January 2025

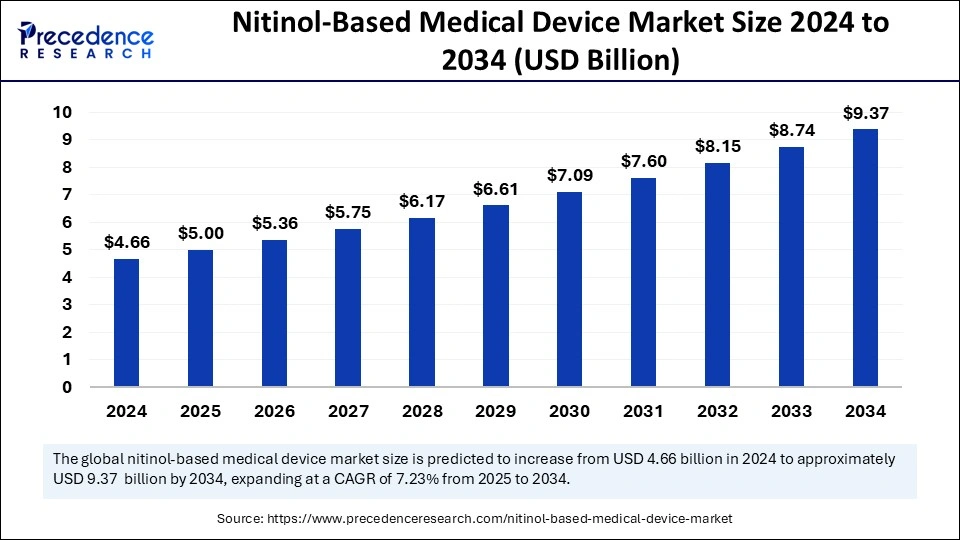

The global nitinol-based medical device market size is calculated at USD 5.00 billion in 2025 and is forecasted to reach around USD 9.37 billion by 2034, accelerating at a CAGR of 7.23% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nitinol-based medical device market size was estimated at USD 4.66 billion in 2024 and is predicted to increase from USD 5.00 billion in 2025 to approximately USD 9.37 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The market growth is driven by rising production of medical devices, ongoing technological advancements, and increasing healthcare expenditures.

Artificial Intelligence (AI) significantly impacts the market for nitinol-based medical device. AI can improve the design and production of nitinol-based medical devices. Integrating AI technologies in manufacturing optimizes device performance by automatically adjusting parameters like heat treatment and assembly. AI also identifies flaws in manufacturing processes and helps in quality inspection, leading to the development of high-quality medical devices. AI can potentially transform the medical devices sector, driving innovations and expanding the scope of applications. AI-based nitinol medical equipment has the potential to improve the accuracy of diagnostics and treatment.

The nitinol-based medical device market is witnessing rapid growth due to the rising advancements in nitinol processing and manufacturing technologies. Advancements in manufacturing technologies led to the development of more sophisticated nitinol-based medical devices. Being a metallic biomaterial and having unique properties such as superelasticity, shape memory, and greater damping characteristics make nitinol a preferred material for use in medical devices. It is a very useful material in orthopedic implants and other surgical instruments.

Despite the greater initial nickel dissolution, it does not induce toxic effects, reduce cell proliferation, or prevent the growth of cells in contact with the metal surface. Nitinol is potentially used in cardiac devices like vena cava filters, stents, guidewires, and heart valves. The applications of nitinol in other equipment areas are rising, predominantly for products intended for usage in minimally invasive procedures. Nitinol is a well-known and common engineering material in the healthcare sector.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.37 Billion |

| Market Size in 2025 | USD 5.00 Billion |

| Market Size in 2024 | USD 4.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Chronic Disease Burden and Growing Geriatric Population

The rising burden of chronic diseases around the world is a key factor driving the growth of the nitinol-based medical device market. Chronic diseases like cardiovascular diseases (CVDs), cancer, and orthopedic conditions often require surgical intervention. This, in turn, boosts the demand for implantable devices and surgical instruments made from nitinol. It is widely used to develop orthodontic devices, vascular stents, and orthopedic devices due to its combination of functional properties, including shape memory effect, excellent thermal conductivity, superelasticity, and great corrosion resistance. In addition, the growing aging population is expected to drive the growth of the market. As people age, they are more prone to chronic and orthopedic conditions requiring surgical intervention.

High Production Costs and Lengthy Approval Process

The high costs of medical devices are a major factor restraining the growth of the nitinol-based medical device market. Nitinol’s availability depends on its raw materials, such as nickel and titanium. These materials are subject to price fluctuations, leading to high production costs of nitinol, which further pass to the cost of the final product. Compared to traditional metals, nitinol’s manufacturing process is complex, making the end products more expensive. Moreover, obtaining regulatory approval for medical devices is time-consuming, limiting the growth of the market.

Advancements in Nitinol-Based Stents

New-generation bare-metal nitinol stents (BNS) and drug-eluting stents have proven effective in potentially improving long-term clinical outcomes for patients undergoing endovascular therapy for femoropopliteal lesions, creating immense opportunities in the nitinol-based medical device market. The use of cilostazol has been shown to reduce in-stent restenosis (ISR) following first-generation BNS implantation, further enhancing therapeutic efficacy. The successful application of everolimus-eluting self-expanding nitinol stents in patients with complex peripheral arterial disease highlights the potential of this advanced equipment to deliver favorable results and enhanced quality of life, supporting market expansion.

The retriever device segment dominated the nitinol-based medical device market with the largest share in 2024. Stent retrievers provide more control, allowing neuro-interventionalists to better eliminate blood clots and restore blood flow to the brain. Retriever devices are frequently used in thrombectomy procedures in patients who have acute ischemic strokes. The rise in the number of surgical procedures further bolstered the segment growth.

The catheters segment is expected to grow at the highest CAGR during the projection period. The excellent elasticity of nitinol allows catheters to navigate the difficult and tortuous pathways of the vascular system along with lower challenges of deformation or kinking. This improves the success rates of processes like valve replacement, stent placement, and angioplasty. Nitinol’s corrosion and fatigue resistance properties make it an ideal material for catheters, enhancing reliability and longevity in the cyclic loading conditions inherent to cardiovascular activities.

The cardiovascular segment led the market in 2024. The segment growth is driven by the increase in the prevalence of cardiovascular diseases requiring surgical intervention. Nitinol stents provide unparalleled durability and flexibility in cardiovascular applications, enabling them to conform to the shape of blood vessels and also offering long-lasting support. This makes nitinol stents the best choice for enhancing patient outcomes and revolutionizing vascular treatments by lowering the risk of restenosis and enhancing quality of life. Nitinol's capability to return to its original shape after being misshaped makes it an outstanding material for stents applied in cardiovascular applications.

The urology segment is anticipated to witness significant growth during the forecast period. The segment growth can be attributed to the rising number of cases of urological conditions. This, in turn, boosts the demand for nitinol-based medical devices like stents and catheters. These devices provide unmatched adaptability, biocompatibility, and versatility for minimally invasive procedures in urological treatments.

The hospitals segment held the largest share of the nitinol-based medical device market in 2024. The growth of the segment is driven by the rise in volume of patients undergoing surgical procedures. This further increased the adoption of nitinol-based medical devices in hospitals. Medical equipment manufactured from nitinol provides greater maneuverability and control during treatment, enabling surgeons to navigate complex anatomical structures easily. Whether for minimally invasive procedures, nitinol devices offer the dexterity required for successful operations.

The ambulatory surgical centers segment is anticipated to expand at the fastest rate during the forecast period. The rapid shift toward outpatient care facilities is a key factor boosting the growth of the segment. Ambulatory surgical centers (ASCs) provide surgical procedures on the same day, reducing the need for hospital admissions. This further reduces overall healthcare costs. Moreover, ASCs offer personalized care plans, attracting more patients. The rising preference for ASCs among patients boosts the demand for nitinol-based medical devices.

North America dominated the market by holding the largest share in 2024. This is mainly due to its well-established healthcare system, which increases the demand for nitinol-based medical devices. Also, the region is at the forefront of medical device production. The availability of well-established healthcare facilities, including hospitals, clinics, and ASCs, further bolstered the market growth in the region.

The U.S. is a major contributor to the North American nitinol-based medical device market. The country is home to some of the leading medical device manufacturing companies, driving innovations in medical devices. The U.S. is the world’s largest producer of medical devices. With the rising healthcare spending, there is a high demand for medical devices. Moreover, the rising prevalence of chronic diseases, the aging population, and the growing demand for minimally invasive surgery support market growth.

Asia Pacific is expected to witness the fastest growth during the forecast period. The regional market growth can be attributed to the growing geriatric population and the increasing number of cases of chronic diseases. The growing patient volumes undergoing surgical procedures further boost the demand for nitinol-based surgical devices. The increasing healthcare expenditures and a strong emphasis of regional government on improving accessibility to healthcare further support regional market growth.

India can have a stronghold on the Asia Pacific nitinol-based medical device market. The rising prevalence of chronic diseases and increasing adoption of advanced medical devices are key factors supporting the market growth in India. The Indian government is making efforts to boost the domestic production of medical devices to reduce reliance on exports. Moreover, there is a strong focus on improving patient outcomes, contributing to market expansion.

Europe is considered to be a significantly growing area. The growth of the European nitinol-based medical device market can be attributed to the presence of a well-established healthcare sector, providing a strong foundation for innovations in medical device technology. The growing aging population, along with the prevalence of chronic diseases, contributes to market growth. Moreover, with the rising healthcare spending, there is a high demand for sophisticated medical devices to enhance surgical outcomes, supporting regional market growth.

By Product Type

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025