August 2024

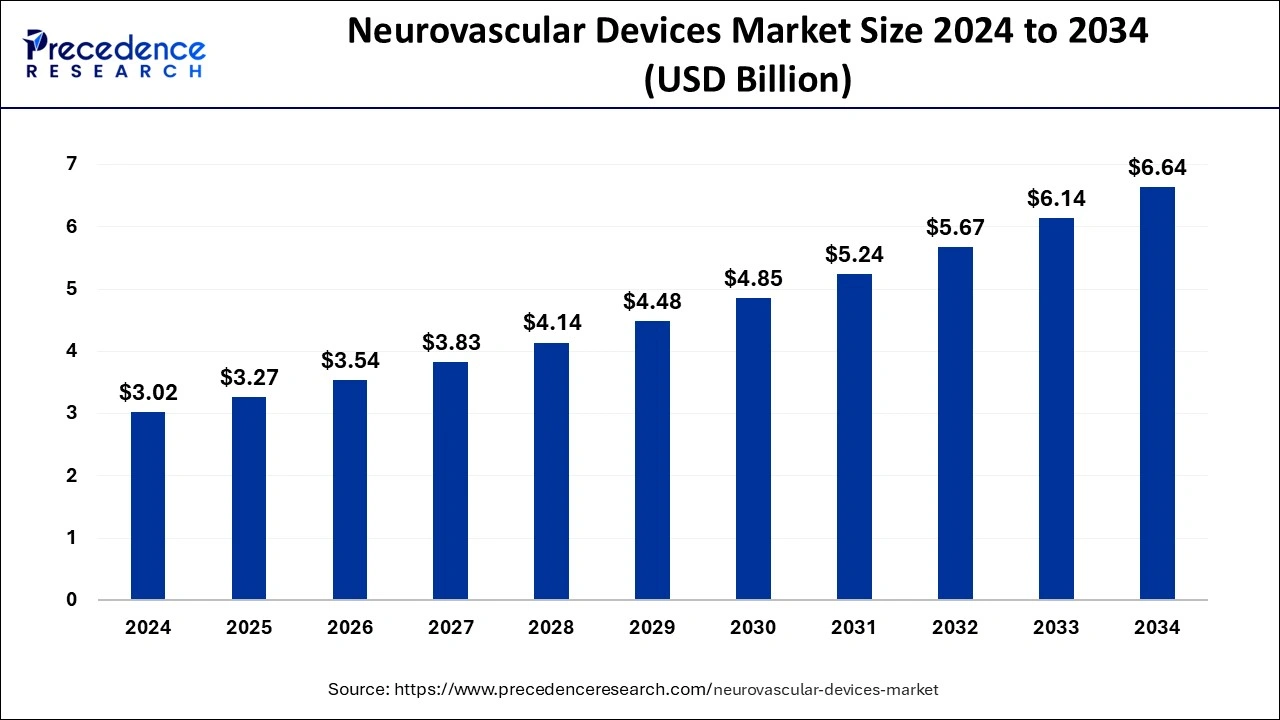

The global neurovascular devices market size accounted for USD 3.02 billion in 2024, grew to USD 3.27 billion in 2025 and is predicted to surpass around USD 6.64 billion by 2034, representing a healthy CAGR of 8.20% between 2025 and 2034. The North America neurovascular devices market size was calculated at USD 940 million in 2024 and is expected to grow at a fastest CAGR of 8.32% during the forecast year.

The global neurovascular devices market size was estimated at USD 3.02 billion in 2024 and is anticipated to reach around USD 6.64 billion by 2034, expanding at a CAGR of 8.20% from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing neurovascular devices which is estimated to drive the global neurovascular devices market over the forecast period.

AI can improve the accuracy and speed of diagnostics by analyzing medical images such as CT scans, MRIs, and angiograms. Machine learning algorithms can detect abnormalities like aneurysms, strokes, or other neurovascular diseases more quickly and accurately than traditional methods, aiding in early detection and treatment.

AI can assist in developing personalized treatment plans by analyzing patient data, including medical history, imaging results, and genetic factors. This can optimize surgical or endovascular interventions for better patient outcomes, reducing complications. AI can forecast patient outcomes and complications, helping healthcare providers make informed decisions. For example, it can predict the likelihood of a stroke or the risk of a clot forming post-surgery, enabling proactive care management.

Wearable AI devices can continuously monitor neurovascular health, offering real-time data to both patients and healthcare providers. This allows for better management of chronic conditions like hypertension, which is a risk factor for neurovascular events. AI can optimize clinical trial design by identifying the most suitable patients, predicting trial outcomes, and analyzing large datasets faster, thus accelerating the approval process for new neurovascular devices.

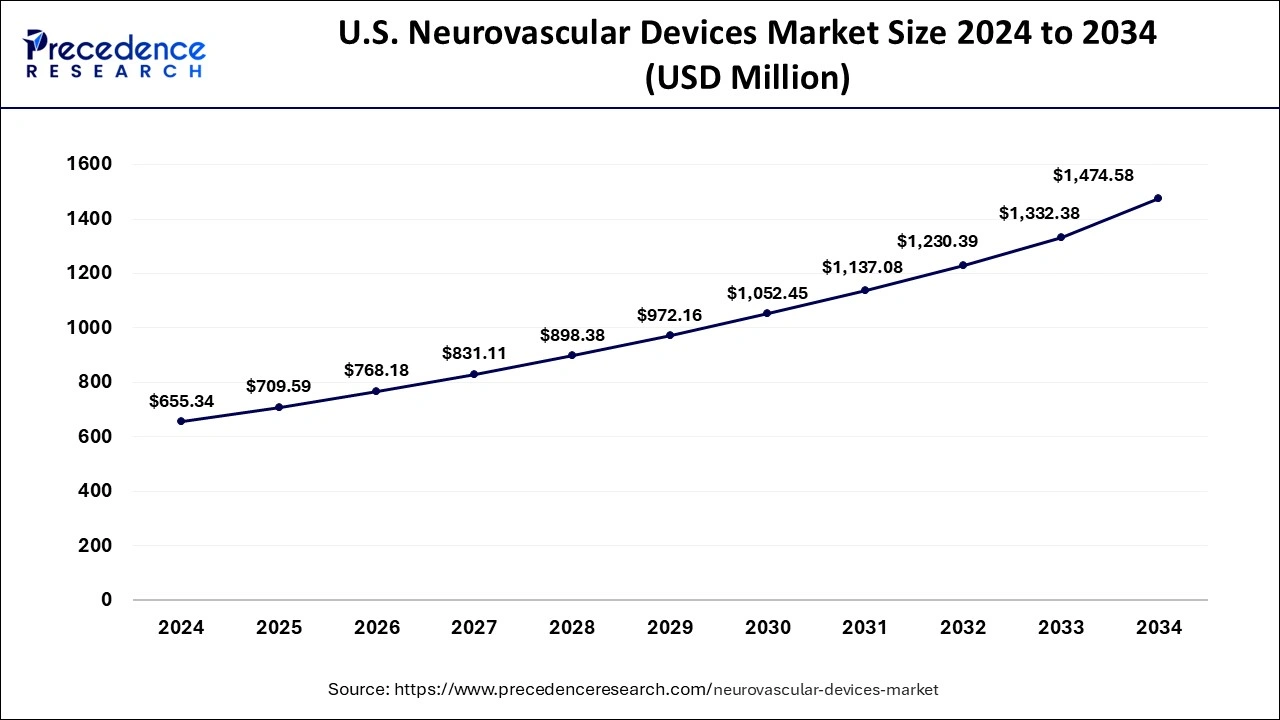

The U.S. neurovascular devices market size was evaluated at USD 655.34 million in 2024 and is predicted to be worth around USD 1474.58 million by 2034, rising at a CAGR of 8.34% from 2024 to 2034.

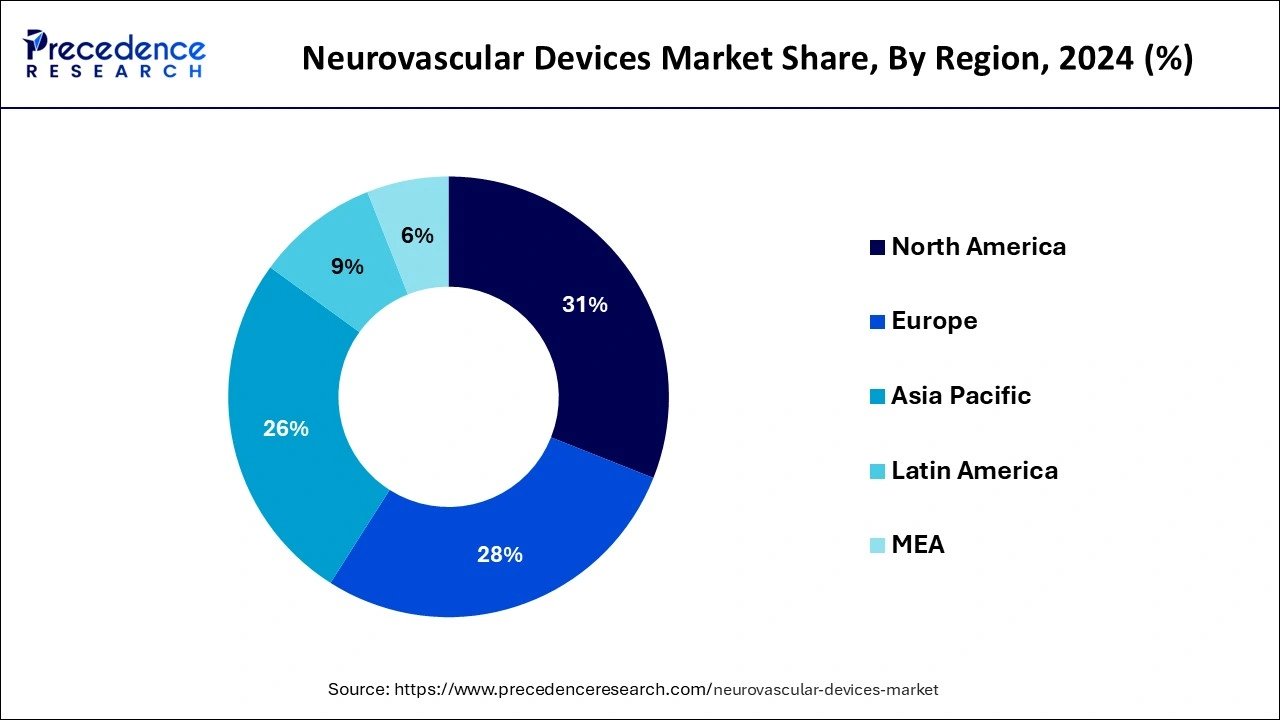

North America dominated the neurovascular devices market with revenue share of 31% in 2024. North America, particularly the United States, has some of the most advanced healthcare infrastructure globally, with cutting-edge hospitals, surgical centers, and diagnostic equipment. This enables the use of high-tech neurovascular devices and supports the adoption of the latest treatment methods. The region has a robust healthcare system that supports a high level of patient care, ensuring access to advanced treatments like neurovascular surgery and endovascular procedures, which often require specialized devices. North America is home to many leading medical device companies, academic institutions, and research organizations focused on developing innovative neurovascular devices.

Companies based in the region often drive advancements in device design, minimally invasive techniques, and improved materials, leading to the introduction of new, highly effective neurovascular devices. The region is known for the early adoption of new medical technologies. Healthcare providers are often quick to integrate the latest advancements in neurovascular treatments, such as robotic-assisted surgery, AI-powered diagnostics, and advanced imaging systems.

North America has a large number of skilled neurovascular surgeons, interventional radiologists, and other specialists who are well-trained in the use of advanced neurovascular devices. Their expertise contributes to better outcomes, which drives the continued use and preference for these devices. The region also offers robust professional development programs for healthcare professionals, ensuring that they remain up-to-date with the latest techniques and technologies in neurovascular treatments.

The dominance of the United States with the largest shares in the neurovascular device market is observed due to the increasing incidence of neurological disorders in the country. According to the Alzheimer’s Association, in 2024 it is estimated that 6.9 million Americans age 65 and older are living with Alzheimer's dementia. The number is expected to reach 13.8 million by 2060. Alzheimer’s is the 5th leading cause of death among Americans. Other than that, the United States is also growing with technological advancement including the integration of artificial intelligence which offers a significant impact on the diagnosis and treatment of neurological disorders.

In the neurovascular device market, Chian is experiencing significant growth. The market is driven by the presence of key players and increasing the number of stroke cases in the country. The leading neurovascular industry leaders in China are developing innovative products for the procedures and treatment of neurovascular disorders. The reason for rising cases of stroke in China is credited to diabetes and hypertension, if remains poorly controlled results in stroke development.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.02 Billion |

| Market Size in 2025 | USD 3.27 Billion |

| Market Size by 2034 | USD 6.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Device, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Supportive Government Initiatives and Awareness Programs

Campaigns aimed at early diagnosis and treatment of neurovascular diseases. Investments in healthcare infrastructure to ensure access to advanced devices. Increasing government initiatives for early diagnosis of neurovascular disease has estimated to create lucrative opportunity for the growth of the neurovascular devices market in near future.

The crebral embolization and aneurysm coiling devices segment held a dominant presence in the market in 2024. Cerebral embolization and aneurysm coiling are both minimally invasive procedures, requiring only small incisions or catheter insertion, significantly reducing the risks associated with traditional open surgeries, such as infection, blood loss, or damage to surrounding tissues. The minimally invasive approach results in shorter hospital stays and faster recovery times, making these treatments more appealing to both patients and healthcare providers. Both cerebral embolization and aneurysm coiling are performed using a catheter-based technique, which is much less invasive than traditional open surgery. This reduces the risk of complications, minimizes patient recovery time, and lowers the overall burden on the patient.

By occluding the aneurysm with coils or embolic material, the devices significantly lower the risk of rupture, which is the main cause of hemorrhagic strokes. Embolization techniques are also effective for preventing re-bleeding in cases where the aneurysm has already ruptured. These devices can be used for a broad range of neurovascular conditions, including cerebral aneurysms, arteriovenous malformations (AVMs), and certain types of brain tumors, making them highly versatile and effective tools in neurovascular surgery.

By device, the neurothrombectomy devices segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing incidence of acute ischemic stroke and the growing number of growth tactics used by major market participants, including product launches and mergers and acquisitions, will propel the segment's expansion in the near future. For instance, Therma Bright Inc. invested in Inretio Inc., a startup that develops Ischemic Stroke Blood Clot Retriever Technologies, in January 2024. During the thrombectomy procedure, the PREVA basket "ensnares" the clot, enclosing it and protecting the brain from any breakoff sub-clots.

A USD 23.94 million Series A investment round was completed in February 2024 by Perfuze, a company creating next-generation catheter-based aspiration technology to treat acute ischemic stroke brought on by major artery blockage. Furthermore, FDA 510(k) authorization for TIGERTRIEVER 13 for substantial use was announced by Rapid Medical, a developer of innovative neurovascular devices. The FDA 510(k) clearance for TIGERTRIEVER 13 for major vessel occlusions was also announced by Rapid Medical, a manufacturer of innovative neurovascular devices, at the 19th Annual Conference of the Society of Neurolnterventional Surgery (SNIS) in Toronto in 2024. After an ischemic stroke, the tiggertriever 13—the tiniest revascularization tool in the world—is intended to clear thrombus from delicate brain blood vessels.

The stroke segment accounted largest market share in 2024. The increased prevalence of strokes among the population, especially among the elderly population has augmented the growth of this segment. According to the CDC, around 16.7% of people across the globe will have a brain stroke. As per the CDC, over 795,000 people have a stroke in the US every year and it accounts for around 140,000 deaths in the US every year. It is also considered to be the second most prominent cause of death. Hence, this segment is expected to sustain its dominance throughout the forecast period.

Moreover, the rising efforts by the government and various NGOs in spreading awareness regarding neurological disorders are fostering the segment’s growth. The new product launches related to stroke solutions are boosting the market growth. For instance, in September 2020, CERENOVOUS introduced CERENOVOUS Stroke Solution which aids doctors in clot removal procedures.

The stroke segment accounted for a significant share of the market in 2024. As a result of things like the rising rates of stroke, hypertension, and other neurological conditions. Over 795,000 people in the United States experience a stroke each year, and 1 in 6 people globally will experience one at some point in their lives, according to the CDC. Strokes cause over 140,000 fatalities in the United States each year, making them the second most common cause of death worldwide. The government of the world has adopted a number of steps to avoid stroke. Additionally, the focus on minimally invasive stroke treatment approaches is driving market expansion because, in comparison to open procedures, these methods usually result in faster recovery times and fewer hospital stays.

Technological developments like real-time imaging and advanced robots are enhancing the safety and accuracy of neurovascular treatments, giving medical professionals more confidence to perform intricate procedures. Additionally, the introduction of technologically sophisticated items is fueling the expansion of this market. For example, Infinity Neuro declared in January 2024 that its Inspira aspiration catheters were now approved by the CE Mark and could be bought in Europe. This is Infinity Neuro's first buffer; in 2024 and beyond, the business plans to provide a wide range of solutions to treat ischemic and hemorrhagic stroke.

By therapeutic application, the cerebral aneurysm segment is anticipated to grow with the highest CAGR in the neurovascular devices market during the studied years. The Brain Aneurysm Foundation estimates that 6.5 million Americans have an unruptured brain aneurysm, and that 30,000 of them experience a rupture every year. Additionally, the launch of technologically advanced items and the growing number of clinical trials will support category expansion in the near future.

For example, VESALIO announced in February 2024 that its NeVa VS device has been successfully used for the first time in the United States to treat cerebral vasospasm following aneurysmal subarachnoid hemorrhage (aSH). The most frequent result of aSAH and the main cause of death and morbidity is vasospasm. Additionally, EndoStream Medical, a company that creates treatments for brain aneurysms, said in February 2024 that the first patient in the United States had been enrolled in the TORNADO-US clinical study. The trial will assess the company's Nautilus intrasaccular system's efficacy in treating cerebral aneurysms. Additionally, the FDA approved Medtronic's clot-resistant implant in April 2021 for the treatment of brain aneurysms, which is anticipated to propel segment expansion in the near future.

The 0.021” segment registered its dominance over the global market in 2024. The 0.021" diameter provides a good balance between flexibility and support, making the devices suitable for navigating the complex and narrow vasculature of the brain. This size allows for better maneuverability through tortuous blood vessels while maintaining the necessary rigidity to deliver therapeutic agents or implants. This size allows the catheter or device to be used effectively in small, delicate blood vessels, especially in the neurovascular system, where precision is critical.

Hospitals segment dominated the neurovascular devices market globally. The primary cause of this segment's rise is the growing number of patients with neurovascular conditions, including arteriovenous malformation (AVM), brain aneurysms, ischemic and hemorrhagic stroke, and traumatic brain injury (TB1). For instance, in August 2024, the World Stroke Organization estimates that 1 in 4 adults over 25 will have a stroke at some point in their lives. It is estimated that 13.7 million people will have their first stroke each year, with 5.5 million of those individuals potentially losing their lives. It seems likely that the annual death toll will rise to 6.7 million if appropriate action is not taken. Furthermore, it is anticipated that the growing number of patients being admitted to hospitals as a result of operations, treatments, and therapies will boost market expansion. Therefore, the introduction of technologically sophisticated goods, the ensuing rise in the number of patients worldwide, and advantageous reimbursement policies are all significant aspects anticipated to support segment expansion.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like new product launches, acquisition, partnerships, mergers, and government policies foster market growth and offers lucrative growth opportunities to the market players.

By Device

By Therapeutic Application

By Size (in Inches)

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

January 2025

January 2025