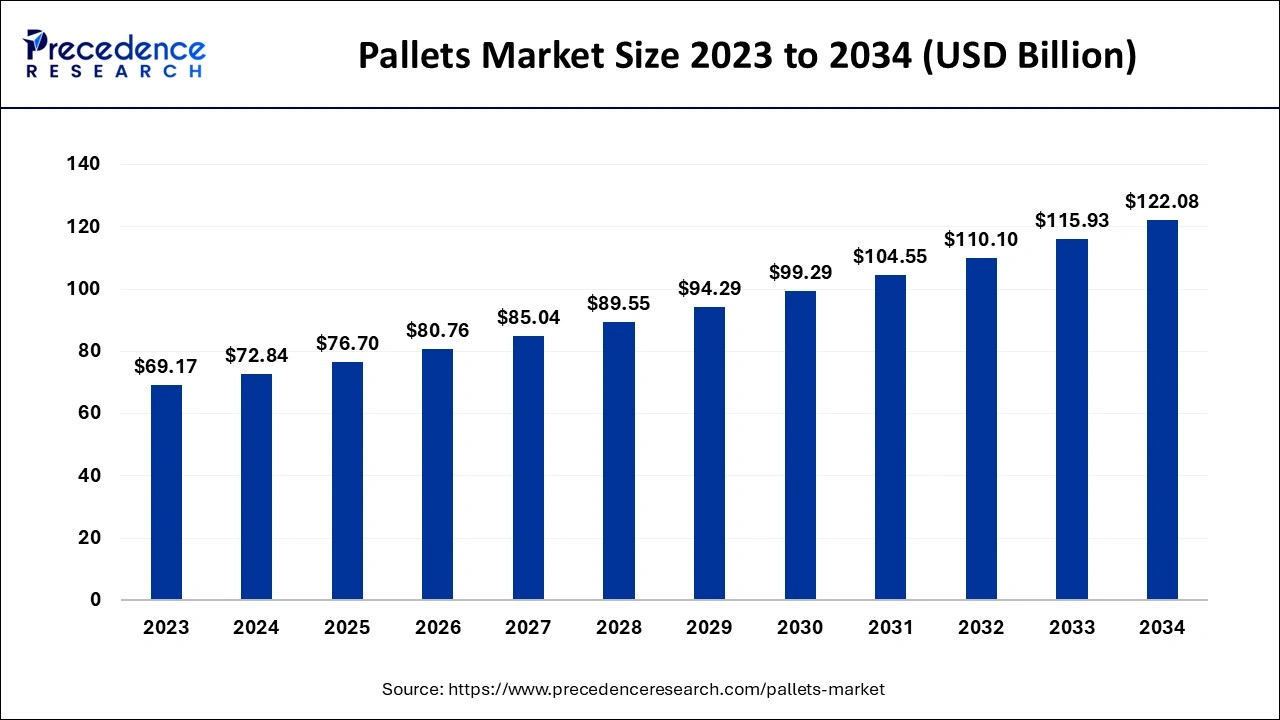

The global pallets market size is calculated at USD 76.7 billion in 2025 and is forecasted to reach around USD 122.08 billion by 2034, accelerating at a CAGR of 5.30% from 2025 to 2034. The North America pallets market size accounted for USD 24.04 billion in 2025 and is expanding at a CAGR of 5.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pallets market size was estimated at USD 72.84 billion in 2024 and is predicted to increase from USD 76.7 billion in 2025 to approximately USD 122.08 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034.

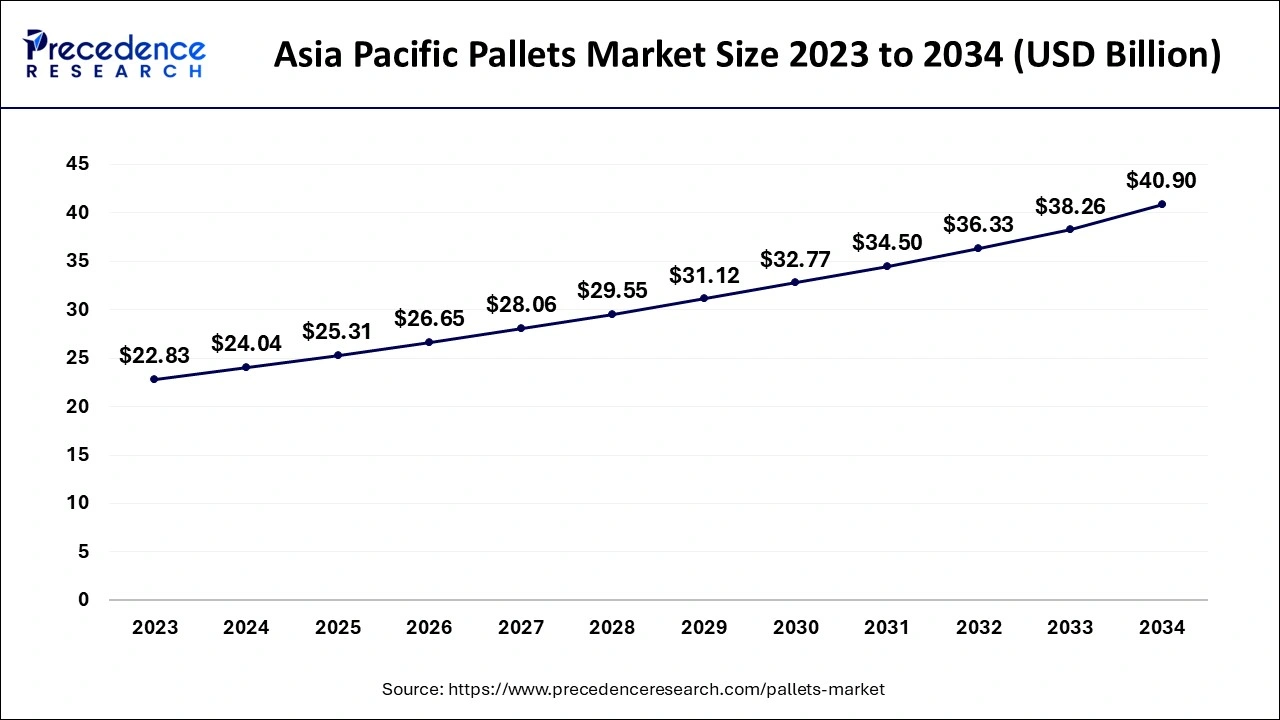

The Asia Pacific pallets market size was exhibited at USD 24.04 billion in 2024 and is predicted to be worth around USD 40.90 billion by 2034, rising at a CAGR of 5.46% from 2025 to 2034.

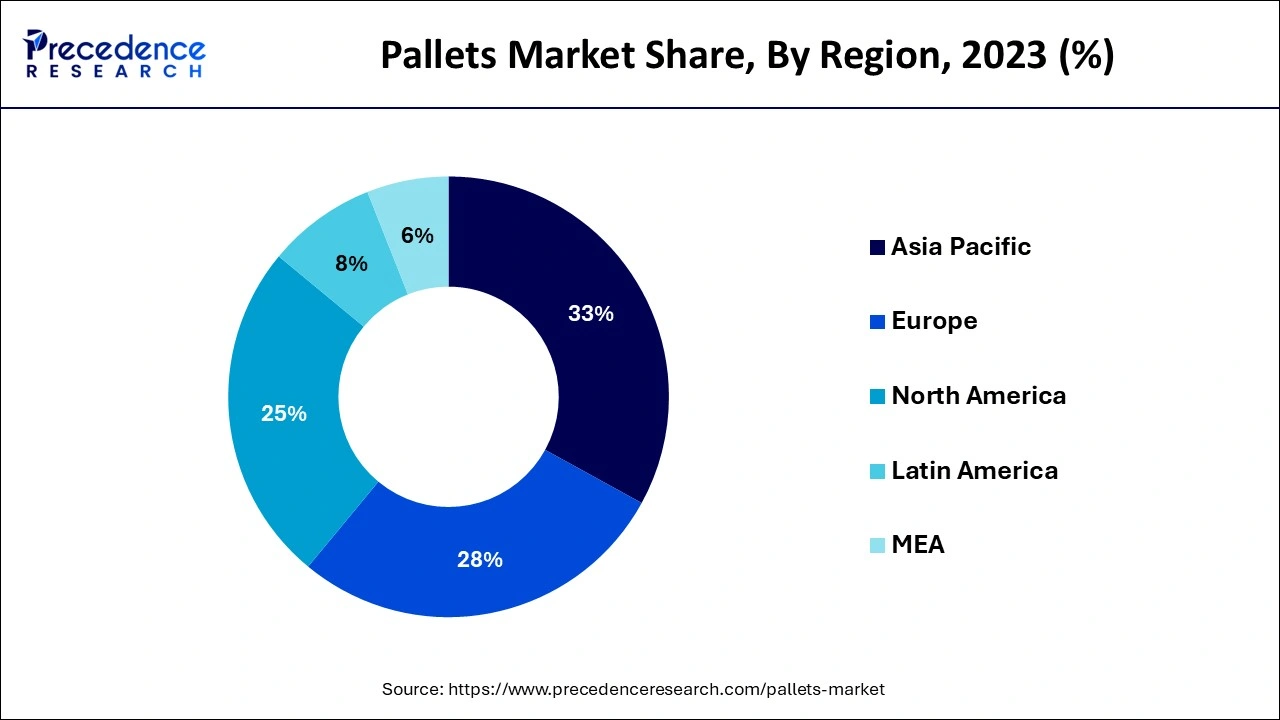

With approximately 33% of the worldwide revenue share in 2024, Asia Pacific was in the lead and is expected to continue to grow at the quickest CAGR from 2025 to 2034. The market in the area will develop at the greatest rate from 2025 to 2034 due to a number of important factors, including the region's rapid industrialization and the exponential rise of e-commerce.

Between 2025 and 2034, North America, which was the second-largest market in 2024, is predicted to see a significant CAGR. Favorable trade agreements, like as the T-MEC between the United States, Canada, and Mexico, are expected to boost regional industrial activity and thereby the North American market. On March 11, 2020, the EU (European Union) published its new "Circular Economy Action Plan," in which they set a goal to have all of the EU market covered by reused and recycled material by 2030 in a way that is financially sustainable. Reuse, recycling, and biodegradable packaging are also major priorities in the European Union. Additionally, it is expected that such encouraging actions will encourage the usage of recyclable plastic pallets in the region.

Innovative Logistics Solutions Benefiting the Pallet Market of India

The pallet market in India has experienced substantial change in recent days, specifically because of the growing need for efficient and economical logistics solutions. A primary factor is the rising need for pallets, which are essential in streamlining loading and unloading procedures while guaranteeing the secure transport of products. The rapid growth of the e-commerce and logistics sectors in India is further driving this demand, as they depend significantly on effective and sturdy packaging solutions.

Wooden pallets, specifically, are gaining popularity since they can be reused several times and match the growing focus on sustainable business practices. As the market keeps changing, the sector expects additional growth, fueled by industrial development, increased focus on supply chain efficiency, and the rising demand for eco-friendly packaging options. Modernization trends in material handling systems, such as the integration of robotics and compression or rotational molding, further boost market expansion.

Pallets are horizontal support platforms that help move products from one location to another with a forklift or a front loader. They are one of the most often used substrates for stacking products, and they are typically stabilized using stretch wrap, pallet collars, glue, or other techniques. Depending on the intended use, they can be produced using a variety of materials, including wood, plastics, metal, etc. Workers may stack larger items on a single pallet without risk of damage since they are considerably tougher than some other containers like plastic wraps and cardboard boxes. Many manufacturers and shippers of business items utilize them widely because of these qualities all over the world.

The need for logistics services is being greatly boosted by the rising smartphone sales, expanding internet usage, and expanding e-commerce sector, which in turn is bolstering the growth of the pallet market globally. In addition, rising consumer spending on housing and infrastructure due to consumers' rising income levels, in conjunction with the fast industrialization and urbanization, is raising the need for pallets globally. Additionally, manufacturers are spending money on research and development (R&D) projects to incorporate technical advancements into the pallet manufacturing process. For instance, they have made multiple-trip pallets available, which help to lower trip costs, eliminate solid waste, and boost operational effectiveness. Due to its capacity to be recycled and reused, plastic pallets have also seen tremendous growth in appeal across a variety of industries.

Growing use of plastic pallets in the pharmaceutical, chemical, food, and beverage industries due to their superior qualities such as lightweight, easy handling, and shock absorption among others; expanding e-commerce activities in the world; and an increase in demand for wooden pallets due to low cost, lightweight, and high strength when compared to other kinds of materials used as pallet decks or surfaces are just a few of the key factors driving this growth in the pallets market.

| Report Coverage | Details |

| Market Size in 2024 | USD 72.84 Billion |

| Market Size in 2025 | USD 76.7 Billion |

| Market Size by 2034 | USD 122.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Type, Application, Structural Design, End Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

In terms of value in 2024, high-density polyethylene (HDPE) held the highest share with 73% of the market for materials. HDPE pallets are popular among end-user organizations because they are simple to maintain, provide great impact resistance, as well as good solvent and corrosion resistance. Furthermore, when handled roughly by forklifts and other material handling equipment, HDPE pallets sustain little to no damage. Additionally, HDPE pallets have strong chemical and weather resistance, which makes them appropriate for use in food and pharmaceutical industries.

Polypropylene (PP) materials are anticipated to see the largest increase between 2025 and 2034 because to their exceptional durability and suitability for heavy-duty applications in a small supply chain. PP pallets are more expensive than HDPE pallets, but because of their superior longevity, PP pallets may make more return trips than HDPE and ultimately end up being more cost-effective. Due to their high cost, PP pallets can only be used in closed-loop applications and cannot be used as export or one-way pallets. However, businesses are choosing returnable pallets more frequently in order to cut down on plastic waste and solve sustainability issues brought on by disposable or one-way pallets, which is anticipated to increase demand for PP pallets.

In 2024, nestable pallets held a commanding 44.6% revenue share in the type segment of the plastic pallets market. Because they may nest inside of one another, they take up less room during return freight and are more economical than other types of pallets. Additionally, they are less costly than their rackable and stackable equivalents, which makes them perfect for use in open-loop supply chains or export. Rackable pallets are made to be stored on racks; because they may be arranged evenly apart in vertical order on the racks, these pallets enable end-use businesses to utilize their floor space. In order to handle big loads, racking pallets typically contain a picture frame or runner frame at the bottom.

In contrast to a nestable pallet, a stackable pallet features a sturdy platform as its basis. When being delivered back to the source, these pallets are often piled on top of one another. Due to its construction, stackable pallets offer the most stability to the loaded products, making them a popular pallet option for shipping goods over extended distances. Because of its more durable architecture than rackable pallets, stackable pallets are frequently utilized in heavy-duty applications. Due to the frequent handling and shipping of heavier components from suppliers' facilities to vehicle assembly plants, larger pallets are favored in the automotive sector. Over the course of the projection period, the demand for stackable pallets is anticipated to benefit from the constant growth of the heavy metal and automotive manufacturing industries.

With more than 23.9% of the worldwide sales in 2024, the market's leading end-use category was food and beverage. Farmers and agricultural businesses that handle fresh produce as well as businesses that store, handle, and transport meat, dairy, baked goods, and other processed foods were the main drivers of demand.

Plastic pallets are frequently used in the chemical industry to handle a variety of powder, granule, and liquid form goods. Pallets are used for loading, unloading, and transportation of chemicals, minerals, metals, and plastic polymers including PET, PP, ABS, and others. Due to their inexpensive cost and widespread availability, wooden pallets are frequently used in the chemical industry for export applications. However, because to their durability, sustainability, and hygienic qualities, chemical firms have started to choose plastic pallets more and more in recent years.

In the pharmaceutical sector, product hygiene for material handling and packaging is crucial. Due to their difficulty in cleaning and ability to house germs and fungi, wooden pallets provide a danger of contamination. However, plastic pallets are a great option for material handling in the pharmaceutical business because of their excellent chemical resistance and lack of contamination.

By Materials

By Type

By Application

By Structural Design

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client