September 2024

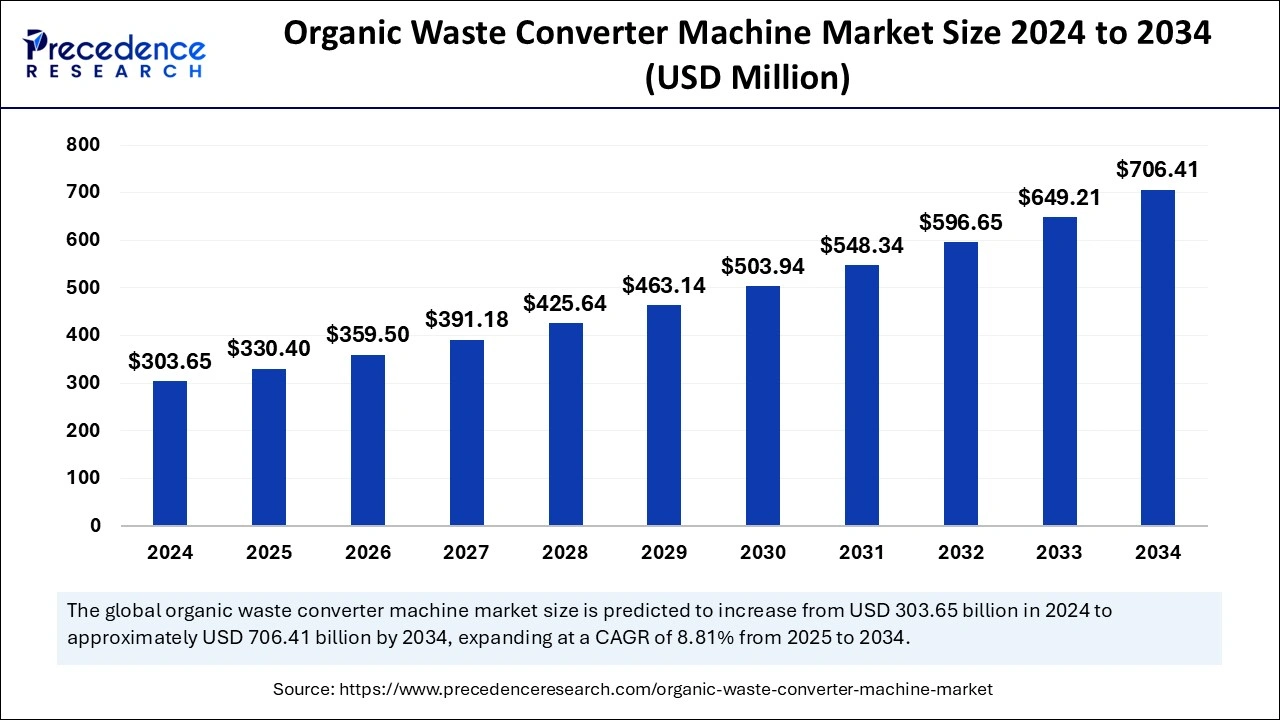

The global organic waste converter machine market size is accounted at USD 330.40 million in 2025 and is forecasted to hit around USD 706.41 million by 2034, representing a CAGR of 8.81% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organic waste converter machine market size was calculated at USD 303.65 million in 2024 and is predicted to reach around USD 706.41 million by 2034, expanding at a CAGR of 8.81% from 2025 to 2034. The market growth is attributed to the increasing adoption of sustainable waste management practices and government regulations promoting waste segregation.

Artificial Intelligence technologies in the organic waste converter machine market are improving the effectiveness and accuracy of methods to transform organic waste. Smart technologies apply artificial intelligence and give guidance on efficiency through monitoring data on waste and sorting the same. AI algorithms assist in forecasting waste generation and identify the sectors’ efficient management of resource adoption.

Growing awareness of the environment and the consequences caused by waste will facilitate the organic waste converter machine market in the coming years. This technology is a critical component of transforming biodegradable Industrial and agricultural waste into compost, biogas, or organic fertilizer solutions to environmental problems of waste disposal. Such measures as waste segregation and recycling are now being widely practiced by governments with the cooperation of industries and converting organic waste into useful material. Furthermore, there is a higher demand and prevalence of environmentally friendly waste management solutions.

| Report Coverage | Details |

| Market Size by 2024 | USD 303.65 Million |

| Market Size in 2025 | USD 330.40 Million |

| Market Size in 2034 | USD 706.41 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.81% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Capacity, Power Source, Operation, End-User, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness of waste management practices

Increasing awareness about waste management practices is expected to drive the organic waste converter machine market growth. Different governments and environmental organizations have scaled up efforts to minimize the use of landfill disposal systems. This promotes the development of organic waste conversion technologies.

The UK’s government has stated that since 31 March 2026, waste collection authorities have been legally required to collect food waste weekly from all homes, thus frequently disposing of stinking organic waste. This policy requires the separation of organic waste, thereby leading to a need for machines to compost biodegradable material effectively. Moreover, the European Union’s Waste Framework Directive focuses also on the waste hierarchy of waste prevention, reuse, and recycling.

Inadequate waste segregation practices

Restrain expansion due to inadequate waste segregation practices, thus hampering the organic waste converter machine market growth. Insufficient policies regarding source segregation in many countries affect the functionality of organic waste converters, as the input waste streams are often contaminated with non-degradable materials. Not only does contamination lower the quality of the resultant compost or by-product, but it also adds the work of sorting out the unwanted material from the compost process, making it expensive. This inefficiency is expected to reduce the investment hump on such machines, especially in the probabilities where segregation rules are either limited or sparsely applied.

Growing technological advancements

Rising investments in technological advancements expand market reach, creating immense opportunities for the players competing in the organic waste converter machine market. Increasing levels of spending on technology lead to an increase in market size. To meet the needs of customers, companies incorporate new technologies that include artificial intelligence, the ability to control smell, and the ability to fit small spaces prevalent in urban areas.

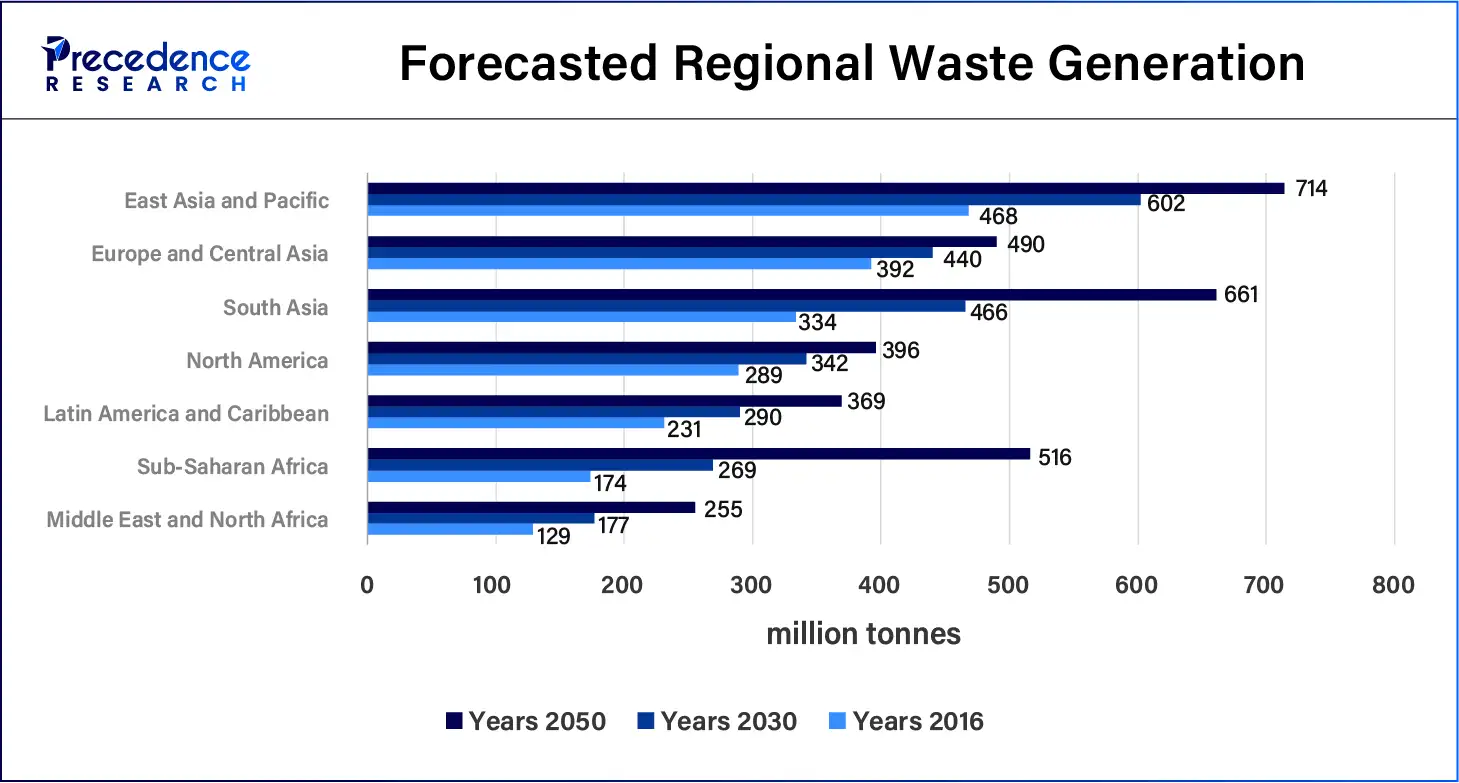

Organic waste converters have the potential to be embraced by as many residents, resultants, small companies, and other users. Furthermore, the World Bank, through the “What a Waste 2.0,” pointed out that the method of open dumping takes approximately 31% of waste, hence the possibility of utilizing advanced WM technologies to enhance recycling and composting.

The continuous feed segment accounted for a considerable share of the organic waste converter machine market in 2024 due to the increased usage of LDPE in small-scale uses, home, and industrial products. Batch feed machines deal with organic waste in steps that make them more appropriate for use where waste production is irregular or inconsistent. These machines are expected to enjoy a continuous expansion occasioned by portability, simplicity, and affordability. Furthermore, the increasing concern in sustainability practices and policies also encouraging decentralized waste management is credited to boosting the use of batch feed machines in the coming years.

The batch feed segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034., owing to the growing demand for technology to deal with huge quantities of organic waste, which is favorable, especially in the industrial, municipal, and commercial domains. They are meant for constant use, which is most appropriate for areas of high waste generation, including the hospitality industry, the food processing industries, densely populated areas, or large-scale waste disposal zones. Furthermore, the rising need for automated and high-capacity solutions in these sectors might boost the demand further.

In 2024, the above 1500 kg segment led the global organic waste converter machine market due to the need to continue to grow waste management systems for commercial and industrial facilities on medium to large scale. These machines are well suited for places such as hotels, restaurants, food processing industries, and medium-sized municipal waste germination units where large quantities of organic waste are produced daily. This underscores the huge market potential for organic waste converters with an installed capacity of 1,000 Kg to 1,500 Kg for appropriately dealing with a part of this biodegradable waste.

The 1000 kg to 1500 kg segment is anticipated to grow with the highest CAGR during the studied years, owing to the growing need for extended-volume refuse disposal systems in commercial and urban environments. Increased volume of organic waste production from food processing industries, large cities, and the commercial industry is facilitating the segment. Large-scale industries and agricultural processing plants are also likely to install machines that have higher capacity in order to manage waste and ensure that the civic body and municipalities comply with strict environmental policies and standards. These high-capacity systems provide relatively greater modularity and automation and are well-suited to large-scale waste management centers.

The electric segment dominated the global organic waste converter machine market in 2024 due to the increased demand for sustainable, energy-efficient structures and comfortable retrofitting to existing surroundings. Electrically heated organic waste disposers are much preferred where electricity is abundantly and often supplied in urban and residential settings. This is the reason why electric power is a desired market trend, as consumers seek to use products and services that reduce their carbon footprint and ensure enhanced environmental protection. Additionally, urban regions and apartment buildings that lack sustainability standards are most likely to utilize electric-driven systems.

The gasoline segment is projected to expand rapidly in the market in the coming years, owing to its applicability to areas where electric power is not available and other rural or off-grid areas where the equate electric network is weak or non-existent. Organic waste converters run on gasoline allow for portability as they are moved from one location to another, regions that might lack convenient access to a constant power source, such as farms, large-scale industries, and rough terrains. These systems are most suitable for large volumes of organics, normally applied in food processing industries and farms, as well as outdoor municipal projects. Moreover, the further expansion of agricultural and rural economies is projected to boost the consumption of gasoline-driven organic waste converters.

The automatic segment dominated the global organic waste converter machine market in 2024 due to the desire for high-efficiency systems that work with the least influence from an operator. Fully automatic systems are always superior to semi-automatic machines, especially in terms of throughput rate, accuracy, and cost of operation. These systems are especially preferred for commercial, industrial, and municipal uses as the heavy-duty environment demands constant and high throughput rates for waste disposal. Furthermore, there is an increase in demand for automatic machines as industries and municipalities want to economize and rebuild their processes.

The semi-automatic segment is projected to grow at the fastest rate in the future years. Semi-automatic organic waste converters are a perfect compromise for users who want fast waste treatment but with a certain measure of manual control. All these systems expect the operator to carry out a few manual functions, including the feeding of waste or the changeover process, and despite the existence of such manual functions, the ease of use is splendid, and the efficiency rate higher than fully manual systems. The increasing focus seen in small enterprises and households on environmentally friendly waste management leads to higher demand for semi-automatic solutions, further compounded by rising consciousness about the use of compost and the reduction of waste.

The industrial segment led the global organic waste converter machine market in 2024 due to the high productivity in food processing, agricultural processing, and packaging industries, considering that they produce large volumes of organic waste. Business firms operating in these industries have started to incorporate organic waste converters for waste management as a strategy for sustainability. Furthermore, governments around the world have set down tighter regulations on waste management, and other organizations are seeking to improve their sustainability stances.

The commercial segment is projected to grow rapidly in the future years, as restaurants, hotels, and supermarkets are expected to grow at a fast pace with the rising environmental pressures on firms to properly dispose of waste. The food services sector generates a great deal of organic waste, and much of this can be recycled with the help of organic waste converters to compost or bioenergy. Organic waste converters should attract many purchases from commercial establishments, increase consumer awareness of environmentally friendly practices, and put greater regulatory pressure on businesses to handle waste properly.

The direct segment dominated the global organic waste converter machine market in 2024. Direct sales also give manufacturers a chance to offer improved after-sales services, such as repairs, technical support, and user training, all of which make the consumers satisfied and loyal. It is expected that the demand for direct distribution also rise due to changing market dynamics and the growing need for sophisticated solutions from commercial companies and municipalities. Furthermore, the direct methods include more accurate messages, convenient chains of supplies, and price competition.

The indirect segment is anticipated to grow at the fastest rate in the market during the forecast period, owing to the geographical distance where the consumer will not be in a position to directly transact with the manufacturer or they choose to deal with local known distributors, then indirect channels become the only way of marketing. Manufacturers enter into agreements with distributors, resellers, and retail chains further to supply end-users, homeowners, and other small companies that cannot afford to participate on their own. Furthermore, the growth in the application of small-scale organic waste converters for home use shall further advance the use of the indirect distribution model.

North America held the largest share of the organic waste converter machine market in 2024 due to the importance of sustainable waste management and practices, such as waste diversion across the U.S. and Canada. Regulatory pressures that promote the usage of organic waste conversion technologies are creating the demand for organic waste converter machine technology.

Local and state governments have already set and enforced different measures regarding the control of landfill waste, and this only tends to rise in the future. Furthermore, the increasing trend of people embracing decentralized waste management systems for home and business use is credited for the fast uptake of organic waste converters.

Asia Pacific is projected to host the fastest-growing organic waste converter machine market in the coming years, owing to population growth, the emergence of new megacities, economic growth resulting in waste production, and the urgency for rational use of the waste. Developed countries, including China, India, and Japan, are leading in the integration of organic waste management technologies as propelled by polity-based encouragements and compulsion to minimize landfills.

As more people wake up to the fact that the natural environment is gradually becoming hazardous, the utilization of organic waste converters has become more rampant within the urban as well as the rural areas. In addition, the burgeoning population, especially of new emerging markets, will fuel the generation of municipal solid wastes and thereby propel the demand for organic waste converters. Furthermore, the overall big-ticket government expenditure is connected with infrastructure development and rising interest in waste-to-energy technologies.

By Type

By Capacity

By Power Source

By Operation

By End-User

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

December 2024