November 2024

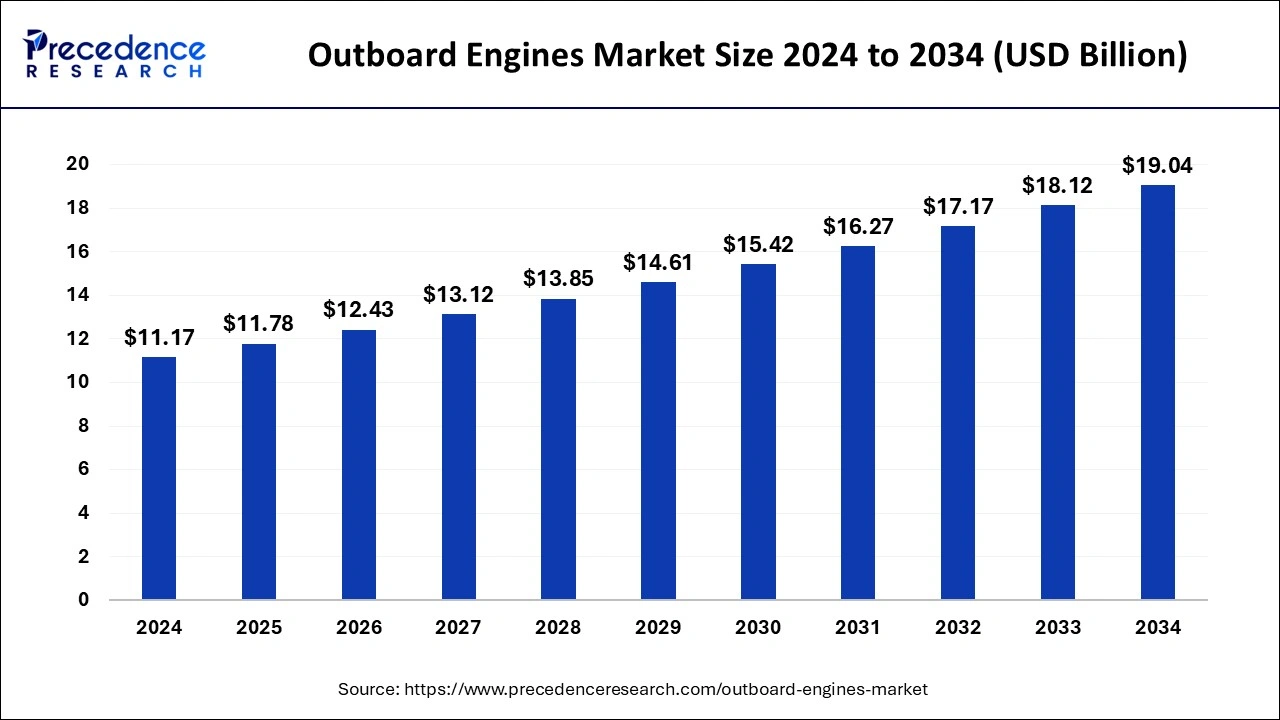

The global outboard engines market size is calculated at USD 11.78 billion in 2025 and is forecasted to reach around USD 19.04 billion by 2034, accelerating at a CAGR of 5.48% from 2025 to 2034. The North America outboard engines market size surpassed USD 6.03 billion in 2024 and is expanding at a CAGR of 5.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global outboard engines market size was estimated at USD 11.17 billion in 2024 and is predicted to increase from USD 11.78 billion in 2025 to approximately USD 19.04 billion by 2034, expanding at a CAGR of 5.48% from 2025 to 2034. The growing popularity of maritime tourism, which includes excursions, water cruises, and adventure sports, increases the need for vessels with dependable outboard motors.

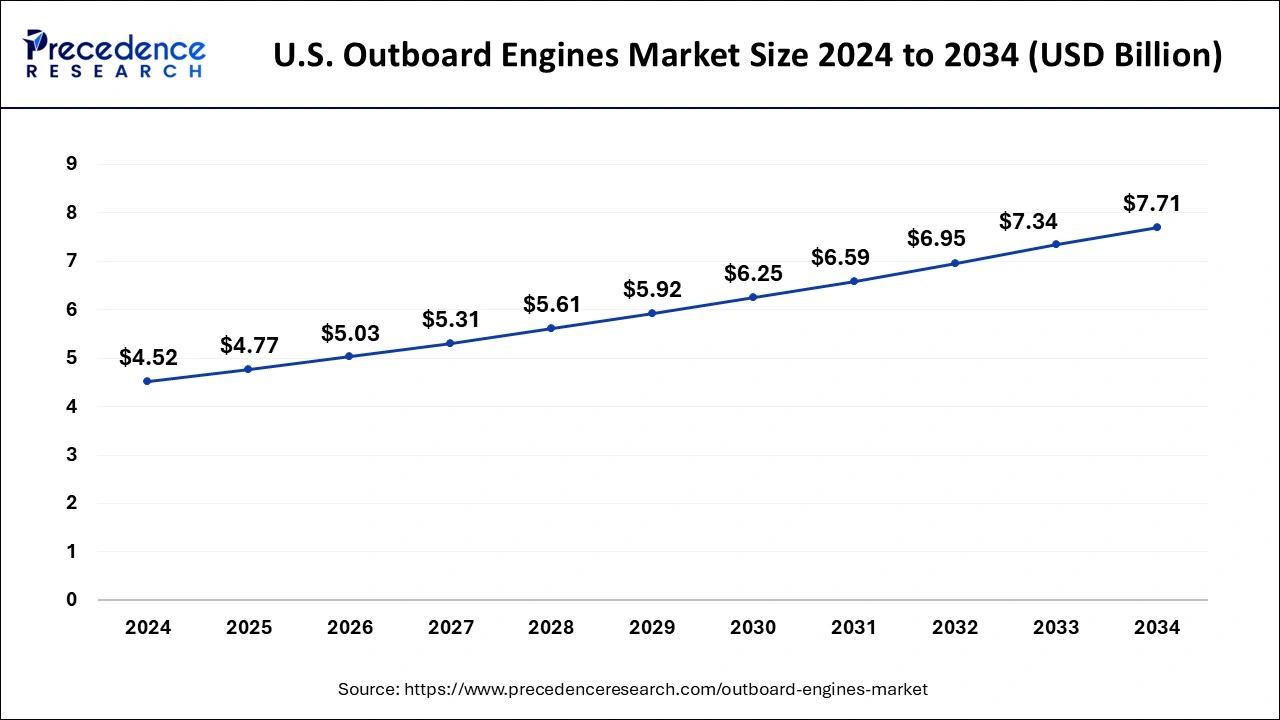

The U.S. outboard engines market size was valued at USD 4.52 billion in 2024 and is anticipated to reach around USD 7.71 billion by 2033, poised to grow at a CAGR of 5.50% from 2025 to 2034.

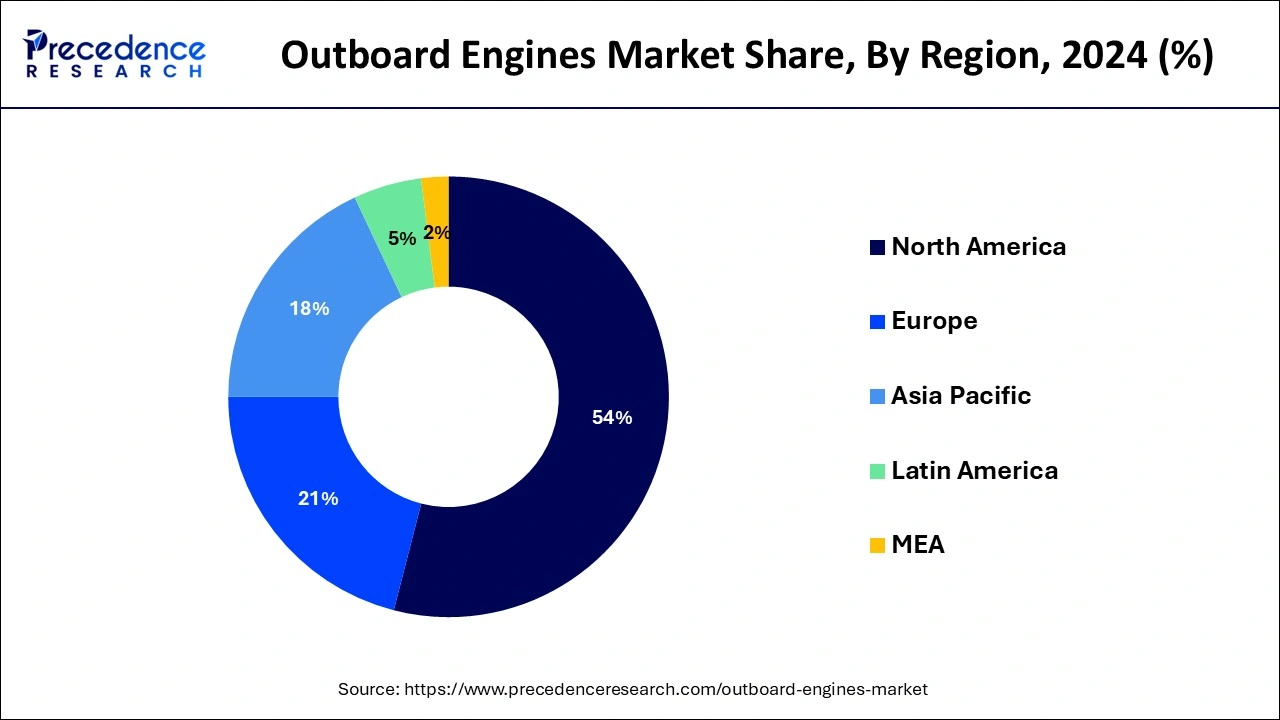

North America held the largest market share of 54% in 2024. Millions of individuals enjoy recreational boating in North America, where they engage in activities including fishing, water skiing, and cruising. Because of their efficiency, adaptability, and convenience, outboard engines are the most popular propulsion technology in recreational boats, increasing demand for them. Recent technological developments in the outboard engine sector have resulted in the creation of more environmentally friendly and fuel-efficient engines. In North America, rules about emissions and marine engine requirements impact the development and design of outboard engines. Manufacturers are required to abide by state and federal laws pertaining to safety requirements, noise levels, and emissions.

Asia Pacific is expected to be the fastest-growing region for the outboard engines market during the forecast period. One major factor driving the outboard engine industry has been the growing popularity of recreational boating and water sports in nations like Australia, Japan, China, and South Korea. Urbanization, rising disposable incomes, and an increasing interest in outdoor leisure activities contribute to this growth. Small commercial vessels with outboard engines are also used for passenger ferries, transportation of coastal goods, and tourism assistance. The need for outboard engines is fueled by the expansion of maritime transportation, particularly in areas with a high concentration of islands or coastal settlements. The development and manufacture of outboard engines are being impacted by environmental rules that aim to lower emissions and increase fuel efficiency.

The outboard engines market is the industry that produces, sells, and distributes outboard motors. Outboard engines are independent propulsion units externally positioned on a boat's transom instead of being integrated within the hull. These engines, which are used to power a variety of watercraft, such as boats, dinghies, pontoons, and fishing vessels, usually consist of a powerhead, gearbox, and propeller. The market for outboard engines is large and diverse, with models to suit various boat sizes, power requirements, and performance requirements. In this market, manufacturers compete based on pricing, technical advancements, engine power, fuel efficiency, weight, dependability, and emissions compliance.

The rising popularity of recreational boating activities like fishing, water sports, and leisure cruises has significantly influenced the outboard engines market. Boats with outboard motors are in greater demand as people look for outdoor recreation opportunities. For both recreational and commercial fishing boats, outboard engines are necessary. The market for outboard engines has expanded due to the fishing industry's growth, which is driven by the rising demand for seafood and related products. The need for boats with dependable outboard engines has increased due to the expansion in maritime tourism, which includes activities like island hopping, whale watching, and sightseeing excursions. This demand is robust in coastal areas and well-known tourist attractions.

The outboard engines market and the recreational boating market are closely related. Boats with outboard engines are in greater demand for uses, including fishing, watersports, and cruising, as disposable incomes rise and leisure time becomes more popular.

Global marine tourism is increasing the demand for boats and outboard motors. Reliable outboard engines are becoming increasingly necessary as more people explore coastal areas and water bodies for fun and adventure. The outboard engines market is expanding due to outboard engine technology advancements, which have improved power output, durability, emissions control, and fuel efficiency. Engine producers are always coming up with new ideas to provide more environmentally friendly engines that perform better.

Outboard engines are crucial to the fishing industry since they power many fishing vessels. The demand for outboard motors and fishing boats is rising with the world's growing demand for seafood.

Outboard engines need to be maintained or replaced like any other equipment. There is a natural market demand for replacement engines as older models age or become less efficient, especially from boat owners who value dependability and performance. The increase in GDP, interest rates, and consumer confidence are macroeconomic variables that significantly impact the outboard engines market. The demand for outboard engines is driven by customers' propensity to indulge in leisure activities like boating during times of economic success.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.48% |

| Market Size in 2025 | USD 11.78 Billion |

| Market Size by 2034 | USD 19.04 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Engine Type, By Ignition Type, By Fuel Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Replacement market

The outboard engines market segment specializing in selling outboard motors to replace older or malfunctioning engines on boats is known as the replacement market. Several causes fuel this market segment, including the aging of current engines. These technological developments result in more efficient engines and boat owners' desire to upgrade to newer models with improved amenities. Modern outboard engine technology might encourage boat owners to swap out their outdated engines for newer, more efficient versions due to features like increased horsepower, less emissions, and better fuel efficiency. Older engines may need to be replaced with newer, greener units that adhere to revised emission requirements due to changes in environmental rules.

Shifts in consumer preferences

Customers are beginning to place a higher value on outboard engines' fuel efficiency. Boaters are looking for engines with higher miles per gallon (MPG) or liters per hour (LPH) economy due to rising fuel prices and growing environmental awareness. A growing number of purchasers are choosing engines built to reduce pollution in water bodies that either meet or surpass emission regulations. These are causing significant hurdles in the growth of the outboard engines market. Greener consumers are increasingly drawn to outboard motors that run on natural gas or propane and electric outboard engines. Consumers are increasingly concerned about quiet operation and slight vibration, particularly those who enjoy recreational boating in calm settings or near residential areas.

Electric and hybrid outboard engines

There is a rising need for greener and more sustainable outboard engine alternatives to conventional gasoline-powered ones as environmental concerns become more widely recognized. Outboard motors powered by electricity and hybrid technology have fewer noise pollution, emissions, and dependency on fossil fuels. Within the outboard engines market, electric engines now have far better performance and range because of advancements in battery technology. Compared to previous battery technologies, lithium-ion batteries offer a better energy density and longer running durations. The initial prices of electric and hybrid outboard engines are typically higher than those of conventional gasoline-powered engines. However, as battery prices continue to drop, the initial expenditure may be offset by cheaper operating and maintenance costs during the engine's lifetime. Thereby, the integration of electric and hybrid outboard engines is observed to create a significant opportunity for the market.

The 2-stroke segment held the largest share in the outboard engines market in 2024. For many years, 2-stroke outboard engines have been a mainstay in the nautical industry. Their excellent power-to-weight ratio, lightweight construction, and simplicity made them famous. The fact that 2-stroke engines emit more pollution than 4-stroke engines is one of their biggest problems. Many regions have tightened their emission rules in response to concerns about environmental contamination, including water pollution from fuel mixes and oil. These issues have caused several manufacturers to concentrate more on creating and selling 4-stroke outboard engines. As a result, there are fewer 2-stroke versions available on the outboard engines market, and their variety has decreased.

Even with the general decrease, 2-stroke outboard engines continue to have some benefits in specific specialized applications. For instance, they are frequently used for racing and high-performance boating because of their reduced weight and more straightforward construction. Even though sales of new 2-stroke outboard engines have decreased, there is still a sizable market for older versions, especially among cost-conscious consumers who value simplicity and ease of maintenance over environmental considerations. In many nations, emission rules have gotten stricter, particularly regarding air and water quality. The market share of 2-stroke outboard engines has decreased due to these laws, which frequently favor engines that burn cleaner.

The electric segment held the largest share in the outboard engines market in 2024. An increasing need for greener and more sustainable propulsion options has resulted from growing awareness of environmental challenges, including pollution and carbon emissions. Environmentally aware consumers and regulatory agencies find electric outboard engines appealing because they emit no pollutants. Electric propulsion systems now have much better energy density, longevity, and efficiency because of the development of high-performance lithium-ion batteries. Due to these developments, electric outboard motors are now more practical for various uses, such as commercial and recreational boating.

Cleaner propulsion solutions are becoming more and more necessary due to regulatory bodies in many areas enforcing more burdensome emissions regulations for marine engines. To comply with these strict requirements, electric outboard engines perform comparable to conventional gasoline-powered engines. Despite their potentially more significant initial cost, long-term running and maintenance expenses are lower for electric propulsion systems than for conventional gasoline engines. Because electric engines have fewer moving components, they require less maintenance and use less fuel. The outboard engine industry's manufacturers are spending money on R&D to improve electric propulsion systems' effectiveness, dependability, and performance. This covers advancements in battery management systems, motor design, and digital technology integration for better monitoring and control.

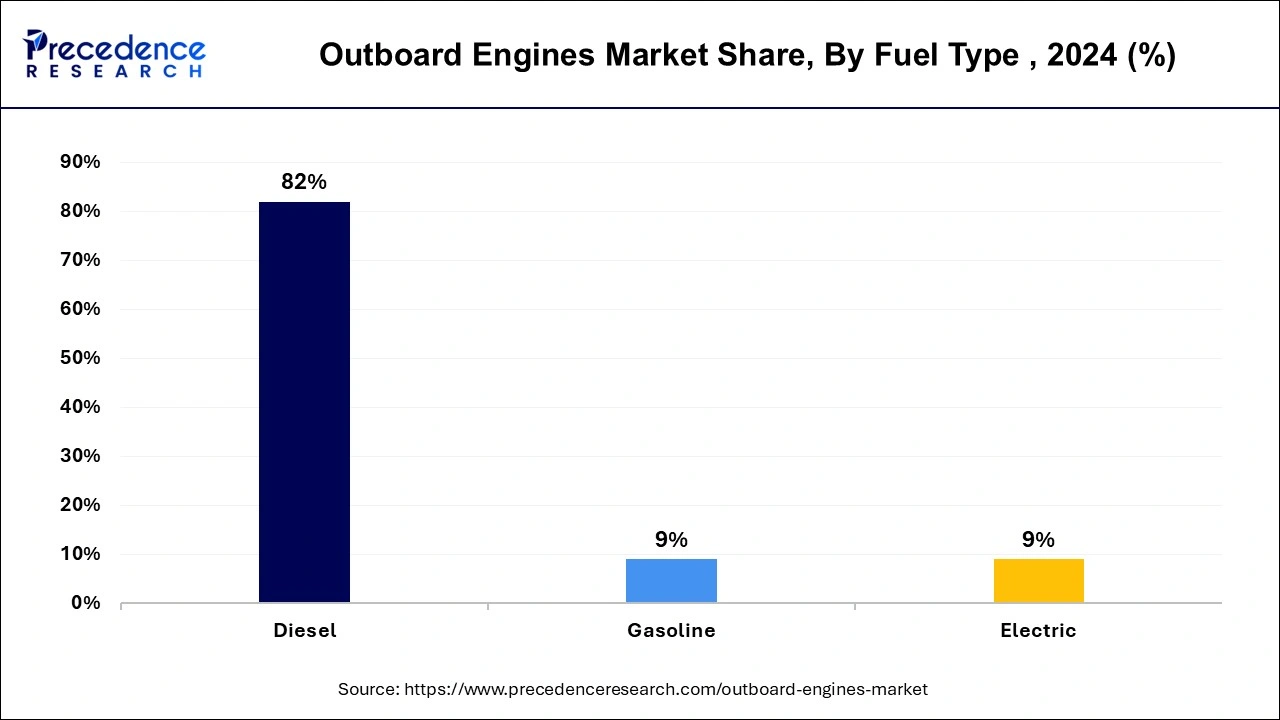

The diesel segment held the largest share of the outboard engines market of 82% in 2024. Generally speaking, diesel engines are more fuel-efficient than gasoline engines, which is advantageous for commercial applications where fuel expenses are a significant consideration. Diesel engines generate torque at lower RPMs than gasoline engines, which is helpful for heavy-duty applications, including offshore operations, commercial fishing, and powering big vessels.

Diesel engines are renowned for their extended lifespan and sturdy design, which makes them ideal for harsh marine settings. Diesel fuel has a lower volatility than gasoline, which can benefit safety, especially in commercial settings where employee safety is a primary concern.

The commercial segment held the largest share of the outboard engines market. Commercial fishing vessels typically employ outboard engines for propulsion. They drive tiny fishing vessels in crabbing, trawling, longlining, and netting operations. Water taxis, ferries, and other boats that move passengers and cargo across waterways are propelled by outboard engines. For patrolling, rescue missions, and other nautical duties, marine service providers, including marinas, harbor patrols, coast guards, and marine police, use outboard engines. In aquaculture, outboard engines are used to maintain fish farms, move equipment, and keep an eye on things. Government organizations and institutions use outboard engines for scientific research, environmental monitoring, and maritime surveying.

By Engine Type

By Ignition Type

By Fuel Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024