January 2025

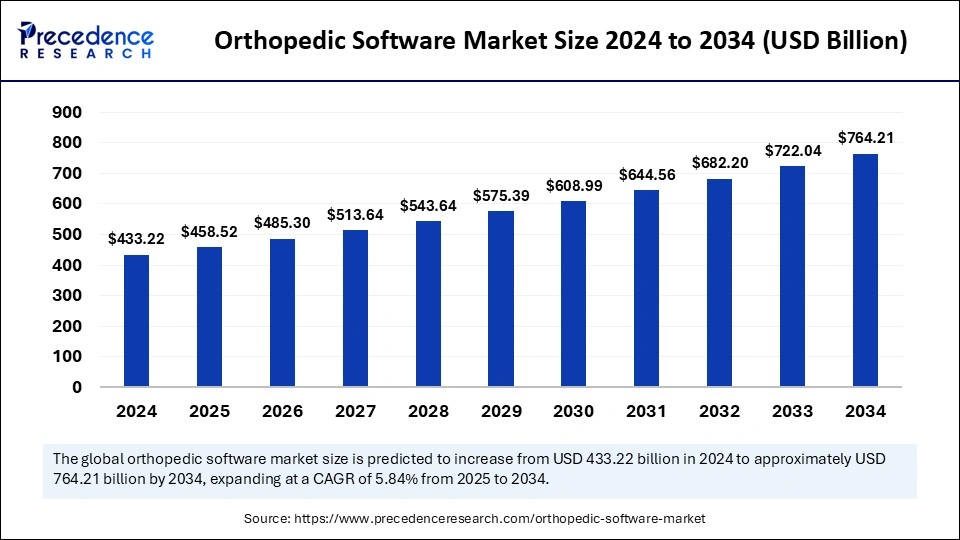

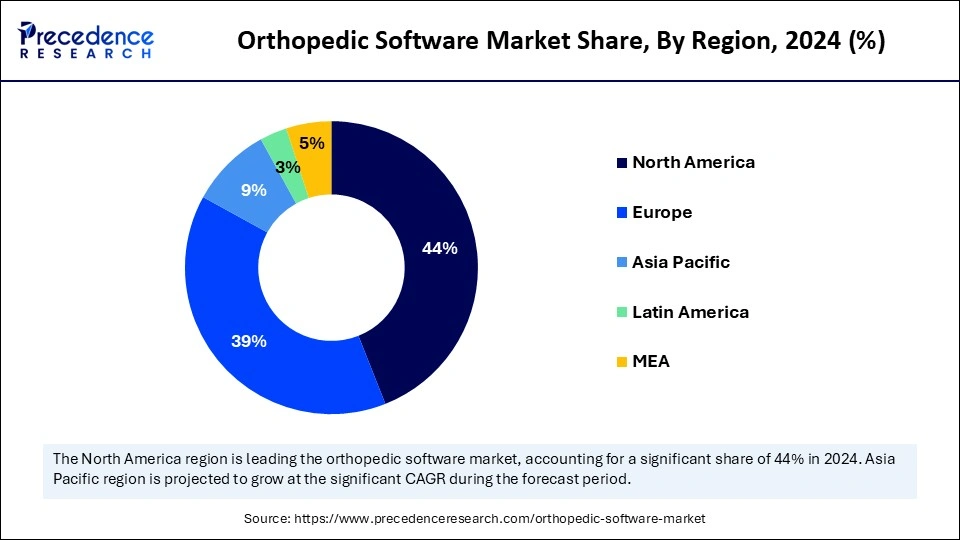

The global orthopedic software market size is calculated at USD 458.52 billion in 2025 and is forecasted to reach around USD 764.21 billion by 2034, accelerating at a CAGR of 5.84% from 2025 to 2034. The North America market size surpassed USD 190.62 billion in 2024 and is expanding at a CAGR of 5.96% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global orthopedic software market size accounted for USD 433.22 billion in 2024 and is predicted to increase from USD 458.52 billion in 2025 to approximately USD 764.21 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034. The rising adaptation of digitization and technological innovations in the healthcare infrastructure drives the growth of the market.

The integration of artificial intelligence into the orthopedic software market is transforming overall operations and improving efficiency. The integration of artificial intelligence into orthopedic applications aims to improve predictive models, diagnostics, risk prediction, and medical image analysis. AI can offer a personalized treatment plan to meet the demands of orthopedic patients. AI possesses potential opportunities in orthopedic treatment, such as AI-assisted surgery, implants developed using AI, AI-based remote patient monitoring, and AI-guided pain management.

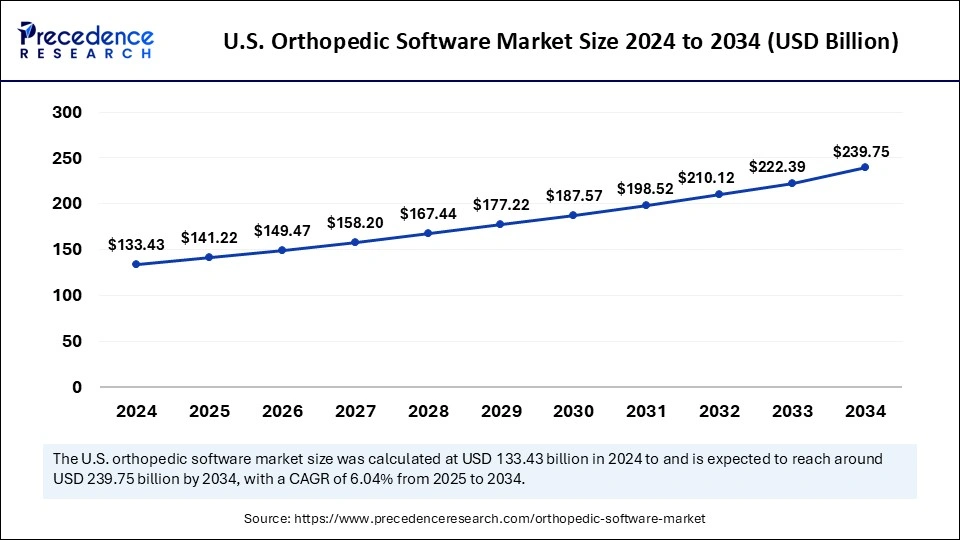

The U.S. orthopedic software market size was exhibited at USD 133.43 billion in 2024 and is projected to be worth around USD 239.75 billion by 2034, growing at a CAGR of 6.04% from 2025 to 2034.

North America dominated the orthopedic software market in 2024. The growth of the market is attributed to the rising implementation of technologies in the healthcare sector and the continuous expansion of the healthcare infrastructure with the support of government investment and policies. Regional countries like the United States have a higher presence of technology leaders associated with healthcare technologies and the various technological integrations into healthcare, such as telehealth, mHealth, eHealth, and others.

Asia Pacific is expecting substantial growth in the orthopedic software market during the predicted period. The growth of the market is owing to the rising economic stability in the population and the rising healthcare infrastructure due to the increasing population, especially the increased number of geriatric populations that are more likely to have bone-related issues and cause the demand for orthopedic surgeries. The increasing cases of bone-related issues, accidents, and sports injuries contribute to the growing demand for orthopedic software across the region.

Orthopedic software is the modern tool or technology that transforms the overall operations of orthopedic treatment and applications. It is one of the electronic health records that is used by orthopedic medical practices and a number of orthopedic physicians. The software provides features like enhanced security, device convenience, patient portals, transcriptions, e-prescribing, reporting, and others. It enables tracking, maintaining, and updating the medical records of patients on a regular basis.

| Report Coverage | Details |

| Market Size by 2034 | USD 764.21 Billion |

| Market Size in 2025 | USD 458.52 Billion |

| Market Size in 2024 | USD 433.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84 % |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Mode Of Delivery, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising digitization

The increasing adaptation of orthopedic software market services physicians for transforming paper-based management into digital records. It allows the easy transfer of medical charts, records, and test results across different healthcare environments. Digitization offers several benefits over orthopedic treatment, such as providing customized treatment plans and templates, streamlining procedural, allowing remote accessibility, providing digital imagery which helps in an easy recovery process, enhancing patient engagement and experience, seamless analytics and reporting, and helps in providing quality treatment to the patients.

Lack of professional

The lack of knowledge about the software and the insufficient number of skilled professionals who can handle the technology limit the growth of the orthopedic software market.

Technological advancements in orthopedic treatment applications

The rising technological adaptation into healthcare applications and the integration of innovative technologies into orthopedic surgeries and other diagnostics are driving growth opportunities in the market expansion. The modernization in orthopedic treatment with the integration of the latest technologies like 3D printing, robotic-assisted surgery, augmented reality, smart orthopedic implants and wearables, telemedicine, orthobiologic treatments, wearables, health monitors, and others are boosting the growth of the market.

The orthopedic EHR segment dominated the orthopedic software market in 2024. The orthopedic EHR is a modern tool or product that is used in the orthopedic process; it helps in addressing all the clinical requirements of orthopedic patients. There are several benefits associated with EHR in orthopedics, such as patient imagery management, in which the staff can easily access and store the digital imagery of patients; it provides real-time insights into the treatment and recovery process. EHR often provides specialty-specific requirements such as helping patients with the proper assistance with the diagnostic and treatment procedures.

The digital templating/preoperative planning segment expects the fastest growth in the market during the predicted period. The orthopedic digital templating software efficiently helps in orthopedic implants; this helps physicians to analyze the accurate replacements or size of the implants as per the anatomy of patients. Digital templating also helps in planning the surgeries by providing a preview of how the implant will work in the body.

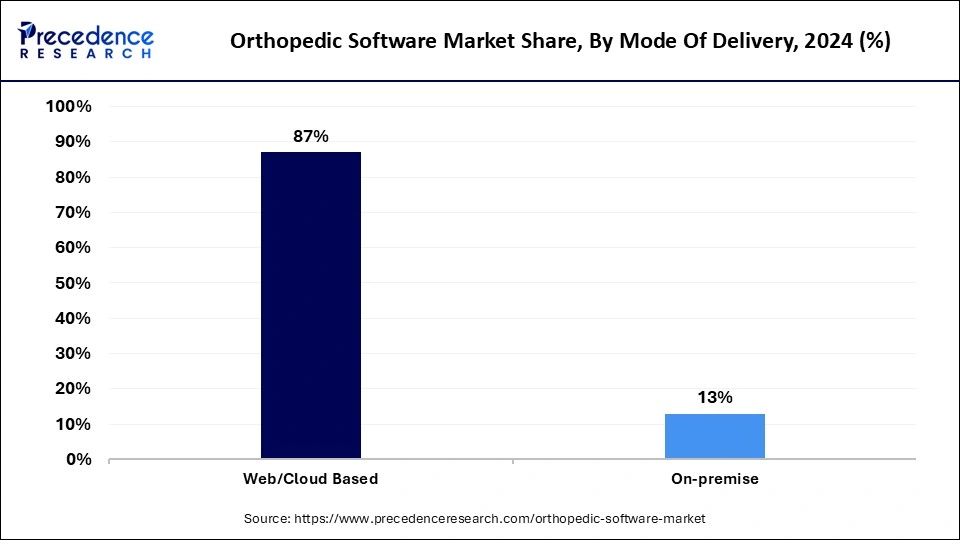

The web/cloud-based software segment led the orthopedic software market in 2024. Web/cloud-based software is software that works remotely on a secure server with internet services. It is the modern form of software delivery system that reduces the need for the on-premises software infrastructure. It allows easy access to patient data from any location, eliminates the downtime or disruption for server maintenance, reduces upfront costs, and provides high security over data. The web/cloud-based software enhances productivity with more efficiency and streamlines prescription management.

The orthopedic surgery segment dominated the orthopedic software market in 2024. The increasing number of orthopedic surgeries owing to the rising geriatric population and the number of accidents is driving the demand for technologically advanced orthopedic software to help physicians in the diagnostics and treatment of the disease. In old age, arthritis is the most common type of bone-related issue, which causes the need for orthopedic surgeries. Additionally, the rising sports culture in the world sometimes causes sports injuries in the players, who end up getting orthopedic surgeries for recovery, which also boosts the segment growth and causes the growth of the market.

The fracture management segment expects the fastest growth during the predicted period. Orthopedic software plays an important role in fracture management by providing easy access to imagery and data exchange, which provides efficiency in fracture management. There are several leading players investing in the advancement of imagery software, which helps in the early diagnosis of trauma.

| ChartLogic | A leading software developed for orthopedic practices and popular EHR among orthopedic physicians. The software is integrated with orthopedic-specific templates and flow sheets for orthopedic surgeons. |

| TraumaCad | A cloud-based orthopedic planning software that can be used remotely, anywhere, anytime. It is designed to automatically generate pre-surgical reports such as implant information, patient images, measurements taken, and comments. |

| mediCAD | It is a premium software solution for transforming the orthopedic workflow; it provides 3D models, 3D planning, and medical imaging. |

| AdvancedMD | It is the leading EHR software solution for orthopedic practices for the diagnostics and treatment of patients with orthopedic conditions. |

| Healthray | An EMR software for the orthopedic, which is designed to streamline the documentation process and other orthopedic applications. |

| Ezovion | Orthopedic practice management is designed to enhance patient engagement, patient care, post-patient care, and other orthopedic applications. |

| Clinicea | An orthopedic software that offers pre-built templates for Knee pain, Osteoarthritis, Low back pain, Fracture, Ankle sprain, Carpal Tunnel Syndrome, Pre-op visits, Cellulitis, and other orthopedic applications. |

By Product

By Mode Of Delivery

By Application Insights

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

August 2024