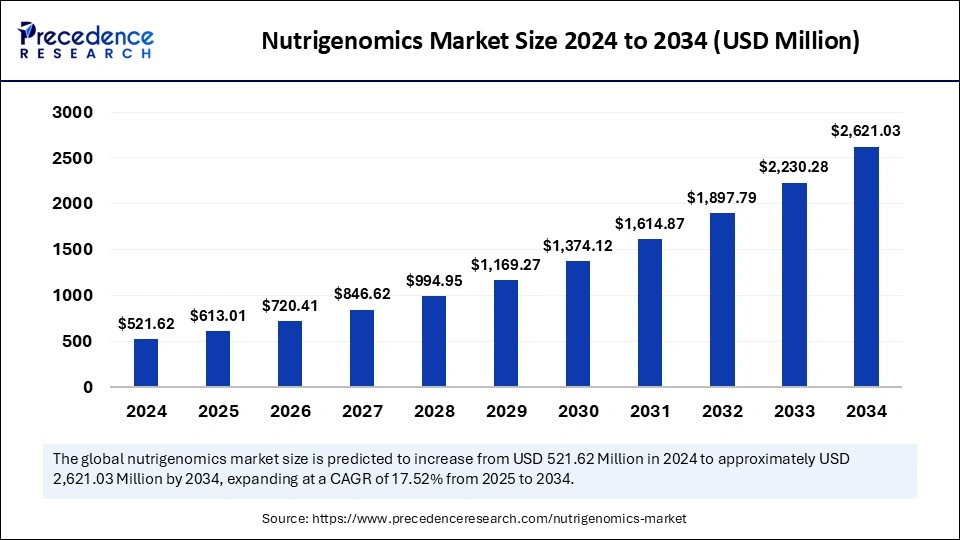

The global nutrigenomics market size is calculated at USD 613.01 million in 2025 and is forecasted to reach around USD 2,621.03 million by 2034, accelerating at a CAGR of 17.52% from 2025 to 2034. The North America market size surpassed USD 213.86 million in 2024 and is expanding at a CAGR of 17.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nutrigenomics market size was estimated at USD 521.62 million in 2024 and is predicted to increase from USD 613.01 million in 2025 to approximately USD 2,621.03 million by 2034, expanding at a CAGR of 17.52% from 2025 to 2034. The demand for personalized nutrition has increased, driving the global market. Growing awareness of genetic expression and nutrition is driving demands for genetic testing, leading the market to grow further.

Artificial Intelligence has the potential to analyze broad datasets of genetic and nutritional information and helps to develop nutrigenomics research platforms. AI enables the predictions of interaction between nutrients and genetic markers. The integration of AI enables the development of more accurate dietary plans according to the interaction between genes, environment, and lifestyle factors. In addition, the ability of an algorithm to provide continuous monitoring of the health helps to adjust the nutrition recommendation accordingly.

AI not only supports enhancing the nutrigenomics market but also improving research capabilities. They play a crucial role in helping researchers identify genetic markers and stimulate the effect of various nutritional interventions on human health to predict outcomes and optimize interventions. For advanced personalized nutrition recommendations, research capabilities, and streamlined analysis, AI is becoming an essential tool in the nutrigenomic platform.

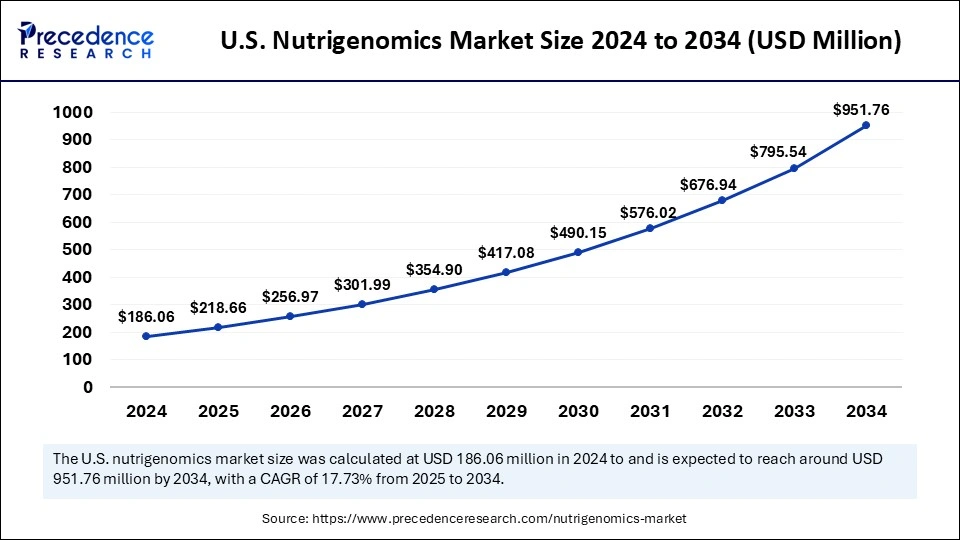

The U.S. nutrigenomics market size was exhibited at USD 186.06 million in 2024 and is projected to be worth around USD 951.76 million by 2034, growing at a CAGR of 17.73% from 2025 to 2034.

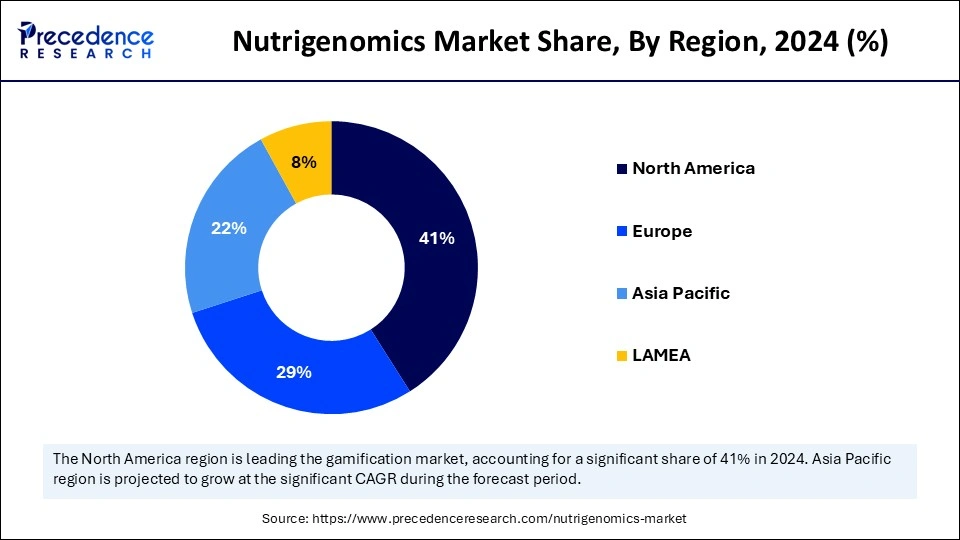

North America dominated the nutrigenomics market with the largest revenue share in 2024 due to the increased prevalence of chronic diseases such as cancer, obesity, and cardiovascular diseases. North America has a highly health-conscious consumer pool. North America is witnessing a higher demand for personalized nutrition plans based on individual genetics profiles due to the increased adoption of direct-to-consumer genetic testing kits. Furthermore, actors like well-established healthcare infrastructure and growing awareness of health and Wellness are driving significant impact on market growth.

The United States is leading the regional market because of the high prevalence of chronic diseases and the increased demand for personalized medicines. Rising obesity rates are driving countries' consumers toward awareness of and importance of health and wellness. The United States is witnessing significant investments in research and developments in genetic tests and therapies. The presence of major market competitors and advanced research institutes is enabling the availability of genetic testing services in the country.

Asia Pacific is expected to host the fastest-growing nutrigenomics market during the forecast period due to increasing chronic disease prevalence, growing advancement in healthcare infrastructure, awareness of health and Wellness, and a large population with diverse genetic profiles. Asia Pacific is expected to boost nutrigenomic areas with growing government support and investments in genomics research and the integration of genomics into healthcare. The growing availability of disposable income allows regional consumers to spend on health-conscious diets, making a significant impact on the adoption of nutrigenomics.

The brand is dedicated to delivering the highest quality supplements to Indians. Countries like China and India are contributing significant market share in the region due to growing awareness of personalized nutrition, increased adoption of genetic testing, advancing healthcare infrastructure, and a large population base. Japan is projected to witness spectacular growth and forecast, driven by the country's advanced healthcare expenditure and large adoption of genetic testing.

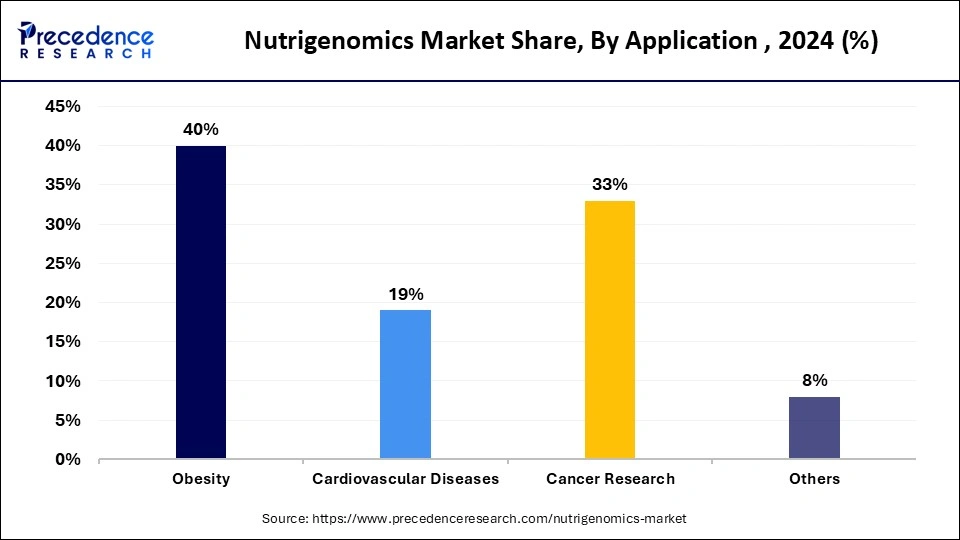

The nutrigenomics market is significantly transforming due to rising concerns for anti-aging, chronic diseases, obesity, and diabetes. The awareness about the impact of food on genes and genes on the coordination of the body and food is driving the shift of healthcare providers to adopt personalized nutrition to enhance patient outcomes. The increased prevalence of chronic diseases such as obesity, cancer, and cardiovascular disease is playing a crucial role in the adoption of personalized nutrition and genetic testing. Several advanced technologies, such as saliva, buccal swabs, and blood sample testing, are trending in healthcare expenditure.

The craze of personalized nutrition is emerging, due to increased awareness and rate of chronic disease prevalence. Increase awareness about the interaction of the individual body with food and driving demands for personalized nutrition to reduce the risk of obesity and prevent chronic diseases. Furthermore, the nutrigenomics market witnessed spectacular growth as the growth in integration of cutting-edge technologies such as AI and Machine Learning took place. The adoption of advanced technologies in clinical research is allowing key companies to develop cutting-edge innovative tests to boost the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,621.03 Million |

| Market Size in 2025 | USD 613.01 Million |

| Market Size in 2024 | USD 521.62 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, Technique, End-Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advanced genomic technologies

Advancements in genomic technologies are driving significant growth in the nutrigenomics market. Advanced genomic technologies such as next-generation sequencing, genomic editing technology, microbiomics, epigenomics, single-cell genomics, and the integration of cutting-edge technologies are emerging in the market. Advanced genomic technologies are enhancing our understanding of the relationship between genomics, nutrition, and health and wellness. These technologies are enabling the development of advanced personalized nutrition strategies to improve health and reduce the risk of chronic disease prevalence.

Rising awareness of nutrigenomics has led to increased demands for personalized nutrition recommendations and genetic testing. The adoption of bioinformatics and computational tools is allowing access to analyzing large amounts of genomic data, enabling the identification of accurate patterns and coordination between genetic profile and nutrition, and helping to provide advanced personalized nutrition plans.

High cost

High costs related to next-generation sequencing, gene expression analysis, and genotyping are the major restraints for the adoption of the nutrigenomics market. Nutrigenomics requires the integration of high-performance computing tools to analyze a broad amount of genetic data, making them more costly. The implementation of nutrigenomics needs large capital and skilled healthcare professionals for the use of nutrigenomics makes it quite expensive. Additionally, the high cost of regulatory compliance and certifications is hampering the market competition.

Expansion of direct-to-consumer (DTC) services

The growing expansion of direct-to-consumer services is driving market potential due to the easy accessibility of genetic testing and its convenient and user-friendly nature. Increasing consumer awareness about the importance of personalized nutrition and its benefits is driving demand for direct-to-consumer nutrigenomic services. Additionally, the demand for tailored dietary recommendations based on genetic profiles is changing the nutrigenomics market.

Advancements in technologies such as next-generation sequencing and integration of AI and ML are enabling more affordability and accuracy of direct-to-consumer services. Key market companies are making great efforts to provide personalized genetic testing and nutrition advice directly to consumers. Additionally, ongoing partnerships of direct-to-consumer services with healthcare providers, nutritionists, and wellness experts are surging the market growth.

The reagents and kits segment contributed the largest nutrigenomics market share in 2024. The segment growth is attributed to increased demand for genetic testing and the adoption of direct-to-consumers and genetic testing. Reagents and kits are a significant tool for genetic testing, which helps researchers and healthcare professionals to analyze genetic markers and develop personalized nutrition plans for patients. DNA extraction kits, PCR reagents, and genotyping kits are trending in the market.

On the other hand, the services segment is anticipated to witness notable growth in the forecast period. The adoption of nutrigenomic services, including personalized nutrition services and genetic testing services, has increased to help clinical research and healthcare professionals in the development of personalized nutrition recommendations. Service segments play a significant role in the development of personalized nutrition. Growing adoption of direct-to-consumer genetic testing and driving demands for services to interpret genetic data and provide personalized nutrition suggestions. Moreover, the growing demand for gene expression analysis services has a significant impact on the market growth.

The buccal swabs segment generated the biggest nutrigenomics market share in 2024. Buccal swabs are non-invasive. The non-invasive nature of buccal swabs makes them accessible, convenient, and user-friendly, which is ideal for at-home personalized nutrition testing kits. Key market companies can provide personalized nutrition plans due to easy access to genetic information through buccal swabs. The user-friendly advantages and cost-effectiveness make buccal swabs more popular.

However, the blood segment is expected to grow at a solid CAGR in the upcoming years. A blood sample provides a high source of genetic information, which supports a detailed analysis of an individual's genes' interaction with nutrients. High-quality DNA provided by blood samples enables accurate nutrigenomic testing. Advancements in blood-based testing methods, such as next-generation sequencing, are improving the accuracy and effectiveness of genetic testing. The rising adoption of blood sample-based genetic testing, gene expression testing, and genotyping is improving personalized nutrient plans.

The obesity segment dominated the global nutrigenomics market in 2024. Obesity is a primary application area for nutrigenomics. The obesity segment is anticipated to continuously witness growth due to the increased prevalence of obesity globally and the demand for personalized approaches to weight loss. Growing advancements in genetic research are enabling the development of genetic testing and personalized nutrition services to control obesity. Growing awareness of DNA and genetic best weight loss approaches are trending in the market.

The cancer research segment is projected to witness significant growth in the forecast period. Cancer research is gaining the fastest-growing application approaches in nutrigenomics due to growing recognition of the role of nutrition in cancer prevention. Growing focus on the identification of research based on patients’ genetic profiles is driving demand for genetic testing. Nutrigenomics is advancing the detection of high-risk cancer, and understanding to develop tailored diet plans accordingly based on their genetic makeup for the prevention of cancer is leveraging the segment to grow.

The hospitals and clinics segment has generated the biggest share of the nutrigenomics market in 2024. Hospitals and clinics at the prior settings for increased adoption of personalized medicines. Deduction of genetic testing is high in hospital and clinical settings given by increasing our awareness of the importance of genetic factors in nutrition and health among patients and healthcare professionals. Hospitals and clinics provide access to advanced diagnostic tools such as next-generation screening, making them ideal for patients. Additionally, the availability of skilled healthcare professionals, such as genetic counselors and nutritionists, drives the popularity of hospitals and clinics. Government initiatives and funding for hospitals and clinics further contribute to segment expansion.

By Product

By Application

By Technique

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client