November 2024

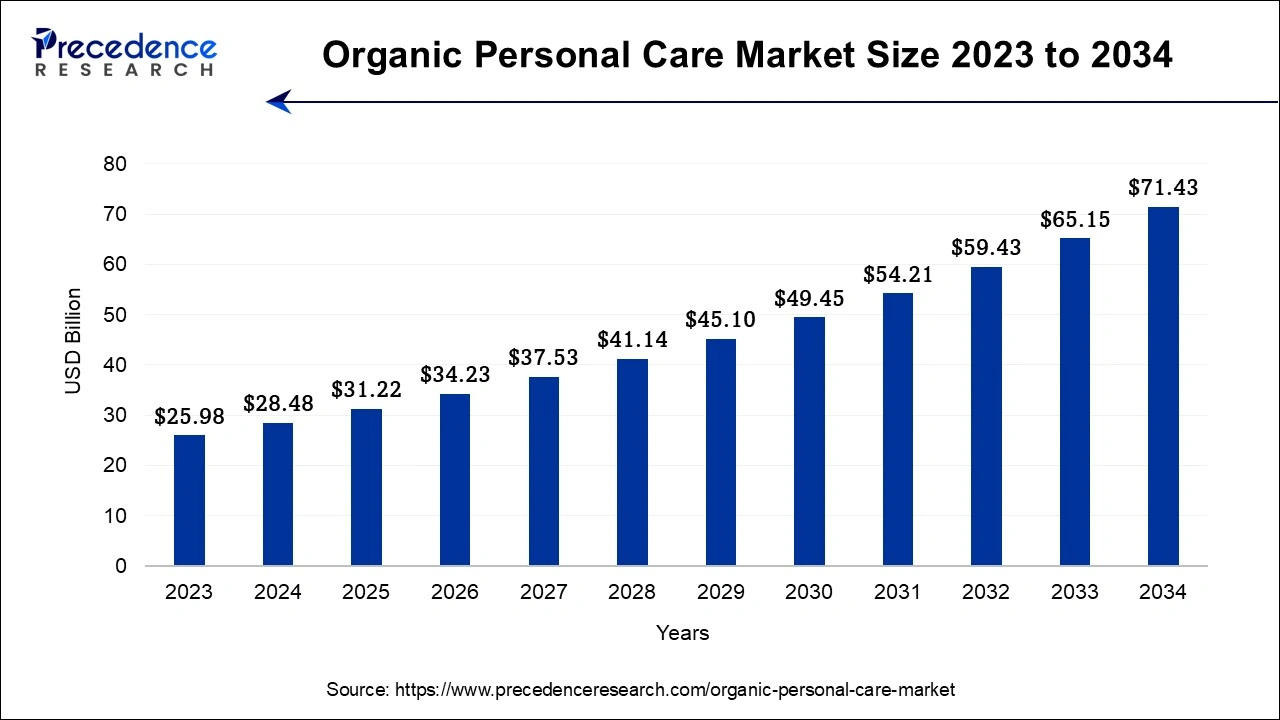

The global organic personal care market size is calculated at USD 28.48 billion in 2024, grew to USD 31.22 billion in 2025 and is predicted to hit around USD 71.43 billion by 2034, expanding at a CAGR of 9.63% between 2024 and 2034. The North America organic personal care market size accounted for USD 9.82 billion in 2024 and is representing a notable CAGR of 9.77% during the forecast period.

The global organic personal care market size accounted at USD 28.48 billion in 2024 and is predicted to hit around USD 71.43 billion by 2034, expanding at a CAGR of 9.63% from 2024 and 2034.

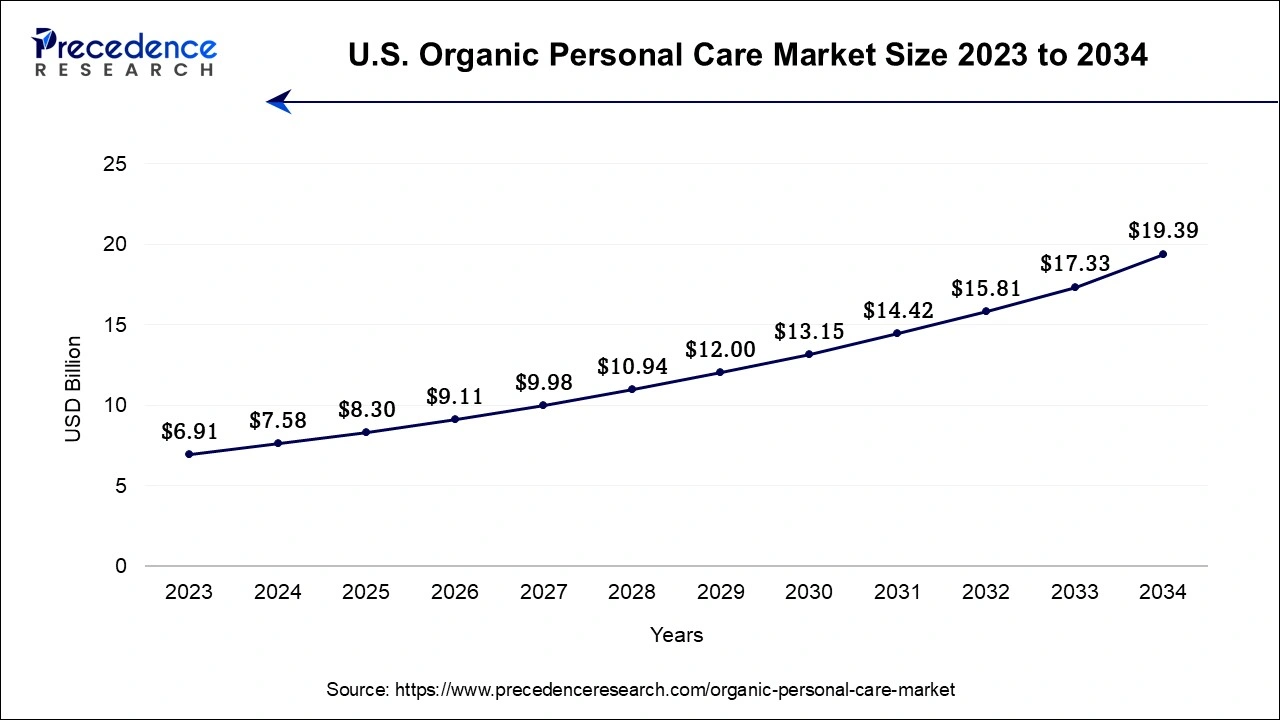

The U.S. organic personal care market size was exhibited at USD 7.58 billion in 2024 and is projected to be worth around USD 19.39 billion by 2034, poised to grow at a CAGR of 9.84% from 2024 to 2034.

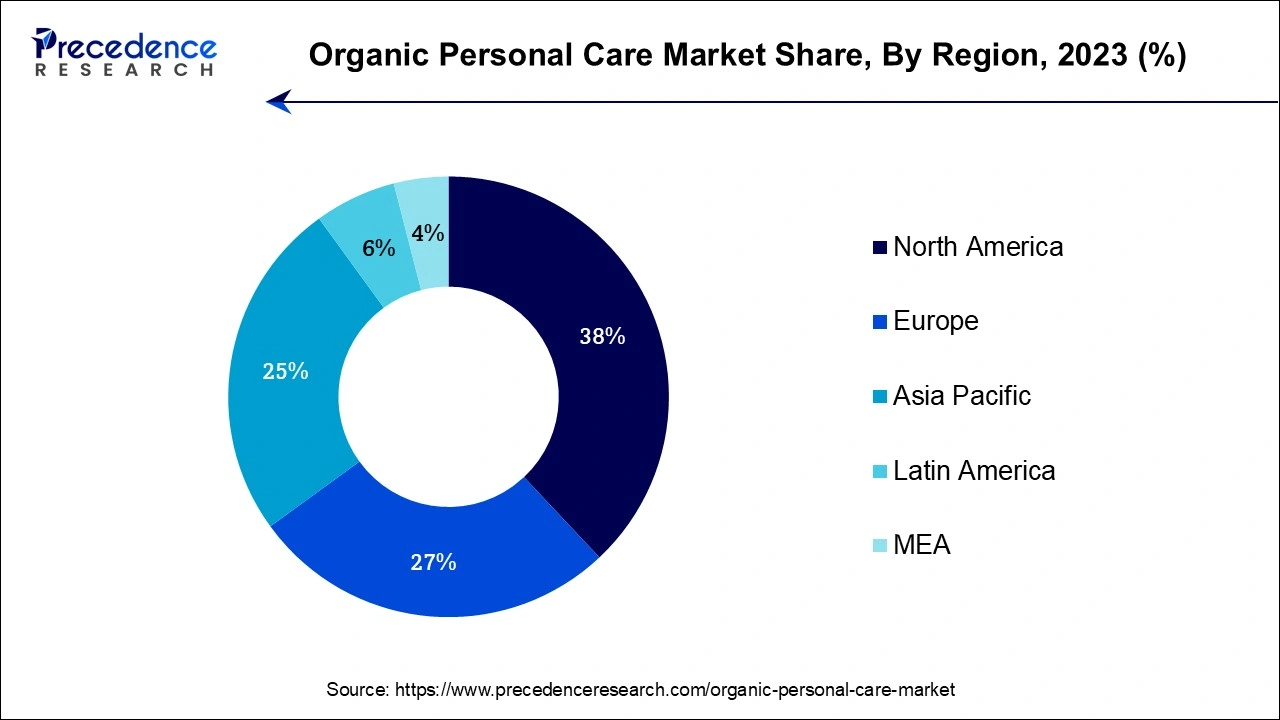

North America dominated the global organic personal care market in 2023. The region's consumers are increasingly drawn to natural, sustainable, and ethically sourced products, aligning with the growing health and wellness trend. The prevalence of health-conscious and environmentally-aware consumers, coupled with stringent regulatory standards, has contributed to the expansion of the market. Prominent brands and a strong retail presence, both offline and online, further drive the market's growth in North America.

Europe stands as a significant hub within the organic personal care market, with EU countries like Germany, France, and the United Kingdom showcasing a strong affinity for organic and natural products. The European emphasis on sustainability and local sourcing propels demand, while a well-established retail landscape and burgeoning e-commerce platforms amplify market reach.

The Asia-Pacific region is experiencing rapid organic personal care market growth due to rising incomes, urbanization, and evolving consumer preferences. Elevated health awareness, coupled with concerns about pollution and skin sensitivities, fuels the demand for natural alternatives. E-commerce platforms play a pivotal role in providing access to organic products, particularly in densely populated urban areas.

Latin America is witnessing a gradual yet consistent surge in organic personal care adoption. Countries like Brazil and Mexico display growing consumer interest in sustainable and natural offerings. Rich biodiversity offers sourcing opportunities for unique organic ingredients, fostering the market growth. Brands emphasizing local sourcing and cultural alignment are gaining traction.

The Middle East and Africa are gradually entering the organic personal care market as evolving consumer health and ethical perceptions drive interest in natural alternatives. A growing desire for organic and natural products is prompting a shift from conventional personal care items. Increasing awareness and economic development signify significant growth potential for the market in these regions.

The organic personal care market refers to the segment of the beauty and personal care industry that offers products made from natural and organic ingredients. These products are formulated without the use of synthetic chemicals, additives, or artificial fragrances. They are more environmentally friendly and safer for both consumers and the planet. The market includes a wide range of products such as skincare, haircare, cosmetics, oral care, and more.

The organic personal care market encompasses a diverse range of products that prioritize natural, non-toxic, and eco-friendly formulations. These products are free from synthetic chemicals, artificial fragrances, and harmful additives. The market includes skincare products (such as moisturizers, cleansers, and serums), haircare products (including shampoos, conditioners, and styling products), cosmetics (like makeup and lip care), oral care (toothpaste, mouthwash), and more. Increasing awareness about the potential harmful effects of synthetic chemicals in traditional personal care products has driven consumers towards organic alternatives. People are becoming more conscious of the ingredients they use on their skin and are seeking out products with natural, plant-based formulations. Customers are searching for items with a low environmental impact as they grow more environmentally concerned.

Organic personal care products often use sustainable sourcing practices, biodegradable packaging, and ethical manufacturing processes. Manufacturers in the organic personal care market are constantly researching and incorporating innovative natural ingredients like botanical extracts, essential oils, and plant-based preservatives to enhance the effectiveness of their products. The clean beauty movement advocates for products that are free from harmful ingredients, including parabens, sulfates, and phthalates. This aligns with the ethos of the organic personal care market, further driving its growth.

The rise of e-commerce platforms has made it easier for consumers to access a wider variety of organic personal care products from around the world. Online channels also provide opportunities for smaller, niche brands to reach a global audience. Larger beauty and personal care companies are investing in research and development to create effective organic formulations, bridging the gap between mainstream and organic products. A combination of the increased consumer awareness and desire for natural and organic goods, regions like North America and Europe have been significant contributors to the organic personal care industry.

The organic personal care market is witnessing robust growth due to a confluence of influential factors. Increasing consumer awareness about the potential risks posed by synthetic chemicals and artificial additives present in traditional personal care products has fuelled a demand for safer alternatives. People are actively looking for organic products given that they believe they are healthier and more natural for their well-being. Consumers are increasingly inclined to choose products with eco-friendly formulations and packaging, in line with the broader push for environmental conservation. Organic personal care products, often packaged in biodegradable and recyclable materials, resonate with consumers who aim to make environmentally responsible choices in their daily lives.

The pervasive trend of embracing holistic health and wellness has further propelled the demand for organic personal care items. Consumers now recognize that the products they apply to their skin can have far-reaching impacts on their overall well-being. This realization has led to a preference for organic personal care products that align with their healthier lifestyle choices.

The clean beauty movement, emphasizing ingredient transparency, honest labeling, and the exclusion of harmful substances, synergizes seamlessly with the ethos of the organic personal care market. Consumers are increasingly inclined to select products with cleaner ingredient lists, further bolstering the demand for organic options. Companies in the organic personal care market are making notable strides in research and development. This innovation has resulted in cutting-edge formulations that offer impressive results, often on par with their conventional counterparts. This has enhanced the credibility of organic products and widened their appeal to a broader audience.

The rise of e-commerce has transformed consumer access to organic personal care products. Online platforms have facilitated the discovery and purchase of these products around the world. Along with broadening the marketplace's reach, this enhanced accessibility has given smaller, niche firms a chance to become well-known worldwide.

The credibility of organic personal care products is bolstered by stringent government regulations and industry standards. Certifications such as USDA Organic, COSMOS, and Ecocert reassure consumers of the authenticity and quality of these products, further driving their adoption. The influence of celebrity endorsements and influencer marketing cannot be understated. As influencers and celebrities promote organic personal care products, consumer interest and trust are heightened, often translating into increased sales and visibility.

A notable trend within the organic personal care market is the rise of niche and indie brands. These smaller enterprises focus exclusively on natural and organic products, prioritizing transparency, unique formulations, and ethical practices. This emphasis has resonated with consumers seeking personalized and conscientious choices in their personal care routines. Demographics play a significant role in shaping the market's trajectory, with millennials and Generation Z emerging as key drivers. These younger generations are actively fuelling the demand for organic personal care products. With a proclivity for research, label reading, and values-aligned choices, they are instrumental in steering the market toward a more sustainable and natural future.

| Report Coverage | Details |

| Market Size by 2034 | USD 71.43 Billion |

| Market Size in 2024 | USD 28.48 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health and wellness trend

The organic personal care market's growth and trajectory have been significantly shaped by the health and wellness movement. The social change towards prioritizing holistic well-being, where people are more aware of the connections between their physical health, mental well-being, and general quality of life, is the core of this trend. This change has affected people's choices for their personal care routines as well as their eating and exercise routines, creating a demand for organic personal care products.

Higher costs

Organic personal care products often rely on natural, organic, and sustainably sourced ingredients. These ingredients can be more expensive to cultivate, harvest, and process than the synthetic counterparts commonly used in conventional products. Meeting the rigorous requirements of organic certifications and adhering to ethical and sustainable production practices necessitate additional investments, which can translate into higher production costs.

Opportunity:

Regenerative agriculture

Promoting sustainability, using regenerative farming methods for obtaining organic ingredients also provides firms aiming to stand out and appeal to environmentally concerned customers. The growing demand for plant-based and vegan products provides an avenue for innovation. Brands that focus on cruelty-free, plant-derived ingredients and clearly communicate their ethical practices are likely to resonate with conscious consumers.

Competition and differentiation

The market has been saturated as a result of the growing popularity of organic personal care products. There are many options available to consumers, making it challenging for certain companies to stand out. Formulations may begin to resemble one another as more brands concentrate on employing comparable natural and organic components. Customers may find it difficult to differentiate between items from various brands as a result.

In 2022, the skin care segment dominated the organic personal care market, driven by consumers' growing awareness of the connection between healthy skin and the use of natural and organic ingredients. Organic skin care products, formulated with plant-based extracts, essential oils, and nourishing botanicals, cater to individuals seeking products that align with their holistic well-being. Cleansers, moisturisers, serums, and face masks are common goods in this market area. Products that specifically target skin issues while avoiding potentially dangerous synthetic additives are more appealing to consumers. Brands prioritize openness and ingredient sourcing to show their dedication to high standards and moral behavior.

The hair care segment is another vital component of the organic personal care market, driven by the increasing demand for natural solutions to maintain healthy and lustrous hair. Organic hair care products, including shampoos, conditioners, and styling products, rely on ingredients like herbal extracts, essential oils, and plant-based proteins to nourish and strengthen hair without the use of harsh chemicals.

The e-commerce segment dominated the organic personal care market in 2023. The rise of e-commerce has significantly transformed the organic personal care market, offering a convenient and expansive platform for consumers to explore and purchase organic products from the comfort of their homes. E-commerce platforms provide a wide range of options, often showcasing products from diverse brands and allowing consumers to access information, reviews, and ingredient lists easily. The e-commerce channel caters to consumers seeking convenience, variety, and often a broader selection of organic personal care products than what may be available in local physical stores. The convenience of doorstep delivery, especially in the wake of the COVID-19 pandemic, has further enhanced the appeal of e-commerce for purchasing organic personal care products.

The supermarket distribution channel remains a key avenue for consumers to access organic personal care products. These brick-and-mortar stores provide a convenient and tangible shopping experience, allowing consumers to physically browse through shelves and engage with products. Supermarkets often allocate dedicated sections for organic products, making it easier for shoppers to identify and select from a variety of natural personal care items.

Segments Covered in the Report

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

August 2024

February 2025