January 2025

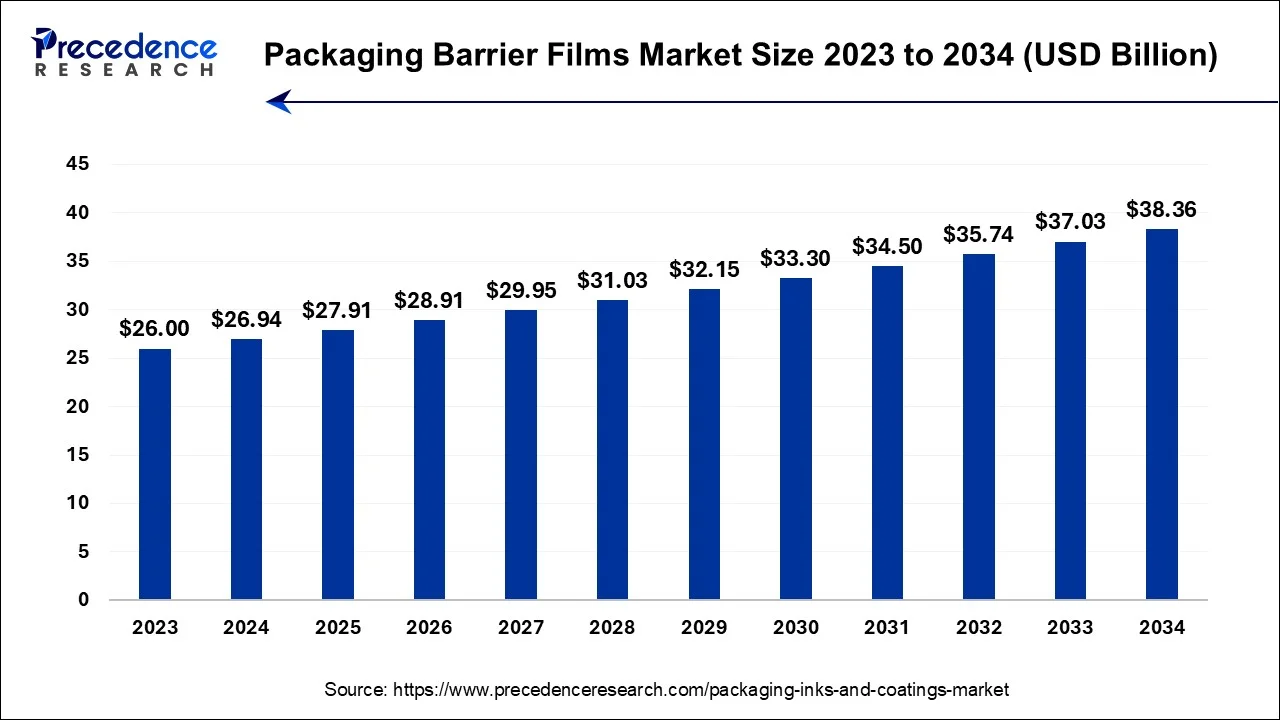

The global packaging barrier films market size is predicted to increase from USD 26.94 billion in 2024, grew to USD 27.91 billion in 2025 and is anticipated to reach around USD 38.36 billion by 2034, poised to grow at a CAGR of 3.60% between 2024 and 2034. The North America packaging barrier films market size is calculated at USD 9.70 billion in 2024 and is estimated to grow at a fastest CAGR of 3.73% during the forecast year.

The global packaging barrier films market size is calculated USD 26.94 billion in 2024 and is predicted to be worth around USD 38.36 billion by 2034, growing at a CAGR of 3.60% from 2024 to 2034.

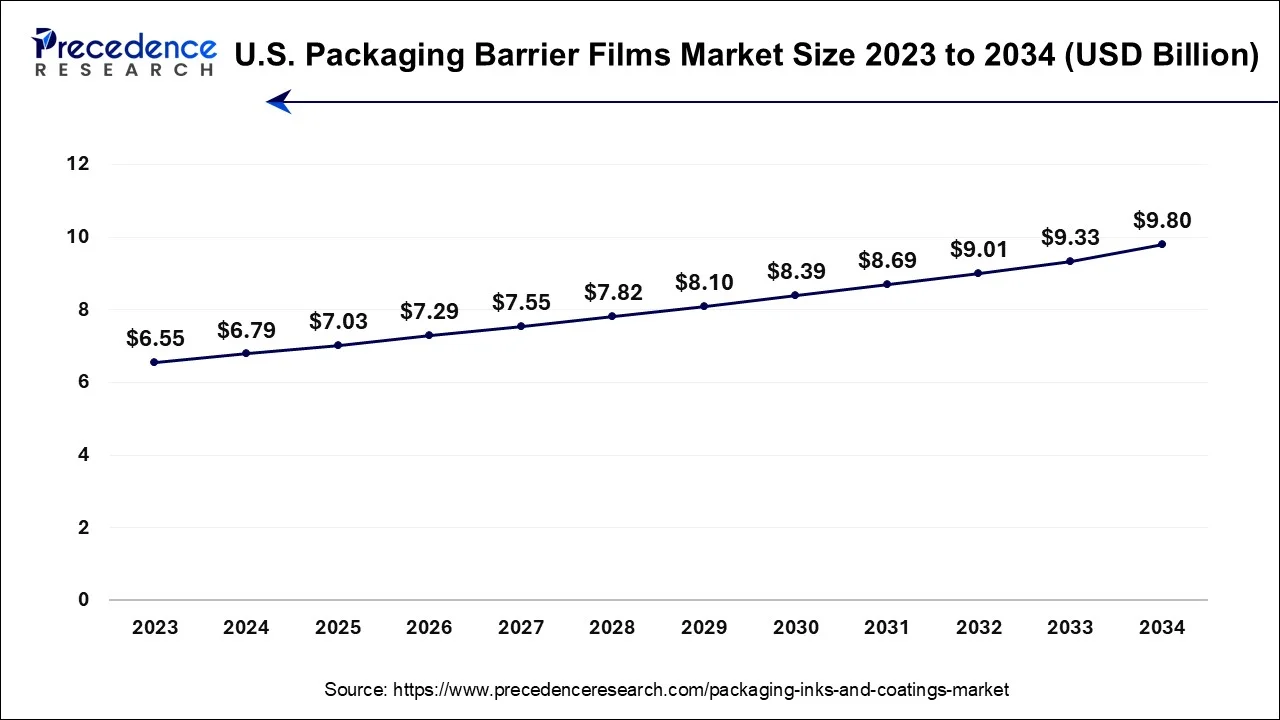

The U.S. packaging barrier films market size was valued at USD 6.79 billion in 2024 and is expected to reach to USD 9.80 billion by 2032, growing at a CAGR of 3.74% from 2024 to 2034.

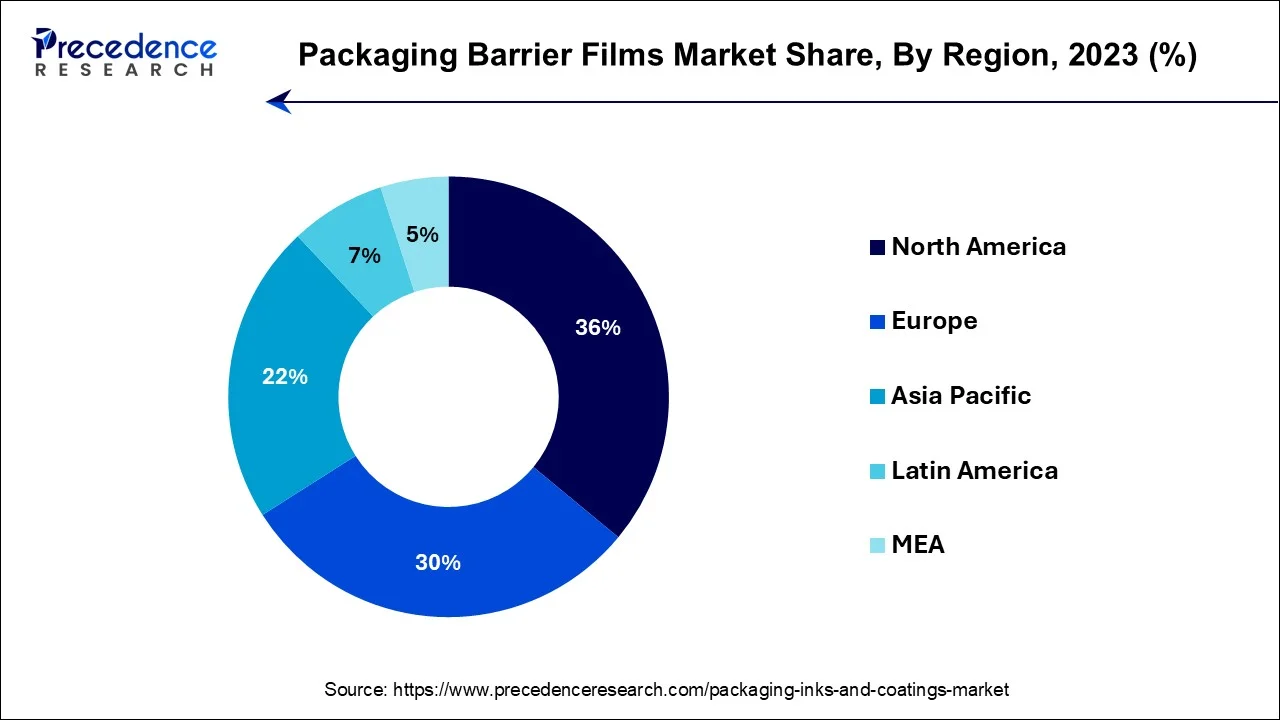

North America has held the largest revenue share 36% in 2023. In North America, the packaging barrier films market is characterized by several noteworthy trends. There is a growing emphasis on sustainability, with increased demand for eco-friendly and recyclable barrier films. Stringent regulations related to food safety and environmental concerns are driving the adoption of compliant films. The rise of e-commerce is boosting the need for barrier films that ensure secure and damage-resistant packaging during transit. Moreover, innovations in advanced barrier technologies are shaping the market, with a focus on precision control over permeability to extend product shelf life.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the packaging barrier films market is witnessing dynamic trends. The surging demand for packaged goods, driven by a growing middle class and urbanization, is a significant driver. Sustainability is a key focus, with increasing adoption of eco-friendly and biodegradable barrier films. The region's burgeoning e-commerce sector is fueling the need for robust packaging solutions, including advanced barrier films. Additionally, advancements in barrier film technologies, especially in countries like China and India, are shaping the market as manufacturers strive to meet the evolving packaging requirements of various industries.

In Europe, the packaging barrier films market is witnessing notable trends. There is a strong emphasis on sustainable packaging solutions, with an increasing demand for eco-friendly barrier films that align with the region's environmental consciousness. Stringent regulations related to food safety and packaging materials are also driving the adoption of compliant barrier films. Furthermore, the market is experiencing a surge in demand for high-performance films catering to the growing e-commerce sector, where secure and protective packaging is essential for online deliveries. These trends collectively shape the evolving landscape of the packaging barrier films market in Europe.

Packaging barrier films are specialized materials used in the packaging industry to provide an effective barrier against external elements such as moisture, oxygen, light, and contaminants. These films are designed to preserve freshness and extend the shelf life of packaged products, particularly food and beverages, pharmaceuticals, and sensitive electronics. Barrier films are crucial for protecting products from environmental factors that can lead to spoilage, degradation, or damage. They are often composed of multiple layers with distinct properties, including high barrier coatings or laminations, tailored to the specific needs of the packaged items. Barrier films play a pivotal role in ensuring product quality, safety, and integrity throughout storage and transportation.

Packaging barrier films are vital components of the packaging industry, offering protective layers that shield products from moisture, oxygen, light, and contaminants. These films are essential for preserving freshness and extending the shelf life of a wide range of goods, from food and beverages to pharmaceuticals and electronics. The global packaging barrier films market is dynamic, driven by various growth drivers, influenced by industry trends, and presenting both challenges and opportunities.

The market's growth is primarily fueled by the increasing demand for extended shelf life and product protection, especially in the food and beverage sector. Rising consumer awareness of food safety and sustainability further drives the adoption of barrier films. Additionally, advancements in packaging technologies and materials contribute to market expansion. Key trends in the packaging barrier films market include a shift towards sustainable and recyclable materials, aligning with environmental concerns. Multilayer films with tailored barrier properties are gaining traction, catering to specific product needs.

The demand for convenient, single-serve packaging solutions is also on the rise. The market faces challenges related to the cost of advanced barrier films and their impact on production expenses. Balancing environmental sustainability with barrier performance remains a complex task. Moreover, stringent regulations concerning food contact materials require compliance, adding complexity to the industry. Opportunities abound for manufacturers who can develop innovative, sustainable, and cost-effective barrier films.

Expansion into emerging markets offers growth prospects. Meeting the evolving needs of e-commerce packaging and addressing the growing demand for biodegradable and compostable barrier films are promising avenues for business expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 38.36 Billion |

| Market Size in 2024 | USD 26.94 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Material, End Users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Extended shelf life and advancements in packaging technologies

Consumers and industries alike place great value on products with extended shelf life. Packaging barrier films create a protective shield against external elements such as moisture, oxygen, and contaminants, preventing spoilage and degradation. This significantly enhances the longevity of products, reducing waste and ensuring the availability of fresh goods over an extended period. As the demand for products with prolonged shelf life continues to rise, so does the need for barrier films that can meet this crucial requirement.

Moreover, Constant innovations in packaging technologies empower manufacturers to develop cutting-edge barrier films. These films are tailored to meet specific packaging needs, offering superior barrier properties while reducing material usage and overall packaging costs. Advanced coatings, laminations, and multilayer structures allow for precise control of barrier characteristics. This flexibility not only improves product protection but also opens up new possibilities for packaging design, leading to innovative and eye-catching solutions. Consequently, businesses are increasingly turning to barrier films to enhance both product quality and packaging aesthetics, propelling market demand to new heights.

Environmental concerns and regulatory compliance

Increasing awareness of environmental sustainability has put pressure on the packaging industry to adopt eco-friendly materials. This includes barrier films that are recyclable, biodegradable, or made from renewable resources. Developing such sustainable barrier films can be costly and technologically challenging, impacting their availability and affordability in the market.

The packaging industry is subject to stringent regulations, particularly in the food and pharmaceutical sectors. These regulations dictate the types of materials that can be used, including barrier films, to ensure safety and hygiene. Adhering to these regulations requires significant investments in research, development, and compliance testing, which can hinder market demand. Balancing the need for effective barrier properties with sustainability and regulatory compliance is a complex task for manufacturers.

However, it also presents opportunities for innovation and differentiation in the market. As consumer and regulatory pressures for greener solutions intensify, the packaging barrier films market may find ways to overcome these restraints and thrive through eco-friendly and compliant offerings.

Sustainable solutions and advanced barrier technologies

In response to escalating environmental concerns, there is a growing appetite for sustainable packaging options. Barrier films are no exception, with increasing demand for eco-friendly, recyclable, and biodegradable films that can effectively preserve products while reducing the environmental footprint. As consumers prioritize eco-conscious choices, manufacturers are racing to develop sustainable barrier films to meet this demand, thus bolstering the market.

Moreover, With rapid technological advancements, barrier films have evolved significantly. Modern films offer precise control over permeability, providing protection against moisture, oxygen, and UV radiation. These advanced films extend the shelf life of products, reduce food waste, and enhance product safety.

As a result, industries such as food, pharmaceuticals, and electronics increasingly rely on these innovations to safeguard their products during storage and transportation, fueling substantial demand for cutting-edge barrier technologies. The synergy of sustainability and advanced barrier technologies is reshaping the packaging barrier films market, making eco-friendly and high-performance films the cornerstone of modern packaging solutions.

According to the product, the pouches segment has held 47% revenue share in 2022. Pouches barrier films refer to a type of packaging material where water is the primary solvent used in the coating or lamination process. These films are eco-friendly and provide protection against moisture, making them suitable for various applications, including food packaging. In the packaging barrier films market, there is a growing trend toward water-based solutions due to their sustainability and compliance with environmental regulations.

Water-based barrier coatings are becoming increasingly popular as they provide an eco-friendly substitute for conventional solvent-based options in the packaging barrier films market. Manufacturers are dedicating resources to research and development to enhance the performance of water-based barrier films, thereby making them more versatile and efficient in safeguarding products during storage and transportation.

The liners segment is anticipated to expand at a significant CAGR of 5.8% during the projected period Liners technology in the packaging barrier films market involves the use of solvents as carriers for polymer resins and additives to create protective film coatings. These coatings provide effective barriers against external elements like moisture, oxygen, and contaminants. While solvent-based films offer excellent barrier properties, they are gradually facing challenges due to environmental concerns, including volatile organic compound (VOC) emissions. As a result, there is a growing trend toward more sustainable, solvent-free, and water-based barrier coatings in the packaging industry, aligning with eco-friendly and regulatory compliance goals.

Based on the material, the PE segment held the largest market share of 29% in 2022. PE refers to packaging materials that are easily deformable and can adapt to the shape and size of the product they encase. It includes pouches, bags, wraps, and films made from materials like plastic, paper, and aluminum. In the packaging barrier films market, a notable trend in flexible packaging applications is the increasing demand for barrier films to enhance the shelf life of perishable goods. This includes fresh produce, meat, and dairy products. Additionally, the rise of convenient, on-the-go packaging solutions has driven the need for flexible barrier films that offer both protection and convenience to consumers.

On the other hand, the PET segment is projected to grow at the fastest rate over the projected period. In the packaging barrier films market, PET refers to the application of printed information or branding onto the film surface. Labeling is crucial for conveying product details, branding, and compliance information. A notable trend in labeling on barrier films is the growing demand for high-quality, visually appealing labels that can adhere effectively to these specialized surfaces. Additionally, there's a rising interest in sustainable labeling solutions, such as recyclable or biodegradable labels, to complement the eco-friendly focus of barrier films, aligning with consumer and industry sustainability trends.

Segments Covered in the Report

By Product

By Material

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025