January 2025

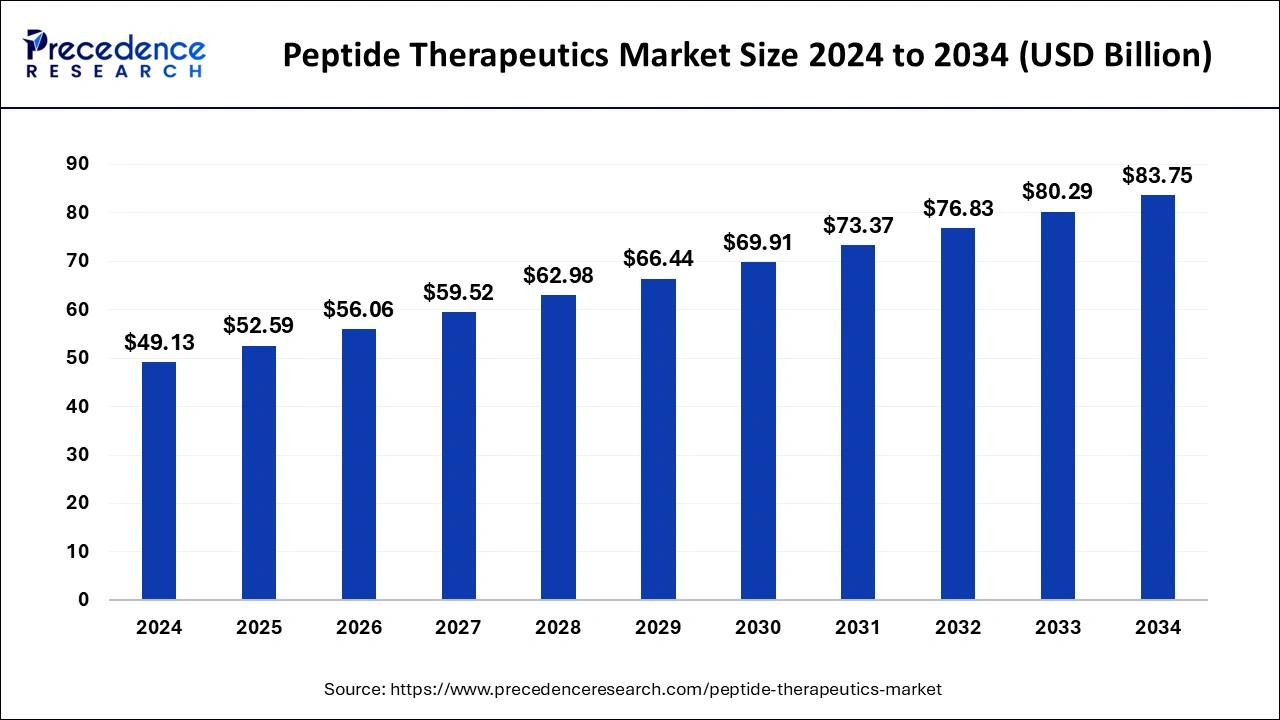

The global peptide therapeutics market size is calculated at USD 52.59 billion in 2025 and is forecasted to reach around USD 83.75 billion by 2034, accelerating at a CAGR of 5.31% from 2025 to 2034. The North America peptide therapeutics market size surpassed USD 22.58 billion in 2024 and is expanding at a CAGR of 5.26% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global peptide therapeutics market size was estimated at USD 49.13 billion in 2024 and is predicted to increase from USD 52.59 billion in 2025 to approximately USD 83.75 billion by 2034, expanding at a CAGR of 5.31% from 2025 to 2034.The peptide therapeutics market growth is driven by an increasing prevalence of cancer and other metabolic diseases.

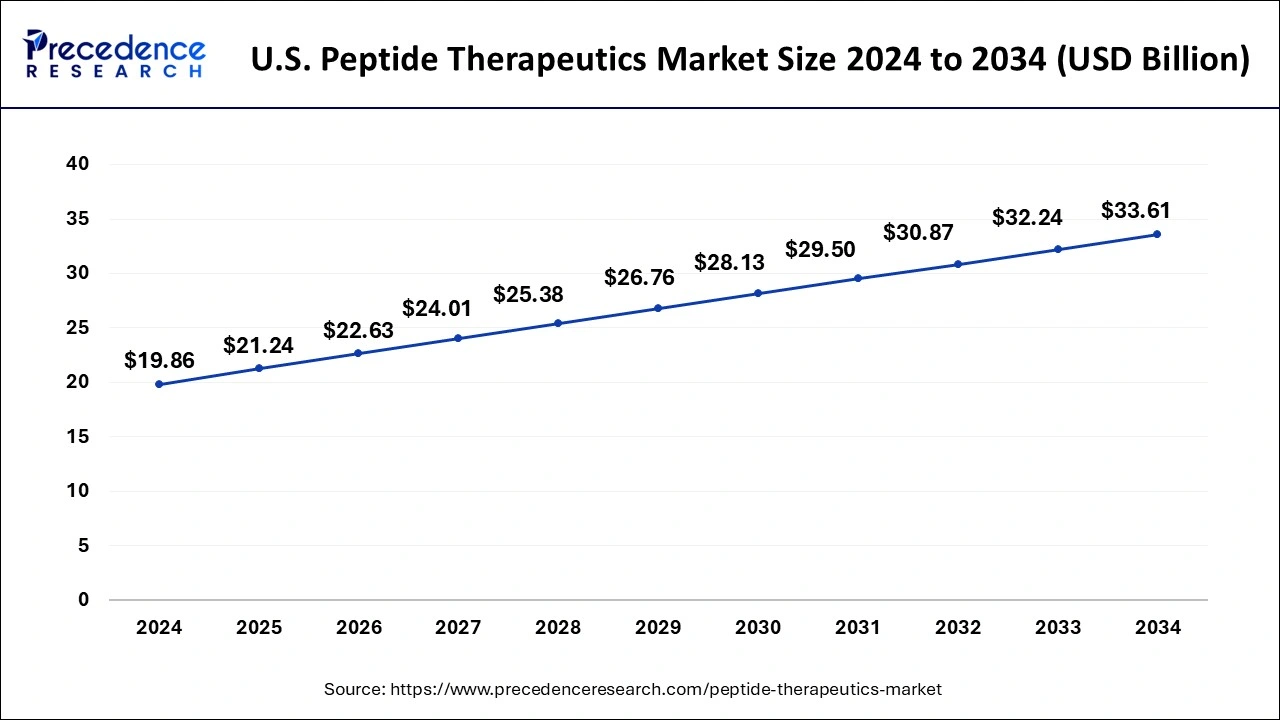

The US peptide therapeutics market size was estimated at USD 19.86 billion in 2024 and is anticipated to reach around USD 33.61 billion by 2034, with a CAGR of 5.23% from 2025 to 2034.

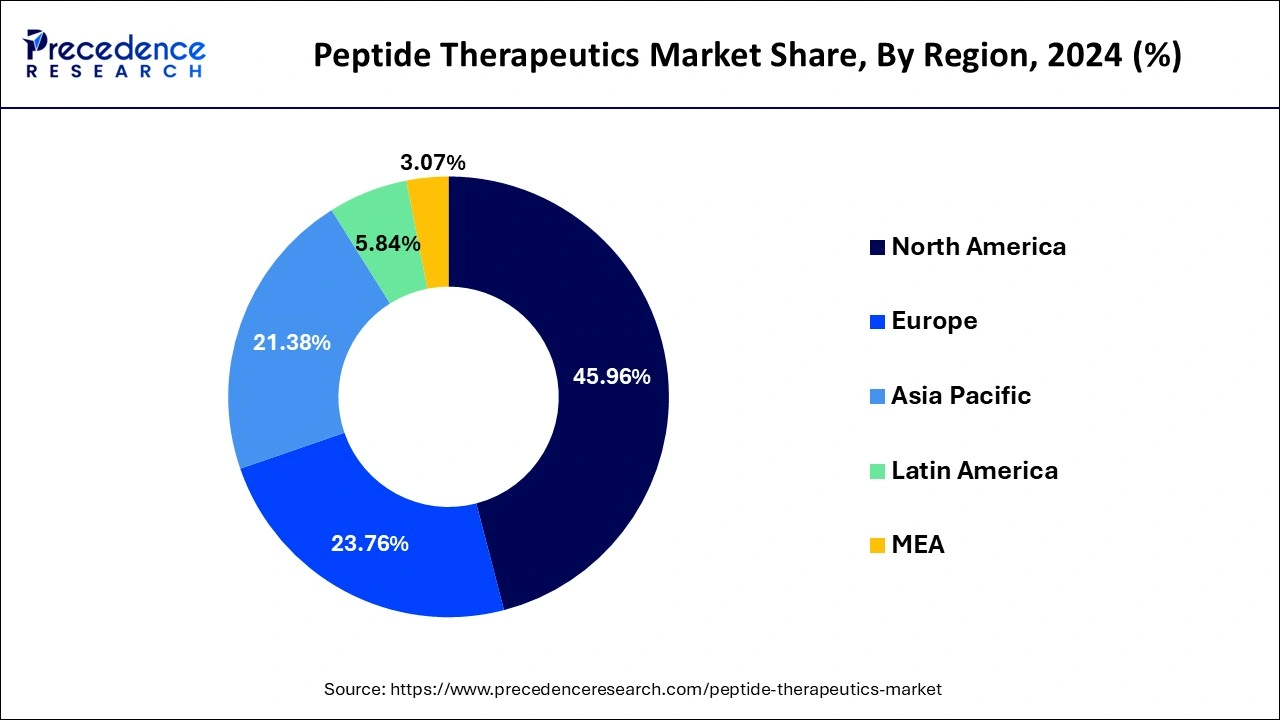

North America led the global peptide therapeutics market and captured more than 45.96% of the revenue share in 2024. The market's growth in North America is attributed to the rising demand for peptide drug products to treat cancer in the region.

The development of the biotechnology and pharmaceutical industries has fueled market growth in North America. Europe shows potential market growth for peptides in the region. The well-established healthcare industry in Europe is considered a significant factor in the development of the market. However, high-priced peptide drugs in Europe hamper the growth of the market.

Asia Pacific is anticipated to witness significant growth during 2025-2034. The rising prevalence of diabetes and infectious diseases is a driving factor for developing the market in the Asia Pacific. Developing the healthcare and biotech sectors in India and China is considered to fuel the demand for peptide drugs in the upcoming years. The growth of the peptide therapeutics market in the Asia Pacific is driven because of the availability of low-cost raw materials in the region.

The rising development of novel peptide drugs for treating respiratory disorders and increasing investments in R&D activities propel the growth of the peptide therapeutics market in Latin America. Brazil is expected to dominate the peptide therapeutics market owing to the country's increased number of peptide therapies. Moreover, rapid adoption and increased awareness of peptide therapies in the Middle East and Africa will boost the demand for peptide therapeutics in these regions during the forecast period.

Naturally occurring peptides are strings of amino acids present in all living organisms. Peptide therapeutics are used for the treatment of various diseases. Peptides act as anti-infective growth hormones and even serve as ion channel ligands. Peptide therapeutics are capable of performing the same functions.

The development in biotech and pharmaceutical industries worldwide has proven that peptide therapeutics can stimulate essential hormones. With growing age, peptide production in the human body is disrupted. Peptide therapeutics safely and effectively reintroduce vital peptides into the body.

Peptide therapeutics treat neurological issues, diabetes, cancer, heart issues, and numerous other diseases. Moreover, peptide therapeutics offer muscle endurance, pain relief, injury recovery, and help in weight loss. Peptides are directly delivered into the bloodstream during the therapy. Peptide therapeutics have advanced rapidly in the pharmaceutical and biotech industries. Peptide therapeutics have gained popularity in the global nutrition industry in recent years.

Furthermore, the healthcare sector across the globe has adopted the peptide drug delivery option rapidly. Peptide therapeutics have positively impacted human health by improving stamina and immunity and reducing undesired side effects caused by prolonged chronic diseases.

| Report Coverage | Details |

| Market Size in 2025 | USD 52.59 Billion |

| Market Size by 2034 | USD 83.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By Type, By Route of Administration, By Distribution Channel and By Synthesis Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increased deployment of peptide molecules in the development of COVID-19 vaccines has already surged the growth of the global peptide therapeutics market. The market is showing potential growth and is predicted to maintain the same during the forecast period. Increasing cases of cancer and other metabolic disorders have boosted the demand for novel peptide conjugates.

The increased demand for peptide conjugates in treating various conditions has forced vital players into strategic partnerships, collaboration, and agreements with other companies to expand their business portfolios.

The significant growth of the global peptide therapeutics market is driven by increased research and development (R&D) activities and investments in the market. Researchers focus on discovering peptide drugs to deal with diabetes and infectious disorders. The global peptide therapeutics market is predicted to witness noticeable growth in upcoming years owing to the increased clinical trials of targeted diseases.

The increasing geriatric population is a major driving factor for developing the peptide therapeutics market. Moreover, technological advancements in the pharmaceutical industry are considered to drive the market's growth during the forecast period of 2024-2033. Several peptide conjugates help reduce inflammation, act as antioxidants and promote weight loss. A surge in the health & nutrition industry has boosted the demand for peptide drugs.

However, the high cost associated with peptide drug discovery and development is likely to hamper the growth of the global peptide therapeutics market. Stringent regulations imposed by several governments for the development and manufacturing of peptide drugs are seen as a major restraining factor for the growth of the peptide therapeutics market. Furthermore, the risk of side effects caused by the longtime consumption of peptide drugs creates an obstacle to market growth.

The global peptide therapeutics market is segmented into gastrointestinal disorders, metabolic disorders, neurological disorders, cancer & others. A metabolic disorder is a dominating segment in the global peptide therapeutics market. The rising prevalence of metabolic conditions such as diabetes and heart disease has fueled the segment's growth. The growing geriatric population globally is considered a major driving factor for the development of the metabolic disorder segment.

The cancer segment is the second-largest and fastest-growing global peptide therapeutics market. Peptides are considered a potential cytotoxic agent that can offer effective cancer treatment. Increased demand for quick yet effective remedies by the oncology sector has surged the growth of the cancer segment in recent years. Increasing discoveries for parenteral peptide drugs for cancer treatment is another driving factor for developing a segment in the global peptide therapeutics market.

Peptide Therapeutics Market Revenue (USD Million), By Application, 2022-2024

| Application | 2022 | 2023 | 2024 |

| Gastrointestinal Disorder | 4.31 | 4.61 | 5.01 |

| Metabolic Disorder | 9.92 | 10.46 | 11.20 |

| Neurological Disorder | 3.02 | 3.20 | 3.45 |

| Cancer | 11.64 | 12.38 | 13.36 |

| Others | 14.23 | 15.02 | 16.10 |

The global peptide therapeutics market is segmented into generic & innovative. The innovative segment dominates the global peptide therapeutics market and captured 60.40% of the revenue share in 2024. The increased investments in research and development (R&D) activities to discover novel peptide conjugates drive the growth of the innovative segment. Increasing prescriptions for peptide drugs to treat various disorders boosts the demand for innovative peptides.

Rising healthcare expenses and high costs associated with peptide therapies are considered to grow the generic segment during the forecast period. The rising focus of several governments on the production and adoption of generic peptide drugs will fuel the growth of the generic segment.

The global peptide therapeutics market is segmented into oral, parenteral, pulmonary, mucosal & others. The parenteral segments dominated the market in 2024 with a revenue share of around 76.03%. Most peptide drugs are delivered by injection, due to which the parenteral route of administration segment dominates the global peptide therapeutics market.

The parenteral route of administration allows faster, more effective, and easy absorption of drugs. Researchers are focused on discovering novel peptide drugs that can be administered parenterally. On the other hand, oral and pulmonary segments in the route of administration are expected to witness significant growth during the forecast period.

The development of the oral segment is driven by higher patient acceptability for oral drugs. However, the risk of inflammation caused by the pulmonary route of administration is likely to hold the growth of the pulmonary segment.

Peptide Therapeutics Market Revenue (USD Million), By Route of Administration, 2022-2024

| Route of Administration | 2022 | 2023 | 2024 |

| Oral | 4.43 | 4.72 | 5.12 |

| Parenteral | 32.77 | 34.72 | 37.35 |

| Pulmonary | 2.59 | 2.74 | 2.94 |

| Mucosal | 1.72 | 1.82 | 1.95 |

| Others | 1.60 | 1.67 | 1.76 |

The global peptide therapeutics market is segmented into Hospital pharmacies, retail pharmacies and online drug stores. The Hospital pharmacies segment is further subdivided into private and public Hospital pharmacies. The hospital pharmacies segment dominated the global market with the largest share of 39.90% in 2024. Peptide hormones are required to be prescribed by doctors; hospital pharmacies offer better input in prescribing decisions.

Hospital pharmacies are also widely preferred as they carry patient data and medical history. The retail pharmacies segment is the fastest-growing global peptide therapeutics market. The online drugstore segment is predicted to be lucrative during the forecast period.

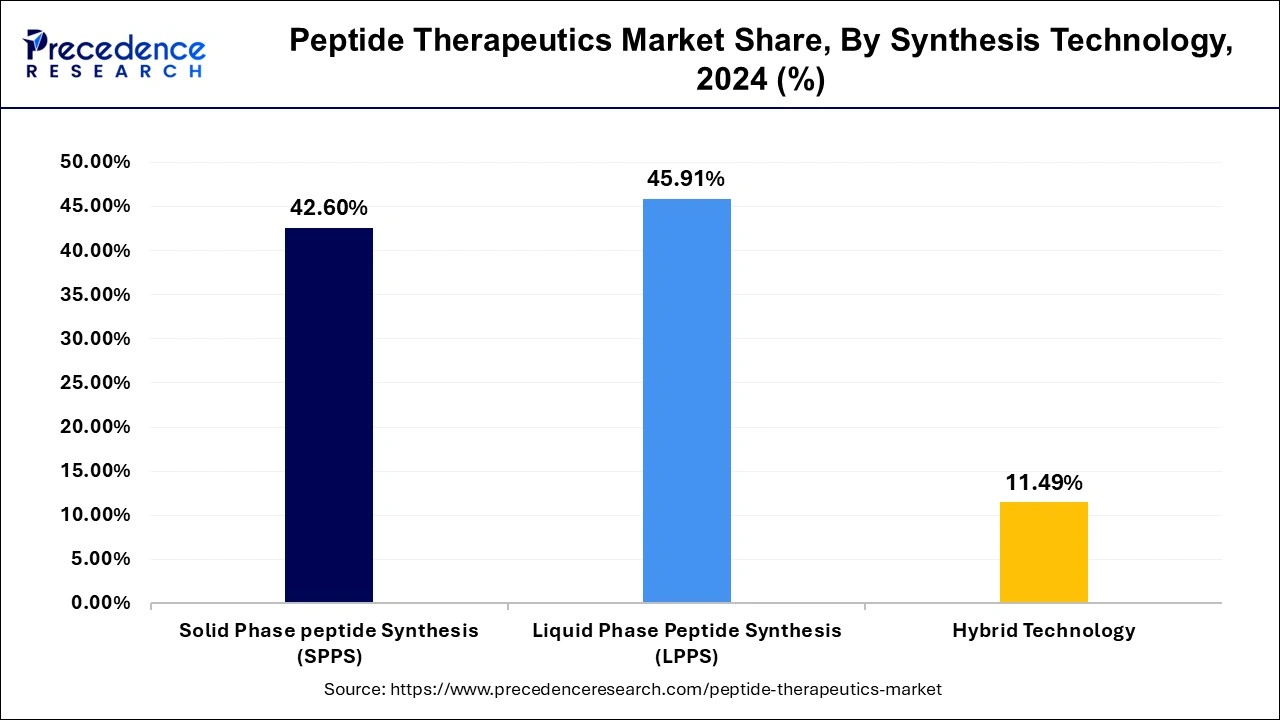

Synthesis technology divides the global peptide therapeutics market into solid-phase peptide synthesis (SPPS), liquid-phase peptide synthesis (LPPS)& hybrid technology. The liquid-phase peptide synthesis segment dominated the market and generated more than 45.91% of the revenue share in 2024.

LPPS technology is considered the most classical and pure approach to synthesis; this factor has boosted the demand for LPPS in recent years. Many researchers and developers have shifted to liquid-phase peptide synthesis from solid-phase. On the other hand, the solid phase peptide synthesis segment is showing significant growth in the market as it offers a faster yet effective synthesis process.

By Application

By Type

By Route of Administration

By Distribution Channel

By Synthesis Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024