July 2025

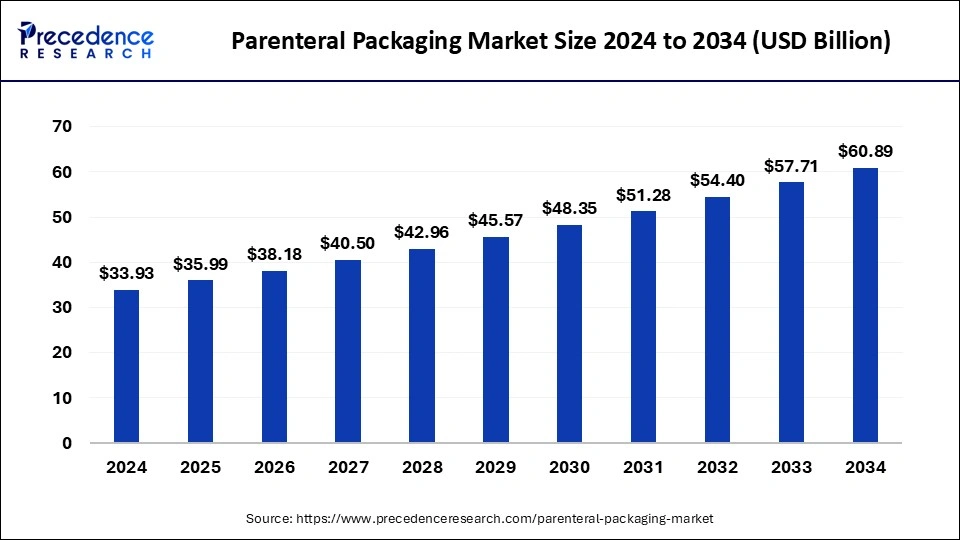

The global parenteral packaging market size accounted for USD 33.93 billion in 2024 and is predicted to increase from USD 35.99 billion in 2025 to approximately USD 60.89 billion by 2034, expanding at a CAGR of 6.02% from 2025 to 2034. The rising demand for pharmaceutical products across the world is driving the growth of the parenteral packaging market.

The parenteral packaging industry is one of the most important industries of the packaging industry. This industry mainly deals with developing storage solutions for medicinal items and pharma-based products. Several types of products are used in parenteral packaging, mainly bottles, ampoules, vials, prefilled syringes, cartridges, and others. The drugs that are stored in parenteral packaging mainly include small molecules, biologics, vaccines, biosimilars, and others. The parenteral packaging industry requires several materials, such as glass, polymer, PVC, and others. It mainly consists of two packaging types that mainly include small-volume parenteral and large-volume parenteral. This industry is expected to grow exponentially with the growth in the healthcare and biopharmaceutical industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 60.89 Billion |

| Market Size in 2025 | USD 35.99 Billion |

| Market Size in 2024 | USD 33.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.02% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Drug, Material, Packaging, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cases of chronic disorders increase the demand for injectables

The number of chronic diseases such as cancer, chronic obstructive pulmonary disease (COPD), and others has increased rapidly in recent times. According to a Journal of Medical Internet Research, 80% of adults above 75 years or over suffered from multiple chronic diseases, and 90% of them suffered from at least one chronic disease. The prevalence of cancer has increased globally, which mainly includes carcinoma, melanoma, lymphoma, sarcoma, and leukemia, which increases the demand for injections for getting cured, thereby driving the market growth.

Also, the prevalence of cardiovascular diseases among patients has also increased rapidly around the globe, which has increased the demand for vaccines and drugs for treatment, which in turn increases the demand for parenteral packaging, thereby driving market growth. Moreover, the rising cases of obesity and diabetes among patients, along with the rising cases of accidents around the world, increases the demand for various types of injections for treating these health conditions, which in turn is expected to drive the growth of the parenteral packaging market.

High manufacturing cost

The application of parenteral packaging is very important in the storage of therapeutics and injections. Although the usage of parental packaging in the pharmaceutical industry is worth mentioning, the problems associated with the prices of raw materials and the rising labor charges in this industry are highly notable. This, in turn, increases the overall manufacturing cost of packaging. Thus, the high cost associated with the manufacturing of parenteral packaging is expected to restrain the growth of the parenteral packaging industry.

Integration of AI in parenteral packaging

The applications of AI have increased rapidly in the fields of labeling and packaging of oral doses and injections due to its ability to provide accurate labeling and a superior level of packaging associated with it. Recently, the integration of AI has been done in parenteral packaging to get superior outcomes and increase the authenticity of the product among consumers. Thus, the growing integration of AI technology in parenteral packaging activities is expected to create ample growth opportunities for market players in the coming days.

The bottles segment is expected to be the fastest-growing segment during the forecast period. The demand for plastic bottles has increased for storing various types of syrups due to their unbreakability and high-temperature resistance ability, driving market growth. Moreover, the growing application of glass bottles for storing medicines that contain strong acids and bases, along with their ability to protect against harmful ultraviolet rays, is likely to boost the growth of the parenteral packaging market.

The small molecules segment dominated the market in 2023 and is expected to continue its dominance during the forecast period. The demand for molecules-based medicines has increased due to the rise in the number of cancer patients across the world, which in turn increases the demand for parenteral packaging for storing these medicines, thereby driving market growth. In January 2024, BridGene Biosciences collaborated with Galapagos. This collaboration is being done to develop small molecule-based drugs for cancer treatment.

The biologics segment is expected to grow with the highest CAGR during the forecast period. The growing cases of psoriasis, rheumatoid arthritis (RA), and bowel diseases across the world have increased the demand for biologics medication, which in turn increases the demand for packaging of these medications, thereby driving the growth of the parenteral packaging market. In July 2023, Biocon Biologics launched Hulia. Hulia is a biological injection that is used to treat rheumatoid arthritis and psoriatic arthritis in the U.S. region.

The glass segment held the dominant share in 2023 and is expected to grow with the fastest CAGR during the forecast period. The growing demand for glass-based bottles, ampoules, vials, prefilled syringes, cartridges, and some other equipment for storing medicines has boosted the market growth. Moreover, glass-based parenteral packaging comes with several advantages, such as chemical stability and inertness for the packaging of medicines and injectables, which has boosted the growth of the parenteral packaging market. Also, glass-based storage solutions can withstand high temperatures and are mostly hydrolytic resistant, which makes them suitable for storing a wide range of medicines, thereby driving the market growth. Additionally, several companies are launching glass-based parenteral packaging products, which in turn has propelled the market growth.

The small-volume segment dominated the market in 2023. The rising applications of small-volume parenteral solutions, ranging from oral drops and otic to vaccinations and local anesthetics for treating patients suffering from various diseases, are likely to drive the growth of the parenteral packaging market.

The large volume segment is expected to grow with the highest CAGR during the forecast period. The growing number of patients suffering from cholera has increased the demand for large-volume parenteral solutions, thereby driving market growth. Moreover, the rising use of large-volume parenteral solutions for correcting organic dysfunction, such as acid-based or saline balance for drug administration in the human body, is likely to boost the growth of the parenteral packaging market.

North America held the largest market share in 2023. The growth of the market in the North American region is mainly driven by the rising government investment in countries such as the U.S., Canada, Mexico, and some others for developing the healthcare sector. The rising developments in the biopharma sector, along with advancements in technologies related to packaging solutions, are driving the market growth in this region. Also, there are several research institutes related to the research and development of parenteral packaging solutions, which in turn has driven the market growth.

Moreover, the rising cases of cancer among patients increases the demand for effective injectables for treatment, which in turn increases the demand for parenteral packaging, thereby driving the market growth in this region. Moreover, several local market players, such as Becton, Dickinson and Company, Berry Global Inc., Baxter International Inc., and some others, are constantly engaged in developing parenteral packaging solutions and adopting strategies such as launches, joint ventures and business expansions, which in turn drives the growth of the parenteral packaging market in this region.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growing number of pharmacies and medical shops has boosted the market growth. Also, rising investments by new startup companies for manufacturing ampoules, vials, prefilled syringes, cartridges, and other packaging products, along with growing development in the biopharmaceutical industry in India, Japan, China, Singapore, and others, is driving the market growth. Also, the governments of several countries, such as India, China, Japan, and others, have increased their emphasis on developing the pharmaceutical industries, which in turn drives market growth.

By Products

By Drug

By Material

By Packaging

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

June 2025

January 2025

August 2025