September 2024

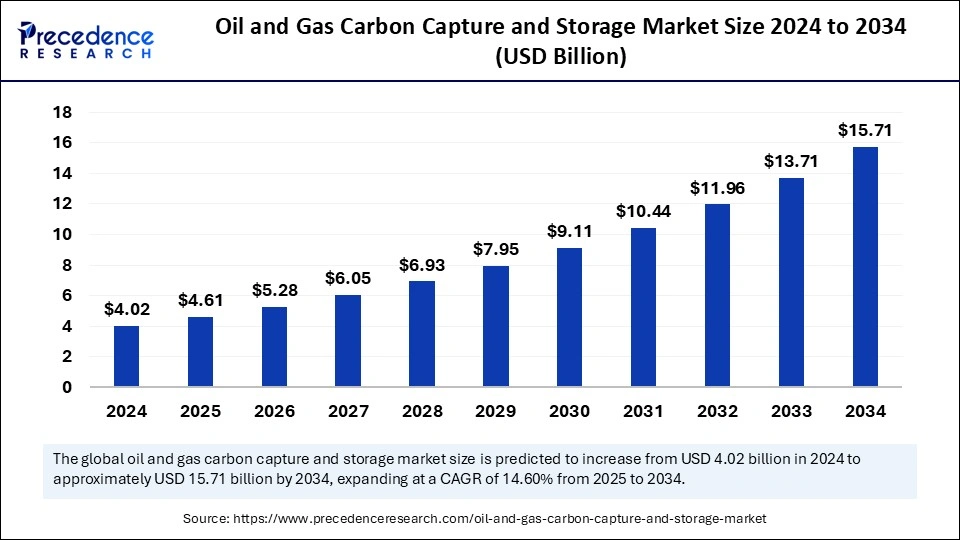

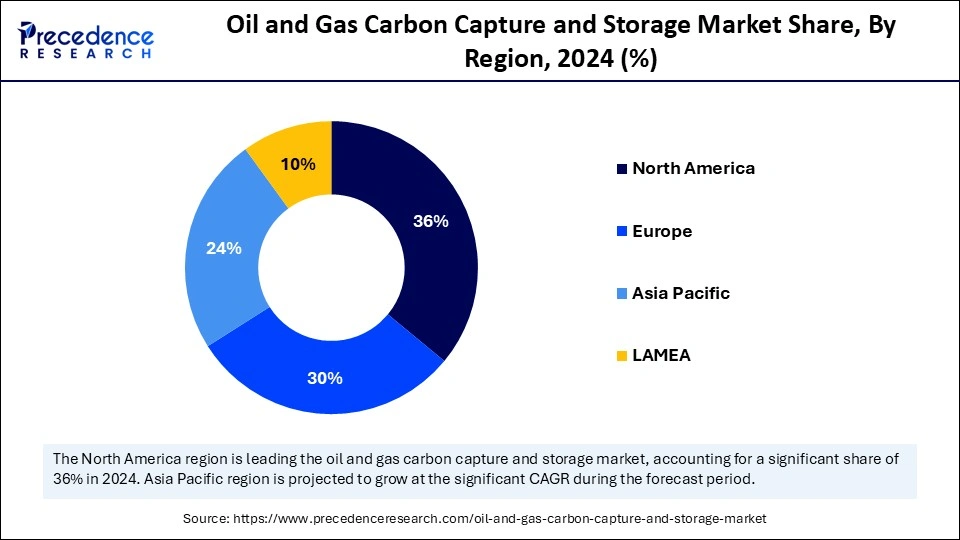

The global oil and gas carbon capture and storage market size is calculated at USD 4.61 billion in 2025 and is forecasted to reach around USD 15.71 billion by 2034, accelerating at a CAGR of 14.60% from 2025 to 2034. The North America market size surpassed USD 1.45 billion in 2024 and is expanding at a CAGR of 14.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oil and gas carbon capture and storage market size was estimated at USD 4.02 billion in 2024 and is predicted to increase from USD 4.61 billion in 2025 to approximately USD 15.71 billion by 2034, expanding at a CAGR of 14.60% from 2025 to 2034. The increasing focus on lowering CO2 emissions, supportive government frameworks, rising popularity of CO2 enhanced oil recovery (EOR) techniques, and expansion of the oil & gas industry are among several factors driving the growth of the oil and gas carbon capture and storage market.

As technology continues to evolve, artificial intelligence (AI) integration presents a promising opportunity to transform the global oil and gas carbon capture and storage market. AI-driven automation processes can enhance the effectiveness of carbon capture systems and significantly improve maintenance practices in oil & gas installations. AI holds the potential to optimize carbon removal technologies and ensure more efficient as well as scalable sustainability practices. AI-powered evaluation systems can considerably enhance the oil & gas industry's efforts in carbon capture and storage (CCS) by enabling accurate real-time monitoring, providing predictive analytics, and optimizing processes. AI solutions can continuously evaluate carbon removal operations by effectively analyzing the massive amount of environmental data from satellite imaging, sensors, operational metrics, and others. Machine learning algorithms can also assist in predicting future emissions trends, optimizing carbon storage methods, and suggesting the required adjustments to boost the effectiveness of carbon removal technologies. By leveraging predictive models, AI assists the oil & gas industry in proactively addressing critical environmental risks and boosts sustainability.

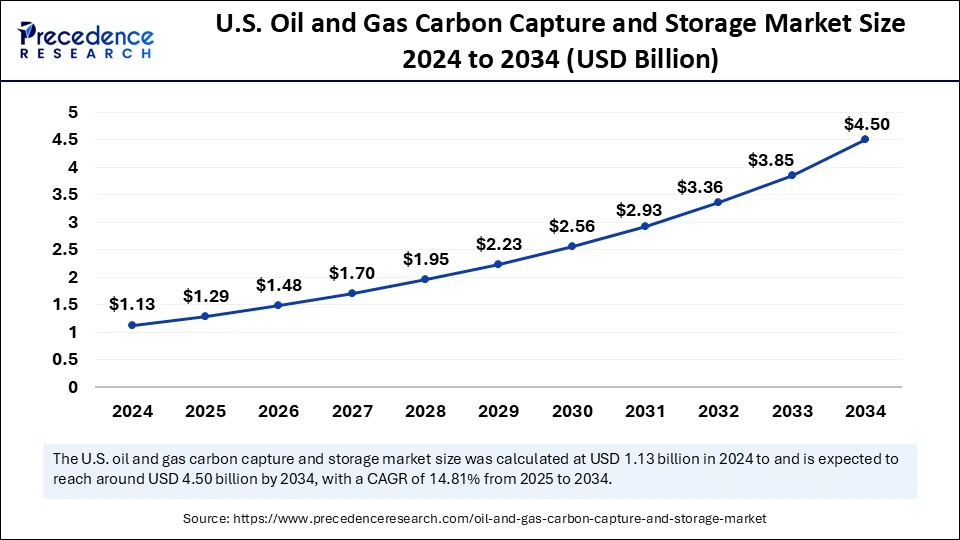

The U.S. oil and gas carbon capture and storage market size was exhibited at USD 1.13 billion in 2024 and is projected to be worth around USD 4.50 billion by 2034, growing at a CAGR of 14.81% from 2025 to 2034.

North America dominated the oil and gas carbon capture and storage market with the largest share in 2024. The region’s dominance is mainly attributed to stringent emission regulations and the high acceptance of advanced carbon-capturing technologies. The region is likely to sustain its position throughout the forecast period due to the growing popularity of CO2-EOR methods. Additionally, the rising integration of carbon CCS and EOR technologies with renewable energy sources holds great potential to create a more sustainable energy ecosystem. These technologies can assist in reducing greenhouse gas emissions from fossil fuel production and increase the utilization of solar energy and wind energy sources.

Asia Pacific is expected to witness the fastest growth during the forecast period. There is a strong focus on lowering greenhouse emissions, which contributes to the Asia Pacific oil and gas carbon capture and storage market. The rising public-private investments in the oil & gas industry, integration of CCS with renewable energy sources, and growing demand for CO2-EOR methods are expected to boost the growth of the market in the region during the forecast period. The rising government efforts to promote sustainability are boosting the demand for CCS. In addition, governments of various countries such as China, Japan, and India are making efforts to achieve carbon neutrality and boost sustainability. Such factors boost the growth of the market in the region.

The European oil and gas carbon capture and storage market is expected to grow at a notable rate in the foreseeable future. Stringent emission standards and the availability of robust carbon storage infrastructures are likely to support regional market growth. There is a strong emphasis on reducing emissions from industrial activities, boosting the adoption of CCS. European Union’s commitment to net-zero emissions further contributes to market growth.

In recent years, the urgent need to address the climate change issue has compelled industries to invest in sustainable solutions. The oil & gas sector is one of the major contributors to carbon emissions. Carbon capture and storage (CCS) technology emerges as a promising solution to capture carbon dioxide (CO2) emissions and geologically store them safely in an underground location. CCS is proven to be a crucial technology in the oil & gas industry to reduce greenhouse gas emissions. The implementation of CCS and EOR can significantly enhance oil production while reducing emissions. Sustainability in the oil & gas industry has become a crucial focus to combat climate change. The rising focus on lowering carbon emissions in the environment has increased the demand for carbon capture and storage (CCS) in the oil & gas industry sector. Carbon capture and storage promote sustainable development and mitigate global warming.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.71 Billion |

| Market Size in 2025 | USD 4.61 Billion |

| Market Size in 2024 | USD 4.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Environmental Concerns

The growing environmental concerns are driving the growth of the oil and gas carbon capture and storage market. Global warming is a major environmental concern around the world, resulting in the frequent occurrence of extreme weather events around the world. Carbon capture and storage (CCS) holds great potential to reduce greenhouse gas emissions from the oil and gas industry and their impact on climate change. The adoption of carbon storage methods can significantly prolong the lifetime of existing oil and gas reservoirs by enhancing recovery and lowering the level of CO2 emitted during production. This approach can provide economic benefits for oil and gas companies and minimize their operations' environmental impact. Thus, increasing efforts to lower CO2 emissions assist in achieving a low-carbon economy.

High Initial Investment

The high initial investment associated with implementing CCS technologies in the oil & gas industry is anticipated to hinder the growth of the oil and gas carbon capture and storage market. The huge capital required for carbon capture, transportation, and storage often discourages various companies from adopting CCS solutions. In addition, the lack of availability of a well-established infrastructure can limit the feasibility of CCS projects in several undeveloped countries. Such factors are likely to restrict the expansion of the market.

Increasing Focus on Capturing CO2

The rising focus on capturing CO2 is projected to offer immense growth opportunities for the oil and gas carbon capture and storage market during the forecast period. Carbon capture and storage (CCS) is a crucial technology for the oil & gas industry. The energy that is generated from burning natural gas or other fossil fuels releases a large amount of CO2 into the atmosphere, which becomes a major concern as CO2 is a greenhouse gas that adversely contributes to climate change. Carbon capture and storage (CCS) allows capturing the CO2 emissions during heavy oil production, storing them safely underground in geological formations, and then releasing them into the atmosphere. The process typically involves capturing CO2 at the emission source, such as a gas plant or a boiler, and then transporting it through the pipelines to a storage site.

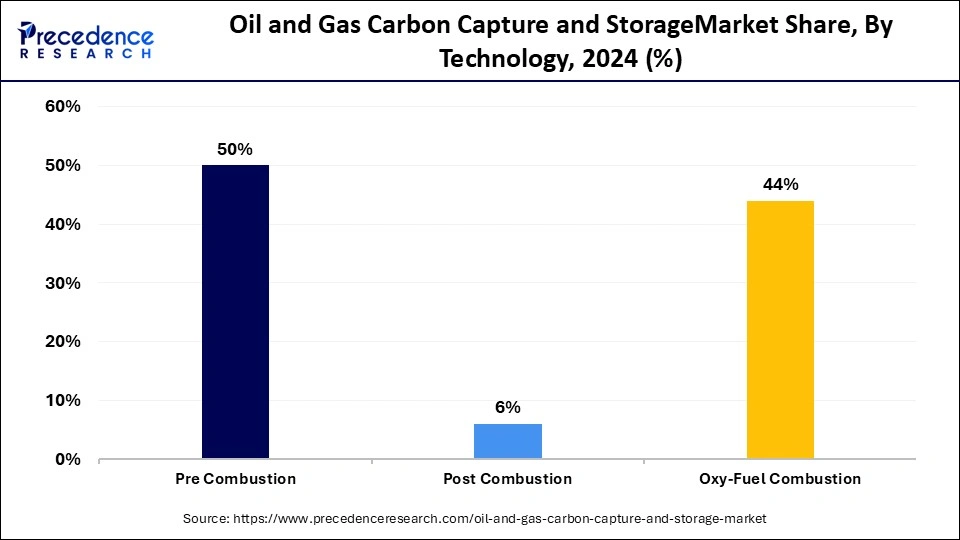

The post-combustion segment held the dominant share of the oil and gas carbon capture and storage market in 2024. This is mainly due to the rise in the adoption of the post-combustion carbon capture and storage (CCS) technology in the oil & gas industry. Post-combustion capture is one of the most cost-effective and widely used methods. This technology removes CO2 from the exhaust gas after combustion. Post-combustion involves capturing CO2 from power plant flue gases. Stringent environmental regulations and a strong emphasis on carbon emission reduction further bolstered the segment.

On the other hand, the pre-combustion segment is expected to grow at a significant rate during the forecast period. Pre-combustion capture involves converting fossil fuels into a gaseous mixture of hydrogen and CO2 prior to combustion. Pre-combustion capture is one of the most popular and efficient capture technologies. This technology is extensively utilized in gasification processes. It captures about 95% of the CO2 produced, which makes it very efficient and gained significant attention in the oil & gas industry.

By Technology

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

December 2024