January 2025

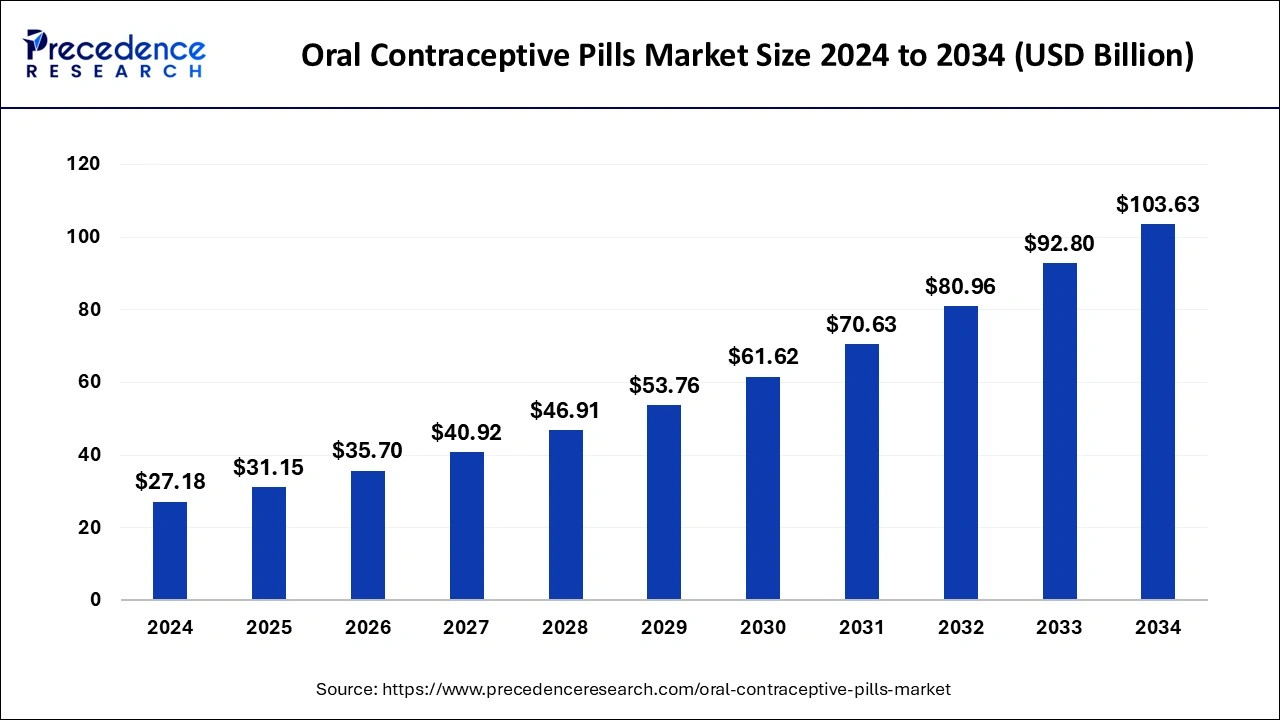

The global oral contraceptive pills market size is accounted at USD 31.15 billion in 2025 and is forecasted to hit around USD 103.63 billion by 2034, representing a CAGR of 14.32% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oral contraceptive pills market size accounted for USD 27.18 billion in 2024 and is predicted to increase from USD 31.15 billion in 2025 to approximately USD 103.63 billion by 2034, expanding at a CAGR of 14.32% from 2025 to 2034. The oral contraceptive pills market is driven by the increasing number of unintended pregnancies.

Oral contraceptive pills (OCPs) are prescription medications used orally to prevent pregnancy. They usually contain progestin and estrogen, two synthetic hormones. These medications function by inhibiting ovulation, thickening cervical mucus to impede sperm motility, and weakening the uterus lining to stop a fertilized egg from implanting.

With the dependable and reversible birth control approach that OCPs offer, women have more autonomy over their family planning choices and reproductive health. Oral contraceptives are essential for population management in areas with rapid population expansion because they help moderate demographic trends and reduce demand on infrastructure and resources.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.32% |

| Market Size in 2025 | USD 31.15 Billion |

| Market Size in 2024 | USD 27.18 Billion |

| Market Size by 2034 | USD 103.63 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Category, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

The growing rate of unintended pregnancies

Unwanted pregnancies have a negative impact on women's and children's health and welfare, especially when the mothers are young and susceptible. Understanding unwanted pregnancy contributes to our understanding of population fertility and the unfulfilled demand for family planning and contraception. Most unwanted births are caused by either not using contraception at all or not utilizing it correctly or consistently.

Risk of complications associated with oral contraceptives

Although oral contraceptive pills are generally safe for most women, some people may experience adverse side effects. Mood swings, headaches, breast discomfort, and nausea are typical side effects. The degree of these adverse effects varies, and some women may decide to stop taking OCPs entirely or to minimize their use. Regulation bodies carefully monitor their effectiveness and safety because of the severe health risks connected to OCPs. Any hint of elevated risk or unfavorable occurrences may trigger regulatory examination involving label modifications, limitations, or removal from distribution. Furthermore, the regulatory environment is further expanded by the possibility of lawsuits linked to unfavorable health consequences, which may also affect market dynamics.

Lack of awareness or education about contraception

Many places may have little or no access to comprehensive sexual education and knowledge regarding contraception, especially in developing nations or communities with traditional cultural values. People are unable to understand the range of contraceptive methods that are accessible to them, including oral contraceptives, due to this lack of access, especially to young adults. Healthcare professionals might not be adequately trained or knowledgeable about contraceptive techniques, including OCPs, even in areas where contraception is widely accessible. This may lead to insufficient guidance and counseling for those looking for contraception, which could result in OCPs being used less effectively or stopped altogether because of worries or misunderstandings.

Increased awareness about hormonal health

The prevalence of digital health influencers and social media platforms has made conversations regarding hormonal health more commonplace. Millions of followers are drawn to the personal stories, advice, and knowledge that celebrities, health experts, and influencers provide on hormonal balancing. The rising prominence of this topic normalizes discussions about hormonal health and motivates people to look for trustworthy information and take charge of their hormonal well-being. When it comes to educating people about hormonal health and contraceptive alternatives, healthcare providers are essential. Such rising awareness about hormonal health is observed to offer lucrative opportunities for the oral contraceptive pills market.

Healthcare professionals are more likely to bring up hormonal health during routine visits and provide tailored contraceptive advice because of patient demand and increasing awareness. Patients and healthcare professionals create a supportive environment supporting proactive hormonal management and educated decision-making.

Rise of telemedicine and e-commerce platforms provides easier access to contraceptive pills

Internet sites are essential for educating people about contraceptive alternatives and sharing information. Individuals can educate themselves on the various forms of oral contraceptives that are available, their benefits and adverse effects, and how to use them properly through educational articles, interactive tools, and community forums. People are now better equipped to make decisions about their reproductive health. Telemedicine platforms allow users to receive continuous support and allow for remote monitoring of contraceptive use.

Healthcare practitioners can monitor and manage side effects and patient adherence using digital health tracking technologies and virtual follow-up appointments. The usage of oral contraceptives is safer and more effective overall because of this proactive strategy.

The progestin only segment held a significant share of the oral contraceptive pills market in 2024. Globally, women's knowledge and acceptability of hormonal contraceptives have significantly increased in the past few years. Educational campaigns, more accessible access to healthcare, and shifting public perceptions of family planning are some of the reasons for this increase. In general, progestin-only pills have fewer adverse effects than oral contraceptives that are combined.

This includes a lowered chance of generating headaches or nausea, a lessened impact on blood pressure, and a decreased risk of blood clots. Progestin-only pills are a desirable alternative for women looking for minimally invasive forms of contraception due to their increased tolerability.

The combination segment shows a notable growth in the oral contraceptive pills market during the forecast period. When used as prescribed, combination oral contraceptives, which contain both progestin and estrogen, are highly effective at preventing pregnancy. The rise can be primarily attributed to its effectiveness, instilling confidence in healthcare providers and patients. Pharmaceutical companies are always coming up with novel ways to combine oral contraceptives, like low-dose or extended-cycle formulations that are more tolerable and have fewer adverse effects. These developments meet women's changing requirements and interests.

The branded segment held the dominating share of the oral contraceptive pills market in 2024. Pharmaceutical companies are constantly developing new ways to differentiate branded drugs from their generic counterparts. They make research and development investments to provide cutting-edge formulations, delivery systems, and other features catering to customers' wants and preferences. These developments give branded contraceptives a competitive edge and draw in customers looking for the newest developments in the field of contraception.

When choosing oral contraceptives, some people place a higher value on brand reputation, perceived quality, and familiarity. They choose well-known brands that provide better advantages and peace of mind. Brand loyalty and favorable experiences with branded products further reinforce consumer preference for these contraceptives, supporting demand and growth.

The generic segment is observed to show a notable growth in the oral contraceptive pills market during the forecast period. When comparing generic oral contraceptives to name-brand alternatives, the former are usually less expensive. Because of their cost, a wider range of women who might otherwise be unable to buy branded drugs or who do not have sufficient insurance coverage can use them. Therefore, people concerned about costs are more likely to choose generic substitutes, which is fueling the growth.

The retail pharmacy segment dominated the oral contraceptive pills market in 2024. Pharmacists are essential for in-patient education and consulting regarding oral contraceptive tablets. In confidential consultation areas found in many retail pharmacies, patients can speak with qualified pharmacists about their requirements, concerns, and medical history regarding contraception. In addition to increasing patient pleasure, this individualized approach builds the pharmacy's reputation for trust and loyalty. To help patients make educated decisions regarding their contraceptive options, pharmacists can offer important information on dose, side effects, drug interactions, and other pertinent topics.

The online segment is the fastest growing oral contraceptive pills market during the forecast period. Confidentiality and discretion are possible when buying oral contraceptives online, which may not be available at conventional brick-and-mortar pharmacies. Many people prefer the privacy that comes with internet purchasing, particularly regarding delicate medical items like contraception. People in younger demographics and others who might feel awkward disclosing their need for contraception in person will find this privacy feature especially appealing.

North America had the largest market share in 2023 in the oral contraceptive pills market and the region is observed to sustain the position throughout the predicted timeframe. Oral contraceptive pill adoption among women of reproductive age is relatively high in the US and Canada. This broad acceptability stems from several variables, including comprehensive sex education programs, cultural acceptance of contraception, and ease of access to healthcare facilities. Oral contraceptive tablets are now more economical and available to more significant portions of the population in North America because many health insurance programs cover them. Furthermore, low-income people frequently receive free or heavily discounted contraceptives through government-sponsored healthcare programs and initiatives, which increases the usage of these drugs.

United States

Canada

Asia-Pacific is observed to be the fastest growing oral contraceptive pills market during the forecast period. In the last few years, there has been a notable surge in the region's knowledge of family planning and contraception. Oral contraceptive pill use has been extensively promoted by governments, non-governmental organizations, and healthcare organizations as a secure and reliable way of birth control. Women in the area are now more accepting of and likely to use oral contraceptives because of this raised awareness. Convenient, dependable, and reversible contraceptive techniques are in growing demand as more women pursue higher education and employment. Women can manage their fertility and other facets of their lives with the freedom that oral contraceptive tablets provide.

India

Japan

By Type

By Category

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

December 2024