March 2025

U.S. Off-road Vehicles Market (By Product Type: All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler; By Propulsion Type: Gasoline, Diesel Electric; By Application: Utility, Sports, Recreation, Military) - Industry Analysis, Size, Share, Growth, Trends, and Forecast 2024-2034

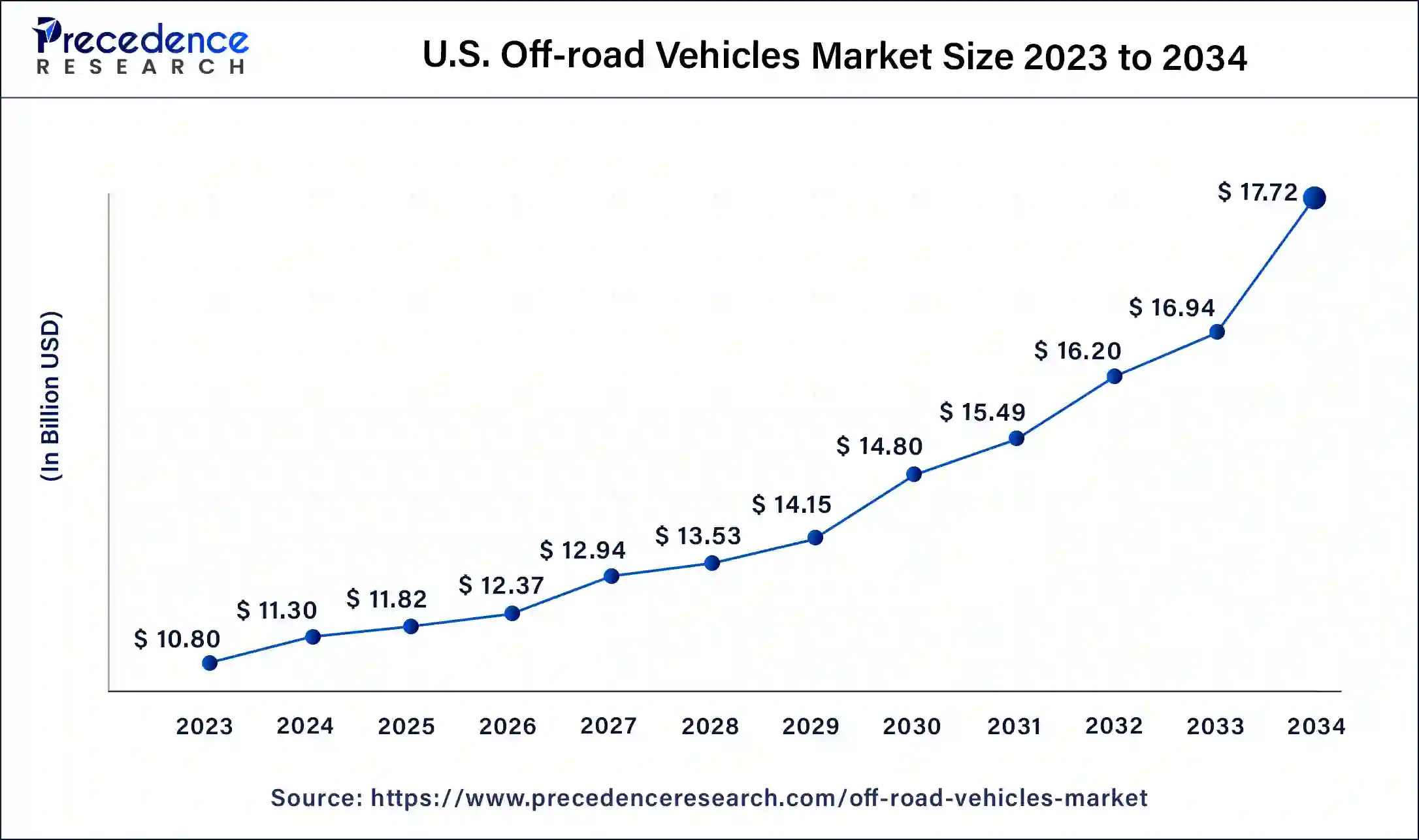

The U.S. off-road vehicles market size was USD 10.80 billion in 2023, accounted for USD 11.30 billion in 2024, and is expected to reach around USD 17.72 billion by 2034, expanding at a CAGR of 4.6% from 2024 to 2034.

The U.S. off-road vehicles market offers specialized vehicles designed for driving on rough terrain like dirt, mud, rocks, and sand, rather than paved roads. These vehicles include ATVs (all-terrain vehicles), UTVs (utility task vehicles), side-by-sides, dirt bikes, and off-road trucks. People use them for various purposes like recreation, work, hunting, and racing. They are popular for outdoor activities such as trail riding, hunting, farming, and exploring remote areas.

Off-road vehicles come in different sizes and shapes, with features like four-wheel drive, rugged tires, and durable suspension systems to handle rough terrain. Safety is essential when using off-road vehicles, including wearing helmets and following safety guidelines to prevent accidents and injuries. Many companies manufacture off-road vehicles in the U.S., offering a wide range of options to suit different needs and preferences.

U.S. Off-road Vehicles Market Data and Statistics

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 10.80 Billion |

| U.S. Market Size in 2024 | USD 11.30 Billion |

| U.S. Market Size by 2034 | USD 17.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Propulsion Type, and By Application |

The expansion of off-road vehicle applications in commercial and industrial sectors significantly boosts the demand for off-road vehicles in the U.S. market. These vehicles are increasingly utilized in various industries such as construction, mining, and utilities due to their versatility and ability to navigate rugged terrain. In the construction sector, off-road vehicles are indispensable for tasks like transporting materials, equipment, and personnel across challenging worksites, improving efficiency and productivity. Similarly, in mining operations, off-road vehicles play a crucial role in hauling heavy loads and accessing remote areas, enhancing operational capabilities, and reducing downtime.

Moreover, off-road vehicles find applications in utilities for tasks like maintenance, inspection, and repair of infrastructure in difficult-to-reach locations. The expansion of off-road vehicle usage in these sectors not only drives sales for manufacturers but also stimulates innovation as companies develop specialized models tailored to meet the unique requirements of commercial and industrial customers. This trend further solidifies the position of off-road vehicles as essential assets across a wide range of professional settings, contributing to sustained growth in the U.S. off-road vehicles market.

During economic downturns, discretionary spending tends to decrease as consumers prioritize essential expenses over recreational purchases like off-road vehicles in the U.S. market. When individuals face financial uncertainty, they are less likely to invest in leisure activities such as off-roading, leading to a decline in demand for these vehicles. As disposable income shrinks, potential buyers may postpone or cancel their plans to purchase off-road vehicles, resulting in reduced sales and market for manufacturers and dealerships.

Moreover, economic downturns can impact the confidence of consumers, making them hesitant to make significant purchases like off-road vehicles. Uncertainty about job security and future income levels can lead individuals to adopt a more conservative approach to spending, further dampening demand in the off-road vehicles market. Consequently, during periods of economic instability, the U.S. off-road vehicles market may experience decreased sales volume and slower growth as consumer discretionary spending contracts.

The integration of digital technology for enhanced navigation and connectivity presents significant opportunities in the U.S. off-road vehicles market. With the advent of global positioning systems (GPS) systems and advanced mapping software, off-road vehicles can now offer users precise navigation tools tailored for off-road terrain. This enables enthusiasts to explore new trails and remote areas with confidence, enhancing their overall off-road experience.

Additionally, connectivity features such as Bluetooth connectivity and smartphone integration allow off-road vehicle users to stay connected while exploring the outdoors. This includes features like receiving real-time weather updates, sharing location information with friends or family, and accessing emergency assistance if needed. By incorporating these digital advancements, manufacturers can attract tech-savvy consumers and differentiate their products in the competitive off-road vehicles market, thereby driving sales and fostering brand loyalty. Overall, the integration of digital technology opens up new possibilities for off-road enthusiasts and enhances the appeal of U.S. off-road vehicles market.

The three-wheeler segment held the highest market share of 46% based on the product type. In the U.S. off-road vehicles market, the three-wheeler segment includes vehicles with a single wheel in the front and two wheels in the back. Historically popular, three-wheelers have seen a resurgence in interest among enthusiasts for their agility and manoeuvrability. However, safety concerns have led to a decline in production and sales. Despite this, niche markets and specialty manufacturers continue to cater to enthusiasts seeking unique off-road experiences, driving modest growth in the segment.

The UTV segment is anticipated to witness rapid growth at a significant CAGR of 8.4% during the projected period in the U.S. off-road vehicles market. UTVs, or Utility Task Vehicles, are off-road vehicles designed for versatile utility applications. They typically feature side-by-side seating, a cargo bed, and four-wheel drive capabilities, making them ideal for work and recreation. In the U.S. off-road vehicles market, the UTV segment has seen steady growth driven by increasing demand in agriculture, construction, and recreational sectors. Recent trends include the introduction of electric-powered UTVs for eco-friendly alternatives and advanced technology integration for improved performance and user experience.

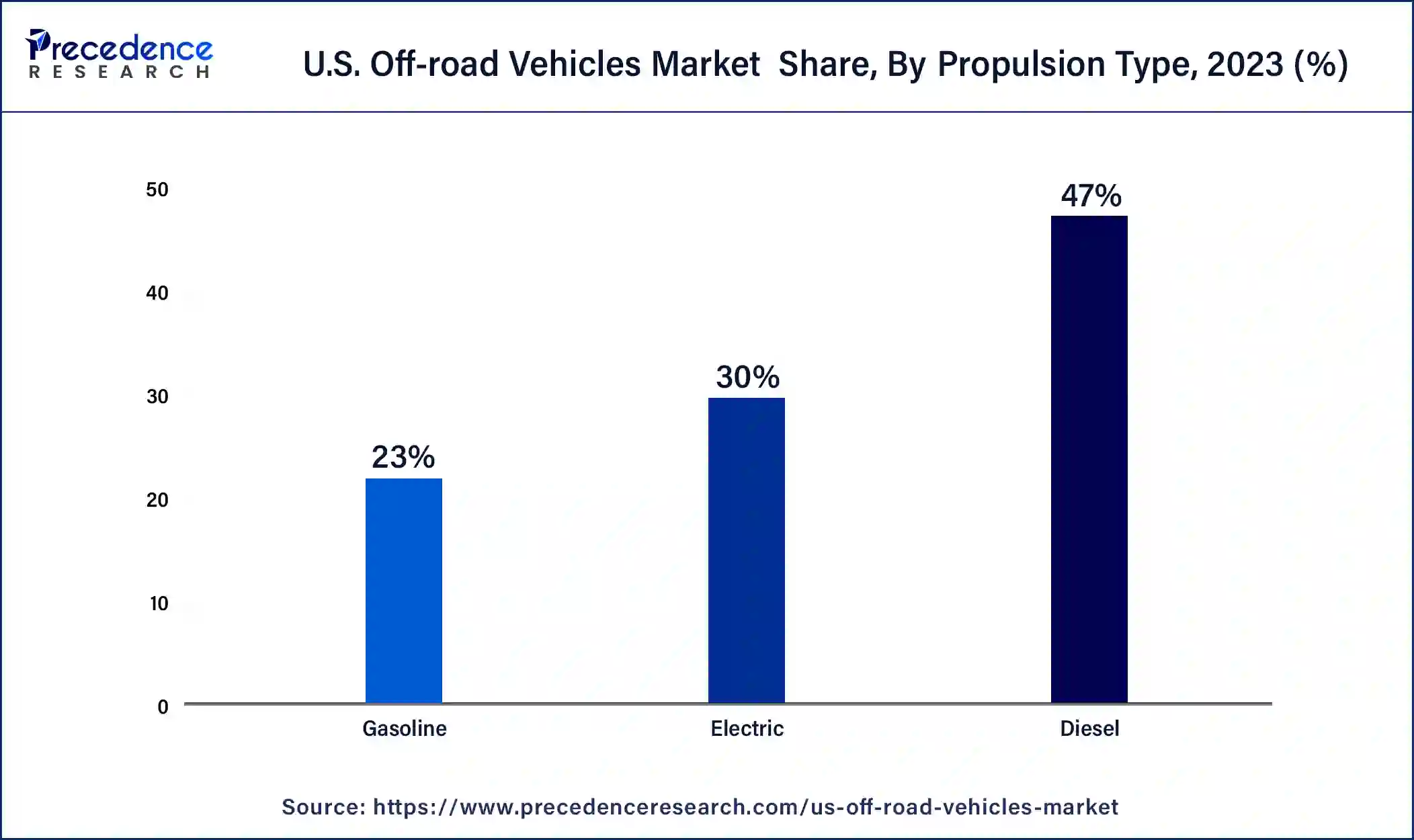

The diesel segment held a 47% market share in 2023. In the U.S. off-road vehicles market, the diesel segment refers to vehicles powered by diesel engines. These vehicles typically offer robust torque and fuel efficiency, making them well-suited for heavy-duty applications in industries like agriculture, construction, and utilities. Despite the growing popularity of electric and gasoline-powered off-road vehicles, the diesel segment continues to see demand, particularly in sectors where durability and towing capacity are paramount. However, there's a rising trend towards cleaner diesel engines compliant with stricter emissions regulations to address environmental concerns.

The gasoline segment is expected to expand at the fastest CAGR over the projected period in the U.S. off-road vehicles market. Factors such as improved engine technology, enhanced fuel efficiency, and greater accessibility to gasoline fueling stations contribute to the segment's robust growth prospects. Additionally, the versatility and reliability of gasoline-powered off-road vehicles make them well-suited for a wide range of applications, including recreational activities, agricultural operations, construction projects, and utility tasks. As demand for off-road vehicles continues to rise across various sectors, the gasoline segment is positioned to lead the market expansion, driving innovation and shaping the future of off-road mobility in the United States.

The sports segment has held a 38% market share in 2023. In the U.S. off-road vehicles market, the sports segment refers to vehicles designed specifically for recreational purposes such as off-road racing, trail riding, and other adrenaline-fueled activities. Trends in this segment include the increasing popularity of off-road racing events and competitions, the demand for high-performance vehicles with advanced suspension systems and powerful engines, and the incorporation of technology for enhanced safety and connectivity features. Sports segment vehicles are favored by enthusiasts seeking excitement and adventure in off-road environments.

The military segment is anticipated to witness rapid growth over the projected period. In the U.S. off-road vehicles market, the military segment refers to vehicles specifically designed for military applications, such as troop transport, reconnaissance, and logistics support. Trends in this segment include a growing demand for rugged, versatile vehicles capable of operating in diverse terrain conditions. Military off-road vehicles are increasingly incorporating advanced technologies for improved performance, durability, and survivability. Additionally, there is a trend towards the development of electric-powered and autonomous off-road vehicles to enhance operational efficiency and reduce environmental impact.

Segments Covered in the Report

By Product Type

By Propulsion Type

By Application

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

May 2024

January 2025

July 2024