December 2024

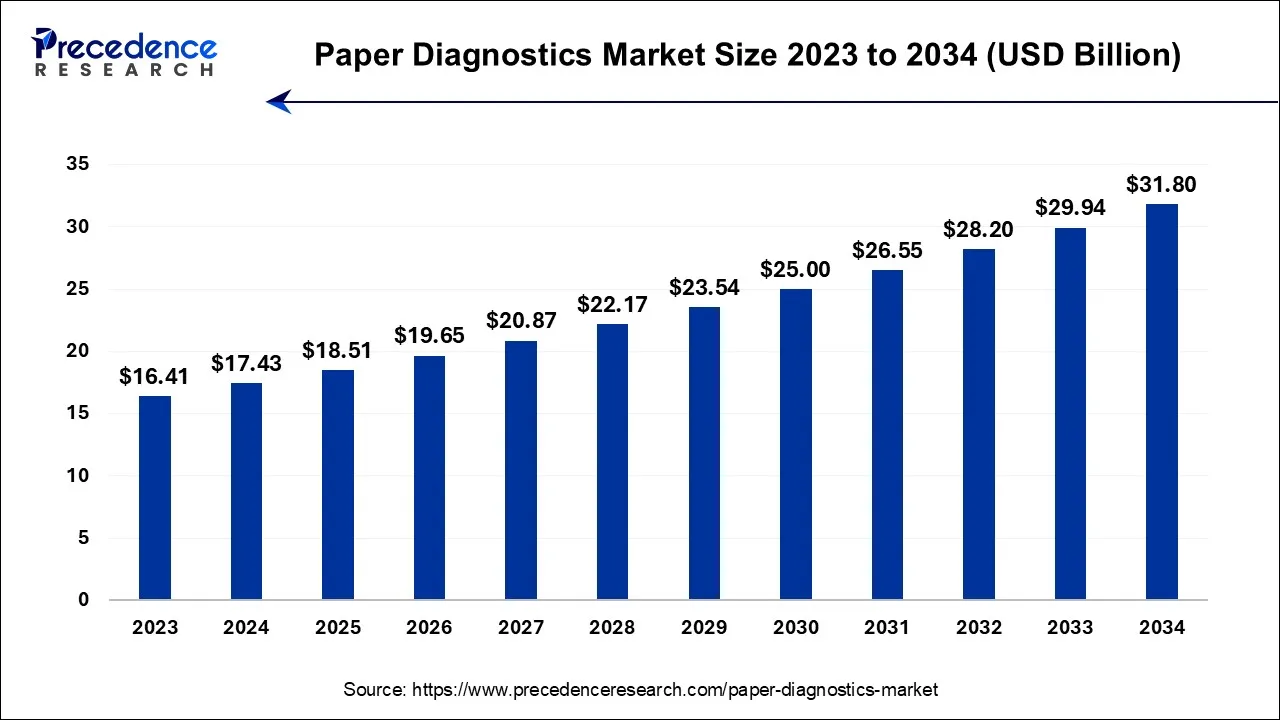

The global paper diagnostics market size is calculated at USD 17.43 billion in 2024, grew to USD 18.51 billion in 2025, and is predicted to hit around USD 31.80 billion by 2034, poised to grow at a CAGR of 6.2% between 2024 and 2034. The North America paper diagnostics market size accounted for USD 6.62 billion in 2024 and is anticipated to grow at the fastest CAGR of 6.33% during the forecast year.

The global paper diagnostics market size is expected to be valued at USD 17.43 billion in 2024 and is anticipated to reach around USD 31.80 billion by 2034, expanding at a CAGR of 6.2% over the forecast period from 2024 to 2034.

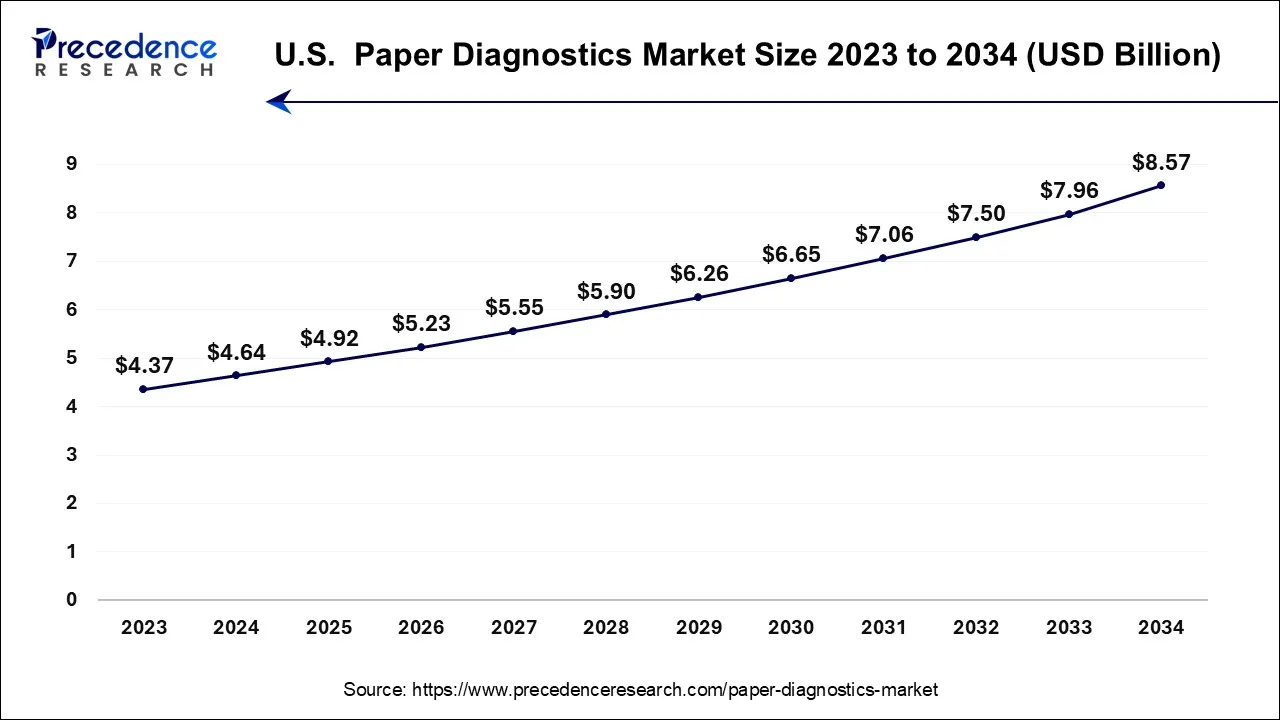

The U.S. paper diagnostics market size is accounted for USD 4.64 billion in 2024 and is projected to be worth around USD 8.57 billion by 2034, poised to grow at a CAGR of 6.32% from 2024 to 2034.

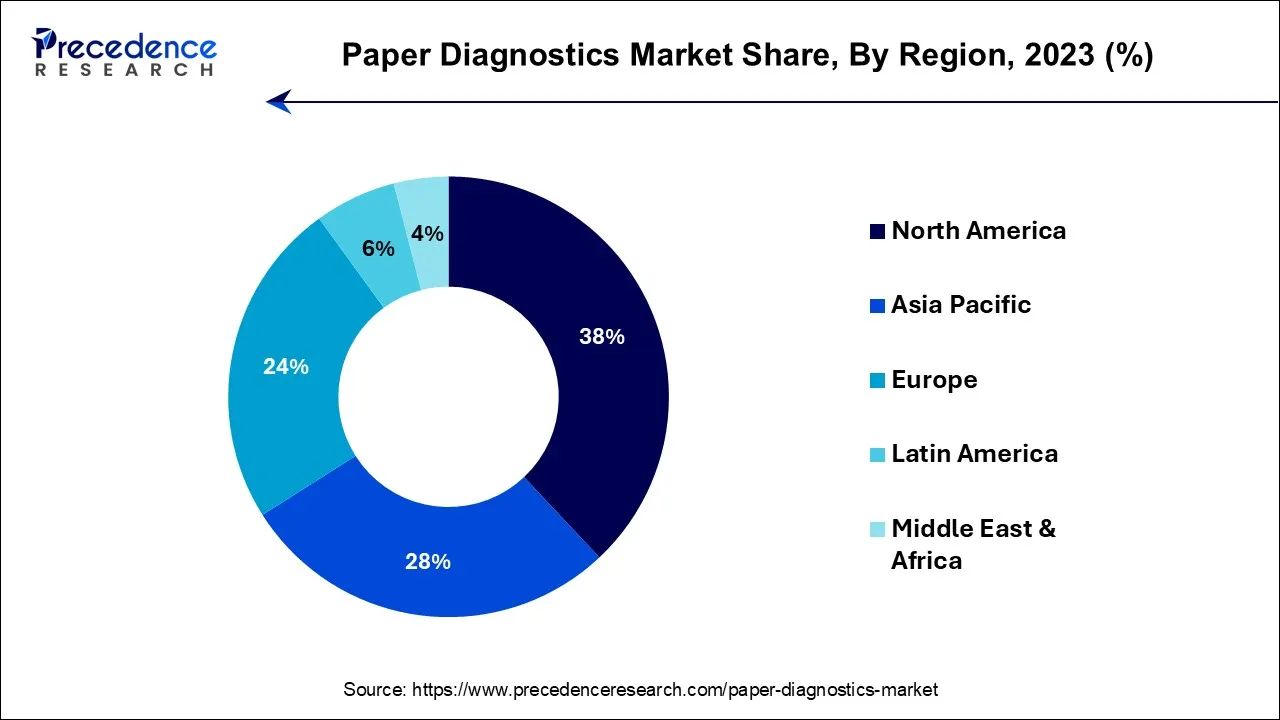

North America has held the largest market share of 38% in 2023. The North America paper diagnostics market has seen growth driven by factors such as the increasing demand for rapid and point-of-care diagnostic solutions, advancements in microfluidics and sensor technologies, and the emphasis on accessible and cost-effective healthcare. The region is home to several key players in the diagnostics industry, contributing to innovation and the development of new paper-based diagnostic technologies. The demand for point-of-care testing solutions, which includes paper diagnostics, has been on the rise in North America. This is driven by the need for quick and decentralized diagnostic results, especially in settings such as clinics, emergency departments, and home healthcare.

| Key Metric | 2023 Data | Source |

| Demand for Point-of-Care Testing Solutions | 15% year-on-year growth | Control and Prevention (CDC) |

| Paper Diagnostics Adoption Rate in Healthcare Facilities | 48% of clinics & hospital | World Health Organization (WHO) |

| Advancements in Microfluidics Technology | 12 new patents filed by top companies | United States Patent and Trademark Office (USPTO) |

| Spending on Diagnostic Solutions | $1.3 billion in North America | U.S. Department of Health and Human Services (HHS) |

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific for paper diagnostics market, driven by factors such as the increasing prevalence of infectious diseases, a large and diverse population, rising healthcare awareness, and the need for affordable and accessible diagnostic solutions. The high prevalence of infectious diseases in some parts of the Asia-Pacific region has fueled the demand for rapid and cost-effective diagnostic solutions. Paper diagnostics, with their ability to provide quick results, are well-suited for addressing these healthcare challenges.

Europe is a significant market for paper diagnostics, characterized by a developed healthcare infrastructure, a strong emphasis on research and innovation, and a growing awareness of the need for accessible and rapid diagnostic solutions. The region includes diverse countries with varying healthcare systems and regulatory environments.

Paper diagnostics refer to a class of diagnostic tools and devices that utilize paper as a key component in the detection and analysis of biological samples. The tests are designed to be simple, cost-effective, and often portable, making them particularly suitable for point-of-care testing in resource-limited or remote settings. The use of paper as a substrate allows for the capillary flow of fluids, enabling various analytical processes without the need for complex equipment.

The technology relies on the principles of microfluidics, where small volumes of fluids are manipulated within paper channels to perform analytical tasks. Various formats, such as lateral flow assays, are commonly used in paper diagnostics. Its formats may be employed for applications like pregnancy tests, infectious disease detection, glucose monitoring, and others. According to the World Health Organization (WHO), paper-based lateral flow tests accounted for 45% of all point-of-care diagnostic tests globally in 2022, driven by their utility in infectious disease management and other critical applications.

The paper diagnostics market encompasses the development, manufacturing, and distribution of diagnostic tools that utilize paper as a substrate for various analytical purposes. Key features of paper diagnostics include their portability, ease of use, and low cost. These tests designed for detecting a range of analytes such as biomarkers, pathogens, or other indicators of health or disease. The Global Health Expenditure Database (World Bank) reports that in 2023, 68% of low- and middle-income countries integrated paper diagnostics into their national healthcare strategies to improve diagnostic access in rural areas. The market for paper diagnostics has grown in response to the increasing demand for rapid and accessible diagnostic solutions, particularly in areas with limited access to sophisticated laboratory infrastructure. Additionally, the U.S. Food and Drug Administration (FDA) has approved over 50 new paper-based diagnostic devices in 2023 alone, further validating the rising importance of this technology in healthcare.

Paper Diagnostics Market Growth Factors

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Market Size in 2024 | USD 17.43 Billion |

| Market Size by 2034 | USD 31.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Kit Type, By Device Type, By End-use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for rapid and decentralized diagnostic solutions

The growing demand for rapid and decentralized diagnostic solutions has become a pivotal driver for the expansion of the paper diagnostics market. In an era where timely and accessible healthcare is paramount, paper diagnostics offer a compelling solution by providing quick and reliable results at the point of care. The simplicity and cost-effectiveness of paper-based tests make them particularly well-suited for deployment in diverse settings, ranging from remote areas with limited access to sophisticated laboratory infrastructure to emergency situations where immediate diagnostics are imperative.

As the global healthcare landscape increasingly emphasizes the importance of early detection and rapid intervention, paper diagnostics fulfill a crucial role in meeting these demands. The ease of use and portability of paper-based tests facilitate their integration into decentralized healthcare environments, including clinics, community health centers, and even home-based testing scenarios.

Furthermore, the ongoing technological advancements in microfluidics and sensor technologies enhance the sensitivity and specificity of paper diagnostics, further fueling their adoption. This trend is amplified by the rising awareness among healthcare professionals and the general public about the benefits of point-of-care testing. In essence, the paper diagnostics market is thriving on the imperative need for swift, cost-effective, and decentralized diagnostic solutions to address the dynamic healthcare challenges of our time.

Growth of Rapid and Decentralized Diagnostic Solutions (2018-2023)

| Year | Percentage of Decentralized Healthcare Facilities Using Paper Diagnostics | Number of Approved Paper Diagnostic Products (Worldwide) | Sources |

| 2018 | 15% | 25 | WHO, FDA, World Bank |

| 2019 | 18% | 30 | WHO, FDA, World Bank |

| 2020 | 22% | 35 | WHO, FDA, World Bank |

| 2021 | 27% | 42 | WHO, FDA, World Bank |

| 2022 | 33% | 48 | WHO, FDA, World Bank |

| 2023 | 38% | 55 | WHO, FDA, World Bank |

Sensitivity and Specificity Concerns

Sensitivity and specificity concerns pose potential restraints on the demand for the paper diagnostics market. While paper-based diagnostic tests offer advantages such as affordability, simplicity, and portability, questions surrounding their sensitivity and specificity may impede widespread adoption. The accuracy of diagnostic results is paramount in healthcare decision-making, and if paper diagnostics exhibit limitations in detecting or ruling out certain conditions, it could diminish confidence among healthcare professionals and end-users.

Challenges in achieving high sensitivity and specificity levels can be attributed to the inherent characteristics of paper-based tests, which may not always match the performance of more advanced laboratory methods. In situations where precise and reliable diagnostic outcomes are critical, healthcare providers may be hesitant to fully embrace paper diagnostics. Regulatory authorities also scrutinize the accuracy of diagnostic tools, and if sensitivity and specificity are not consistently demonstrated, obtaining approvals and market acceptance may become challenging.

Addressing these concerns requires ongoing research and development efforts to enhance the performance of paper diagnostics, ensuring that they meet the rigorous standards expected in clinical settings. Establishing a balance between simplicity and accuracy remains a key challenge, and resolving sensitivity and specificity concerns will be pivotal in unlocking the full potential of paper diagnostics across various healthcare applications.

Rapid testing in emergencies

The demand for rapid and decentralized diagnostic solutions, particularly during emergency situations, presents significant opportunities for the paper diagnostics market. The unique attributes of paper-based tests, such as their portability, simplicity, and quick turnaround time, position them as invaluable tools in emergency response scenarios. According to the World Health Organization (WHO), point-of-care testing, including paper diagnostics, reduced the time to diagnosis by an average of 50% in emergency response settings during recent outbreaks, such as Ebola and COVID-19. During disease outbreaks, natural disasters, or public health crises, the ability to conduct immediate on-site testing becomes paramount for timely decision-making and effective containment strategies.

Paper diagnostics offer a rapid and accessible means of diagnosing infectious diseases, enabling healthcare professionals to swiftly identify and manage cases in emergency settings. Their ease of use allows for deployment in diverse environments, including makeshift healthcare facilities, mobile clinics, and remote areas with limited access to traditional laboratory infrastructure. In 2021, Médecins Sans Frontières (MSF) reported that portable diagnostics, including paper-based tests, were used in over 60% of its emergency health missions, helping to detect and manage disease outbreaks in remote and conflict-affected areas. Furthermore, the simplicity of these tests facilitates training for non-specialized personnel, a crucial factor in emergency situations where the availability of skilled healthcare professionals may be constrained.

Governments, public health organizations, and humanitarian agencies recognize the pivotal role that paper diagnostics play in emergency response efforts. In 2021, UNICEF collaborated with diagnostic manufacturers to distribute over 20 million rapid diagnostic kits to countries facing health crises, highlighting the growing reliance on such technologies. Collaborations and strategic partnerships between these entities and paper diagnostics manufacturers further enhance the development and distribution of tailored diagnostic solutions, solidifying the market's position as an indispensable component in global health preparedness and crisis management. As the world faces increasing uncertainties, the paper diagnostics market stands poised to provide swift and reliable diagnostic support in times of emergencies.

Kit Type

According to the kit type, the lateral flow assays segment has held the highest market share of 46% in 2023. Lateral Flow Assays (LFAs) are widely used, with the World Health Organization (WHO) estimating that over 2 billion lateral flow tests are performed globally each year, including applications in pregnancy tests and infectious disease detection. These assays typically use a strip of paper as the medium for detecting the presence or concentration of a target analyte. The test sample flows laterally through the paper, interacting with specific reagents to produce a visible result, often in the form of a color change. LFAs are commonly used in pregnancy tests, infectious disease detection, and various rapid tests due to their simplicity and quick results.

The paper-based microfluidics segment is anticipated to expand at a CAGR of 8.1% over the projected period. In 2022, a study published by the U.S. National Institutes of Health (NIH) noted that paper-based microfluidics had the potential to reduce diagnostic costs by 40% compared to traditional lab-based methods, making it highly attractive for resource-limited settings. Paper-based microfluidics involves the integration of microfluidic principles into paper diagnostics. These platforms use paper as a substrate for creating intricate fluidic channels on a microscale. This allows for more sophisticated and multiplexed diagnostic capabilities. Paper-based microfluidic devices are designed to control the flow of small volumes of liquids, enabling precise and controlled reactions for detecting multiple analytes simultaneously. This technology is advancing the capabilities of paper diagnostics, especially in scenarios where more complex testing is required.

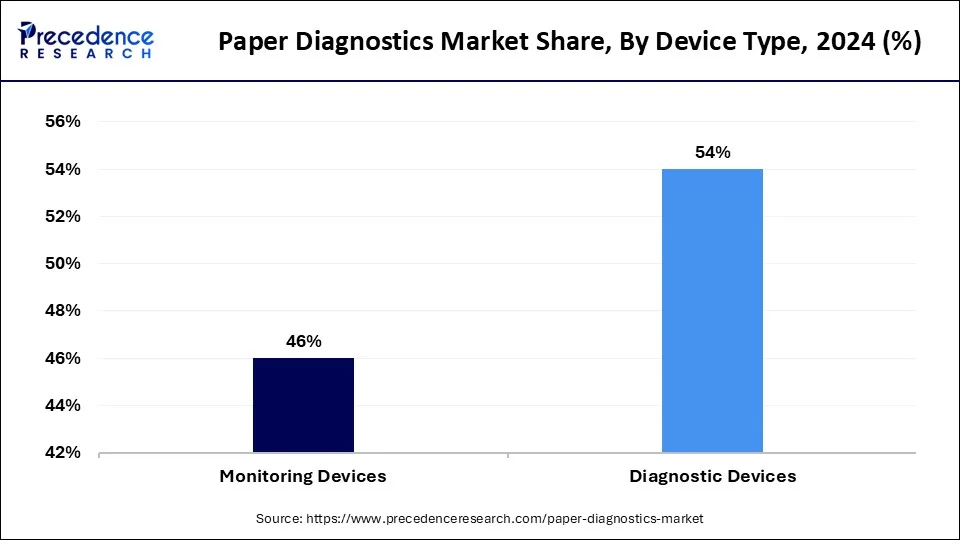

Device Type Insights

The diagnostic devices segment had the highest market share of 54% in 2023. According to the Centers for Disease Control and Prevention (CDC), approximately 70% of all clinical decisions are based on diagnostic test results, underscoring the critical importance of rapid testing. Diagnostic devices in the paper diagnostics market are designed primarily for the detection of specific analytes or the diagnosis of medical conditions. These devices enable rapid and accessible testing for various diseases, infections, or biomarkers. They encompass a wide range of tests, including infectious disease detection, pregnancy tests, glucose monitoring, and other point-of-care diagnostics. They play a crucial role in providing quick and reliable results for immediate decision-making in clinical settings or at the point of care.

The monitoring devices segment is anticipated to expand at a CAGR of 6.9% over the projected period. A report by the World Health Organization (WHO) indicates that the prevalence of diabetes has been steadily increasing, with an estimated 422 million people globally affected by the condition, thereby driving the demand for effective monitoring devices. Monitoring devices in the paper diagnostics market are geared toward continuous or periodic assessment of specific parameters over time. These devices enable ongoing tracking and surveillance of health indicators for managing chronic conditions or monitoring specific health parameters. They are used in scenarios where regular and repeated testing is necessary, such as in the management of chronic diseases like diabetes. They facilitate patient self-monitoring or allow healthcare providers to track changes in health status over time.

The clinical diagnostics segment had the highest market share of 45% in 2023 and is expected to expand at the fastest CAGR of 8.5% over the projected period. According to a report by the World Health Organization (WHO), timely diagnosis and treatment reduce disease morbidity and mortality, particularly for infectious diseases, which is driving the demand for rapid diagnostics. Clinical diagnostics in the paper diagnostics market pertain to applications within the field of human healthcare. These diagnostics are designed for the detection of specific diseases, infections, or health conditions, providing rapid and accessible results for healthcare professionals. They cover a broad spectrum of tests, including infectious disease detection (such as HIV, malaria, and COVID-19), pregnancy testing, monitoring of chronic conditions (like diabetes), and various point-of-care tests. The portability and simplicity of paper-based diagnostics make them particularly suitable for clinical settings and decentralized healthcare environments.

The hospitals and clinics segment had the highest market share of 49% in 2023. According to the American Hospital Association (AHA), approximately 6,090 hospitals in the U.S. are leveraging advanced diagnostic technologies, including paper diagnostics, to improve patient outcomes and operational efficiency. Hospitals and clinics represent traditional healthcare settings where a wide range of diagnostic tests and medical services are provided. In this segment, paper diagnostics may be integrated into existing healthcare workflows to enhance the efficiency of point-of-care testing. Paper diagnostics in hospitals and clinics cover a broad spectrum of applications, including infectious disease testing, rapid diagnostics in emergency departments, and routine screenings. They contribute to streamlined and decentralized testing within these healthcare institutions.

The assisted living healthcare facilities segment is anticipated to expand at a CAGR of 8.1% over the projected period. A study by the Centers for Disease Control and Prevention (CDC) indicates that about 800,000 individuals reside in assisted living facilities, highlighting the need for efficient health monitoring solutions. Assisted living healthcare facilities encompass settings where individuals receive support for daily living activities but may not require full-time medical care. Paper-based diagnostics in these facilities provide a means for convenient and efficient testing, contributing to resident care and health management. They may use paper diagnostics for routine monitoring of health parameters, managing chronic conditions, and conducting basic diagnostic tests without the need for extensive laboratory resources.

Segments Covered in the Report

By Kit Type

By Device Type

By End-use

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

September 2024

October 2024