January 2025

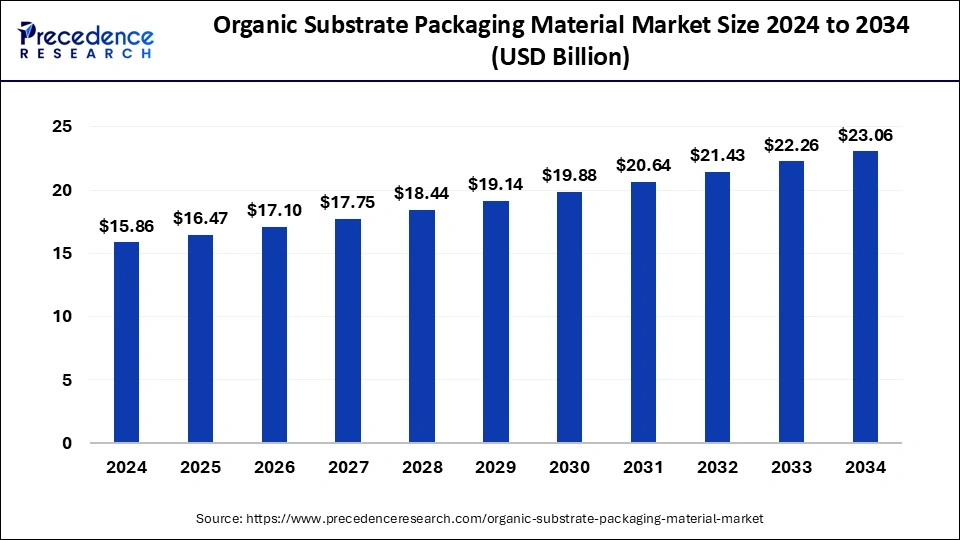

The global organic substrate packaging material market size is calculated at USD 16.47 billion in 2025 and is forecasted to reach around USD 23.06 billion by 2034, accelerating at a CAGR of 3.81% from 2025 to 2034. The North America market size surpassed USD 10.78 billion in 2024 and is expanding at a CAGR of 3.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organic substrate packaging material market size accounted for USD 15.86 billion in 2024 and is predicted to increase from USD 16.47 billion in 2025 to approximately USD 23.06 billion by 2034, expanding at a CAGR of 3.81% from 2025 to 2034. A significant rise in the demand for portable electronic devices, in addition to the advancements in information and communication technology is the organic substrate packaging material market driver.

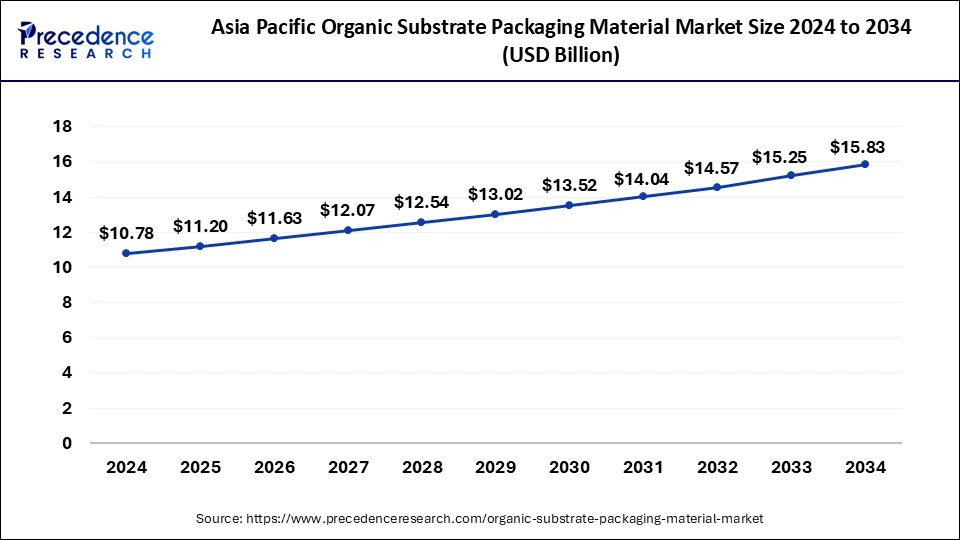

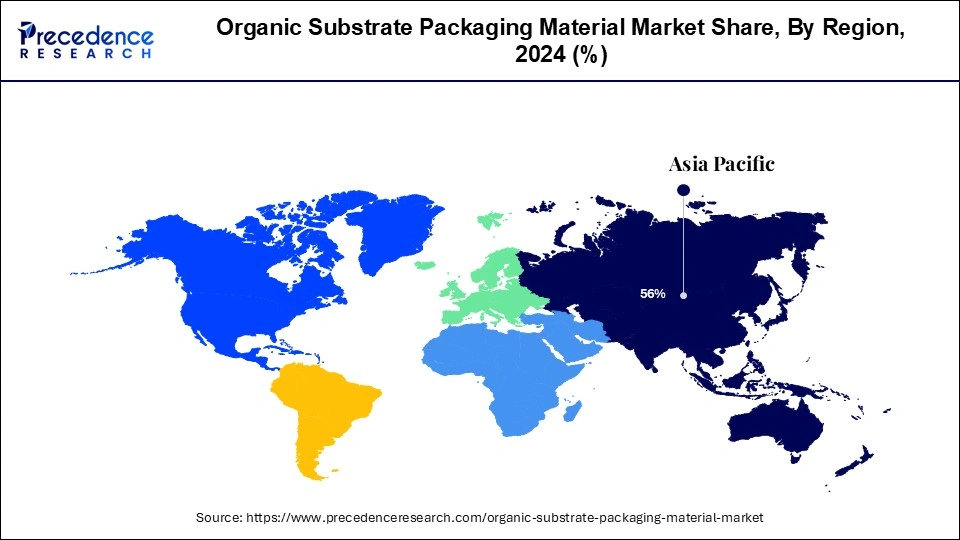

The Asia Pacific organic substrate packaging material market size was evaluated at USD 10.78 billion in 2024 and is projected to be worth around USD 15.83 billion by 2034, growing at a CAGR of 3.92% from 2025 to 2034.

Asia Pacific dominated the organic substrate packaging material market in 2024. Market growth in the Asia Pacific is primarily driven by the rising adoption of smartphones, the increasing number of Internet users, and the introduction of new features and technologies that attract new customers and expand footprints in emerging markets. Also, the region's leading position in the global printed circuit board market supports the growth of organic substrate PCBs. Major global packaging substrate manufacturers are primarily located in Taiwan, South Korea, and Japan.

North America is projected to show the fastest growth in the organic substrate packaging material market over the forecast period. The rising demand for biodegradable and compostable packaging materials in the region can be attributed to the expanding food and beverage industry. Furthermore, advancements in packaging technology, including flat no-lead packages, quad-flat packages (QFP), dual in-line packages (DIP), small outline (SO) packages, and grid arrays (GA) packages, have further driven market growth in the region.

Organic substrate packaging materials are used as the base layer for printed circuit boards (PCBs) to ensure high reliability and excellent electrical performance. These materials reduce the weight of PCBs, enhance their functionality, and improve dimensional control. They also help to minimize the environmental impact compared to inorganic alternatives. As a result, the global demand for organic substrate packaging materials is rising. China, the world's largest smartphone market, is expected to continue seeing high smartphone sales, particularly from domestic companies like OPPO and VIVO, which benefit from significant cost advantages over international competitors.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.06 Billion |

| Market Size in 2025 | USD 16.47 Billion |

| Market Size in 2024 | USD 15.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.81% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for sustainability

Governments and regulatory bodies worldwide are implementing stricter regulations and policies to reduce plastic waste and promote sustainable packaging. These regulations support the adoption of the organic substrate packaging material market. Increasing environmental awareness among consumers is driving demand for sustainable products, including packaging materials. Consumers are more inclined to choose products with eco-friendly packaging, creating a market for organic substrates. Organic substrate packaging materials, such as those made from plant-based fibers, are biodegradable and compostable. This reduces environmental pollution and waste accumulation, addressing the growing concern over plastic pollution.

Advancements in electronic packaging technologies

The organic substrate packaging material market is growing significantly due to advancements in electronic packaging technologies and the increasing demand for compact, lightweight electronic devices. Materials like fiberglass-reinforced epoxy laminate (FR4) and polyimide are becoming popular for their excellent electrical insulation and mechanical strength. Moreover, the trend toward miniaturization in consumer electronics and the automotive sector can drive market expansion soon.

Complexity of the manufacturing process

The organic substrate packaging material market growth is limited by challenges such as the high costs of advanced organic substrates and the complexity of manufacturing processes. Additionally, stringent regulatory requirements regarding material safety and environmental impact can create further obstacles for market players. However, the ongoing research and development efforts aimed at improving substrate performance and reducing production costs can impact the market positively.

Rising government initiatives

Governments worldwide are increasingly implementing stricter environmental regulations to reduce plastic waste and promotes the organic substrate packaging material market. This creates a favorable environment for organic substrate packaging materials, which are biodegradable and eco-friendly, as businesses seek alternatives to comply with these regulations.

Many governments offer financial incentives, subsidies, and grants to companies that develop and use sustainable packaging materials. These incentives lower the cost barrier for businesses to transition to organic substrates, boosting demand and innovation in the market. Government agencies and departments are increasingly adopting green procurement policies, requiring suppliers to use sustainable packaging materials. These policies create a direct organic substrate packaging material market within the public sector and set a precedent for private companies to follow.

The consumer electronics segment dominated the organic substrate packaging material market in 2023. Factors driving growth in the consumer electronics segment, an important market for semiconductors, include the rising adoption of wearable and smart products, the expanded smartphone market, and the increasing prevalence of consumer IoT devices used in applications such as home monitoring. Furthermore, Chip manufacturers anticipate significant global popularity of high silicon 5G smartphones in the forecast period, which can potentially improve the organic substrate packaging material market.

TOP 10 ELECTRONICS MANUFACTURERS BY COUNTRY IN 2022-2023 IN USD BILLION)

| Country | Value ($B) |

| China | 1,368 |

| Taiwan | 507 |

| South Korea | 321 |

| Vietnam | 213 |

| Malaysia | 190 |

| Japan | 170 |

| United States | 166 |

| Germany | 151 |

| Mexico | 150 |

| Thailand | 114 |

The automotive segment is expected to grow at the highest CAGR in the organic substrate packaging material market during the forecast period. Automotive electronics generate significant amounts of heat. Organic substrates, particularly those with high thermal conductivity, are crucial for effective thermal management, ensuring the longevity and reliability of electronic components under the harsh conditions often found in automotive environments.

The SO packages segment held a significant share of the organic substrate packaging material market in 2023. By integrating multiple functions into a single package, SO packages can reduce the overall cost of assembly and testing. This cost efficiency makes them attractive for high-volume consumer electronics and other applications where cost competitiveness is crucial. SO packages enable the integration of multiple electronic components, such as processors, memory chips, and passive components, into a single package. This integration supports the trend towards miniaturization in electronic devices, which is critical for applications like smartphones, wearables, and IoT devices.

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

April 2025

January 2025