January 2025

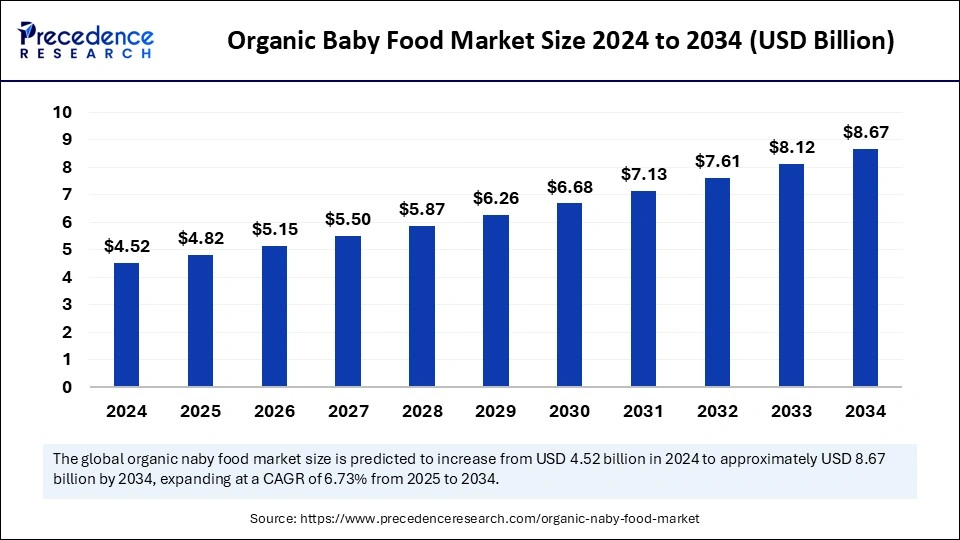

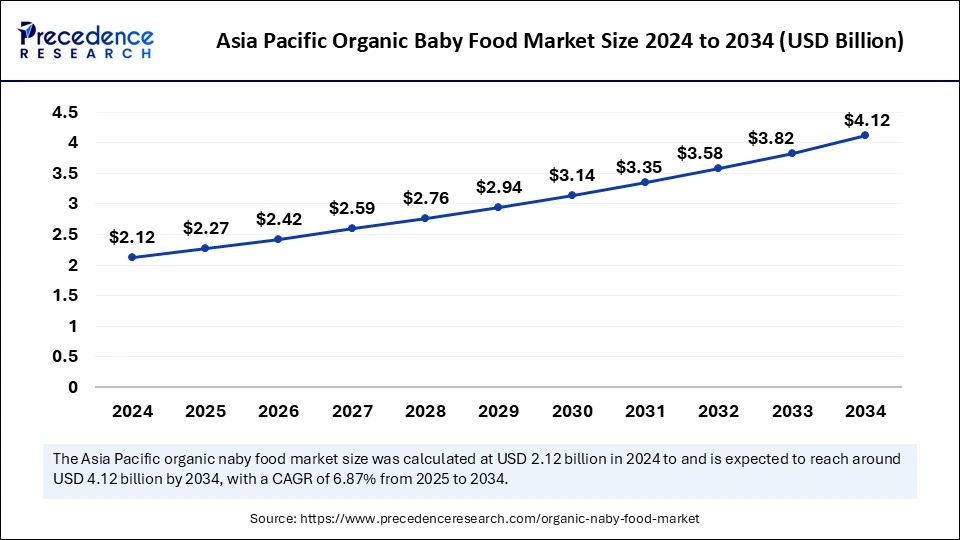

The global organic baby food market size is calculated at USD 4.82 billion in 2025 and is forecasted to reach around USD 8.67 billion by 2034, accelerating at a CAGR of 6.73% from 2025 to 2034. The Asia Pacific market size surpassed USD 2.12 billion in 2024 and is expanding at a CAGR of 6.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organic baby food market size was estimated at USD 4.52 billion in 2024 and is predicted to increase from USD 4.82 billion in 2025 to approximately USD 8.67 billion by 2034, expanding at a CAGR of 6.73% from 2025 to 2034. Increasing consumer awareness regarding the health benefits of organic infant nutrition is the key factor driving market growth. Also, increasing disposable incomes coupled with government initiatives promoting organic farming can fuel market growth further.

Artificial Intelligence provides market players the opportunity to forecast their customers' preferences. By processing large amounts of data on flavor preferences and sales patterns for each demographic, producers are now able to develop new products and model future trends. Furthermore, AI is also being utilized to allow customers to customize the goods they buy to a greater degree. This advancement identifies flavor combinations and helps in product development.

The Asia Pacific organic baby food market size was exhibited at USD 2.12 billion in 2024 and is projected to be worth around USD 4.12 billion by 2034, growing at a CAGR of 6.87% from 2025 to 2034.

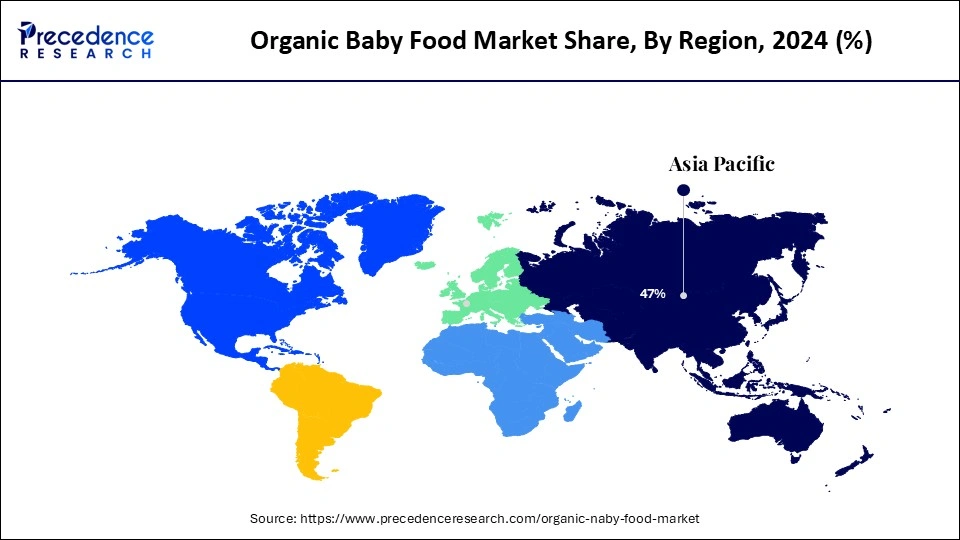

Asia Pacific dominated the global organic baby food market in 2024. The dominance of the region can be attributed to the growing consumer awareness regarding the adverse effects of chemical ingredients and the advantages of organic products. Moreover, the surge in the middle-class population and the increasing purchasing power of the majority of the population have boosted the requirement for premium organic baby food. New product launches and mergers have further propelled this growth.

Europe is expected to grow at the fastest rate in the organic baby food market over the studied period. The growth of the region can be credited to the strict government regulations that maintain high grades for organic baby food. Furthermore, the creation of novel mixes by market players that go well with this food can propel regional growth further in the market. Many consumers in the region are ready to pay a high price for quality organic baby food products.

Organic baby foods are products made from ingredients that are cultivated and processed without using fertilizers, synthetic pesticides, artificial additives or preservatives, and genetically modified organisms (GMOs). These foods are basically derived from vegetables, grains, proteins, and organically farmed fruits. The organic baby food market offers infants wholesome and nutritious options while decreasing their exposure to hazardous chemicals and supporting sustainable agricultural practices.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.67 Billion |

| Market Size in 2025 | USD 4.82 Billion |

| Market Size in 2024 | USD 4.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.73% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Changing lifestyles and eating habits

The growing urbanization in developing countries has facilitated changes in people's lifestyle patterns, particularly among women. The shifting lifestyle preferences such as working and eating habits such as consumption of caffeine, red meat, alcohol, fast food products, and unpasteurized milk have resulted in certain medical conditions in females. In addition, the consumption of medicines by breastfeeding mothers creates greater risks to the babies. Which in turn results in the growing demand for the organic baby food market.

High costs associated with organic products

Limiting knowledge and awareness among the majority of the population creates hindrances for the organic baby food market in the low-income group. In emerging economies, the concern related to food safety is far from many consumers. Moreover, most developing nations are price-sensitive, with extensive variation in earning power. Organic Food is more expensive than traditional food products.

Rising adoption of premium-quality organic products

The immune systems of infants and toddlers are not developed enough to tackle all infections, and hence, they are generally more susceptible to foodborne illness, which can be a substantial hurdle for parents seeking baby food. Furthermore, this, in turn, resulted in increasing awareness among parents about the ill effects of preservatives and chemicals. Hence, major organic baby food market companies like Ormeal, Happa, and Tiny Spoons are preparing baby food with natural ingredients and utmost care.

The infant milk formula segment held the largest organic baby food market share in 2024. The dominance of the segment can be attributed to the surge in demand for nutritionally balanced and convenient feeding solutions for infants, particularly for parents who require supplemental feeding options. Additionally, this trend highlights the importance of offering reliable, safe, and nutritious options for the nourishment of baby. Suboptimal breastfeeding rate due to hormonal disorders or premature birth is the major factor driving market growth further.

The prepared baby food segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising demand for nutritious and convenient food options for toddlers and infants, along with the increasing consumer awareness regarding the necessity of balanced food in child development. Moreover, ongoing advancements in packaging and processing ensure good nutrition and high shelf life.

The supermarkets and hypermarkets segment held the largest share of the organic baby food market in 2024. The dominance of the segment can be linked to the growing preference for hypermarkets and supermarkets by consumers for groceries, consumer goods, and infant care items. Also, enhanced inventory management and distribution channel networks globally have made this segment a leader in the market.

The online retailers' segment is projected to grow at the fastest rate during the forecast period. The growth of the segment can be driven by rising internet penetration worldwide. The convenience provided by this segment increases the adoption of product selection, which makes online shopping options for parents more attractive. Furthermore, young parents are increasingly utilizing online purchasing platforms and mobile apps that will impact segment growth positively soon.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

October 2024

March 2025