North America Aluminum Extrusion Market Size and Forecast 2026 to 2035

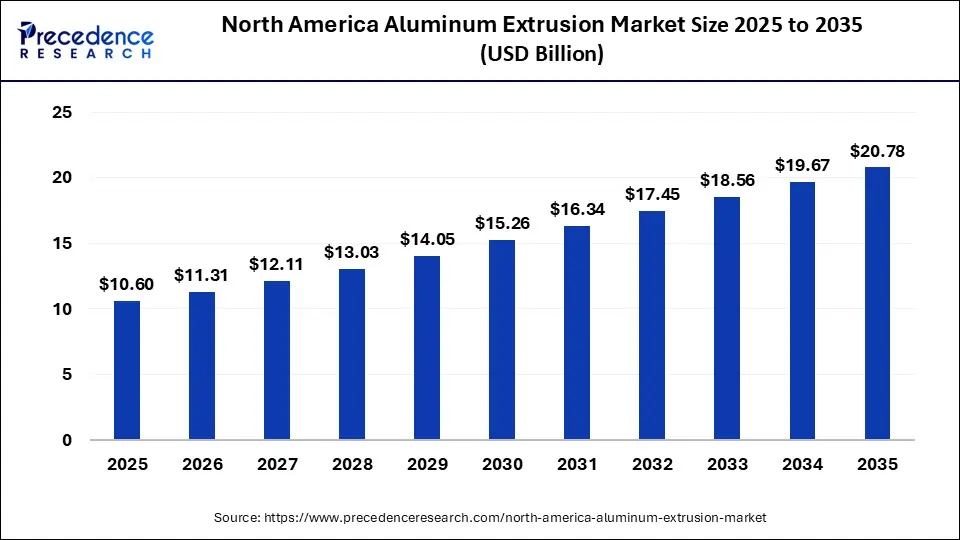

The North America aluminum extrusion market size is calculated at USD 10.6 billion in 2025 and is expected to reach around USD 20.78 billion by 2035, expanding at a CAGR of 6.96% from 2026 to 2035. The rising environmental concern in industrial applications are driving the growth of the market.

North America Aluminum Extrusion Market Key Takeaways

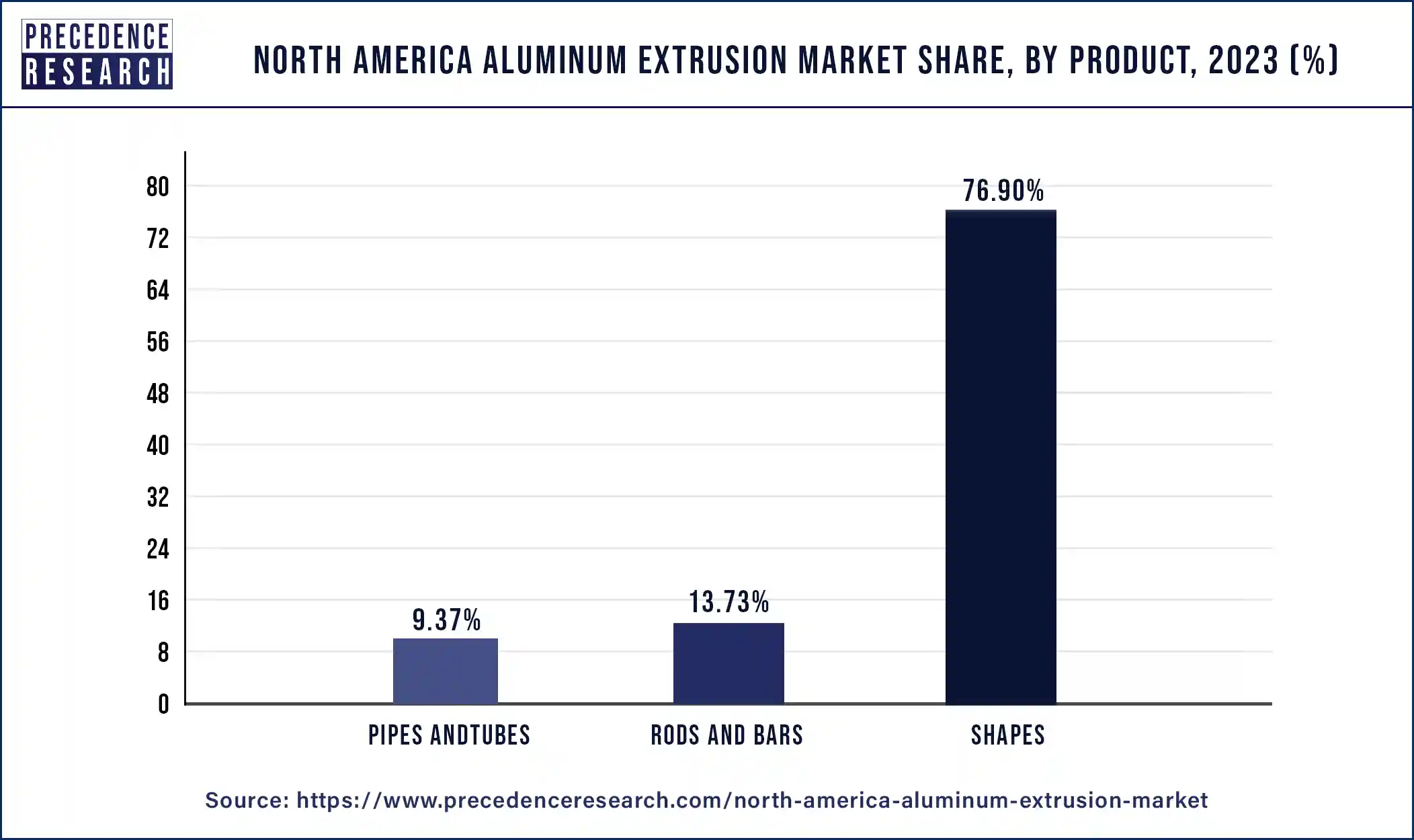

- By product, the shapes segment has held a major revenue share of 77.2% in 2025.

- By product, the rods and bars segment is anticipated to be the fastest growing segment in the market during the forecast period.

- By application, the building and construction segment has contributed more than 63.7% of revenue share in 2025.

- By application, the automotive and transportation segment is expected to grow at the fastest rate during the forecast period.

What is the Role of AI in North America Aluminum Extrusion Market?

Artificial intelligence (AI) offers unprecedented opportunities to improve efficiency, reduce costs, and meet sustainability goals. The use of AI technology practically removes the room for human error and substantially amplifies the production rates of companies with a lot to offer in a plate. The benefits of AI in aluminum industry include data analytics and AI, precise engineering, maintenance and quality control, supply chain optimization, streamlined activities, and industry 4.0.

AI-based quality control during the aluminum extrusion process, guaranteeing early scrap identification. AI aluminum extrusion analysis is a powerful technology that allows business to improve their aluminum extrusion process, reduce costs, innovation, new product development, yield improvement, predictive maintenance, process optimization, and improve product quality.

Market Overview

The North America aluminum extrusion market revolves around the offering of processes of pressing aluminum raw material by the die with the specific cross-sectional profile that helps in transforming aluminum into the objects that can be used in the wide range of applications. Aluminum extrusion is majorly divided into the two categories direct and indirect, in the direct extrusion, the die or mold remains constant, and the ram applied forces into the metal to move through it. And in the indirect extrusion the metal remains constant while the die moves against it and creates pressure to push the metal through it. The rising demand for aluminum due to its beneficial properties and the lightweight material that are driving the growth of the North America aluminum extrusion market.

North America Aluminum Extrusion Market Growth Factors

- The rising demand for aluminum extrusion in the several end-use industries such as construction, automotive and transportation, aerospace, and defense is driving the demand for the aluminum extraction market.

- North America has been seeing significant economic growth in the last several years, which positively impacted the industrialization in the regional countries that contributed to the expansion of the aluminum extrusion market.

- The rising population and the increasing demand for commercial, residential, and industrial buildings are driving the growth of the construction industry. The rising demand for aluminum in the construction industry is increasingly fostering the growth of the market.

- The rising concern about the environmental pollution is one of the major factors for the adoption of aluminum in the various end use industries and driving the growth of the North American aluminum extrusion market.

- The beneficial properties of aluminum, such as durability, strength, ductility, non-magnetic properties, conductivity, and repeated recyclability without losing its strength, is driving the growth of the market.

- Growing demand for consumer electronics

- Growth in aerospace and defense sector

- Government initiatives for sustainable infrastructure

- Increasing demand for lightweight materials in automotive industry

North America Aluminum Extrusion Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.60 Billion |

| Market Size in 2025 | USD 11.31 Billion |

| Market Size by 2035 | USD 20.78 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.96% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product and Application |

Market Dynamics

Driver

Rising industrialization in the region

The rising population and economic development is driving the growth of industrialization across the region. Furthermore, the rising demand for aluminum in the several industries like in construction, automotive, packaging, transportation, aerospace and defense, consumer goods, healthcare, energy, manufacturing industries, and infrastructural development are fueling the growth of the market. Aluminum is used in the wide range of industrial applications such as aluminum extrusion is used in the manufacturing of vehicles, in the making of conventional gas-or-diesel powered vehicles, steel is replaced by the aluminum to make it lightweight and helps in lowering carbon emission from the vehicle.

The automobile and transportation industry is wholly responsible for 25% of the total carbon emission in the United States. Aluminum extrusion in the consumer goods industry is responsible for producing high strength, lightweight, high thermal conductivity, ease in fabrication, and non-corrosive consumer products. Thus, the higher adaptability of aluminum extrusion in the various end-use industries are driving the growth of the aluminum extrusion market.

Restraint

High cost

The increasing initial cost of the aluminum extrusion in the manufacturing industries is restricting the growth of the North America aluminum extrusion market. The cost factor usually limits the entry of new market players in the industry by acting as a hindering factor for the entire market. However, support initiatives by governments are observed to support the market in terms of overcoming the restraint.

Opportunity

Rising implementation in healthcare industry

The increasing healthcare sector due to the rising prevalence of diseases in the population and the increasing demand for technologically advanced diagnostic machines and equipment are highly contributing to the growth of the market. The rising adoption of the aluminum extrusion for the production of surgical equipment to the diagnostics machines due to its beneficial properties like corrosion resistance, light weight, design flexibility, fabrication, ease of machining, cost effectiveness, and durability that makes the materials an ideal for the production of machines. Aluminum extrusion is time saving, lower in cost, and delivers the near-net shape process than the other manufacturing methods.

Aluminum extrusion is used in healthcare applications like patient care, the manufacturing of beds, equipment stands, patient positioning systems, cubicle curtain tracks, corridor crash/handrails, service panels and electrical/utility raceways, and surgical lights. Thus, the rising demand for the healthcare industry in North America is driving the growth opportunity in the market.

By Product

In 2025, the shapes segment dominated the North America aluminum extrusion market with a substantial revenue share. This commanding position is primarily attributed to the broad range of structural and architectural applications that shapes offer across multiple industries. “Shapes” in aluminum extrusion typically include channels, angles, z-sections, tees, and other custom cross-sectional profiles that serve as essential components in construction frameworks, window and door systems, industrial equipment, and consumer products. The versatility of extruded shapes allows them to replace heavier steel or iron components, delivering the benefits of aluminum's high strength-to-weight ratio, corrosion resistance, and ease of fabrication.

The rods and bars segment is projected to be the fastest-growing product category in the North America aluminum extrusion market during the forecast period. This anticipated growth is driven by rising adoption across emerging industrial applications, particularly where precision-machined components are required. Rods and bars provide foundational raw material for further fabrication in sectors such as automotive, electrical, machinery, aerospace, and consumer electronics.

Growth in this segment is strongly correlated with the shift toward lightweighting frameworks in transportation and manufacturing industries. For instance, aluminum rods and bars are increasingly used for drivetrain components, structural supports, fasteners, and machined parts due to their favorable mechanical properties and recyclability. In the electrical sector, these products are leveraged for bus bars, connectors, and conductive components due to aluminum's excellent conductivity and reduced weight relative to copper.

North America Aluminum Extrusion Market, By Product, 2023-2025 (USD Million)

| By Product | 2023 | 2024 | 2025 |

| Shapes | 7,297.5 | 7,737.3 | 8,240.9 |

| Rods & Bars | 1,289.7 | 1,353.0 | 1,425.8 |

| Pipes & Tubes | 871.0 | 903.9 | 941.9 |

By Application

The building and construction segment commanded largest share in 2025 within the North America aluminum extrusion market, underscoring the material's deep integration into architectural and infrastructure projects. Aluminum extrusions are widely used in residential and commercial construction for windows, doors, curtain walls, roofing systems, structural glazing, sunshades, framing, and interior architectural elements.Several factors underpin this dominance. First, aluminum's lightweight nature and impressive strength support easier installation, reduced structural loads, and enhanced design flexibility, critical attributes in modern construction. Second, aluminum is highly durable and resistant to corrosion, weathering, and environmental stressors, making it ideal for exterior building components that require long service lives with minimal maintenance.

The automotive and transportation segment is anticipated to be the fastest-growing application category in the North America aluminum extrusion market during the forecast period. This rapid expansion is primarily driven by industry-wide efforts to reduce vehicle weight, improve fuel efficiency, and meet increasingly strict emissions regulations. Aluminum extrusions are being adopted more widely in automotive structures, chassis components, body panels, heat exchangers, suspension systems, and battery housings for electric vehicles (EVs).

North America Aluminum Extrusion Market Share by By Application (%)

| By Application | Share % |

| Automotive & Transportation | 18.0% |

| Building & Construction | 63.7% |

| Consumer Goods | 5.1% |

| Electrical & Energy | 5.9% |

| Others | 7.25% |

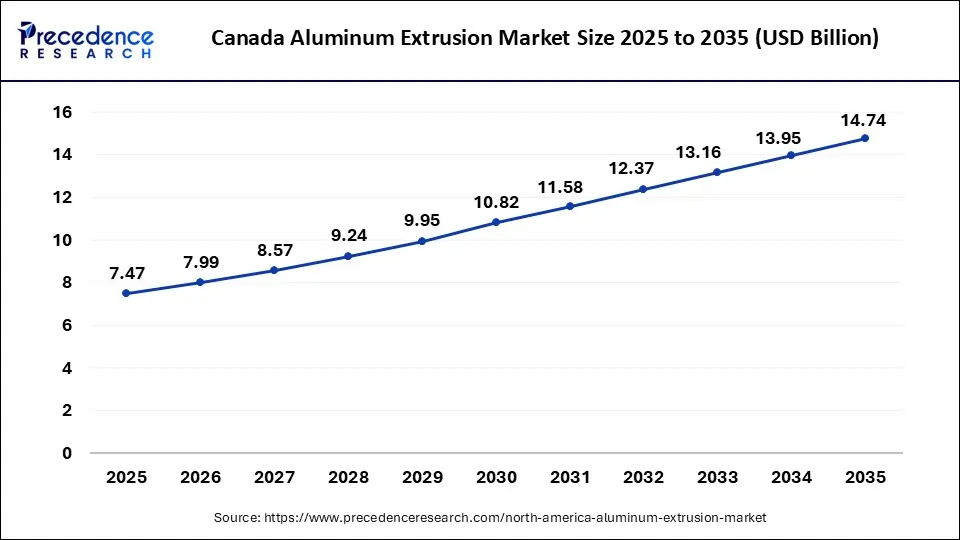

Canada Aluminum Extrusion Market Size and Growth 2026 to 2035

The Canada aluminum extrusion market size reached USD 7.47 billion in 2025 and is projected to attain around USD 14.74 billion by 2035, poised to grow at a CAGR of 7.03% from 2026 to 2035.

Canada dominated the North American aluminum extrusion market with the largest revenue share of 70.5% in 2025. The increasing infrastructural development and the rising industrialization, such as automotive, manufacturing, energy, consumer goods, and other industries, are driving the demand for aluminum extrusion activities. The rising investment in the manufacturing units and industrial development is boosting the growth of the market. Increasing economic development and the government support in the infrastructural development is contributing to the growth of the market.

North America Aluminum Extrusion Market

The North America region focuses on recyclable materials, sustainability, and the circular economy. The government policies, federal incentives for domestic manufacturing, and trade protection are strengthening the regional supply chain. The U.S. federal and state-level investments in infrastructure have accelerated demand for structural and architectural aluminum extrusions. The huge adoption of electric vehicles and the increased use of extrusions by manufacturers for vehicle lightweighting and battery trays aim to meet stricter emission standards.

Country-level Insights

U.S. Aluminum Extrusion Market Trends

The U.S. industry witnesses infrastructure modernization, electric vehicle transition, federal trade policy and tariffs, sustainability, and recycling. The major government programs include industrial decarbonization grants, workforce education, and critical minerals funding. The U.S. government makes efforts towards decarbonization, trade enforcement, and domestic production capacity.

Latest Announcements by Industry Leaders

- In September 2025, Peter Tokar III, CEO of Arconic Corporation Bahrain, reported the commissioning of a $57.5 million project for the expansion of high-purity aluminum production for defense and aerospace applications.

- In December 2025, Jason Weber, President of Aluminum Extrusion Co., proclaimed that the company members must ensure the nurturing of every opportunity to educate students in community colleges, trade schools, high schools, and universities, aiming to make and design innovative products with aluminum extrusions.

Investments in the North America Aluminum Extrusion Market

- In December 2025, ALUKO Group planned to establish the second U.S. manufacturing facility in Lauderdale County, which aims to mark nearly $110 million in capital investment and create 285 new jobs. ALUKO Group invested $107.7 million to locate its integrated aluminum manufacturing operations in Tennessee.

- In July 2025, H&H Aluminium Pvt. Ltd. announced the launch of India's largest solar frame manufacturing facility in Rajkot with an investment of INR 150 million. This facility will be 28,000 square meters and located in Chibhda village, and has an annual production capacity of 24,000 tonnes.

North America Aluminum Extrusion Market Companies

- Aluminum Products Company: Architectural systems, standard & custom profiles, advanced surface treatments, sustainable solutions.

- Arconic Corporation Bahrain: Aerospace components, automotive solutions, specialty products, high-purity aluminum.

- Aluminum Extrusion Co. (Balexco): Structural and custom profiles, pipes and tubes, rods and bars, specialized EV components, sustainable product lines, advanced alloy series, value-added finishing.

- Century Extrusions Limited: Bars and rods, coiled products, hardware sets, clamps, and connectors.

- China Zhongwang Hindalco: Automotive and EV solutions, specialty engineered products, consumer durables

Recent Developments

- In August 2025, in the U.S. and Canada, raises the bar for aluminum extrusion quality, reliability, and worth was launched by Metra North America. Extruded aluminum company, Profile Custom Extrusions and Metra Canada unite as Metra North America to redefine aluminum extrusion quality reliability and worth.

Metra North America launches in the US and Canada, raises the bar for aluminium extrusion quality, reliability and worth - In May 2025, with the industry leading a TULC Technology, forging a New Era of Aluminum Beverage Can Manufacturing was launched by ValCan Packaging.

VulCan Packaging Launches with Industry-Leading aTULC™ Technology, Next-Generation Aluminum Beverage Can Manufacturing

Segments Covered in the Report

By Product

- Shapes

- Rods and Bars

- Pipes and Tubes

By Application

- Automotive & Transportation

- Building & Construction

- Consumer Goods

- Electrical & Energy

- Others

By Country

- U.S.

- Canada

- Mexico

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting