hardware components. The growing popularity of 3D printing has given rise to robots built with printing materials through fused deposition modeling made of polylactic acid, which makes manufacturing, construction, and assembly cost-effective and easy.

The software segment is expected to have the highest compound annual growth rate in the mobile robots market during the forecast period. Software is a crucial part of mobile robots as it runs the scanning and visual processing software, motion planning, navigation systems, control systems, and safety systems.

North America dominated the global mobile robots market in 2023. The region houses several major players in the space and is a major producer of mobile robots for warehouse automation. Substantial investment in research and development in sensors, mobile networking, artificial intelligence, and machine learning in the region has led to several breakthroughs in mobile robotics. The robust technological infrastructure and a rise in e-commerce in the region have led to widespread automation in manufacturing and logistics. Companies are increasingly investing in automation to improve productivity and cut down on labor costs.

Asia Pacific is set to host the fastest-growing mobile robots market over the forecast period. Emerging economies like China and India are seeing widespread adoption of mobile robots due to a rapid expansion of the e-commerce, automotive, and food and beverage sectors. Rapid industrialization is spurring demand for mobile robots to optimize material handling, transportation, and warehouse logistics.

Japan is especially looking to robots and automation to deal with labor shortage issues expected in the coming years. Moving cargo in and out of trucks and warehouses is one of the most time-consuming tasks in logistics. Automating the process could save up to 25% of working hours, allowing employers to adhere to Japan’s overtime regulations and thus boosting productivity. Japan is also exploring mobile robotics options for infrastructure maintenance.

Segments Covered in the Report

By Product

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

December 2024

November 2024