January 2025

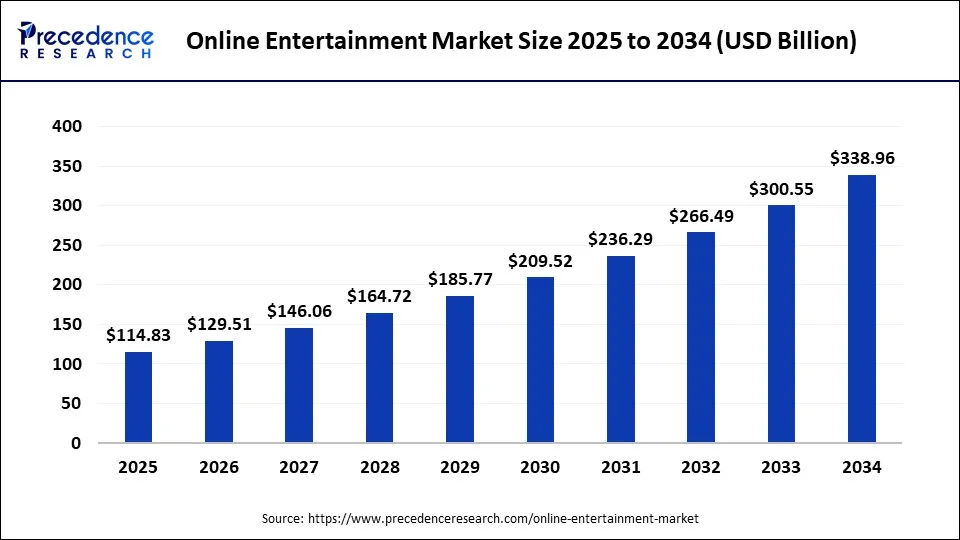

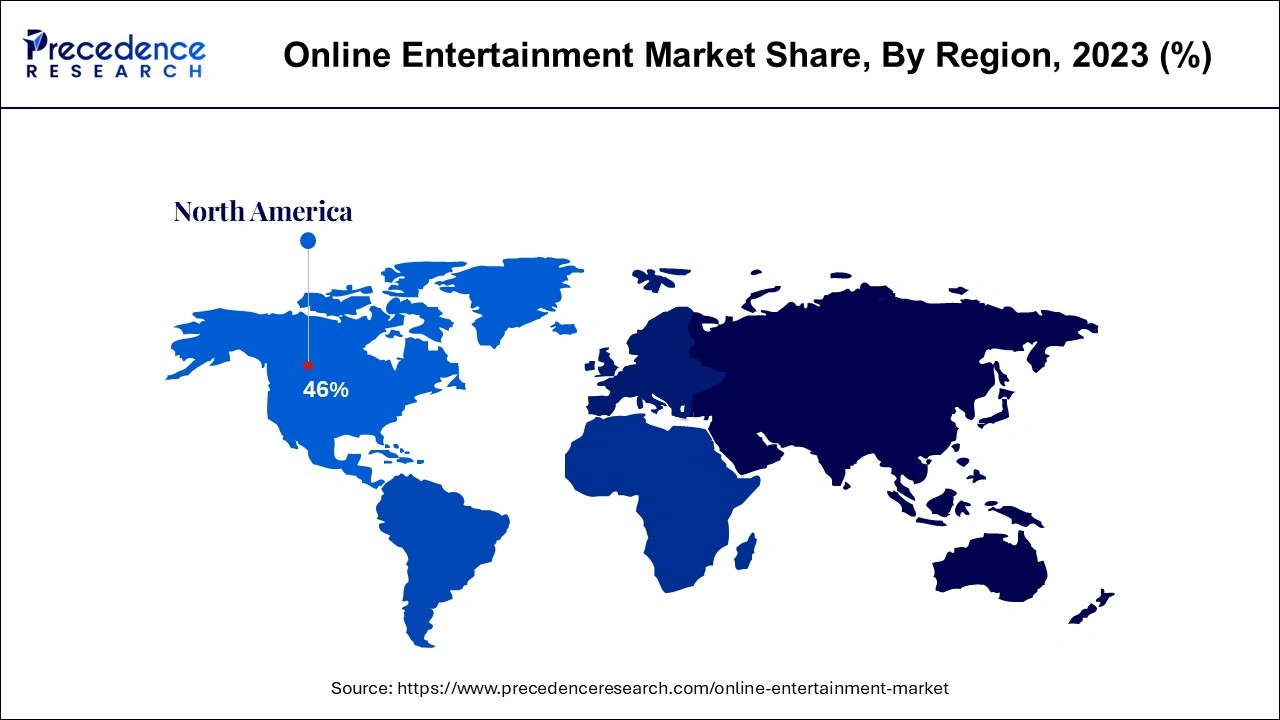

The global online entertainment market size is calculated at USD 101.82 billion in 2024, grew to USD 114.83 billion in 2025 and is predicted to surpass around USD 338.96 billion by 2034. The market is expanding at a CAGR of 12.78% between 2024 and 2034. The North America online entertainment market size is evaluated at USD 46.84 billion in 2024 and is estimated to grow at a CAGR of 12.89% during the forecast period.

The global online entertainment market size accounted for USD 101.82 billion in 2024 and is projected to reach around USD 338.96 billion by 2034, growing at a CAGR of 12.78% from 2024 to 2034. The rising preference towards the consumption of internet-based entertainment such as web series, online video gaming, podcasts, and others is driving the growth of the market.

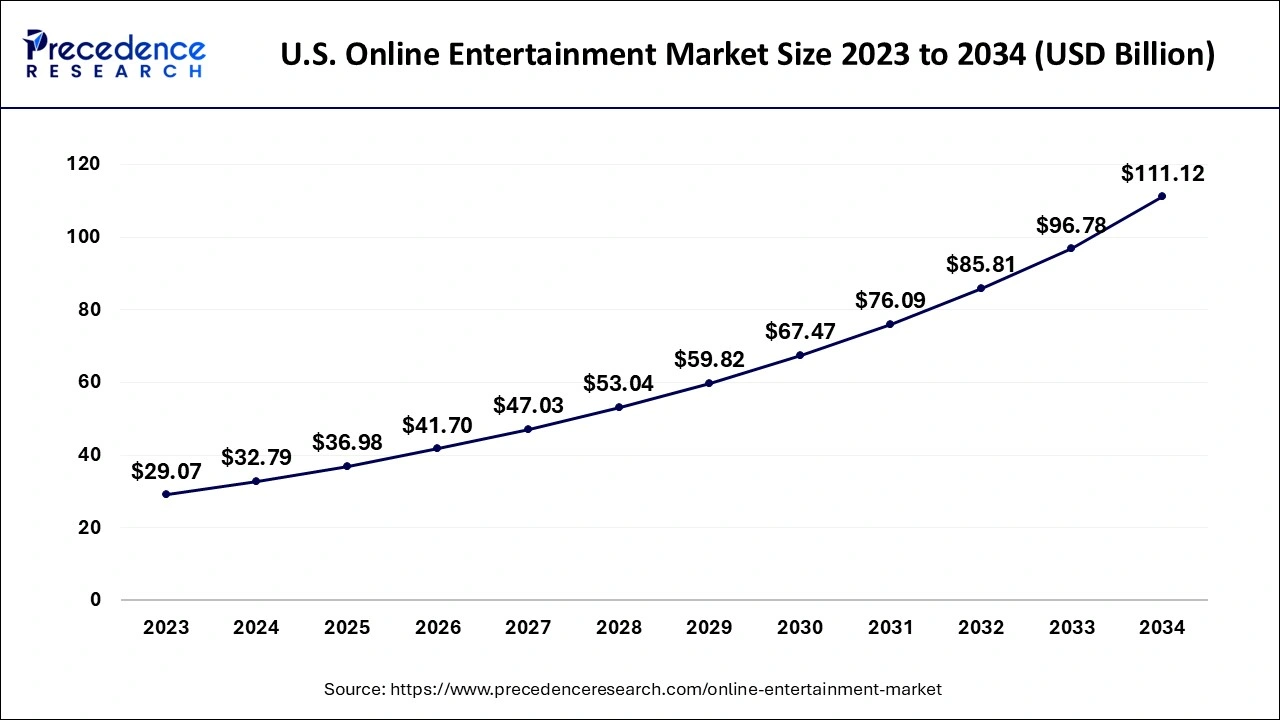

The U.S. online entertainment market size is evaluated at USD 32.79 billion in 2024 and is anticipated to be worth around USD 111.12 billion by 2034, growing at a CAGR of 12.96% from 2024 to 2034.

North America dominated the online entertainment market in 2023. The region is considered the hub for technology and entertainment. Regional countries are the early adopters of technologies in every industry for better accuracy and profitability. Countries like the U.S. have the world’s biggest media and entertainment house, Hollywood, which incorporates the latest technology. The region also consists of the headquarters of Netflix, Disney+, YouTube, and others. The rising availability of high-speed internet connectivity and the robust consumer base for the media and entertainment industry, online gaming, and other data-intensive platforms are contributing to the growth of the market.

Europe anticipates significant growth during the forecast period. The growth of the market in the region is attributed to the higher preference for high-speed internet connectivity, social media culture, and the availability of leading media and entertainment houses, which boosts the growth of the online entertainment market. The rising younger population and the inclination towards esports, online gaming, podcasts, live streaming, vlogging, online education channels, and others are further contributing to the expansion of the market in the region.

Online entertainment is simply considered as the consumption of entertainment via online or digital media. The digital entertainment industry has revolutionized the concept of media and entertainment over the past decades, thanks to technologies and gadgets like computers, laptops, smartphones, tablets, and others. Online entertainment is known for its easy accessibility and immersive experience. Online entertainment includes online entertainment channels, video games, social media entertainment, and others. The rising online content consumption in terms of podcasts, video content, storytelling, audio, and others are collectively driving the growth of the online entertainment market.

The technologies are helping to revolutionize the entertainment industry

For Instance,

How Can AI Impact the Online Entertainment Market?

Artificial Intelligence (AI) plays a significant role in the media and entertainment industry, including fields such as films, music, gaming, TV, content creation, and book publishing. In the music industry, AI is used to make recommendations and produce music. In the film and TV industry, it is used for editing, adding VFX, scripting, and several other options. In the advertising industry, its predictive analytics and content generation properties are inclining the industry towards profitability. AI automates several manual tasks in the media and entertainment industry in real time with greater efficiency and profitability.

| Report Coverage | Details |

| Market Size by 2034 | USD 338.96 Billion |

| Market Size in 2024 | USD 101.82 Billion |

| Market Size in 2025 | USD 114.83 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.78% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Device, Revenue Model, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising preference for online media over traditional channel

The rising interest and inclination towards online media channels for better content and the rise in the OTT platform are driving the adoption of online entertainment over traditional forms of entertainment. The rising internet penetration and the availability of high-speed data connectivity are driving the consumer base of online entertainment and social media channels, and the rising investment in online entertainment media by the leading producers is further contributing to the expansion of the online entertainment market.

Health issues

The rising screen time due to the higher consumption of social media, entertainment, gaming, and other applications results in a lack of social and physical activities, which may cause severe health issues that limit the adoption of the market.

Rising consumer base for online video gaming

The increasing consumer base for online video gaming, especially in the younger generation, is driving the opportunity for the expansion of the market. The gaming industry is significantly contributing to the expansion of the online entertainment industry. The rising e-sports culture is accelerating the interactive gaming and immersive user experience with enhanced technology.

The video segment held a dominant presence in the online entertainment market in 2023. The rising consumption of online entertainment, especially video content by several digital platforms, is driving the growth of the video segment in the online entertainment industry. Video content attracts more consumers with its high-definition quality and visual effects, making consumers more accessible. The rising penetration of the internet and the evaluation of high-speed internet connectivity are driving consumers to adopt the segment more.

The rising penetration of internet services by the population and the continuously developing media and entertainment industry in private and public online platforms like Netflix, Amazon Prime, YouTube, Disney+, and other mediums is accelerating the expansion of the video segment. The rising interest in digital media and video content making among the younger population and the investment in producing the web series and launching it on the digital entertainment platform are further contributing to the expansion of the segment.

The audio segment is expected to grow at a significant rate in the online entertainment market over the studied period of 2023 to 2034. The rising number of audio platforms for entertainment and educational purposes in online media is driving the growth of the segment. There are leading audio platform types, including Audible, Packet FM, Pixabay, and others.

The smartphone segment dominated the online entertainment market globally in 2023. The rising population and the rising concern over staying updated with the world and current scenarios are driving the adoption of the smartphone segment. The rising penetration of the internet and the evaluation of high-speed internet services are further boosting the demand for smartphones. The development in internet connectivity with high-speed data like 4G and 5G worldwide evaluation is also accelerating the market for smartphones.

The rising market competition in the mobile phone companies with the availability of different designs, technologies, and features in mobile phones with enhanced internet connectivity and the rising inclination towards the social media culture, online games, and user-generated content (UGC) are driving the demands for the smartphone segment.

The smart TV, projectors, and monitors segment is predicted to witness significant growth in the market over the forecast period. The rising advancement in technology and the evaluation of smart TVs, projectors, and monitors in households for the consumption of online entertainment is driving the growth of the segment.

The advertisement segment registered its dominance over the online entertainment market in 2023. Online entertainment, or digital entertainment, is one of the rapidly growing industries all over the world, with the largest consumer base. The online content platforms have a large number of consumers, which provides advertisement agencies with a wide reach, targeted audience, and low-cost advertisement. Online entertainment includes video streaming services and social media with a large audience, which helps advertisers to make more precise advertisements to the consumer based on search behavior and interest. Many advertisement agencies are highly investing in social media channels and sponsoring a large amount of content. The most prevalent and highly used user-generated content platforms, like TikTok and YouTube, monetize their content by using advertisements and revenue sharing with creators.

The subscription segment is projected to expand rapidly in the online entertainment market in the coming years. The rising culture of subscription to a particular channel or package for unlimited entertainment is boosting the subscription segment. A lot of platforms are on the rise that use subscription-based services, which allow the user to pay to view premium content. Platforms like YouTube use subscriptions to remove ads and support creators, while Instagram launched its new feature of premium content in which consumers pay subscription charges to watch premium content of content creators.

Segments Covered in the Report

By Form

By Device

By Revenue Model

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2023

September 2024

March 2025