April 2025

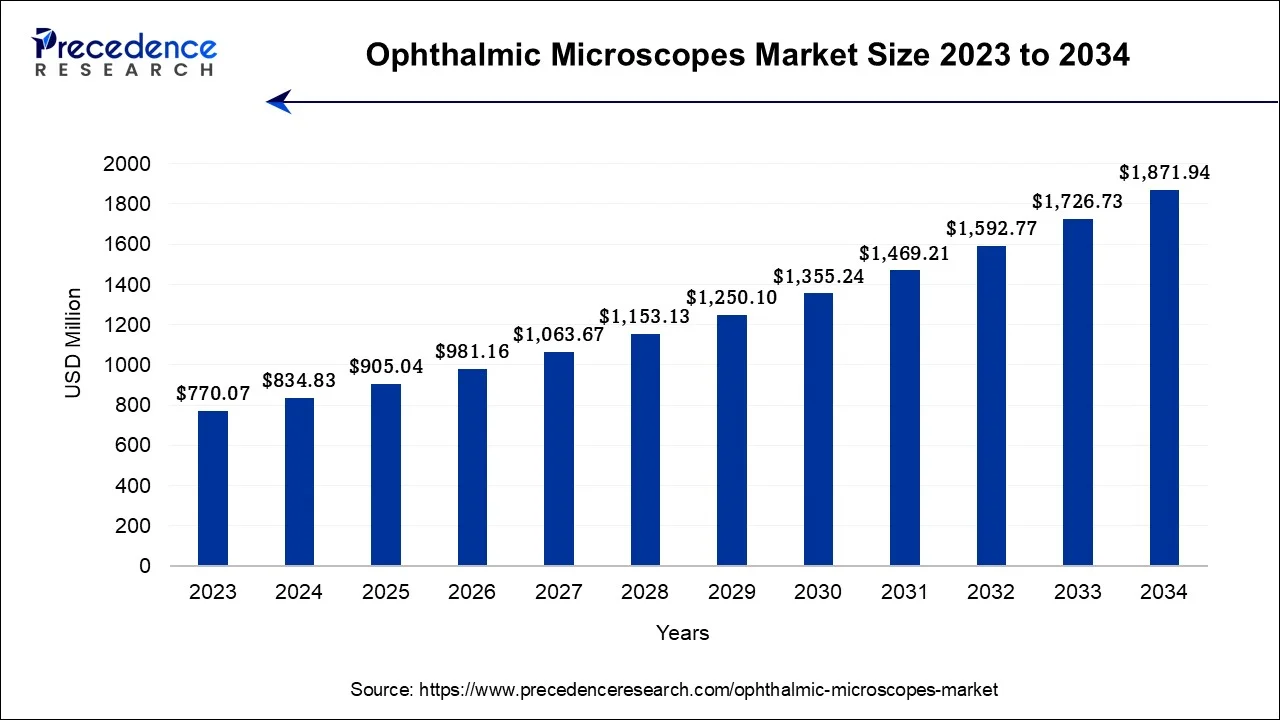

The global ophthalmic microscopes market size is estimated at USD 834.83 billion in 2024, grew to USD 905.04 billion in 2025 and is predicted to surpass around USD 1,871.94 billion by 2034, expanding at a CAGR of 8.41% between 2024 and 2034. The North America ophthalmic microscopes market size accounted for USD 475.85 billion in 2024 and is anticipated to grow at a fastest CAGR of 8.50% during the forecast year.

The global ophthalmic microscopes market size accounted for USD 834.83 billion in 2024 and is anticipated to reach around USD 1,871.94 billion by 2034, expanding at a CAGR of 8.41% from 2024 and 2034.

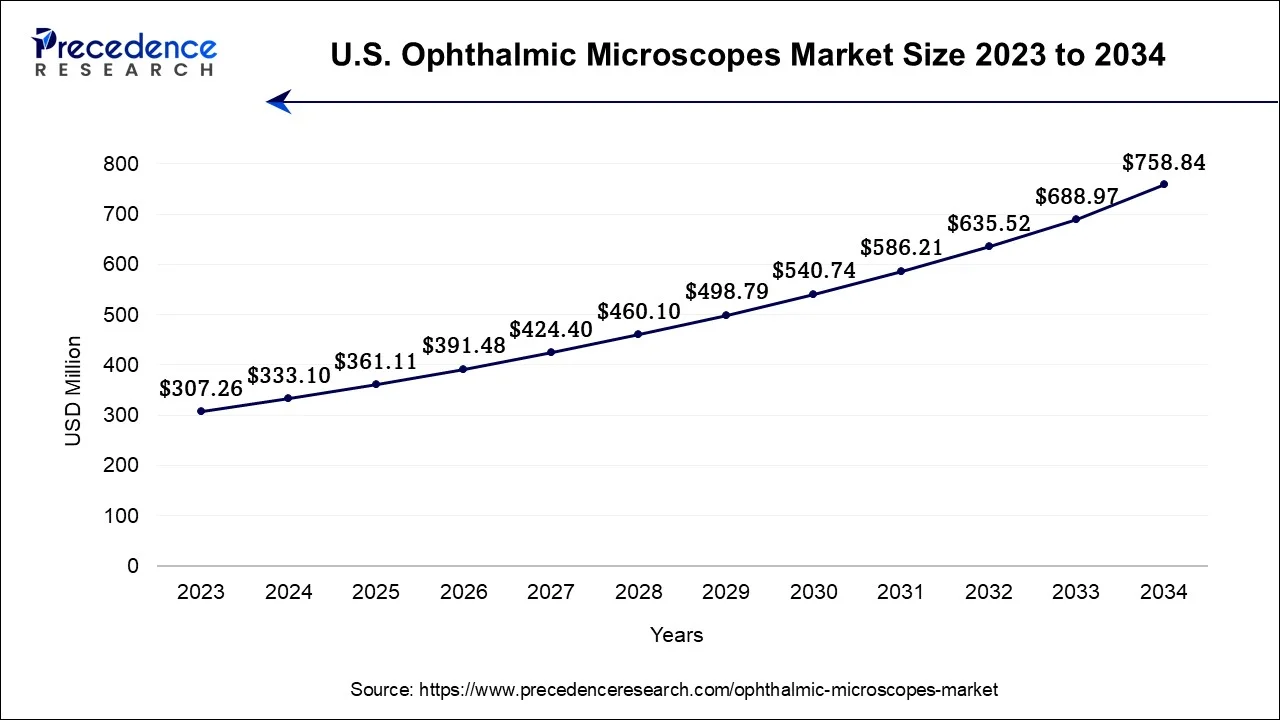

The U.S. ophthalmic microscopes market size is estimated at USD 333.10 billion in 2024 and is expected to be worth around USD 758.84 billion by 2034, growing at a CAGR of 8.58% from 2024 and 2034.

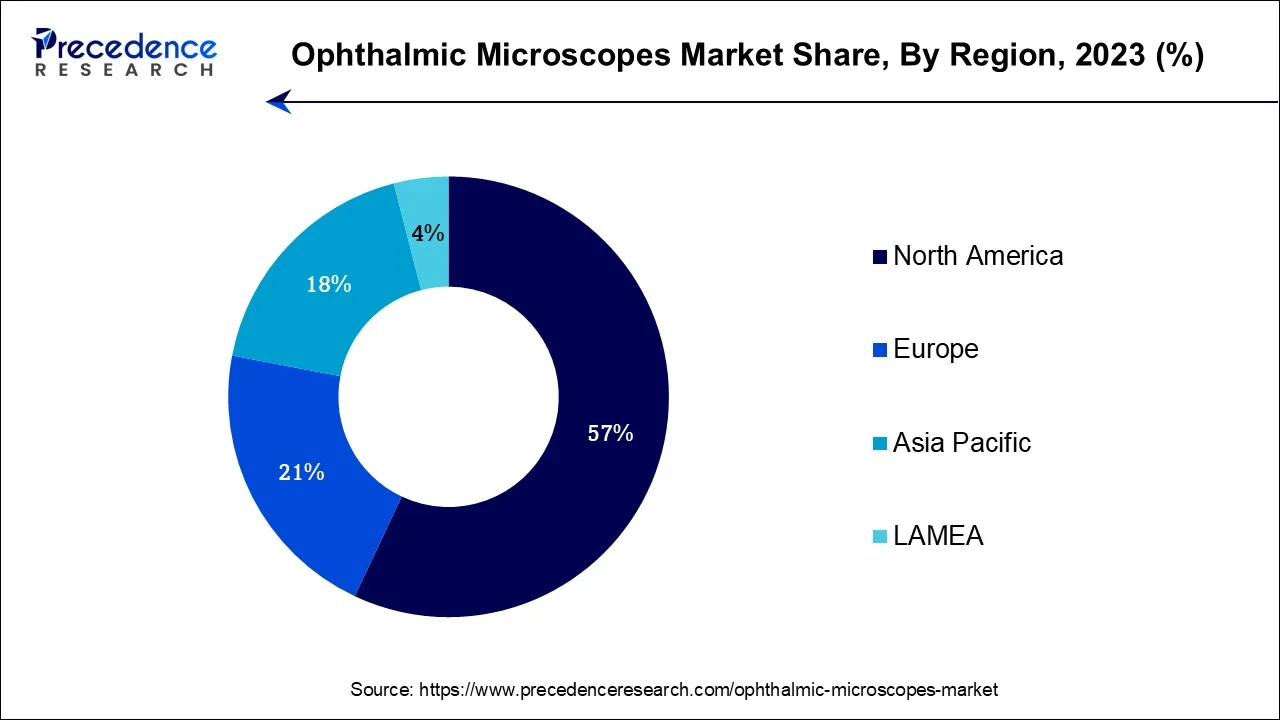

North America dominated the market in 2023, the region is expected to sustain its position during the forecast period. The overall well-established healthcare sector of the region is observed to be the major factor for the region’s dominance. The presence of major market players in the region plays a significant role in the market’s expansion. North America has stringent regulatory standards and quality control measures for medical devices. In the United States, almost 24.4 million people (about the population of Texas) aged 40 and older have cataracts. By the age of 75 almost half of the population in the United States have cataracts. Considering the number of patients and availability of high-quality services for eye-care in the region, the market in North America is observed to get accelerate during the forecast period.

Asia Pacific is expected to witness the fastest rate of growth during the forecast period. Improving healthcare infrastructure and the potential for investing in medical equipment promotes the growth of the market in Asia Pacific. Additionally, growing awareness about the importance of regular eye check-ups and early diagnosis of eye diseases, leading to greater demand for ophthalmic equipment. Asia Pacific carries an aging population, which often requires more frequent eye examinations and procedures, driving the demand for advanced ophthalmic equipment.

Eye treatment is one of the most delicate treatments in the healthcare sector. Ophthalmic surgeries, also known as eye surgeries, require a high degree of precision and accuracy when treating the manipulation of delicate ocular tissues. For maximum accuracy, ophthalmologists widely use microscopes during such surgeries. The ophthalmic microscope is used to detect or visualize micro-anatomical details to perform extremely precise movement. Ophthalmic microscopes are useful in the anterior and posterior types of surgeries.

Ophthalmic microscopes can perform complete imaging ophthalmology. These microscopes are getting advanced with an effortless combination of imaging technologies, like high-definition display, Optimal Coherent Tomography (OCT), and documentation features. The global ophthalmic microscope market is growing at a substantial rate with the presence of top manufacturers in the market, including Alcon, Inc., Leica Microsystems (Danaher Corporation), Topcon Corporation, etc.

The global ophthalmic microscope market is accelerating with the rising number of patients with significant eye problems requiring immediate surgeries. Cataract is one of the most widely performed eye surgeries. According to government reports, India performs approximately 65 Lakh cataract surgeries each year. Such rising cases of multiple eye problems, such as problems with the retina, corneal transplant, and glaucoma, will keep promoting the market’s growth in the upcoming years. In addition, more people prefer LASIK eye surgery that corrects vision problems; this element will also act as a growth factor for the market.

Ophthalmic microscopes are specifically designed to take a close look at detailed and contrast imaging of all sections of the human eye. In the changing times, ophthalmic surgeries and microscopes have undergone several technological upgrades. The technological advancement in ophthalmic surgeries has significantly impacted the growth of the ophthalmic microscope market.

| Report Coverage | Details |

| Market Size in 2024 | USD 834.83 Million |

| Market Size by 2034 | USD 1,871.94 Million |

| Growth Rate from 2024 to 2034 | CAGR of 8.41% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Modality, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for LASIK surgery

LASIK, also commonly referred to as laser eye surgery, is in demand owing to the requirement of correcting vision by making anatomical changes. Approximately 1 lakh people in India undergo laser eye surgery every year. As more people seek LASIK surgery for vision correction, the demand for ophthalmic equipment, including microscopes, increases to meet the needs of a growing patient base. LASIK surgeons need to be confident in their ability to perform delicate corneal procedures. Ophthalmic microscopes help build this confidence by providing a better view and control during surgery. Thus, the element is observed to act as a driver for the market.

Expensive equipment

High-cost surgical procedures can make it challenging for healthcare facilities, especially in resource-constrained areas, to invest in expensive ophthalmic microscopes. This limits access to advanced eye surgeries for patients who cannot afford them. Hospitals and clinics often have limited budgets, and allocating a significant portion of their funds to purchase expensive ophthalmic microscopes can be a barrier, especially when there are other pressing needs in healthcare. Thus, the element of expensive equipment is observed to create a restraint for the market.

Technological advancements

The evolution and development of surgical microscopes has been extensive. Surgical microscopes won't stop here; they will flourish in the future due to a variety of appealing features and new imaging technologies. With robotic positioning, increased use, and better light management, the drawbacks of enormous bulk, high cost, and potential tissue injury by high-power illumination will be further addressed. The surgical microscope's three primary future directions are to be combined with more sophisticated technology, to provide novel imaging techniques, and to be utilized more frequently in clinical settings. Such technological advancements will act as an opportunity provider for the market by leveraging the adoption of ophthalmic microscopes.

The on-caster segment dominated the market in 2023; the segment is expected to grow at a notable rate throughout the forecast period. The segment's dominance is attributed to the wide application of on-caster microscopes as they offer easy momentum and revolving microscopes, which is helpful during the operation. A caster is a type of device with a small wheel attached to the table or the stand to move or rotate easily. On-caster microscopy is used in various operations due to its accessible repositioning properties, which need less effort and can occupy less space. The on-caster microscopy can be easily moved from one place to another according to the needs of the surgeons at the time of operation. On-caster microscopes are highly acclaimed for their offering of superior and precise brightness levels.

The wall-mounted microscope segment is expected to grow significantly during the forecast period. Apart from the ophthalmology sector, wall-mounted microscopes are used in various types of surgeries, such as dental and cosmetic. Wall-mounted microscopes are heavy and are only helpful in significant surgeries. The wall-mounted microscope comes with an in-build spring so it can be moved from one direction to another. With the wide range of applications in the examination of eyes, wall-mounted microscopes are becoming extensively popular in specialty centers as well as hospitals.

The anterior segment surgery dominated the market in 2023. The rising number of anterior surgery patients is driving the growth of the segment. Anterior surgeries cover the correction of the front part of the eye such the cornea, lens, etc. The term anterior segment surgery refers to the operations of iris and lens whichever is a natural lens, or the synthetic intraocular lens placed via cataract surgery. Widely performed refractive, cataract, corneal, glaucoma, and laser eye surgeries highlight the dominance of the segment in the market.

Ophthalmic microscope technology has seen significant advancements in recent years. Improved optics, lighting and image-capturing capabilities have made the anterior segment more versatile in the market.

Meanwhile, the posterior segment is expected to expand at a robust pace during the forecast period. Posterior surgery includes retinal detachment repair, Vitrectomy, Maculopathy, posterior sclerotomy, radical optic neurotomy, and macular translocation surgery. Posterior surgery helps to clear the visionary problem in patients. The availability of posterior surgeries at local centers makes it more general and easily accessible for patients.

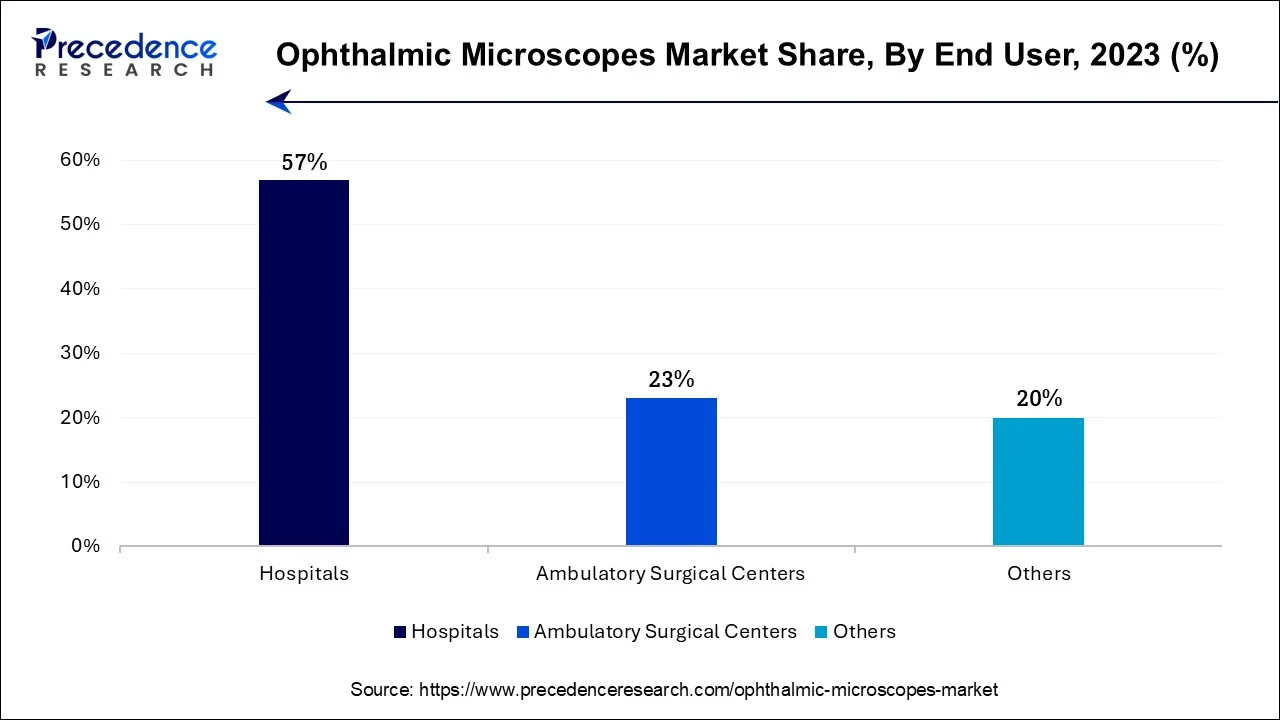

The hospital segment dominated the market in 2023; the segment is expected to sustain its position throughout the forecast period. The hospital is the primary place for regular and surgical treatment for ophthalmic-related problems. The hospital segment dominates due to the substantial rate of patient visits and admissions for surgeries of their situation. Hospitals have more vital financial ability to purchase a surgical microscope for the operation or the treatment of the disease. Hospitals have the financial capacity and funding to invest in the most technically advanced surgical microscopes in operation rooms. This element promotes the growth of the segment.

The ambulatory surgical centers segment is expected to witness the fastest rate of growth during the forecast period. The ambulatory services center offers proper facilities where surgeries are performed without the requirement of hospital admission. The ambulatory surgical centers provide an essential environment that is less stressful than the hospitals. The potential for investing finances in advanced equipment shows promising growth for the segment.

Segments Covered in the Report:

By Modality

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

January 2025

September 2024