January 2025

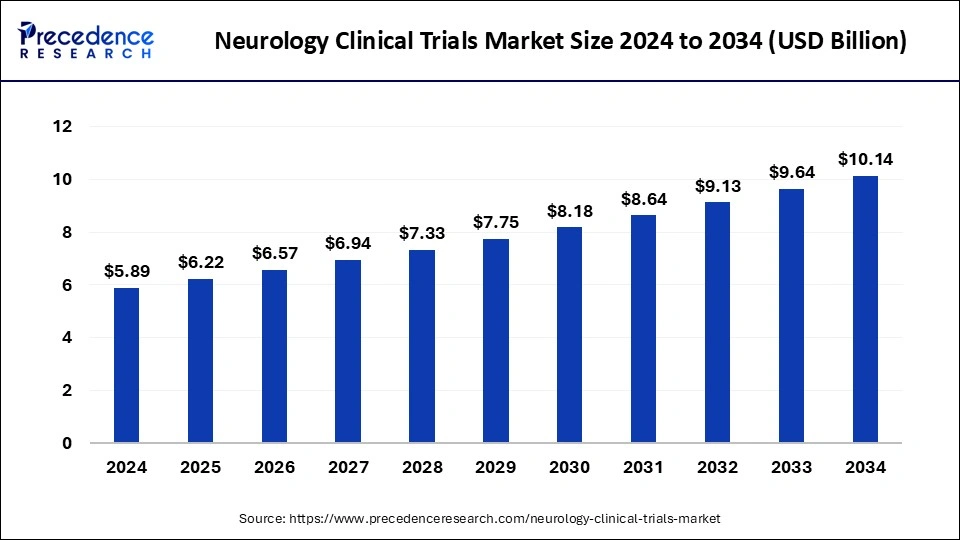

The global neurology clinical trials market size is calculated at USD 6.22 billion in 2025 and is forecasted to reach around USD 10.14 billion by 2034, accelerating at a CAGR of 5.58% from 2025 to 2034. The North America neurology clinical trials market size surpassed USD 2.83 billion in 2024 and is expanding at a CAGR of 5.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global neurology clinical trials market size was estimated at USD 5.89 billion in 2024 and is predicted to increase from USD 6.22 billion in 2025 to approximately USD 10.14 billion by 2034, expanding at a CAGR of 5.58% from 2025 to 2034. The benefits of neurology clinical trials include access to the latest therapies, reduced cost, a chance to help others, closer monitoring, and careful and regular monitoring from the research team that includes healthcare professionals, doctors, and others. These factors help to the growth of the market.

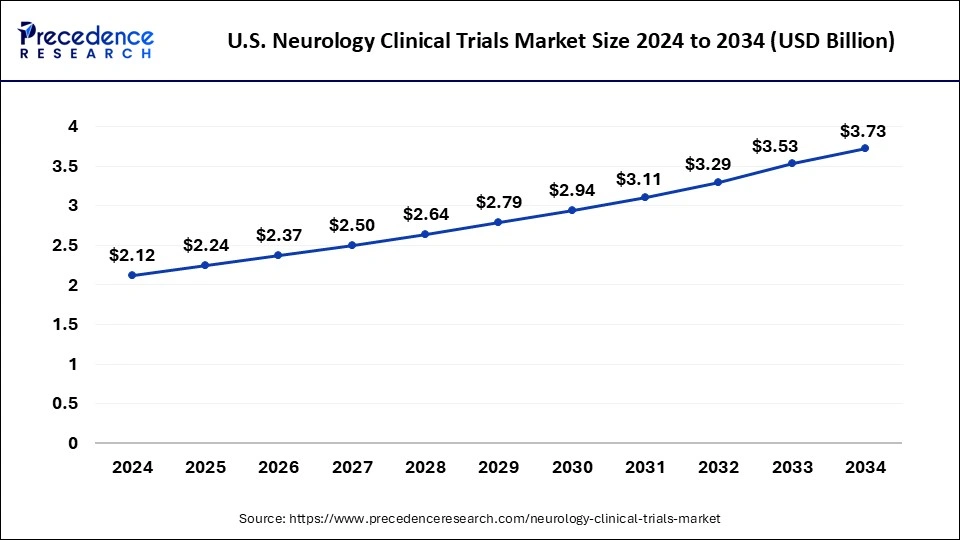

The U.S. neurology clinical trials market size was exhibited at USD 2.12 billion in 2024 and is projected to be worth around USD 3.73 billion by 2034, poised to grow at a CAGR of 5.81% from 2025 to 2034.

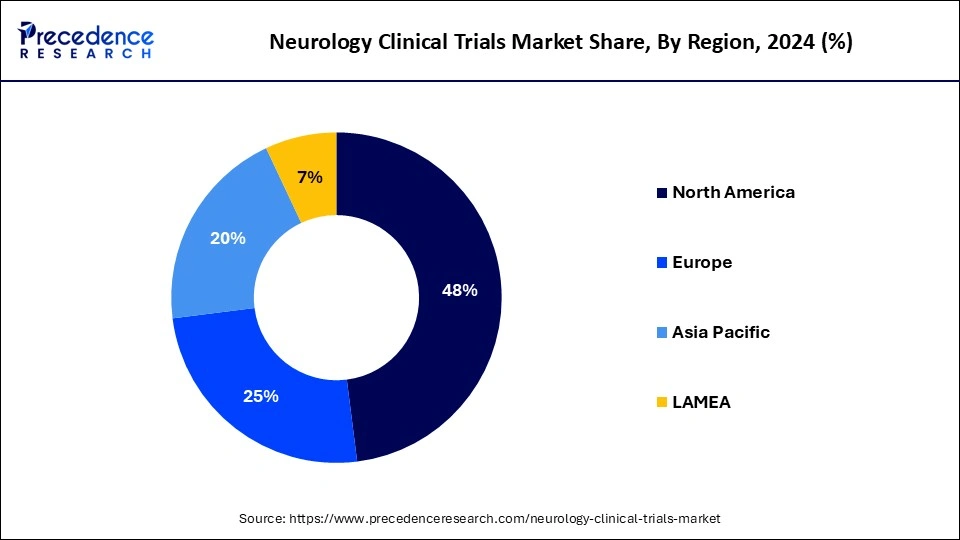

North America dominated the neurology clinical trials market in 2024. The presence of a high number of players in neurological clinical trials and the increasing prevalence of neurological diseases leads to the growth of the market in the North American region. In the United States, from 1990-2017, many people suffered from neurological disorders like stroke, TTH, SCI, migraine, AD, and other dementias, which helped the growth of the market. To improve brain health, the government of Canada helps with research.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Researchers are actively developing new treatments for neurological disorders. In the Asia Pacific region, neurological disorders like migraine, stroke, and other dementias are high, which leads to the growth of the neurology clinical trials market. In India, 1 % population out of the total population suffers from the prevalence of epilepsy, which leads to the growth of the market. In January 2024, the Siemens Healthineers-CDS (computational data science) collaborative lab for AI (artificial intelligence) in precision medicine at IISc Bengaluru was launched by the Indian Institutes of Science (IISc) and Siemens Healthineers.

Neurology clinical trials are research studies that examine behavioral, medical, or surgical interventions in people related to disorders or diseases that are linked with brain or cognitive behavior. The neurology clinical trials market deals with pharmaceutical & biotechnology companies, clinical research laboratories, contract research organizations, etc., for the researchers to determine whether the prevention or treatment of new drugs, medical devices, or diet is effective and safe to use for people. Neurology clinical trials are research studies that involve volunteer participants. These human research studies help physician-scientists to better understand, treat, diagnose, and prevent conditions and diseases. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.14 Billion |

| Market Size in 2025 | USD 6.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.58% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase, Study Design, Indication, Study Design, Phase, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of neurological diseases

Neurological disorders are types of nervous system disorders that affect neurons and the brain. The causes of the increasing prevalence of neurological disorders include exposure to pollutants, stroke, infections, genetic disorders, changing lifestyles, and the aging population. The increasing number of neurological diseases like stroke, traumatic brain injury, muscle regeneration, Parkinson’s disease, etc. These factors help to the growth of the neurology clinical trials market.

Limitations of neurology clinical trials

Limitations of neurology clinical trials include regulatory complexities governing trial data and protocols reporting, retention & recruitment of suitable patient populations, and high costs linked with trial design and implementation. Limited understanding of the basic biology of disease, understanding of how nosology can constrain innovation, insufficient sharing of expertise, data, and knowledge, clinical trials high failure rates, clinical trials across therapeutic areas high costs, lack of clarity on regulatory requirements, etc. These barriers can restrict the growth of the neurology clinical trials market.

Future scope of neurology clinical trials

Opportunities to enhance neurology clinical trials include understanding the basic biology of neurological diseases, obtaining all essential evidence across all phases of drug development, developing new endpoints, tools, and statistical approaches to enhance the effectiveness of clinical studies, implementing operational changes to neurology clinical trials, arranging innovative research programs, collaborating across countries and disciplines, making neurology clinical trials more patient-centric, and meeting regulatory requirements. These factors help the neurology clinical trials market grow.

The phase II segment dominated the market in 2024. Phase II plays an important role in neurology clinical trials. It allows close monitoring of a relatively homogeneous patient population, involves participants selected by using narrow criteria, normally randomized and controlled studies, and evaluates the efficacy and safety of a drug for a particular condition. Phase II of the clinical trial helps in drug development by bridging the gap between safety assessments in Phase I and efficacy evaluations in Phase III. Phase II is also helpful for the understanding of new treatments' therapeutic potential and obtaining detailed data on safety, effectiveness, and dosage profiles. These factors help the growth of the phase II segment and contribute to the growth of the neurology clinical trials market.

The phase III segment is estimated to be the fastest-growing during the forecast period. Phase III plays an important role in neurology clinical trials. It is generally the last phase of testing before drug approval. It generally involves a large number of participants, assesses safety and efficiency information simultaneously, monitors side effects, confirms treatment effectiveness, and also compares new treatments with standard or reference treatments. These factors help the growth of the phase III segment and contribute to the neurology clinical trials market.

The epilepsy segment dominated the neurology clinical trials market in 2024. Neurology clinical trials play an important role in epilepsy disease, which is a neurological disease. The causes of epilepsy include abnormal activities in the brain that can affect any area of the brain, increasing disorders in the brain like autism, injury or damage to the brain at the time of birth, brain infectious diseases like meningitis, medical conditions like brain stroke or tumor that can affect the brain, trauma or injury to the head, etc. To overcome this disease, the development of new tests and procedures like neurological examination, neuropsychological examination, functional MRI, electroencephalogram, etc., is essential, which leads to neurological clinical trials. According to WHO (World Health Organization), nearly 50 million people suffer from epilepsy, and around 80% of them live in low- or middle-income countries. These factors help to the growth of the epilepsy segment and contribute to the growth of the market.

The Huntington’s disease segment is estimated to be the fastest-growing during the forecast period. Huntington’s disease is caused by a gene defect inherited from parents. Huntington’s disease causes disorders like psychiatric, movement, and cognitive disorders with symptoms highly different between individuals. To overcome this disease and its disorders, there is a need for new therapies, medications, prevention methods, genetic testing, etc., which leads to neurology clinical trials. Past epidemiological studies on Huntington’s Disease have shown a collective incidence of 0.38 per 100000 person-years and a global prevalence of 2.71 per 100000 person-years. These factors help the growth of the Huntington’s disease segment and contribute to the growth of the neurology clinical trials market.

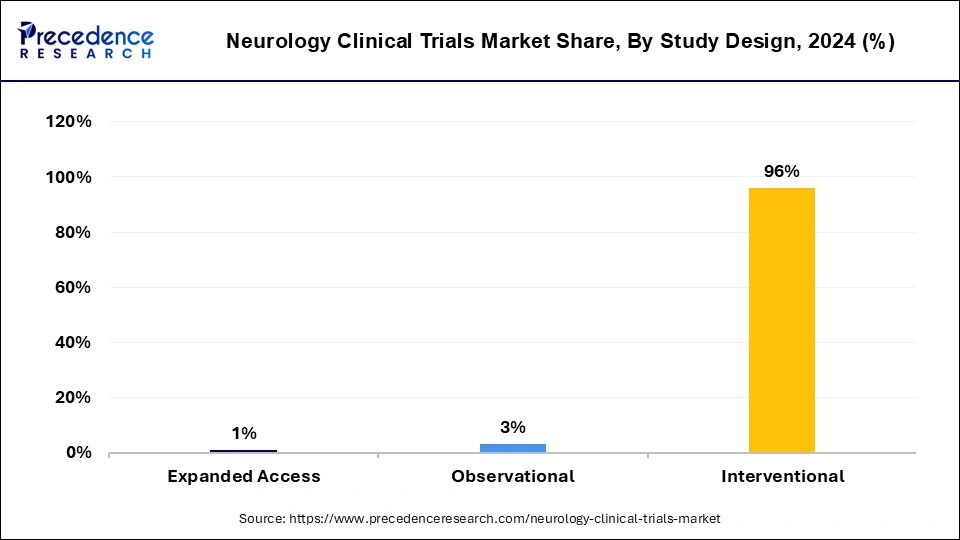

The interventional segment dominated the neurology clinical trials market in 2024. Interventional study design plays an important role in neurology clinical trials. The benefits of interventional study design include eliminating cofounding towards creating groups that are comparable for all factors that hold known, unknown, outcome, or difficult to measure, eliminating selection bias, any guideline differences that exist between study groups are accountable to chance rather than bias, it also gives statistical tests validity based on probability theory, etc.

An increased number of interventional studies on CNS (central nervous system) conditions conducted worldwide leads to the growth of the market. These factors help to the growth of the interventional segment and contribute to the growth of the market.

The observational segment is estimated to be the fastest-growing during the forecast period. The benefits of observational study design include providing information about complicated topics in an efficient manner and with low cost, enabling the study of topics that may not be randomized ethically, safely, or efficiently, may normally be completed inexpensively and quickly, enabling change to be recorded, more easily designed and completed than randomized clinical trials (RCTs), straightforward to conduct, etc. These factors help the growth of the observational segment and contribute to the growth of the neurology clinical trials market.

By Phase

By Study Design

By Indication

By Study Design

by Phase

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

February 2025

February 2025