January 2025

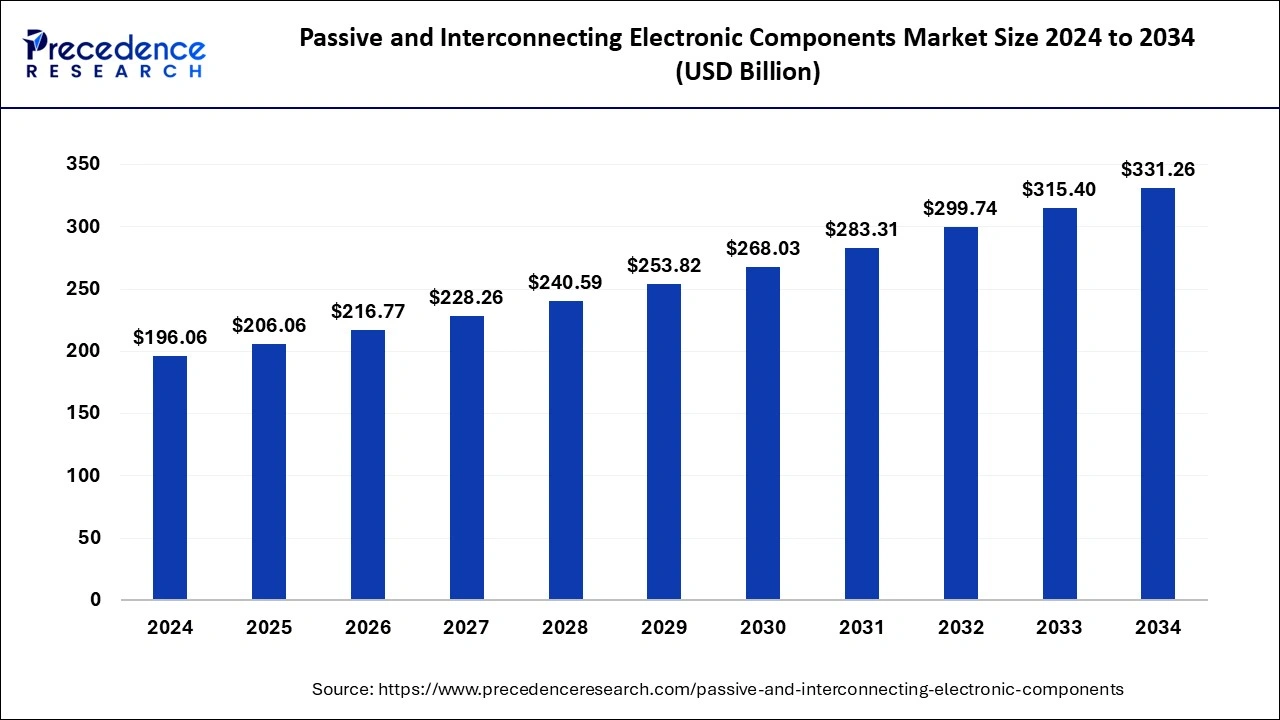

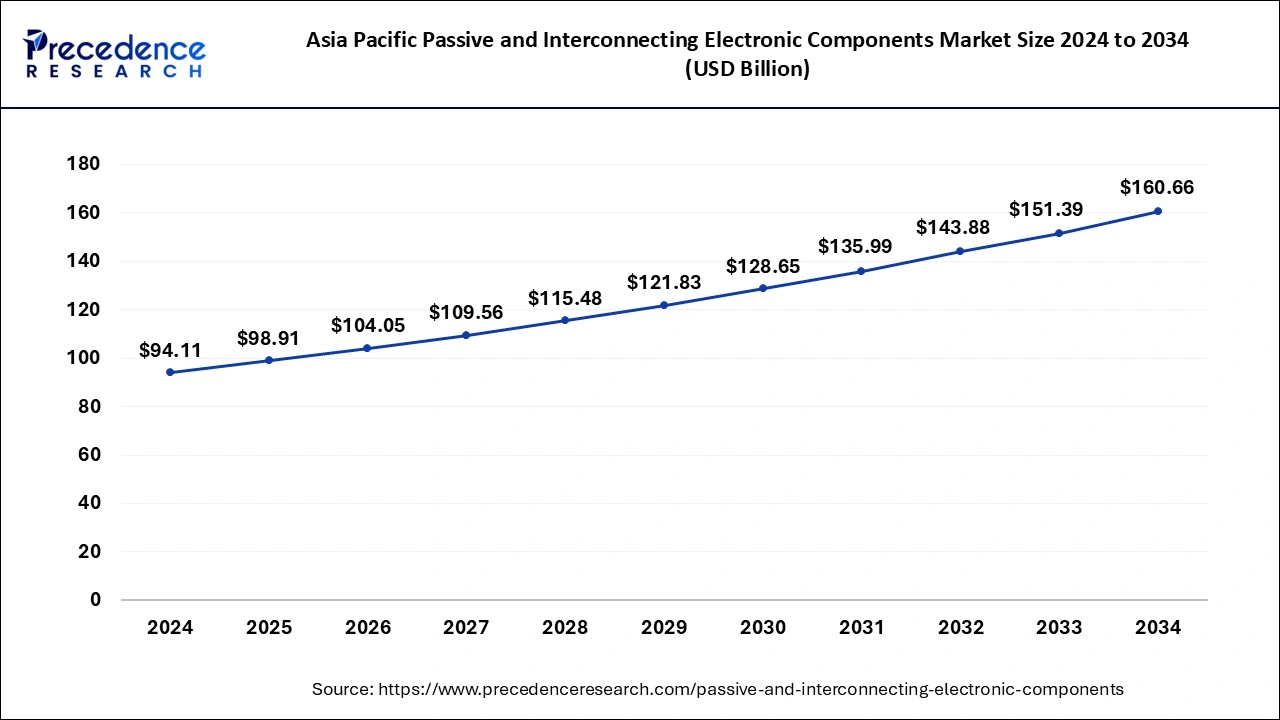

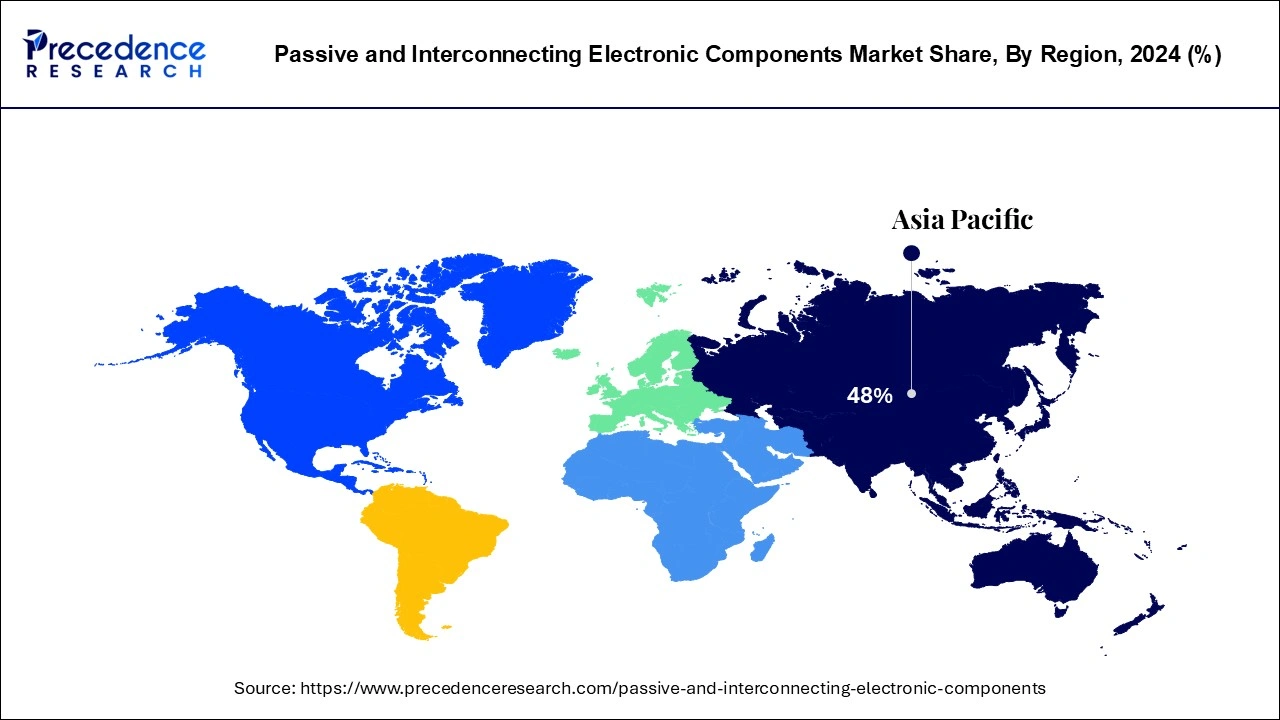

The global passive and interconnecting electronic components market size is calculated at USD 206.06 billion in 2025 and is forecasted to reach around USD 331.26 billion by 2034, accelerating at a CAGR of 5.38% from 2025 to 2034. The Asia Pacific passive and interconnecting electronic components market size surpassed USD 98.91 billion in 2025 and is expanding at a CAGR of 5.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global passive and interconnecting electronic components market size was accounted for USD 196.06 billion in 2024 and is anticipated to reach around USD 331.26 billion by 2034, growing at a CAGR of 5.38% from 2025 to 2034. The increasing industrial automation and use of control systems like robots and computers which help the growth of the passive and interconnecting electronic components market.

Artificial intelligence (AI) can transform the passive and interconnect design. Applications of AI in these components include handling large datasets and, the need for multiple distributed GPUs, and CPUs communicating in real-time. AI in electronics is used to improve device functionality and user experience, allowing features like facial and voice recognition, predictive maintenance, and effective energy management across a range of devices from smartphones to industrial machinery. AI is used in the electronic industry which makes easier and faster product development to enhance quality and strengthen supply chains which helps the growth of the passive and interconnecting electronic components market.

The Asia Pacific passive and interconnecting electronic components market size was evaluated at USD 9.11 billion in 2024 and is predicted to be worth around USD 160.66 billion by 2034, rising at a CAGR of 5.49% from 2025 to 2034.

Due to the presence of major market players in the region such as Samsung Electronics Co., Ltd., BBK electronics (Includes brands such as Oppo, Realme, and Vivo), Foxconn Technology Group, and Xiaomi Corporation, Asia Pacific dominated the Passive and Interconne. citing Electronic Components Market, contributing a revenue share of more than USD 97.1 billion in 2020. China dominates the passive and interconnecting electronic components market in this region and is the major exporter of electronics products across the world. For instance, In 2018,

In North America, the soaring demand for connected cars in the U.S. is leading the telecom giants such as Verizon Inc.; and AT&T Inc., to invest heavily in deploying 5G network infrastructure. The 5G mobile network is estimated to provide unified connectivity to vehicles with infrastructures across the country. Also, the U.S. government is spending heavily on building smart cities countrywide. In the future years, the high demand for 5G networks would need the implementation of 5G network infrastructure, which will propel the industry forward. For instance, On 23rd September 2021, KYOCERA AVX Components Corporation, a leading manufacturer and supplier of sophisticated electronic components and connector, sensor, control, and antenna systems, has introduced a new series of external, dual-band Wi-Fi antennas that are optimized for 2.4GHz and 5GHz applications and are IP67-rated. The new X9001748 Series external, dual-band Wi-Fi antennas have a standardized, ready-to-use, RoHS-compliant design with IP67 sealing for reliable outdoor operation, and provide high-gain, high-efficiency, and high-reliability performance in a variety of device configurations and frequencies spanning 2,400–2,485MHz and 5,150–5,850MHz.

| Report Highlights | Details |

| Market Size in 2025 | USD 206.06 Billion |

| Market Size by 2034 | USD 331.26 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.40% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application |

| Regional Scope |

North America, Europe, Asia Pacific, LAMEA |

The industrial sector is quickly changing as a result of the widespread adoption of Internet of Things (IoT) devices. By providing simplicity of operation and reducing total system downtime, industrial IoT devices assist manufacturing facilities in increasing overall productivity and operational efficiency. In addition, as part of the fourth industrial revolution (Industrial 4.0), numerous manufacturing facilities are installing a variety of connected devices to improve operational operations via remote monitoring. As a result, the market is likely to grow faster as IoT devices are deployed across a wide range of industrial applications, such as process automation and motion control.

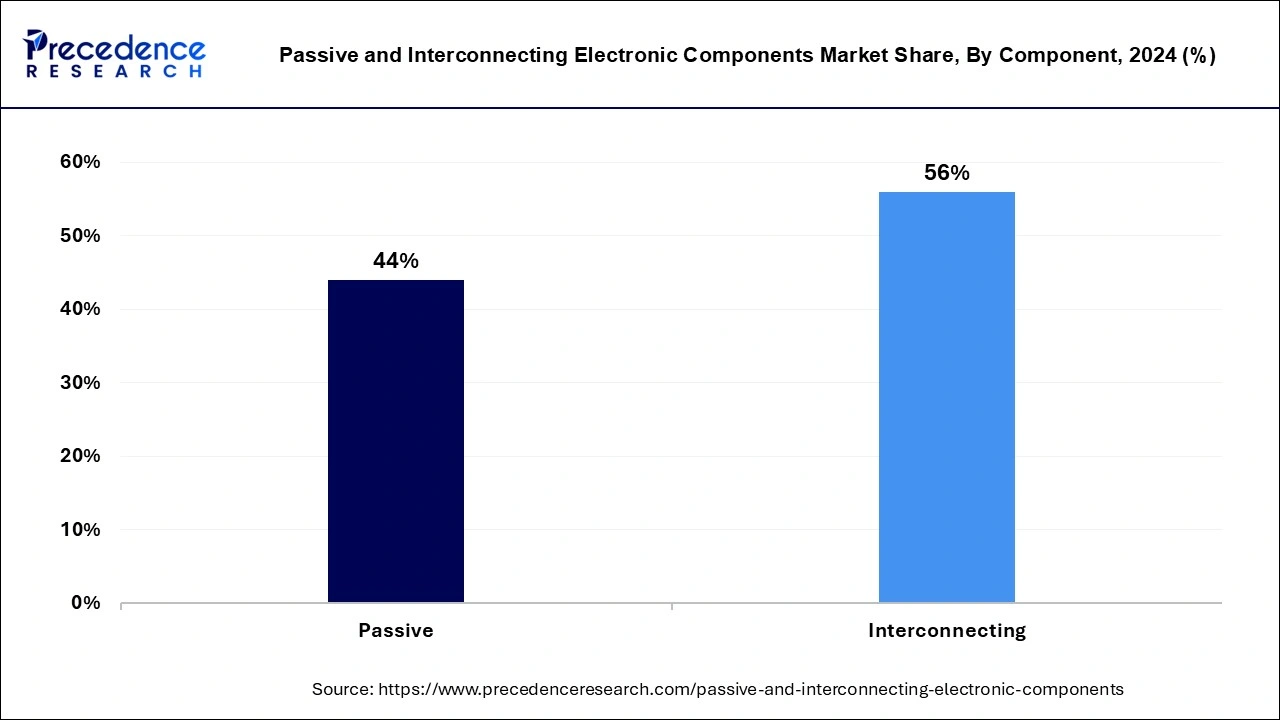

The interconnecting segment contributed the highest market share of 48% in 2024 and it is also considered to grow significantly during the forecast period. It's due to the increased demand for various types of capacitors in consumer electronic devices, industrial applications, and other uses.

The transformer product segment is also expected to grow significantly during the forecast period owing to the vital role of the transformer in an electronic device by stepping down the high voltage to the required voltage for the circuit. As a result of the increased manufacturing of various types of household appliances, industrial digital devices, and other consumer electronic items, transformer demand is expected to skyrocket.

The interconnecting segment includes printed circuit boards (PCB), connectors/sockets, switches, relays, and others. Additionally, the surge in demand for networking and storage devices in data centers is further anticipated to boost the market growth.

The consumer electronics segment accounted for the highest market share of 36% in 2024. It's owing to a surge in demand for passive and linking components for a variety of consumer gadgets, including wearables, smartphones, set-top boxes (STBs), and household appliances.In addition, demand for security cameras, sensor-based devices, and robotics is fast rising across a wide range of industrial applications, including process automation and remote monitoring. And it is projected that these characteristics will propel the market forward.

The increased demand for networking devices such as modems, gateways, and repeaters is likely to drive market expansion in the office automation and residential application segments. Furthermore, 5G telecom infrastructure development is accelerating, and telecom operators are substantially spending in order to give higher bandwidth experiences to their consumers, which is expected to stimulate the growth of the IT and telecommunication application market. Furthermore, the market is expected to increase due to strong demand for infotainment systems, driver assistance systems, Global Positioning Systems (GPS), and other electronic systems for automotive applications.

Instances to support opportunity

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024