April 2025

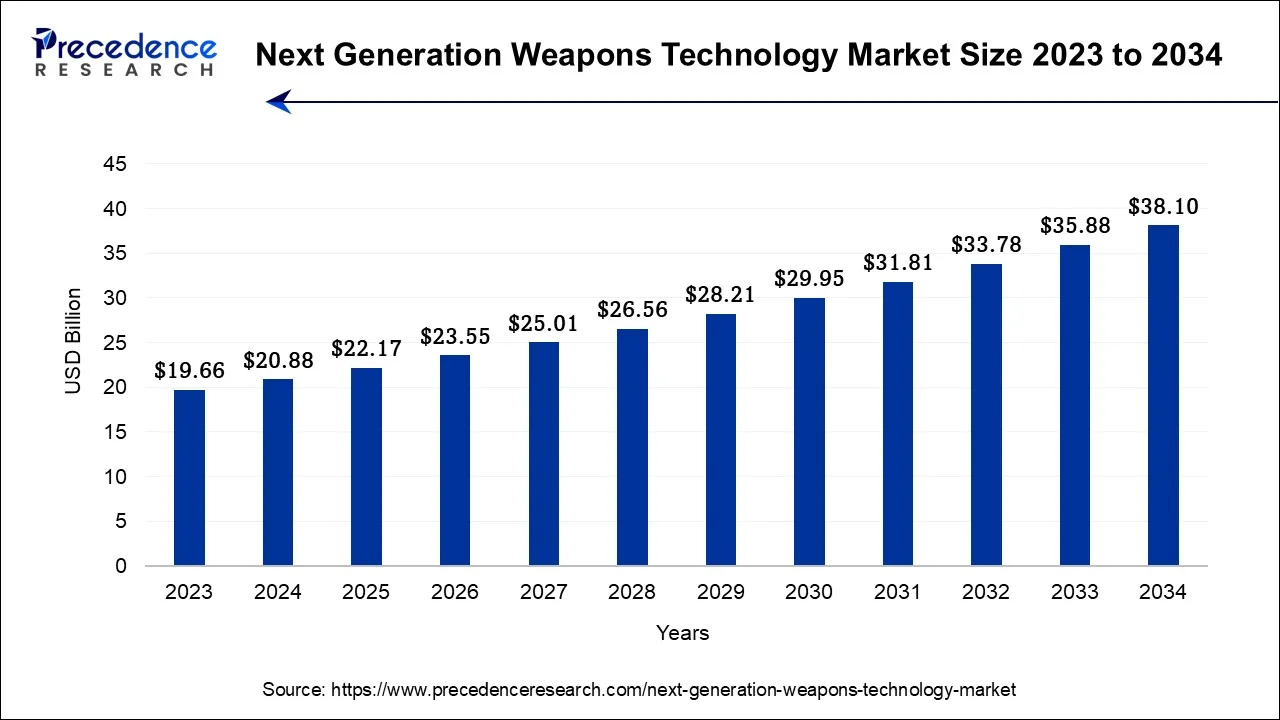

The global next generation weapons technology market size accounted for USD 20.88 billion in 2024, grew to USD 22.17 billion in 2025 and is projected to surpass around USD 38.10 billion by 2034, representing a healthy CAGR of 6.20% between 2024 and 2034.

The global next generation weapons technology market size is estimated at USD 20.88 billion in 2024 and is anticipated to reach around USD 38.10 billion by 2034, growing at a CAGR of 6.20% between 2024 and 2034.

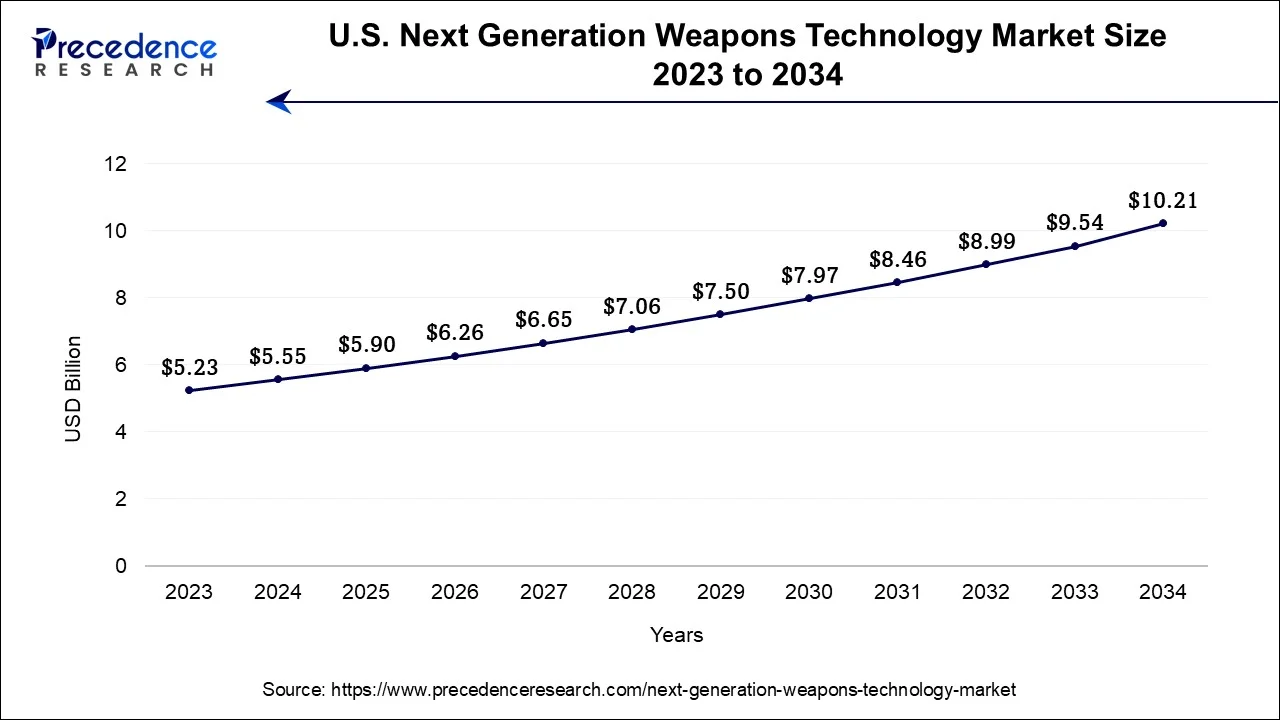

The U.S. next generation weapons technology market size accounted for USD 5.55 billion in 2024 and is exopected to be worth around USD 10.21 billion by 2034, at a CAGR of 6.28% from 2024 to 2034.

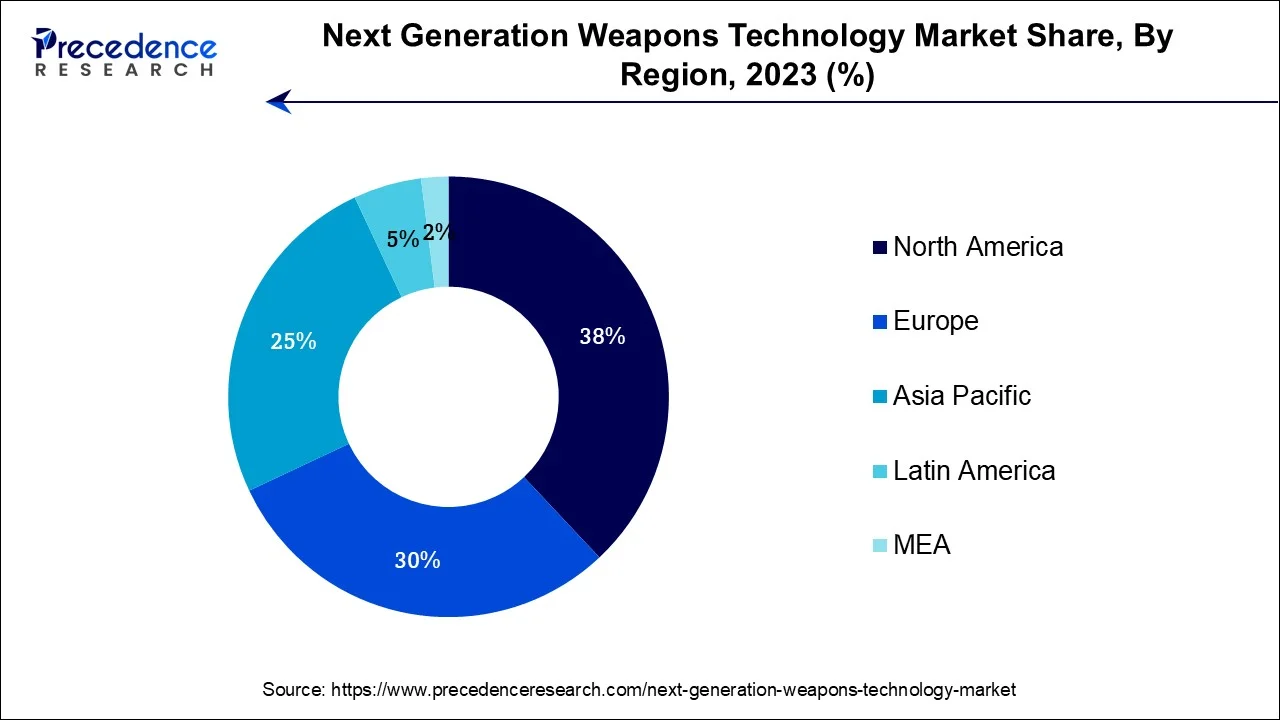

North America has held the largest revenue share 38% in 2023. In North America, the next generation weapons technology market is characterized by sustained innovation and military modernization efforts. The region's trends include a strong emphasis on artificial intelligence, autonomous systems, and hypersonic weapons development. North American defense agencies prioritize research and development to maintain technological superiority, especially in the face of evolving global security challenges. Furthermore, collaborations with tech giants and emerging startups contribute to the region's leadership in cutting-edge defense solutions, making it a key hub for advancements in the next generation weapons technology sector.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the next generation weapons technology market is experiencing notable trends. Rising geopolitical tensions, particularly in the South China Sea and the Korean Peninsula, are propelling regional nations to invest significantly in advanced defense technologies. Countries like China and India are actively modernizing their military capabilities, driving the demand for cutting-edge weaponry. Additionally, the region is witnessing increased collaboration with international defense contractors and research institutions, fostering technology adoption. The Asia-Pacific's evolving security landscape and emphasis on military modernization are key drivers of growth in the next generation weapons technology market.

Due to Russia's weapon modernization, market share in Europe is projected to rise significantly over the projected period. The government of Russia invested a significant amount of money in developing data management techniques to enhance decision-making during war situations. For instance, the Russian Ministry of Defense established a department committed to the development of artificial intelligence arms in August 2022. A novel department has been established to accelerate efforts on the implementation of AI technology in the production of firearm models for the military as well as special equipment.

Next Generation Weapons Technology Market Overview

The next generation weapons technology market covers the development, research, and deployment of advanced military systems and equipment that surpass conventional weaponry. This includes innovations like autonomous drones, cyber warfare tools, directed energy weapons, and AI-enhanced systems, signifying a shift towards highly sophisticated and modernized defense solutions.

This market's essence lies in its rapid technological progress, emphasis on precision engineering, and the incorporation of artificial intelligence. These dynamics are propelled by the necessity for enhanced defense capabilities in a continuously changing global security environment. It operates at the crossroads of military innovation, geopolitical considerations, and the pursuit of state-of-the-art defense solutions.

The next generation weapons technology sector is evolving rapidly, driven by industry trends, growth drivers, and facing significant challenges. Advancements in materials, artificial intelligence (AI), and precision engineering have led to innovations in weaponry, but these developments also raise ethical and strategic questions. Amidst these challenges, there are substantial business opportunities for companies that can navigate the complexities of this evolving field while adhering to global security and ethical standards.

Several trends and growth drivers are shaping the next generation weapons technology industry. Firstly, the integration of AI and machine learning into weapon systems has improved accuracy, decision-making, and autonomous capabilities. Additionally, the development of hypersonic weapons and directed energy technologies promises to redefine the battlefield, making defense systems more capable and responsive. Furthermore, advancements in materials science are enabling lighter, more durable, and efficient weaponry, reducing logistical burdens and increasing military effectiveness.

While the sector offers immense potential, it also faces significant challenges. Ethical concerns regarding the use of autonomous weapons and AI-driven decision-making algorithms have sparked debates on the need for responsible governance and regulation. Additionally, the proliferation of advanced weaponry poses security risks and necessitates robust export controls and international cooperation. The high costs of research and development, coupled with stringent testing and safety standards, can also impede progress in this industry.

Opportunities in the next generation weapons technology market lie in innovation, collaboration, and responsible leadership. Companies that invest in AI, materials science, and precision engineering can gain a competitive edge. Collaborations with defense agencies and international partnerships can drive technology adoption and export potential. Furthermore, businesses that emphasize ethical use, transparency, and compliance with international arms control agreements can establish themselves as leaders in this high-stakes industry.

The growing demand for defense capabilities in an increasingly uncertain world presents substantial growth prospects for those who can navigate the challenges while ensuring the responsible use of advanced weaponry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Market Size in 2024 | USD 20.88 Billion |

| Market Size by 2034 | USD 38.10 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Platform, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Military modernization initiatives significantly drive market demand for next generation weapons technology. As defense agencies seek to maintain a competitive edge and address evolving threats, they invest in advanced weapon systems, including autonomous drones, precision-guided munitions, and cyber warfare tools.

The need for cutting-edge capabilities, enhanced lethality, and improved defense mechanisms fuels procurement of next-gen weaponry. This surge in demand propels research, development, and deployment, positioning the next generation weapons technology market as a critical player in meeting the modernization requirements of armed forces worldwide. Moreover, Technological advancements are a paramount driver of market demand in the next generation weapons technology sector.

Breakthroughs in artificial intelligence, materials science, and precision engineering enable the development of cutting-edge weapon systems with superior accuracy, range, and lethality. The allure of these highly advanced and efficient weapons drives military modernization efforts worldwide. As nations prioritize staying ahead in an increasingly complex security environment, the demand for technologically advanced weaponry continues to surge, shaping the landscape of defense capabilities for the future.

High development costs present a significant restraint on market demand in the next generation weapons technology sector. Research and development of cutting-edge weaponry, often involving complex technologies and precision engineering, require substantial financial investments. These high costs can limit accessibility to advanced weapon systems, particularly for smaller nations or organizations with budget constraints. Additionally, they can extend the development timeline, delaying the deployment of much-needed defense solutions. Balancing innovation with cost-effectiveness remains a challenge, impacting the pace of adoption and growth in this technologically demanding industry. Moreover, ethical concerns act as a significant restraint on the demand for next generation weapons technology.

The deployment of autonomous weapons and AI-powered decision-making systems raises moral and humanitarian questions, fueling debates on responsible governance and regulation. Public sentiment and international pressure demand accountability in the use of such technology, potentially limiting the market's growth. Additionally, the ethical dilemmas surrounding the development and utilization of advanced weaponry can deter both governments and defense contractors from pursuing certain technologies, affecting their adoption and demand in the market.

Cybersecurity solutions play a pivotal role in surging market demand for next generation weapons technology. As warfare becomes increasingly digital, the need for robust defense against cyber threats intensifies. Advanced cyber security tools and technologies integrated into weapon systems bolster their resilience against cyberattacks, enhancing their overall effectiveness and reliability. This heightened security assurance fuels the demand for next-gen weaponry, as nations prioritize safeguarding their advanced defense assets in an era of evolving cyber threats, thus driving growth in the market for cybersecurity-integrated weapons technology.

Moreover, Research and development (R&D) efforts play a pivotal role in driving market demand for next generation weapons technology. As nations seek to maintain a strategic edge in an ever-evolving security landscape, the allure of innovative weaponry fosters a continuous demand for technologically advanced solutions. Companies at the forefront of R&D can cater to this demand, shaping the future of defense capabilities and bolstering market growth.

Impact of COVID-19:

The COVID-19 pandemic had mixed effects on the next generation weapons technology industry. On one hand, disruptions in supply chains and manufacturing facilities led to delays in research, development, and production of advanced weaponry. Travel restrictions also impeded international collaboration and defense trade agreements. However, the pandemic underscored the significance of secure and resilient defense capabilities, driving governments to prioritize investment in next generation weapons technology. Additionally, cyber threats escalated during the pandemic, increasing the demand for advanced cybersecurity solutions. Remote warfare tactics gained prominence, further stimulating the need for innovative technologies. While initial disruptions were evident, the crisis ultimately reinforced the market's importance and led to renewed focus on defense innovation and preparedness.

The missile segment has held 43% revenue share in 2023. Missiles in the next-generation weapons technology market are advanced projectiles designed for precision strikes and versatile defense applications. Missiles represent a diverse category, encompassing surface-to-air, anti-ship, hypersonic, and cruise missiles, among others. Emerging trends in this sector focus on the creation of hypersonic missiles known for their exceptional speed and agility. These missiles are characterized by increased autonomy and precise guidance systems driven by artificial intelligence.

Additionally, advancements in stealth technology play a crucial role, enabling missiles to operate covertly and evade enemy detection, marking significant progress in the field of next generation weapons technology. Additionally, missile defense systems are evolving to counter emerging threats, driving innovation and investment in this critical segment of modern warfare.

The guided firearms segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Guided firearms are advanced weapons equipped with technology that enables precise targeting and accuracy. These firearms use sensors, GPS, and sophisticated algorithms to guide bullets or projectiles to their intended targets, reducing the margin of error significantly.

In the next generation weapons technology market, the trend is towards miniaturization and integration of guided systems into conventional firearms, making them more accessible and cost-effective. Enhanced data connectivity and integration with augmented reality are also emerging trends, providing soldiers with real-time information and improved situational awareness in combat scenarios.

The Infrared segment held the largest market share of 34% in 2023. Infrared (IR) technology plays a pivotal role in the next generation weapons technology market. It involves the use of infrared radiation for target detection, tracking, and guidance. The trends in this field are marked by advancements in IR sensors, offering enhanced sensitivity and precision, which is crucial for accurate targeting and reduced collateral damage. Moreover, the fusion of infrared (IR) technology with artificial intelligence and data analytics is gaining prominence. This integration enables real-time decision-making and enhances autonomous capabilities, significantly amplifying the operational effectiveness of next-generation weaponry.

On the other hand, the Laser technology segment is projected to grow at the fastest rate over the projected period. Laser technology in the next generation weapons technology market refers to the use of high-energy lasers for various military applications. This encompasses laser weaponry designed for precise and swift target incapacitation.

Notably, a noteworthy trend in this domain revolves around the advancement of Directed Energy Weapons (DEWs) utilizing lasers. DEWs are employed in tasks such as anti-missile defense, interception of unmanned aerial vehicles (UAVs), and the disruption of enemy electronic systems, marking a significant evolution in modern warfare technology. These advancements offer faster response times, reduced logistical constraints, and enhanced accuracy, making laser technology a pivotal component of the evolving arsenal in modern warfare.

In 2023, the Land segment had the highest market share of 47% on the basis of the platform. In the next generation weapons technology market, the "land" platform primarily refers to ground-based weapon systems. This category encompasses advanced artillery, tanks, infantry weapons, and associated technology. Trends in land-based next generation weapons technology include the integration of AI for enhanced targeting and autonomous vehicles for logistics and combat support. Within the land platform of the next generation weapons technology market, a significant emphasis is placed on precision-guided munitions, including smart artillery shells and missiles. Furthermore, the sector is dedicated to advancing armor materials and anti-drone systems to effectively counter evolving threats, aligning with the dynamic nature of modern land-based warfare.

The Naval is anticipated to expand at the fastest rate over the projected period. In the next generation weapons technology market, the "land" platform primarily refers to ground-based weapon systems. This category encompasses advanced artillery, tanks, infantry weapons, and associated technology. Trends in land-based next generation weapons technology include the integration of AI for enhanced targeting and autonomous vehicles for logistics and combat support. Within the naval domain of the next generation weapons technology market, there is a notable emphasis on precision-guided munitions, encompassing technologies like smart artillery shells and missiles. Simultaneously, there is ongoing development in advanced armor materials and anti-drone systems, aimed at countering emerging threats. These priorities underscore the evolving landscape of modern naval warfare, with an increasing reliance on cutting-edge solutions for enhanced defense and offense capabilities.

Segments Covered in the Report:

By Product

By Technology

By Platform

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025

April 2025

October 2024