August 2024

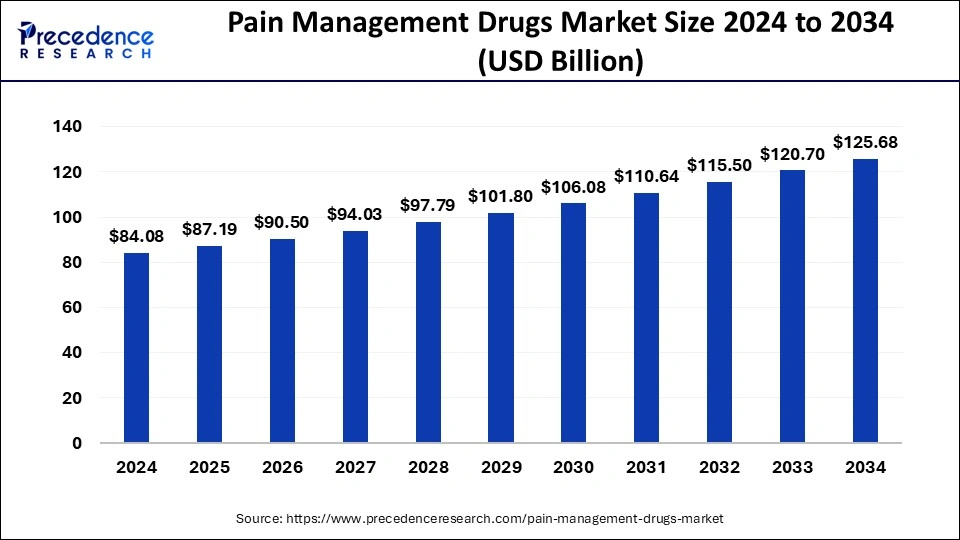

The global pain management drugs market size accounted for USD 87.19 billion in 2025 and is forecasted to hit around USD 125.68 billion by 2034, representing a CAGR of 4.10% from 2025 to 2034. The North America market size was estimated at USD 37.50 billion in 2024 and is expanding at a CAGR of 3.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pain management drugs market size was calculated at USD 84.08 billion in 2024 and is predicted to increase from USD 87.19 billion in 2025 to approximately USD 125.68 billion by 2034, expanding at a CAGR of 4.10% from 2025 to 2034.

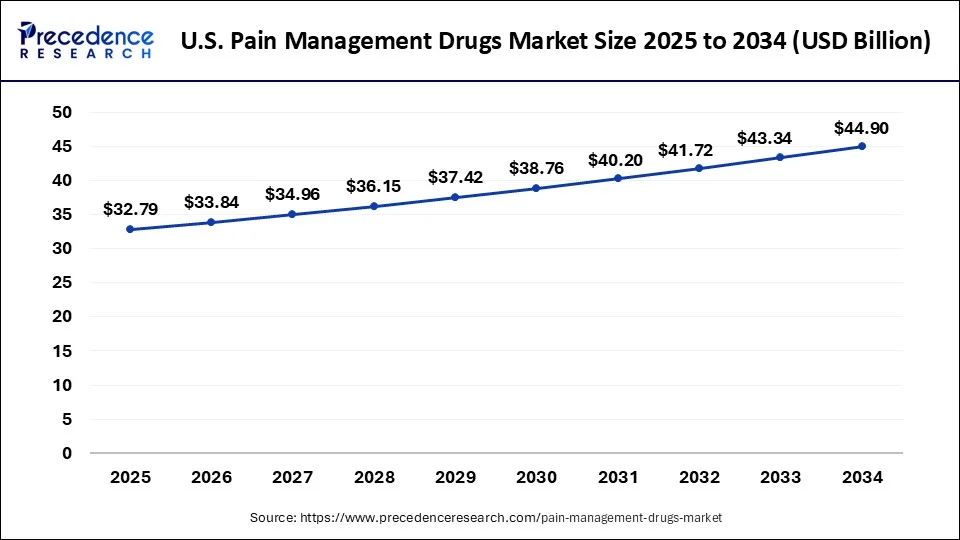

The U.S. pain management drugs market size was exhibited at USD 31.80 billion in 2024 and is projected to be worth around USD 44.90 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

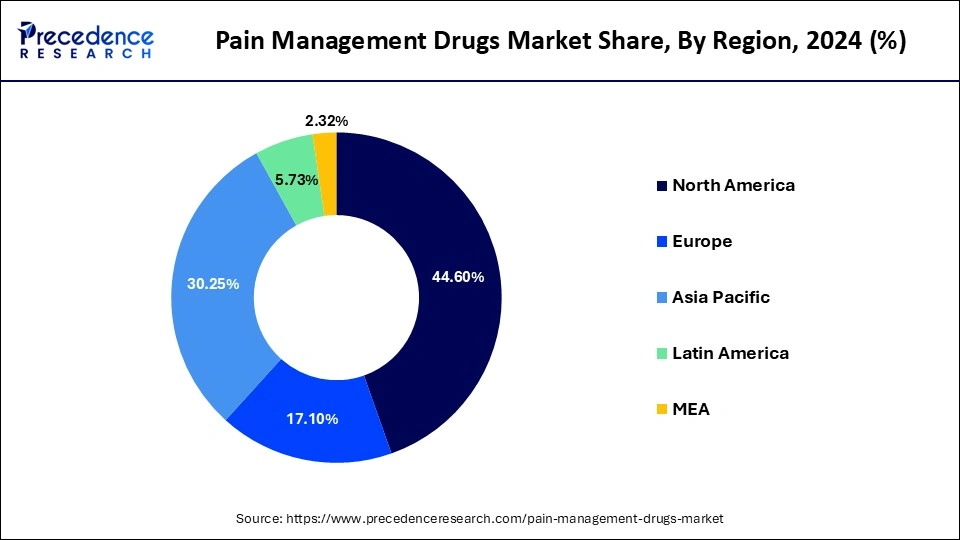

Based on the region, the global pain management drugs industry is segmented into North America, Europe, Asia Pacific, and LAMEA. North America region generated more than 44.80% revenue share in 2024, owing to a large number of patients with chronic disorders. Additionally, the rising government initiatives leading to a suitable healthcare infrastructure with unchallenging access to advanced pain management solutions are driving market growth. The prevalence of state-of-the-art healthcare facilities, a large number of blood pressure & CVD patients, and a large pool of aging population contribute to the market development.

On the other hand, Asia Pacific is expected to grow at the fastest rate over the projected timeframe due to the increasing R&D investments that will make technologically advanced healthcare medications available. Furthermore, many trade agreements increase the chances of market growth. The Asia Pacific Trade Agreement (APTA) includes China, India, Lao PDR, Bangladesh, Mongolia, Korea, and Sri Lanka has relaxed trade laws allowing for increased imports & exports.

Pain management drugs refer to analgesic medications used to manage and treat pain. Pain occurs in the central nervous system, while the peripheral nervous system reports on skin damage via a powered event known as nociception, characterized by the release of high-edge primary afferent fibers. Pain can be moderate, reasonable, or dangerous and treated with either non-steroidal anti-inflammatory medications or potent opioids. Pain management is the most critical aspect of medicine, providing patients with simple and quick pain relief through interdisciplinary treatments that include physiotherapy, medication, and psychotherapy, among other therapies.

Factors such as increasing healthcare expenditures, higher disease awareness among doctors and patients, and numerous R&D initiatives positively impact the pain management drug market. However, the rise in concerns regarding drug exploitation is restraining the market growth. Furthermore, recent advances in pain management based on nanoparticles are expected to create ample opportunities in the pain management drugs industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 81.15 Billion |

| Market Size by 2034 | USD 120.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Indication, Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The rising demand for pain management drugs

According to the National Health Statistics, over 310 million major procedures are performed annually, of which approximately 40 to 50 million are in the US and 20 million in Europe. Moreover, there is a rise in the rate of surgeries worldwide which is the primary reason for the growing consumption of pain management drugs. Subsequently, the increased cancer therapies associated with pain incidence and a rising geriatric population having various therapies drive the market.

Furthermore, rising road accidents due to the increasing number of vehicles and traffic violations lead to relative trauma injuries, which create demand for pain management post surgeries. According to WHO, 1.3 million people die yearly from road traffic crashes. Between 20 and 50 million people suffer from non-fatal injuries, with many incurring a disability due to their injury.

Consumer preference for pain management therapies is influenced by their high availability, ease of access, heightened awareness, cost-effectiveness, and rapid relief.

A rise in concern regarding drug exploitation

The rise in concerns regarding drug misuse and patent expiration of pain medication drugs are expected to obstruct the growth of the pain management drugs market. Opioids are used widely for pain relief, but it has a significant concern linked with abuse, addiction, and the deadly repercussions of diversion. Concerns about addiction appear to have contributed to the undertreatment of conditions typically believed appropriate for opioid therapy, such as cancer pain, end-of-life pain, and acute pain. According to the National Library of Medicine, three million US citizens and 16 million individuals worldwide are addicted to opioids and are suffering from opioid use disorder.

Recent advances in pain management based on nanoparticle technology

Nanotechnology-based drug delivery has produced satisfactory outcomes in pain control, reducing side effects and boosting analgesic drug efficacy. Aside from the capacity of nanotechnology to distribute medications, sophisticated nanosystems have been built to improve imaging & diagnostics, which aid in illness detection and substantially impact pain control.

Furthermore, with the development of various tools, nanotechnology can precisely measure pain and use these measurements to demonstrate the efficacy of multiple interventions. Therefore, advances in novel nanoparticles with intrinsic analgesic properties that can modulate pain perception with high satisfaction have provided a new perspective on pain management. Recent developments in nanomedicine have resulted in the production of numerous nanoparticles with distinct features. This has enabled the application of nanoparticles to a broader range of medical domains, including diagnosing, preventing, and treating diseases such as cancer, diabetes, and cardiovascular disease.

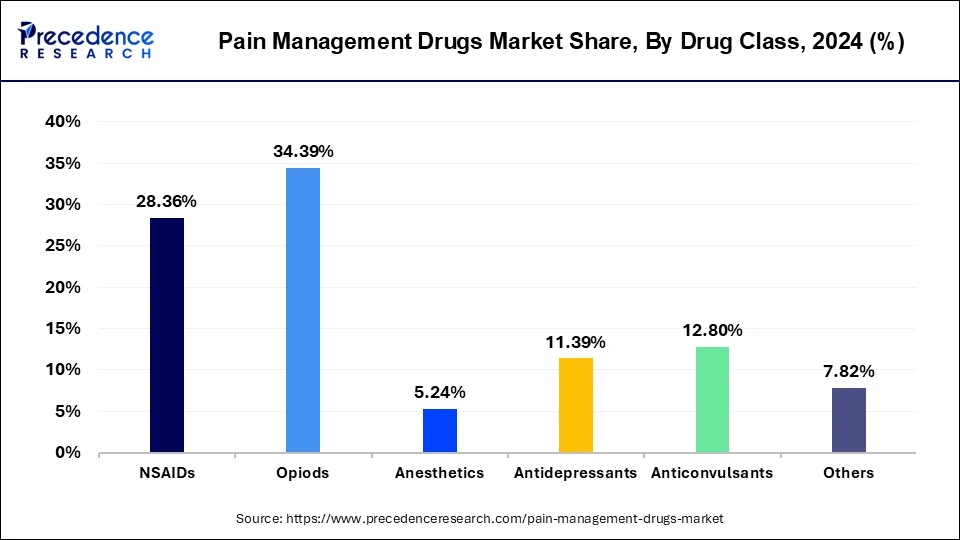

Based on the drug class, the global pain management drugs market is segmented into NSAIDs, anesthetics, opioids, anticonvulsants, antidepressants, and others. In 2024, the NSAIDs segment accounted 28.36% market share. This is due to the availability as over the counter drugs and their low cost. NSAIDs (Non-Steroidal anti-inflammatory drugs) are the drugs that are used to treat a broad spectrum of symptoms, such as to bring down high body temperatures, relieve pain, and reduce inflammation. NSAIDs are available as OTC tablets, creams, capsules, injections, suppositories, and gels. They are often used to relieve painful period cramps, headaches, muscle trauma, colds & flu, and joint pain. The main types of NSAIDs involve aspirin, ibuprofen, celecoxib, mefenamic acid, indomethacin, and many more.

Furthermore, the opioids segment is expected to grow faster owing to the launch of innovative drugs and increasing use in alleviating cancer pain. Opioids, also called narcotics, are prescribed by doctors to treat severe pain. Opioids are majorly used by patients with chronic headaches and backaches, recovering from surgery, or experiencing acute pain associated with cancer, sports injuries, accidents, or other incidents. Opioids include codeine, fentanyl, oxycodone, and morphine, often sold under brand names such as OxyCotin, Percocet, Palladone, and Vicodin.

Pain Management Drugs Market Revenue, By Drug Class, 2022-2024 (USD Million)

| Drug Class | 2022 | 2023 | 2024 |

| NSAIDs | 22,013.2 | 22,905.2 | 23,845.4 |

| Opioids | 27,275.7 | 28,067.5 | 28,917.5 |

| Anesthetics | 4,073.2 | 4,232.7 | 4,408.9 |

| Antidepressants | 8,561.5 | 9,053.9 | 9,573.0 |

| Anticonvulsants | 10,183.5 | 10,461.5 | 10,759.6 |

| Others | 6,302.9 | 6,433.5 | 6,571.4 |

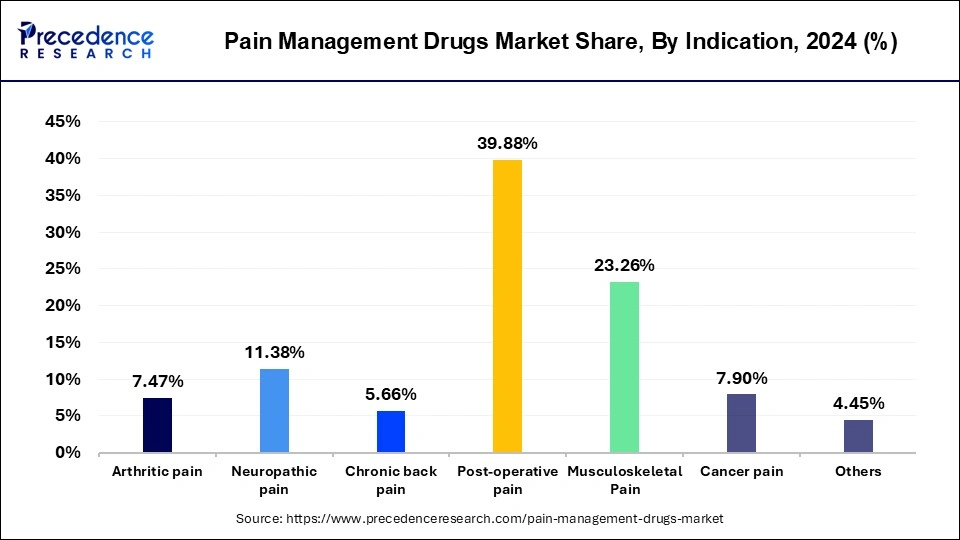

Based on the indication insights, the global pain management drugs market is segmented into arthritic pain, chronic back pain, neuropathic pain, post-operative pain, cancer pain, and others. In 2024, the neuropathic segment accounted 11.38% market share owing to the rising patient pool and increasing initiatives by market players. Damage or disease that disrupts the somatosensory nervous system causes neuropathic pain. Most neuropathic pain is chronic. The syndrome of the phantom limb is one type of neuropathic pain. When a limb is amputated or injured, this condition develops because the brain is still receiving pain signals. Nerve misfiring is the root cause of pain. Despite the fact that neuropathic pain is chronic, painkillers are frequently available, generating a sizable revenue share.

Furthermore, the cancer pain segment is expected to grow at a faster pace over the projected timeframe owing to the rising cancer cases. The number of cancer patients is increasing, which leads to the demand to reduce the pain caused by nerve compression due to tumor compressing and other cancer progressions.

Pain Management Drugs Market Revenue, By Indication, 2022-2024 (USD Million)

| Indication | 2022 | 2023 | 2024 |

| Arthiritic pain | 5,708.5 | 5,986.6 | 6,283.0 |

| Neuropathic pain | 8,962.3 | 9,252.9 | 9,564.1 |

| Chronic back pain | 4,298.2 | 4,520.4 | 4,759.1 |

| Post-operative pain | 31,591.5 | 32,535.3 | 33,531.7 |

| Musculoskeletal Pain | 17,928.8 | 18,718.5 | 19,556.2 |

| Cancer Pain | 6,275.0 | 6,454.1 | 6,644.3 |

Based on the distribution channel, the global pain management drugs market is segmented into online pharmacies, retail pharmacies, and hospital pharmacies. In 2024, retail pharmacies dominated the distribution channel segment due to the high demand for over the counter drugs and a strong grid of retail pharmacies. On the other hand, online pharmacy is expected to grow at a faster pace over the projected timeframe owing to the increasing number of e-pharmacy websites.

By Drug Class

By Indication

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

October 2024

October 2024

December 2024