September 2024

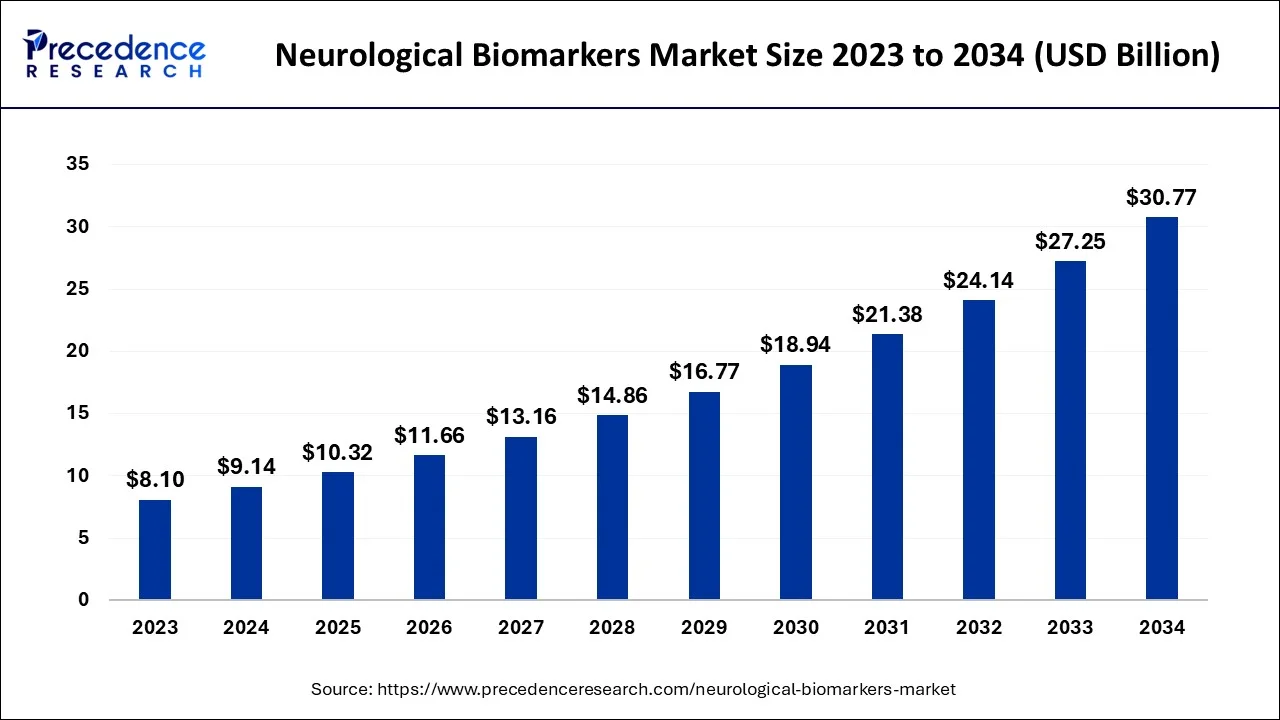

The global neurological biomarkers market size accounted for USD 9.14 billion in 2024, grew to USD 10.32 billion in 2025 and is expected to be worth around USD 30.77 billion by 2034, registering a healthy CAGR of 12.90% between 2024 and 2034. The North America neurological biomarkers market size is calculated at USD 3.66 billion in 2024 and is estimated to grow at a fastest CAGR of 13.02% during the forecast period.

The global neurological biomarkers market size is calculated at USD 9.14 billion in 2024 and is projected to surpass around USD 30.77 billion by 2034, expanding at a CAGR of 12.90% from 2024 to 2034. The benefits of neurological biomarkers include being used to track brain health by researchers measuring molecules, being helpful in more effective treatments, faster drug development, earlier diagnosis, and being less invasive, which helps the growth of the market.

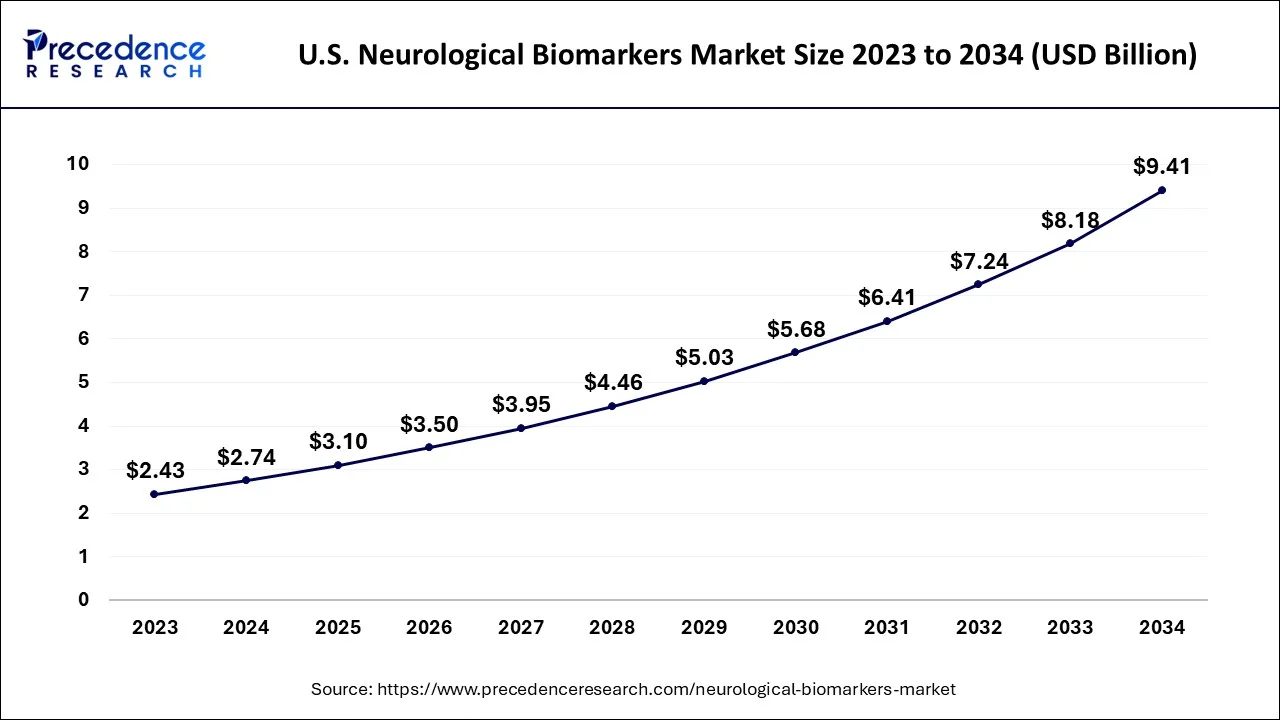

The U.S. neurological biomarkers market size is exhibited at USD 2.74 billion in 2024 and is projected to be worth around USD 9.41 billion by 2034, growing at a healthy CAGR of 13.09% from 2024 to 2034.

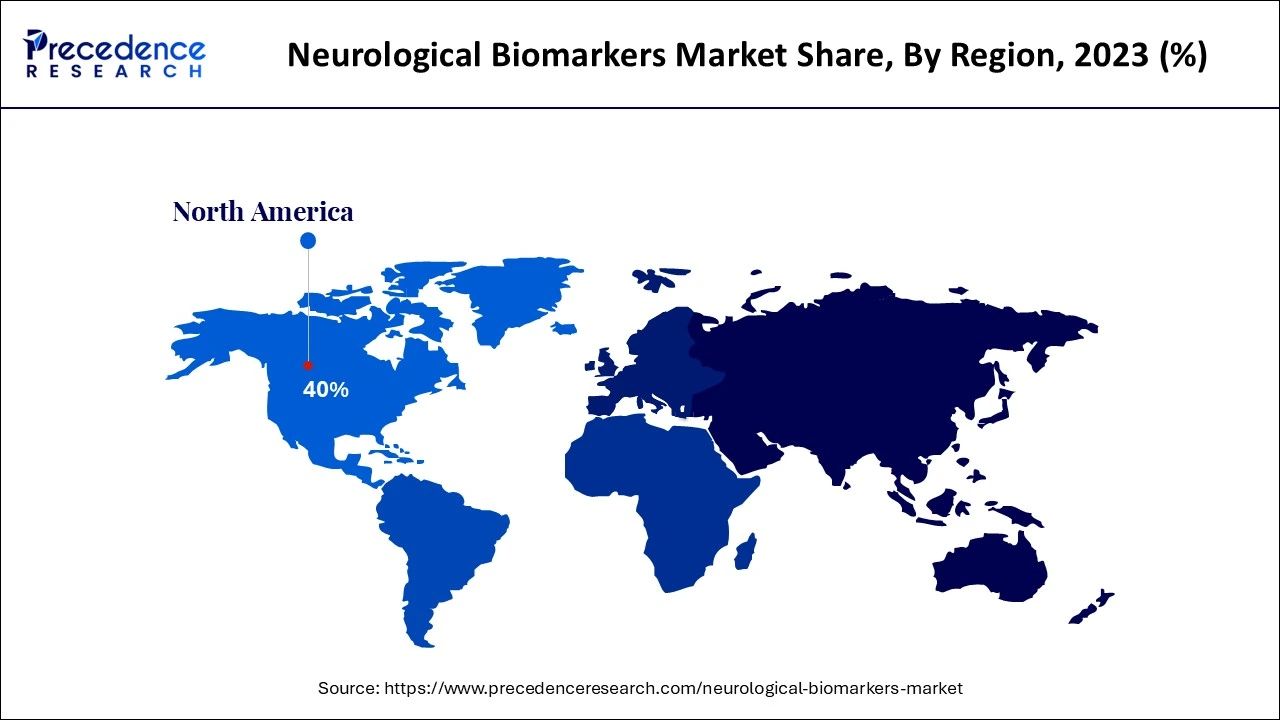

North America dominated the neurological biomarkers market in 2023. In drug development, a rising understanding of the remarkable potential of biomarkers and the presence of regulatory bodies helps the growth of the market in North America. For the development of neurological biomarkers, government funding increased, which helped the growth of the market.

In Canada, one in 400 Canadian people, or more than 90000 people across Canada, live with MS (multiple sclerosis), a chronic, neurodegenerative disease that affects the central nervous system.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. The rising senior population which is highly susceptible to these neurological diseases and the increasing prevalence of neurological diseases contribute to the growth of the market. India and China are the leading countries for the growth of the neurological biomarkers market in the Asia Pacific region.

The neurological biomarkers market is a dynamic and rapidly evolving sector in the broader field of life sciences and healthcare. Neurological biomarkers are key tools that allow the monitoring, diagnosis, and research of conditions affecting the central and peripheral nervous systems and neurological disorders. In neurodegenerative diseases, the identification of biomarkers is a major topic. Biomarkers are objectively evaluable and measurable indicators that serve to describe pathological processes, normal biological processes, and pharmacological responses to therapeutic intervention. The main aim of the use of biomarkers is to enhance clinical diagnosis in the sense of raising the accuracy of different diagnoses. These factors help to the growth of the market.

How can AI help the Neurological Biomarkers Industry?

Artificial intelligence (AI) can help to analyze wide data volumes, and biomarkers clinicians may miss and improve treatment and diagnosis accuracy. Machine learning (ML) algorithms can process high-data sets and patient information, developing accurate models for treatment and diagnosis. Current tools use AI for accurate brain mapping, surgical planning, and epilepsy diagnosis. The use of AI can improve diagnosis and treatment accuracy, explore biomarkers clinicians may miss, and analyze large data volumes. These factors help to the growth of the neurological biomarkers market.

| Report Coverage | Details |

| Market Size by 2034 | USD 30.77 Billion |

| Market Size in 2024 | USD 9.14 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of neurological conditions

The rising prevalence of neurological conditions contributes to the growth of the market. Neurological conditions or disorders that affect the functions of the nervous system. This involves the peripheral nervous system and central nervous system. The causes of neurological conditions include stroke, tumors, injury or damage, abnormal development, infections, genetic disorders, aging, and exposure to pollutants. These disorders may cause behavioral, emotional, cognitive, and physical symptoms like coordination difficulties, mood changes, confusion, and pain. These factors help to the growth of the neurological biomarkers market.

Challenges of neurological biomarkers

The challenges of neurological biomarkers include disadvantages such as laboratory errors, ethical responsibilities, normal range difficulty to start, longevity of sample or storage, expensive or high cost of analyses, and timing critical. These factors can hamper the growth of the market. Neurological biomarkers are crucial tools for understanding and diagnosing neurological disorders, but there are some disadvantages, including clinical challenges, technical issues, high cost and complexity, poor clinical diagnosis, lack of standardization, and limited accessibility. These factors can restrict the growth of the neurological biomarkers market.

Biomarker Research

The future opportunities of neurological biomarkers are encouraging and expected to significantly impact the management, diagnosis, and treatment of neurological disorders. There is an opportunity for advancement in biomarker research to understand the pathophysiology of neurological disorders and design therapeutic targets for effective mediation. To overcome challenges like laboratory errors, ethical responsibilities, normal range difficulty to start, longevity of samples, high cost of analyses, and critical timing by research and development in neurological biomarkers. These factors help the growth of the neurological biomarkers market.

The proteomic biomarkers segment dominated the neurological biomarkers market in 2023. In the field of medical research and diagnostics, proteomic biomarkers play an important role. The advantages of proteomic biomarkers include the detection of diseases like different types of cancer, understanding of disease pathogenesis, and the discovery of non-invasive diagnostic biomarkers that may be detected in biological samples like urine or blood, which help to make the diagnostic process less irritating for patients. In personalized treatments, proteomic biomarkers can indicate how a patient’s disease progresses and how they respond to specific treatments. Identification of proteomic biomarkers leads to the discovery of novel therapeutic targets, which lead to the development of more effective treatments.

The advantages also include the prediction of treatment side effects and monitoring treatment response, which will help the growth of the market. These factors help to the growth of the proteomic biomarkers segment and contribute to the growth of the market.

The other segment is anticipated to grow significantly during the forecast period. The other types include digital biomarkers, which help the growth of the market. The benefits of digital biomarkers include helping to allow for better health management, reducing the cost of clinical data collection, and providing personalized remote patient care. The capacity of wearable and mobile application technology to continually assess health data from many sources enables patients to better understand their disorders and to make better health decisions. It helps doctors to deliver remotely individualized care without the need to visit a hospital or a doctor. These factors help to grow the other types of digital biomarkers and contribute to the growth of the neurological biomarkers market.

The Alzheimer’s disease segment dominated the neurological biomarkers market in 2023. In the treatment of Alzheimer’s disease, neurological biomarkers play an important role. Clinical diagnosis is based on the clinical phenotype; increasingly, biomarkers are available to differentiate between the different diseases and different Alzheimer’s disease phenotypes, mainly at the early stages, and help in identifying those at risk for symptomatic Alzheimer’s disease. Biomarkers of Alzheimer's disease help in the identification and treatment of neuropsychiatric symptoms of dementia, disease-modifying therapies, monitoring the impact of lifestyle intervention, aiding in differential diagnosis of mild cognitive impairment (MCI) and dementia, screening at-risk populations for disease, and aiding in planning for end-of-life care. These factors help the growth of the Alzheimer’s disease segment and contribute to the growth of the market.

The Parkinson’s disease segment is expected to grow substantially during the forecast period. Parkinson’s biomarkers are helpful for researchers in diagnosing earlier Parkinson’s disease with greater precision. It also helps to track disease progression and respond to the treatment. These factors help the growth of the Parkinson’s disease segment and contribute to the growth of the neurological biomarkers market.

The research organizations & others segment dominated the neurological biomarkers market in 2023. In research organizations & others, biomarkers are uncommonly used in neurological disorders, but better technology is making it easier for researchers by measuring molecules to track brain health. This will hopefully lead to more effective treatments, faster drug development, earlier diagnosis, and less invasive testing. These factors help to the growth of the research organizations & other segments and contribute to the growth of the market.

The hospital & hospital laboratories segment is estimated to be the fastest-growing during the forecast period. In hospital & hospital laboratories, neurological biomarkers play an important role. Neuroimaging biomarkers are obtained from devices like DTI, MRI, and PET, which offer objective measures of mind shape and functions. In hospital & hospital laboratories, personalized medicinal drugs use neurological biomarkers to adopt remedies for individual patients based on their different needs and treatments. Neurological biomarkers can monitor progression and response to therapy, evaluate disease stage, and guide clinical diagnosis. These factors help the growth of the hospital & hospital laboratories segment and contribute to the growth of the neurological biomarkers market.

Segments Covered in the Report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

May 2025

December 2024

January 2025