February 2025

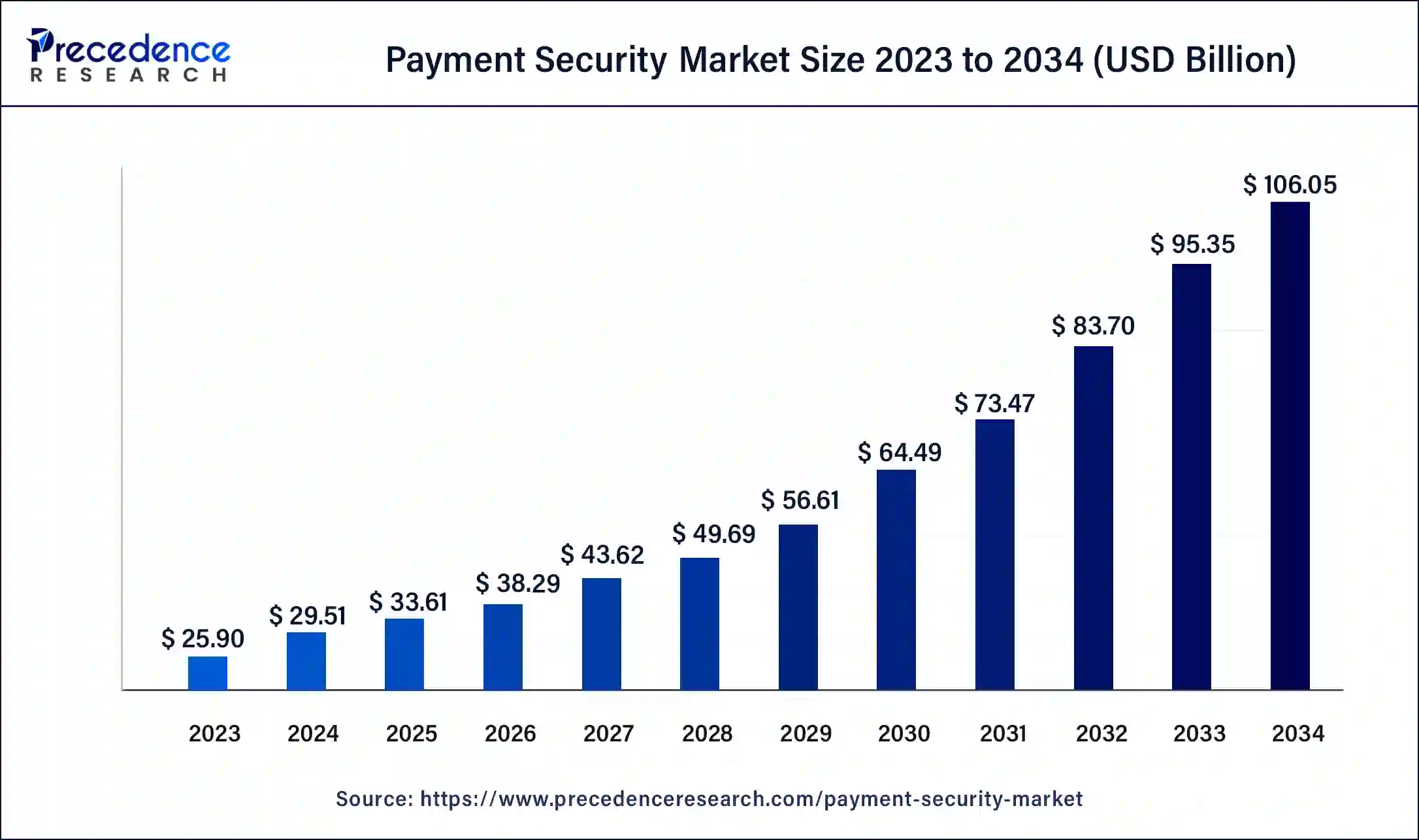

The global payment security market size was USD 25.90 billion in 2023, estimated at USD 29.51 billion in 2024 and is anticipated to reach around USD 106.05 billion by 2034, expanding at a CAGR of 13.65% from 2024 to 2034.

The global payment security market size accounted for USD 29.51 billion in 2023 and is predicted to reach around USD 106.05 billion by 2034, growing at a CAGR of 13.65% from 2024 to 2034. The North America payment security market size reached USD 9.32 billion in 2023. The growth is driven by the need to protect consumer data, comply with regulations, and keep up with the evolving threat landscape.

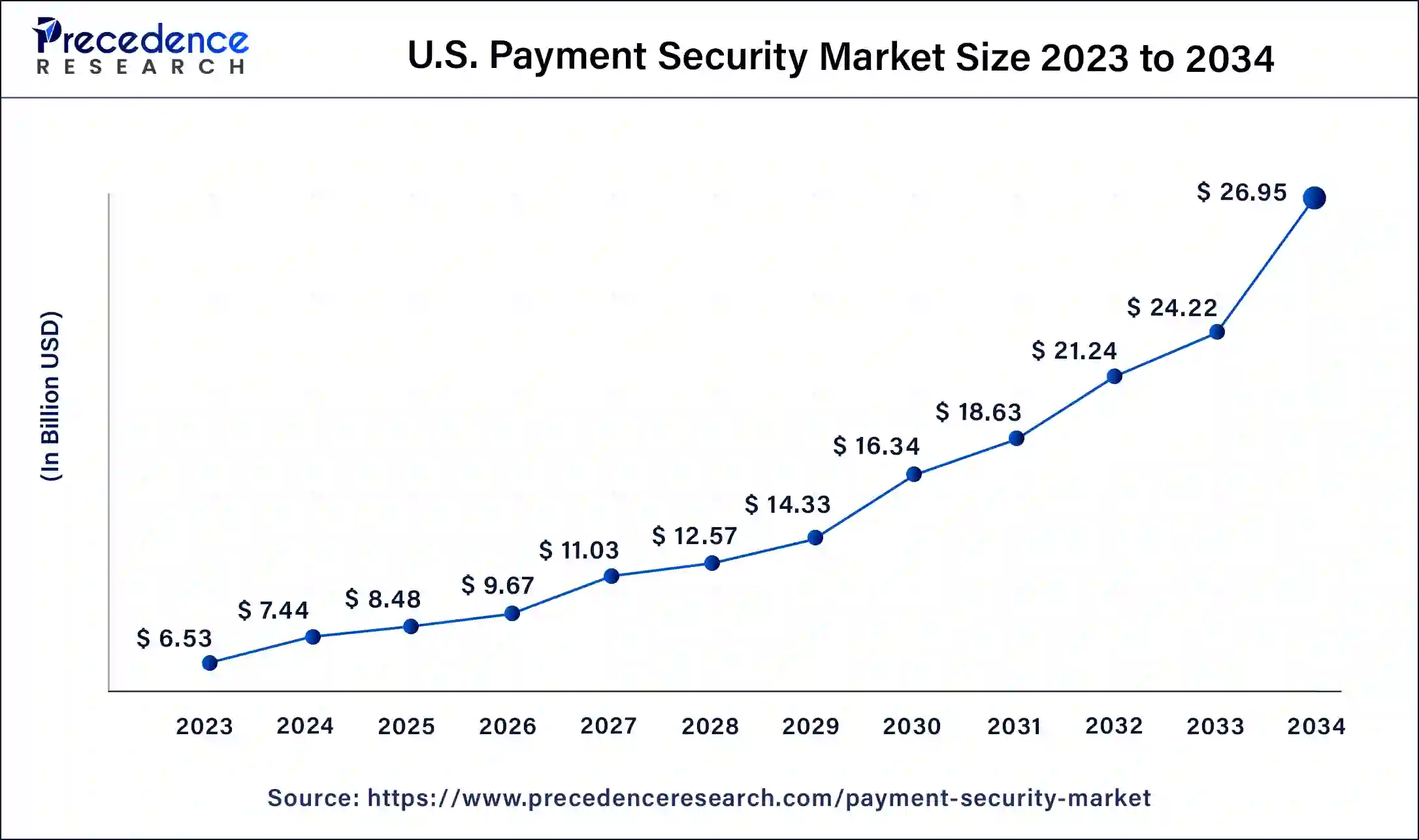

The U.S. payment security market size was estimated at USD 6.99 billion in 2023 and is predicted to be worth around USD 26.95 billion by 2034 with a CAGR of 13.73% from 2024 to 2034.

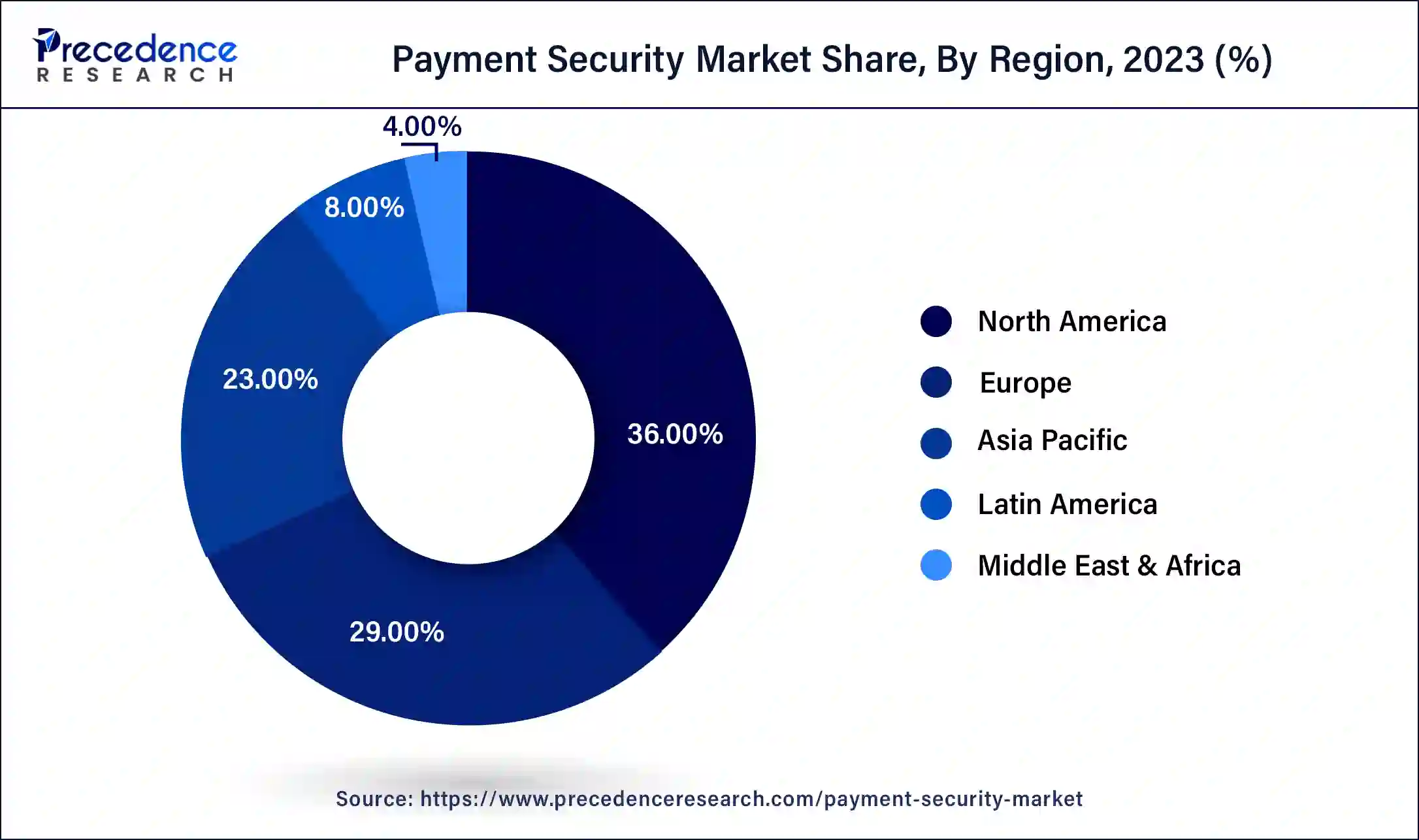

North America dominated the payment security market in 2023. North America has traditionally dominated the market due to its advanced technological infrastructure, stringent data security and privacy regulations, and the strong presence of key market players. Major regional economies, such as the U.S. and Canada, widely adopt digital payment systems across various industries. The North American market benefits from the high demand for secure payment solutions in the banking, financial services, and e-commerce sectors.

Asia Pacific is the fastest-growing region in the payment security market. The region's growth is driven by increasing regulatory requirements and compliance standards for payment security. Furthermore, many Asia Pacific countries, including China, India, and Japan, have implemented strict regulations and guidelines, which can contribute to market growth. Authorities are guiding the payments industry through litigation and regulations to foster a competitive environment that prioritizes consumer protection.

As the use of digital payment systems expands across various industries, the need for robust payment security measures becomes increasingly critical. Security breaches can severely damage retailers' reputations, prompting a wider adoption of advanced security systems. These measures include point-to-point tokenization, encryption, and EMV technology, all of which ensure transparency, real-time updates, full control, and multilevel checks.

The growing adoption of digital payment methods significantly drives the market revenue for payment security. Compliance with PCI DSS guidelines and the rise in fraudulent activities in e-commerce further fuel this market growth. As payment applications become more prevalent across different sectors, the demand for sophisticated payment security solutions in digital commerce continues to rise.

| Report Coverage | Details |

| Market Size in 2023 | USD 25.90 Billion |

| Market Size in 2024 | USD 29.51 Billion |

| Market Size by 2034 | USD 106.05 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.65% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Platform, Organization, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing adoption of digital payment systems

The growing popularity of digital payment systems, such as mobile payments and online transactions, is increasing the demand for advanced payment security measures. Both consumers and businesses are turning to digital payment methods for their convenience and efficiency. This shift drives the need for solutions that ensure secure transactions, hence boosting the growth of the payment security market.

A significant factor driving the global payment security market is the rise in payment fraud incidents. As digital payment methods become more widespread, cybercriminals are discovering new ways to exploit vulnerabilities in these systems. This trend intensifies the need for robust security solutions to protect sensitive financial information and prevent fraudulent activities.

Adaptation to advanced technology

The global payment security market, like any major industry, faces several challenges. Many businesses are transitioning to digital payment channels, but the adoption of new technologies is slower than necessary. This slow pace presents a significant hurdle for companies trying to enter the market.

Another challenge for the payment security market is the inability of many firms to identify security flaws and take steps to strengthen their platforms. This incapacity hampers the efforts of organizations to ensure robust security. Additionally, while government standards promote research and development in the payment security industry, stringent regulations can also act as constraints.

The growing number of cybersecurity threats and data breaches

The digital transformation has led to an increase in cybersecurity threats, such as unauthorized access, fraud, and data breaches in payment security. Cybercriminals are becoming more sophisticated in exploiting vulnerabilities, making it essential for businesses to prioritize comprehensive payment security strategies. Unauthorized access to payment data can result in severe financial losses and reputational damage, driving widespread adoption of payment security solutions and contributing to market growth. Hackers often target weak points in payment systems through phishing attacks, malware, or social engineering, further influencing market growth.

Additionally, fraudulent activities like credit card fraud and identity theft impact both individuals and businesses, which necessitates stringent security measures. This has led to the adoption of multi-layered security approaches, including real-time transaction monitoring, two-factor authentication, data encryption, and employee training to recognize and prevent potential security breaches. These measures create a positive market outlook for the payment security industry.

The fraud detection & prevention segment dominated the payment security market in 2023. Fraud is one of the biggest threats to payment systems and data security. It can take many forms, including card-not-present fraud, identity theft, account takeover, and social engineering attacks. As payment systems grow more complex and transactions increasingly move online, the risk of fraud rises. Therefore, fraud detection and prevention solutions have become a critical aspect of payment security.

The tokenization segment is expected to register significant growth in the payment security market over the projected period. Tokenization solutions are gaining traction by replacing sensitive payment information with unique tokens, adding an extra layer of security, and driving market growth. These tokens are used for payment processing and can be securely stored on various devices, such as smartphones, wearables, or computers. This enables quick and easy payments across different channels and platforms.

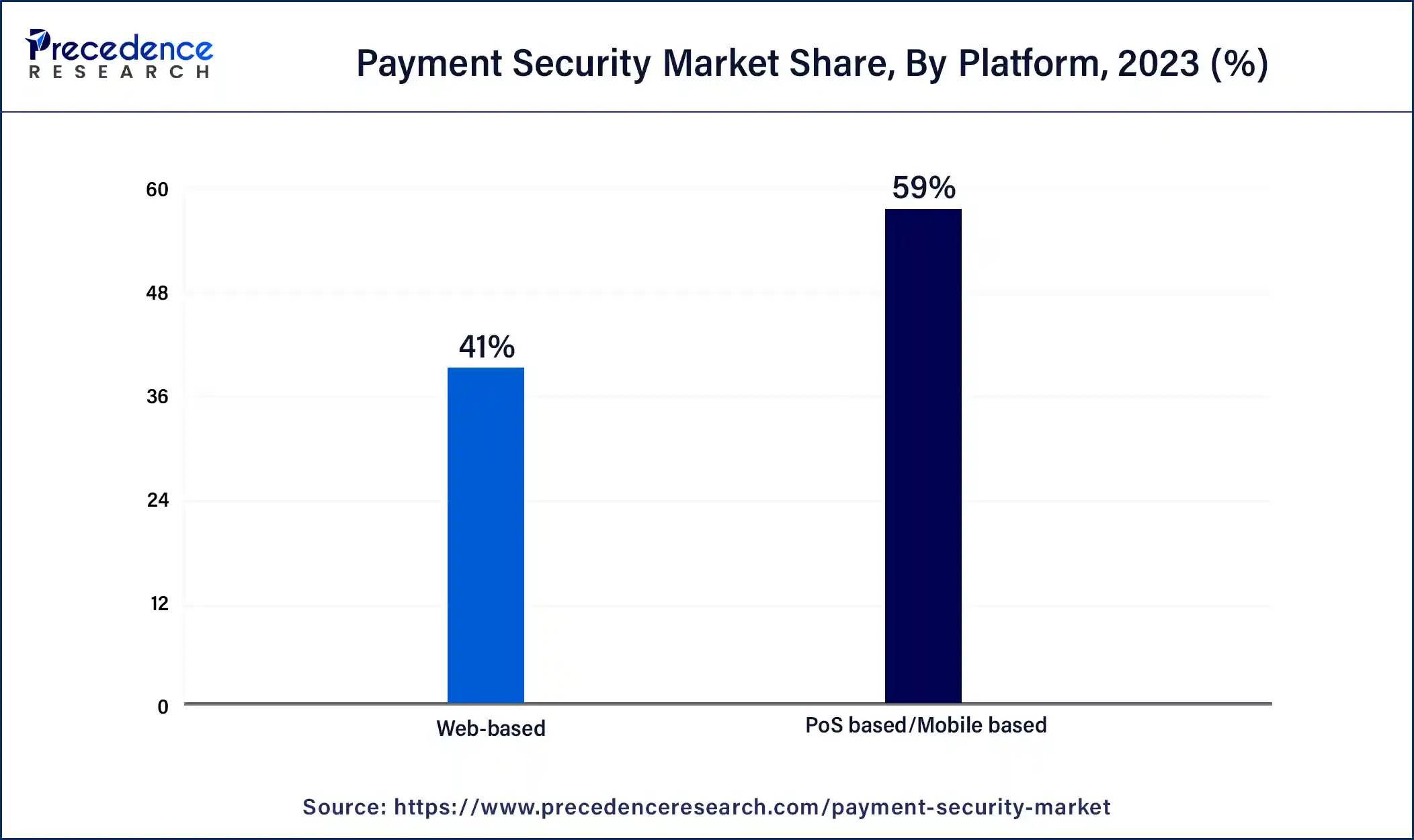

The PoS-based/mobile-based segment dominated the payment security market in 2023. Point-of-sale (POS)-based platforms ensure secure payment transactions across various industries. These systems facilitate payment processing now of purchase, by providing a seamless and familiar experience for merchants and customers. This enhances user confidence, encourages the adoption of secure payment practices, and contributes to market growth.

The web-based segment is expected to grow at a significant rate in the payment security market during the forecast period. The segment's growth is fueled by the rising popularity of online payments and e-commerce. Web-based payment systems allow consumers to make payments online using their desktop or mobile devices, eliminating the need to visit a physical location or use a specific payment terminal. This convenience has led to a notable increase in online transactions, which highlights the importance of web-based payment systems in the payment ecosystem.

The large enterprises segment dominated the payment security market in 2023. Large enterprises have significant advantages due to their ample resources, both financial and human, which allow them to invest heavily in robust payment security solutions. With their expansive budgets, they can implement advanced technologies and sophisticated encryption methods and maintain dedicated teams focused on monitoring and mitigating security risks. This not only safeguards their operations but also positions them as industry leaders in promoting secure payment practices.

The small & medium-sized enterprises (SMEs) segment is expected to register significant growth during the forecast. The segment is expected to have a higher rate (CAGR) in the foreseeable future. Small- and medium-sized businesses are increasingly adopting encryption and tokenization technologies. Payment security is crucial for these enterprises because they are vulnerable to cyberattacks, which could result in the loss of financial information and other critical documents.

The retail & e-commerce segment dominated the payment security market in 2023. Retail and e-commerce businesses are undergoing significant transformation, shifting from traditional brick-and-mortar models to dynamic online platforms. Consumers now entrust their sensitive financial information, such as credit card details and personal data, to these online platforms. This has led to the implementation of stringent payment security measures, including tokenization, biometric authentication, and AI-driven fraud detection, to protect customer information and enhance the shopping experience, which drives market growth.

The education segment shows significant growth in the payment security market during the forecast period. Educational institutions, which often hold large amounts of sensitive information and are perceived to have weaker security measures than other industries, are frequently targeted by cybercriminals. Moreover, the education industry is increasingly adopting mobile payment apps and other online tuition payment portals, to streamline payment processes and enhance student and families' payment experience. This shift has heightened the demand for payment security in the education sector.

Segments Covered in the Report

By Solution

By Platform

By Organization

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

December 2024

January 2025