October 2024

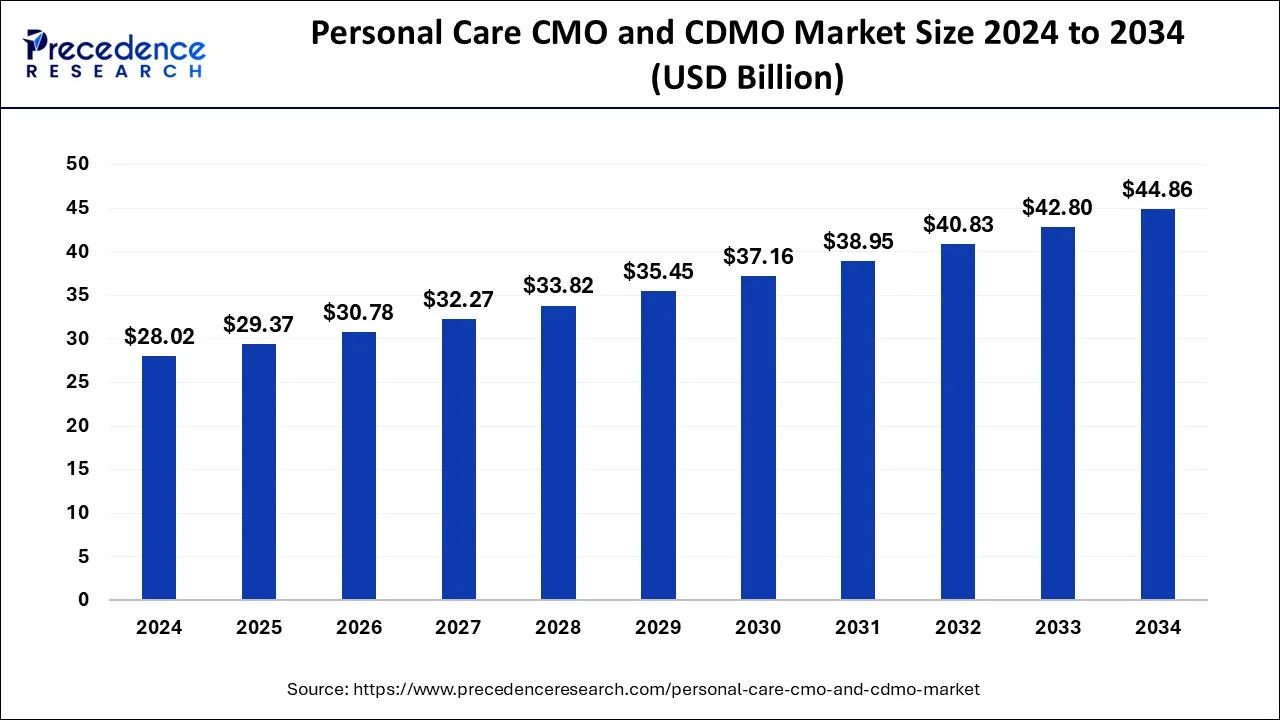

The global personal care CMO and CDMO market size is calculated at USD 29.37 billion in 2025 and is forecasted to reach around USD 44.86 billion by 2034, accelerating at a CAGR of 5.37% from 2025 to 2034. The Asia Pacific personal care CMO and CDMO market size accounted for USD 14.69 billion in 2025 and is expanding at a CAGR of 5.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global personal care CMO and CDMO market size was USD 28.02 billion in 2024, grew to USD 29.37 billion in 2025 and is predicted to surpass around USD 44.86 billion by 2034, expanding at a CAGR of 5.37% between 2025 and 2034. The growing demand for cosmetics and personal care is the key factor driving the market's growth. Cosmetic brands are seeking new contract manufacturing models, and innovations in cosmetics manufacturing can fuel market growth further.

Artificial Intelligence (AI) is transforming the way consumers deal with cosmetics. With access to a wide range of data and insights, AI tools can optimize formulas, help identify trends, and suggest completely new products specific to customers' demands. Furthermore, Through AI-powered skin care applications, users can get individualized skin assessment and diagnosis applications that can analyze the skin, detect skin-related issues, and then advise skincare routines and products to the end user.

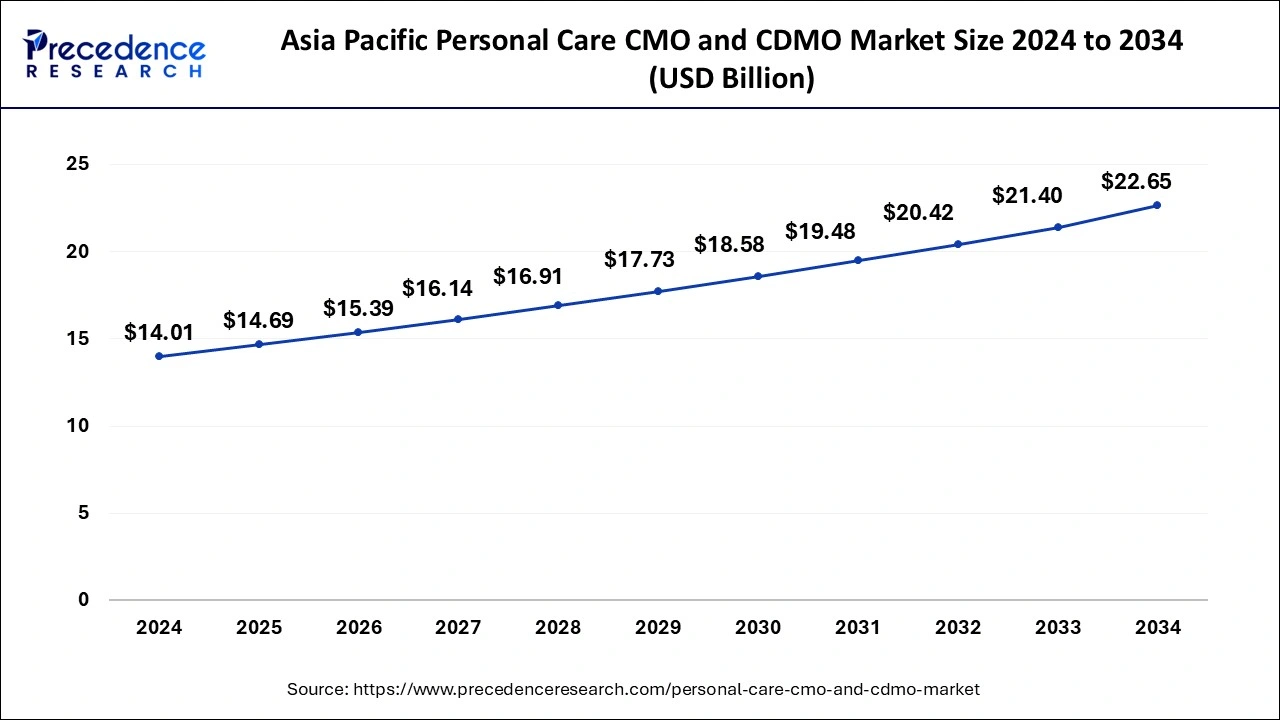

The Asia Pacific personal care CMO and CDMO market size was exhibited at USD 14.01 billion in 2024 and is projected to surpass around USD 22.65 billion by 2034, growing at a CAGR of 5.48% from 2025 to 2034.

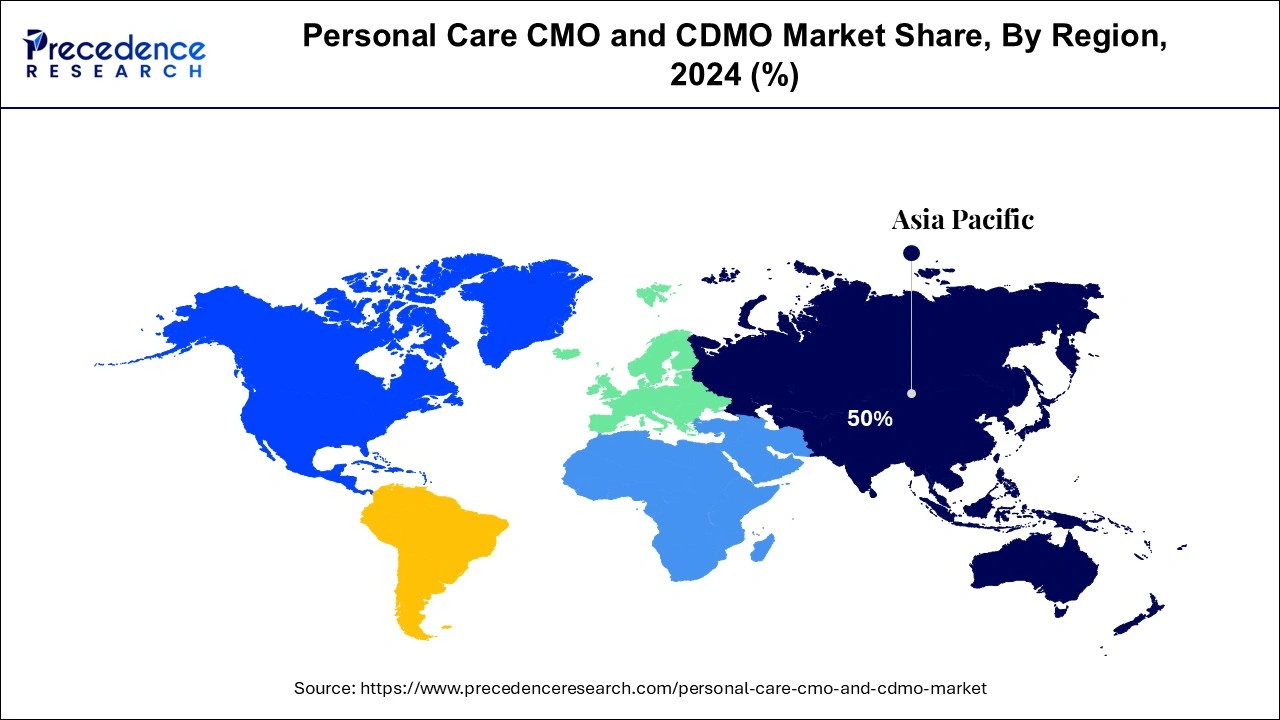

Asia Pacific led the personal care CMO and CDMO market in 2024. The dominance of the region can be attributed to the increasing cosmetic production, innovation, and strong cost-efficiency provided by key players in nations such as China and India. Furthermore, increasing demand for different product categories and ongoing technological expertise and innovation in the region boosted the region's market growth.

North America is expected to witness lucrative growth over the projected period. The growth of the region can be driven by the strong presence of established production companies and increasing advancement in personal care products. However, the expansion of retail chains for cosmetics products is also a significant factor fuelling the market expansion in the region.

In the personal care field, CMOs and CDMOs are the key organizations that offer outsourced services to various businesses desiring to manufacture and package personal care goods. Manufacturing and packaging of a wide range of personal care products such as haircare, oral care, skincare, and cosmetics are the special areas for a CMO. Also, by utilizing an integrated strategy, organizations can simplify the whole manufacturing process and create high-quality products by using the CDMO's experience.

Beauty Cosmetics and Skincare Imports by Country (2023)

| Country | Import in billions of USD |

| Mainland China | $14.4 billion |

| United States | $6.8 billion |

| Hong Kong | $5.8 billion |

| Singapore | $3 billion |

| Germany | $2.9 billion |

| United Kingdom | $2.8 billion |

| France | $2.6 billion |

| Netherlands | $2.04 billion |

| Canada | $1.97 billion |

| Macao | $1.63 billion |

| Report Coverage | Details |

| Market Size by 2034 | USD 44.86 Billion |

| Market Size in 2024 | USD 28.02 Billion |

| Market Size in 2025 | USD 29.37 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.37% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Services, Product Category, Form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for skincare products

The demand for sunscreen lotions face care creams, and face serums are increasing rapidly, along with the growing trend of using organic and natural skincare solutions. Additionally, this growth is supported by the rising awareness of the benefits of various skin care products and the increasing popularity of online purchases. Also, major market players are seeking external resources and expertise to streamline their operations and improve product development; hence, the demand for CMO and CDMO services is expanding in the personal care CMO and CDMO market.

Threat over intellectual property protection

Intellectual property protection threats act as a substantial barrier to a partnership between cosmetic companies' CMOs and CDMOs. Personal care products often depend on manufacturing processes, proprietary formulations, and branding strategies, which makes IP protection important for protecting innovations in the personal care CMO and CDMO market. However, collaborating with CMOs and CDMOs involves the sharing of confidential data, raising concerns of probable IP theft or leakage.

Growing demand for ingredient-based cosmetics

The rising utilization of ingredient-based cosmetics is the major trend in the personal care CMO And CDMO market. The need for skincare products with natural ingredients is rising due to factors such as changing weather conditions, environmental pollution, and raised disposable income. Furthermore, ingredient-based cosmetics contain a wide range of ingredients like fragrances, emulsifiers, antioxidants, and hyaluronic acid, which not only improve the texture of the skin but also give a natural glow to it, which can provide anti-aging care.

The manufacturing segment dominated the personal care CMO And CDMO market in 2024. The dominance of the segment can be attributed to the growing need for streamlined production processes, enhanced cosmetic formulations, and a growing product portfolio. Additionally, the Adoption of plant-based ingredients and increasing product launches can contribute to the segment's expansion soon. The expanding cosmetic brands launched by entrepreneurs and celebrities have also led to increasing requirements for outsourcing.

The documentation segment is expected to grow at a significant rate over the forecast period. This growth can be credited to rising regulatory compliance, quality control, and product safety throughout the product's life. According to the regulation, every personal care product in the market must have a dossier called PIF, which has safety data about the product. The files are not meant to be registered or submitted, but the other legal requirements should be well documented and fulfilled.

The skincare segment led the personal care CMO And CDMO market in 2024 by holding the largest market share. This is due to rising interest in self-care products and health-promoting practices, which have led to this surge. These products have a substantial ability to address an extensive range of skin-related problems, including pimples, acne, and others. Furthermore, the active ingredients in this skincare product can repair damaged skin and rejuvenate new cells, coupled with strengthening the skin barrier.

The makeup & color cosmetics segment is expected to show significant growth during the projected period. The growth of the segment can be driven by a surge in product innovations and ongoing upgrades in color cosmetics and makeup products. Also, social media influencers showcase their makeup looks, which has helped stimulate the use of color cosmetics. Additionally, Health-conscious consumers are seeking hybrid products that blend skincare advantages with color cosmetics, which can create new trends in the personal care CMO and CDMO market.

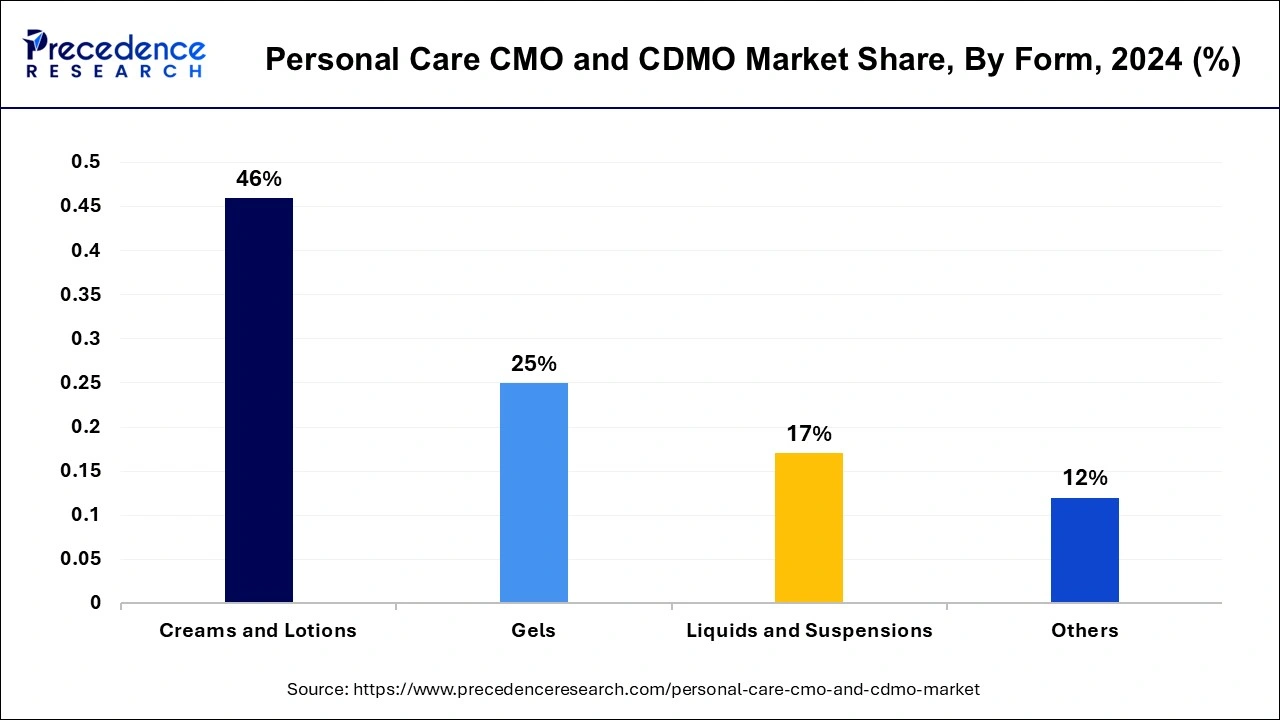

In 2024, the creams & lotions segment dominated the personal care CMO And CDMO market. The dominance of the segment can be linked to the rising requirement for cost-effective products and increasing emphasis on skin appearance and hydration. In addition, there is a growing trend towards gender-specific skincare products. For example, the male skincare market is expanding because men are becoming more aware of the benefits of skincare and searching for products that are specific to their needs.

The liquids and suspensions segment is estimated to grow at significant rate over the studied period. This is because of substantial advancements in liquid formulation along with the growing focus on innovations by market players. Moreover, the growth in web penetration globally has added to the expansion of the segment. Changing lifestyles and fashion preferences are further creating lucrative growth opportunities for the personal care CMO and CDMO market.

By Services

By Product Category

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

June 2024

November 2024