March 2025

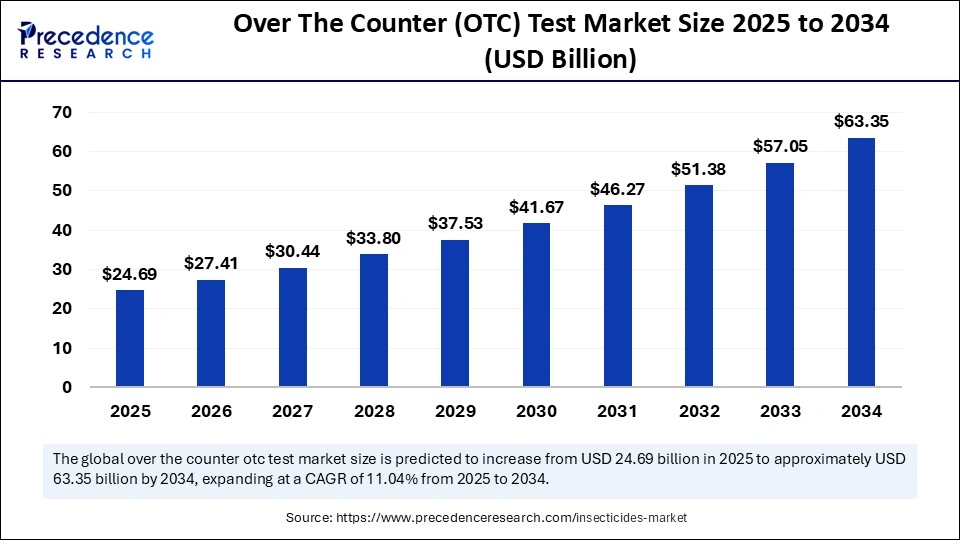

The global over the counter (OTC) test market size is calculated at USD 24.69 billion in 2025 and is forecasted to reach around USD 63.35 billion by 2034, accelerating at a CAGR of 11.04% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global over the counter (OTC) test market size accounted for USD 22.23 billion in 2024 and is predicted to increase from USD 24.69 billion in 2025 to approximately USD 63.35 billion by 2034, expanding at a CAGR of 11.04% from 2025 to 2034. The increasing need for rapid and effective testing solutions across the world is expected to boost the growth of the market during the forecast period.

Artificial Intelligence (AI) is steadily transforming the landscape of the over the counter (OTC) test market. With AI-driven tools, huge amounts of data generated by OTC tests can be analyzed in real-time. AI helps in data analysis that may be missed by traditional methods, leading to accurate diagnosis. This helps patients and healthcare professionals make informed decisions. AI-driven tools can help offer more customized recommendations and insights that are suitable for individuals, bringing a more personalized approach. AI technology is beneficial in adhering to compliance and regulatory frameworks. Utilizing AI-driven algorithms for automated compliance checks can help minimize the risk of errors and penalties. Overall, AI is beneficial in improving healthcare delivery.

The over the counter (OTC) test market encompasses testing devices and products that are available for people without a prescription. These types of tests are prominently used by people for monitoring some health conditions. The easy availability and accessibility of OTC tests in retail and online pharmacies is expanding the market reach. The rising trend of self-medication and the growing awareness about the benefits of health monitoring are key factors propelling the growth of the market. People are becoming more aware of preventive medications, along with the convenience of these tests, which further supports market expansion.

The increasing prevalence of chronic diseases across the world is boosting the demand for over-the-counter tests. Integration of digital and advanced technologies into the healthcare infrastructure will continue to help market growth. Technological advancements are enhancing the accuracy and reliability of these tests, aiding the growth of this market. Public and private sectors alike are funding and investing in research and development activities related to healthcare services, which will help market grow.

| Report Coverage | Details |

| Market Size by 2034 | USD 63.35 Billion |

| Market Size in 2025 | USD 24.69 Billion |

| Market Size in 2024 | USD 22.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a key factor driving the growth of the over the counter (OTC) test market. Chronic diseases like diabetes, respiratory illnesses, viral diseases, and hypertension require regular monitoring to manage symptoms and prevent complications. The demand for diagnostics tests and point-of-care tests that are available over the counter is rising. The availability and accessibility of such tests offer patients a convenient way to monitor health conditions. With the changing lifestyle patterns, the cases of respiratory issues and diabetes are rising. For instance, according to the European Respiratory Society (ERS), about 7 million deaths are caused every year by lung ailments like respiratory infections, COPD, and lung cancer. Meanwhile, approximately 589 million adults lived with diabetes in 2024, according to the International Diabetes Federation (IDF). Such a rapid rise in cases boosts the demand and requirement for advanced, accurate, and reliable OTC diagnostic tests.

Competition from Conventional Healthcare Services

A major challenge for the over the counter (OTC) test market is the constant competition it faces from conventional healthcare services. These conventional healthcare services provide a more vast and comprehensive range of options for diagnostics. While the OTC tests are reliable, accurate, and offer convenience, some consumers prefer sticking to the traditional methods. The lack of awareness among consumers about the OTC tests and concerns over the accuracy or false diagnosis limits the adoption of self-administrated tests, restraining market growth.

Rise of Telemedicine

The rise of telemedicine creates immense opportunities in the over the counter (OTC) test market. In the aftermath of the COVID 19 pandemic, many patients have continued using various telemedicine services across the world. Telemedicine makes healthcare services more accessible to people, especially those living in remote areas. Telemedicine allows healthcare professionals to monitor patients remotely by collecting data from OTC tests. Key players operating in the market can capitalize on this trend to tap into remote areas. In addition, the expansion of e-commerce healthcare platforms opens up new avenues for market growth. These platforms increase the accessibility and availability of OTC tests and drugs.

The glucose monitoring test segment led the over the counter (OTC) test market with the largest share in 2024. This is mainly due to the rise in the number of cases of diabetes worldwide. Diabetic patients often require regular blood glucose monitoring to manage conditions and enhance treatment effectiveness. The heightened awareness among people about timely management of diabetes further bolstered the segment’s growth.

Meanwhile, the pregnancy & fertility tests segment is expected to show considerable growth during the forecast period. The growth of the segment can be attributed to the growing birth rates. Women have become more aware of the availability and convenience of home pregnancy tests. Technological advancements in medical devices led to the development of digital pregnancy tests, contributing to the growth of the segment.

The lateral flow assays segment dominated the over the counter (OTC) test market in 2024. The rapid increase in the prevalence of infectious diseases bolstered the segmental growth. Lateral flow assays provide rapid results. These assays are easy to use, making them suitable for home use. A significant rise in the trend of self-medication and preventive medication further bolstered the segment.

On the other hand, the immunoassays segment is anticipated to grow at a significant rate in the coming years. The growth of the segment is attributed to the rising demand for accurate diagnostic solutions. Immunoassays are highly sensitive, providing reliable results. With the increasing prevalence of chronic diseases worldwide, the demand for immunoassays is rising, supporting segmental growth.

The hospital pharmacies segment held a significant share of the over the counter (OTC) test market in 2024. This is mainly due to the easy availability of a range of testing products in these pharmacies. Consumers often prefer to buy OTC tests from these establishments. These pharmacies provide detailed information and guidance about OTC tests, attracting more consumers. The rising government initiatives to improve the accessibility to healthcare services further contribute to segmental growth.

Meanwhile, the online pharmacies segment is projected to grow at a rapid pace over the studied years. Online pharmacies offer a wide range of OTC tests, enabling consumers to choose from a variety of options as per their requirements. These pharmacies provide doorstep and discreet delivery, attracting more consumers. Moreover, the rising popularity of telehealth and remote healthcare services is expected to drive segment growth.

North America dominated the over the counter (OTC) test market with the largest share in 2024. This is mainly due to the availability of advanced healthcare infrastructure and the presence of major market players. There is a heightened awareness among people about early disease detection and prevention, boosting the demand for OTC tests. The region is at the forefront of innovations in healthcare technologies, leading to the development of cutting-edge OTC tests. The increased popularity of telehealth or telemedicine further bolstered regional market growth.

The U.S. plays a key role in the North American over the counter (OTC) test market. The increasing prevalence of chronic diseases like diabetes in the country due to lifestyle changes is expected to boost market growth. For instance, according to the Centers for Disease Control and Prevention (CDC), more than 38 million people (about 1 in 10) in America have diabetes. Such a substantial population of the country suffering from chronic diseases is a major factor boosting market growth. Moreover, rising healthcare spending and increasing demand for home healthcare services are likely to support market growth.

Asia Pacific is poised to witness the fastest growth in the upcoming period. The growth of the market in the region can be attributed to the increasing burden of chronic diseases. Governments around the region are investing heavily in improving healthcare infrastructure and accessibility to quality healthcare services, which influence the market. Countries like China and India are expected to play important roles in the growth of the over the counter (OTC) test in Asia Pacific. The rising awareness among people about self-diagnosis and preventative healthcare is likely to boost the demand for OTC tests.

Europe is projected to witness notable growth during the forecast period. The rising geriatric population across Europe and advanced healthcare infrastructure contribute to market expansion. The rising healthcare spending and increasing demand for high-quality healthcare supplies further support regional market growth. The U.K. and Germany’s governments are implementing favorable policies for preventative healthcare. Moreover, there is a high demand for cutting-edge testing solutions, propelling the growth of the market.

By Product Type

By Technology

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

October 2024

February 2025