January 2025

Oilfield Equipment Market (By Equipment: Drilling Equipment, Field Production Machinery, Pumps, Valves; By Application: Onshore, Offshore) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

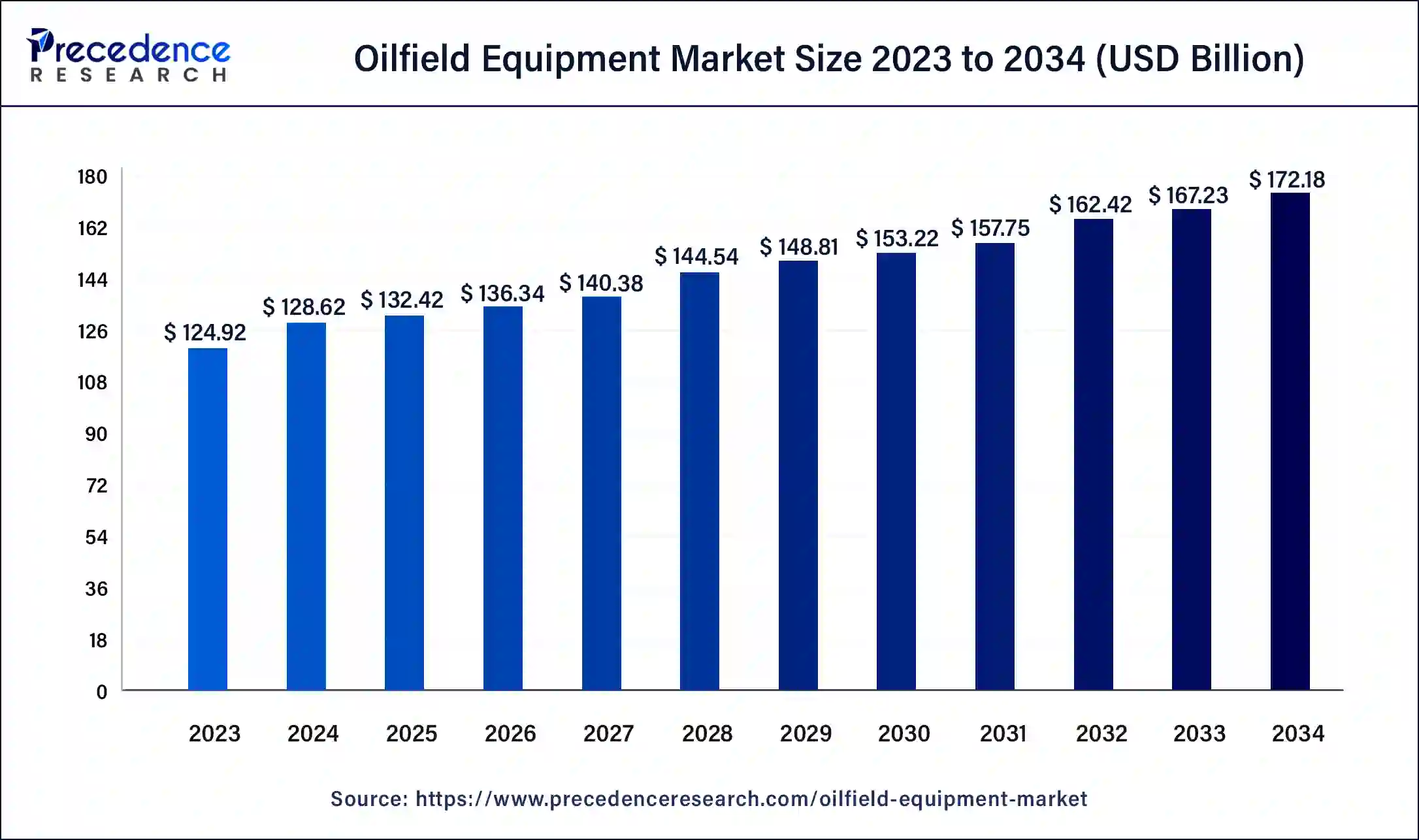

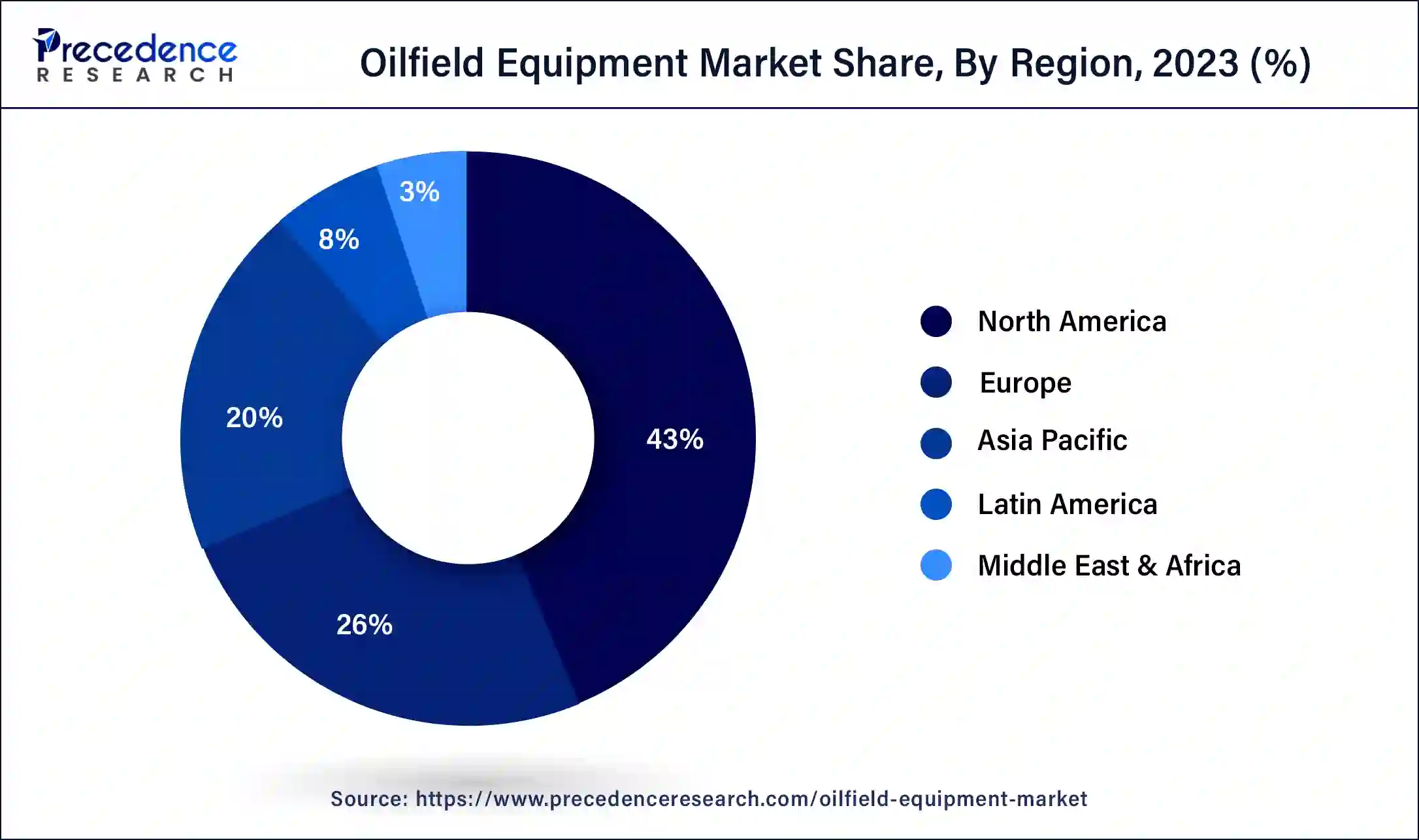

The global oilfield equipment market size was USD 124.92 billion in 2023, accounted for USD 128.62 billion in 2024 and is expected to reach around USD 172.18 billion by 2034, expanding at a CAGR of 2.96% from 2024 to 2034. The North America oilfield equipment market size reached USD 53.72 billion in 2023. The rising demand for crude oil across the world is driving the growth of the oilfield equipment market.

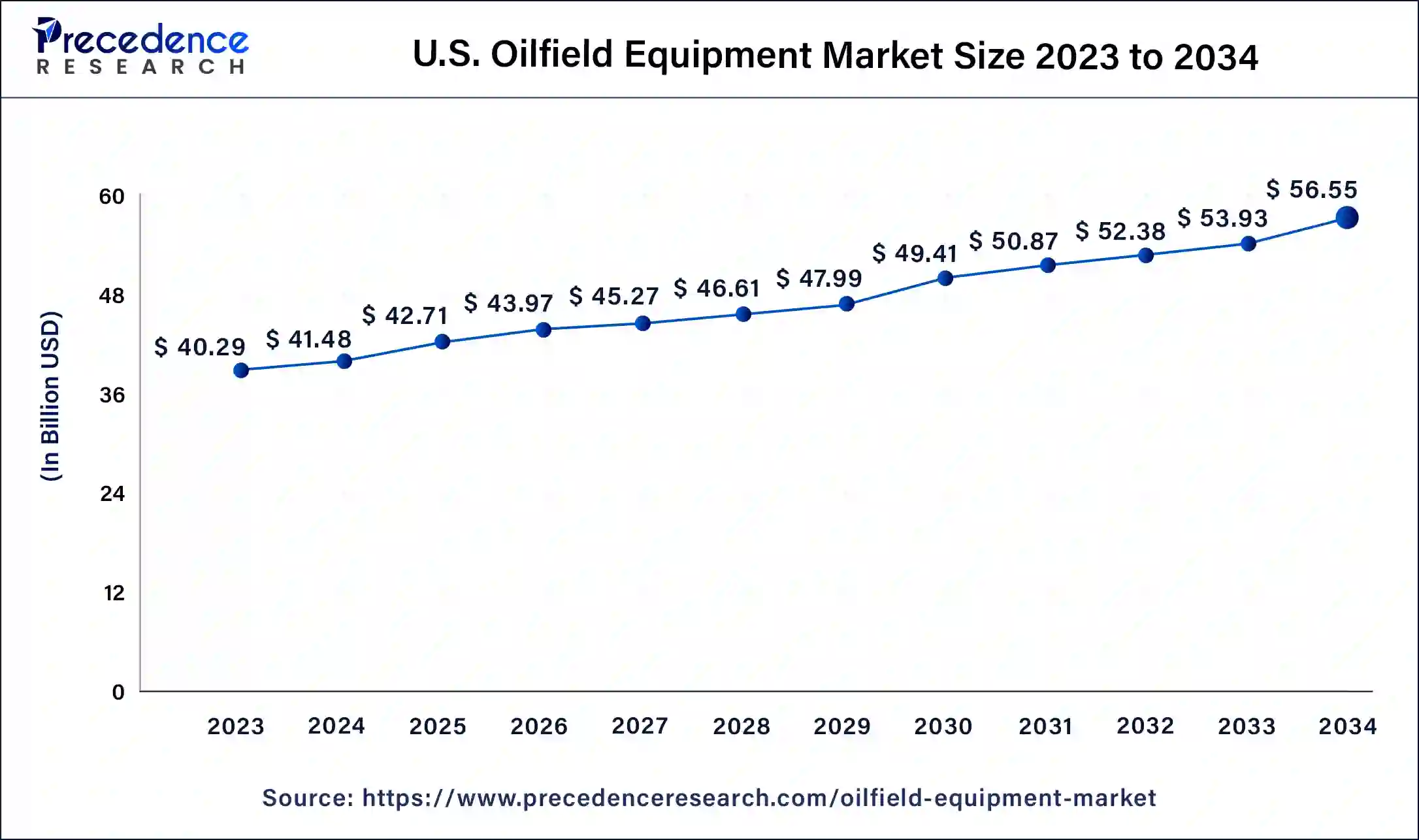

The U.S. oilfield equipment market size was exhibited at USD 40.29 billion in 2023 and is projected to be worth around USD 56.55 billion by 2034, poised to grow at a CAGR of 3.13% from 2024 to 2034.

North America held a significant share of the global oilfield equipment market in 2023 and is expected to maintain its dominance throughout the forecast period. The growth of the market in the North American region is mainly driven by the rising demand for oil and gas in countries such as the U.S. and Canada, which increases the demand for oilfield equipment, thereby driving the market growth. The growing number of off-shore applications in North America, along with the rising government initiatives in countries such as the U.S. and Canada for strengthening the oil and gas industry, has boosted the market growth.

Moreover, the presence of several local market players in oilfield equipment, such as Baker Hughes, MSP/Drilex, Halliburton, Deep Well Services, and some others, are continuously engaged in developing oilfield consumables for oil & gas industries and adopting several strategies such as partnerships, collaborations, and business expansions, which in turn drives the growth of the global oilfield equipment market in this region.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The rising number of onshore activities in this region increases the demand for oilfield equipment, thereby driving market growth. Moreover, there are several oil and gas companies such as Indian Oil Corporation, Sinopec, The Oil and Natural Gas Corporation Limited, PetroChina, INPEX Corporation, and some others have increased the demand for oilfield equipment for several oil extraction applications, which in turn is driving the global oilfield equipment market growth.

Additionally, the presence of various local companies of oilfield equipment, such as Delta Corporation, Integrated Equipment, Sudhir Windlass, China Oilfield Services Limited, and some others, are developing superior quality oilfield equipment to fulfill the demand from oil and gas industries across the Asia-Pacific region that in turn is expected to drive the growth of the oilfield equipment market.

The oilfield equipment market is one of the important industries in the oil and gas industry. This industry mainly deals in the manufacturing and distribution of oilfield equipment around the globe. This industry consists of various types of equipment for oilfields, including drilling equipment, field production machinery, pumps, valves, and others. The demand for oil field consumables has increased in recent times with the growing number of oil and gas companies across the world. The oilfield equipment mainly finds application in the on-shore and off-shore activities. This industry is expected to grow exponentially with the growth in the oil and gas industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 172.18 Billion |

| Market Size in 2023 | USD 124.92 Billion |

| Market Size in 2024 | USD 128.62 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.96% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising development in technologies contributes to industrial growth

The oil and gas industry has developed significantly in recent times with growing advancements in technologies such as AI and IoT. The integration of modern technologies helps in the oil extraction process and helps oil companies analyze the quality of diesel, liquefied petroleum gas, jet fuel, lubricants, natural gas, petrochemicals, and others. Moreover, the incorporation of AI in oilfield equipment for the exploration of oil and gas has also recently gained prominent attention. Thus, growing development in technologies related to oilfield equipment, such as drilling machines, valves, plug sockets, and some other machinery, is expected to drive the growth of the oilfield equipment market during the forecast period.

High maintenance costs and increasing prices of raw materials

The use of oilfield equipment is very prominent in the oil and gas industry for numerous applications across the world. Although the application of oilfield equipment in the oil and gas industry is worth mentioning, there are several problems associated with it. Firstly, the maintenance cost associated with oilfield equipment, such as drilling machines and pumps, is very high. Secondly, the prices of raw materials that are used in the manufacturing of oilfield consumables have increased significantly. Thus, the high cost of maintenance coupled with rising prices of raw materials is expected to restrain the growth of the oilfield equipment market during the forecast period.

Integration of additive manufacturing or 3D printing to shape the future

The developments in oilfield equipment are gaining traction with the rising demand for oil and gas across the world. Recently, some oilfield equipment companies have started using 3D printing technologies for manufacturing oilfield consumables as they help reduce lead time, rapid prototyping, complex geometries, and manufacturing costs. Thus, the growing integration of 3D printing in the production of oilfield equipment is likely to create opportunities for the global oilfield equipment market players in the future.

The drilling segment held the largest market share in 2023. The rise in the number of oil and gas companies around the world has increased the demand for drilling equipment, which, in turn, drives market growth. Moreover, the development of drill bits, collars, drill pipes, and other drilling components fosters market growth. Additionally, the increasing offshoring drilling activities increases the demand for drilling equipment, which in turn boosts the growth of the oilfield equipment market.

The pumps segment is expected to grow with the highest compound annual growth rate during the forecast period. The rising use of reciprocating plunger pumps, centrifugal pumps, gear pumps, progressive cavity pumps, diaphragm pumps, and metering pumps for transferring fluids in oilfields boosts market growth. Also, the increasing application of positive displacement pumps for pumping out natural gas, crude oil and viscous liquids has contributed to the market growth. Moreover, the growing use of high-pressure pumps for circulating mud and removing cuttings in oilfields is likely to propel the growth of the oilfield equipment market.

The on-shore segment held a dominant share in 2023. The growing number of on-shore drilling activities in countries such as the U.S., UAE, and others has boosted market growth. Also, there are several advantages of on-shore drilling applications, including high oil production, cost-efficiency, and low environmental risks compared to off-shore drilling, which drives the market growth. Moreover, the on-shore drilling activities help with smooth logistics, easier transportation, and less regulatory compliance, which in turn is expected to propel the growth of the oilfield equipment market.

The off-shore segment is expected to attain the fastest CAGR during the forecast period. The rising demand for hydrocarbons located beneath the oceans to meet energy demands across the world is driving market growth. Also, advancements in drilling technologies associated with off-shore applications have boosted market growth. Moreover, the advantages of off-shore application, including access to vast oil and gas reserves underwater along with minimizing conflict with local people, are expected to foster the growth of the oilfield equipment market during the forecast period.

Segments Covered in the Report

By Equipment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024