January 2025

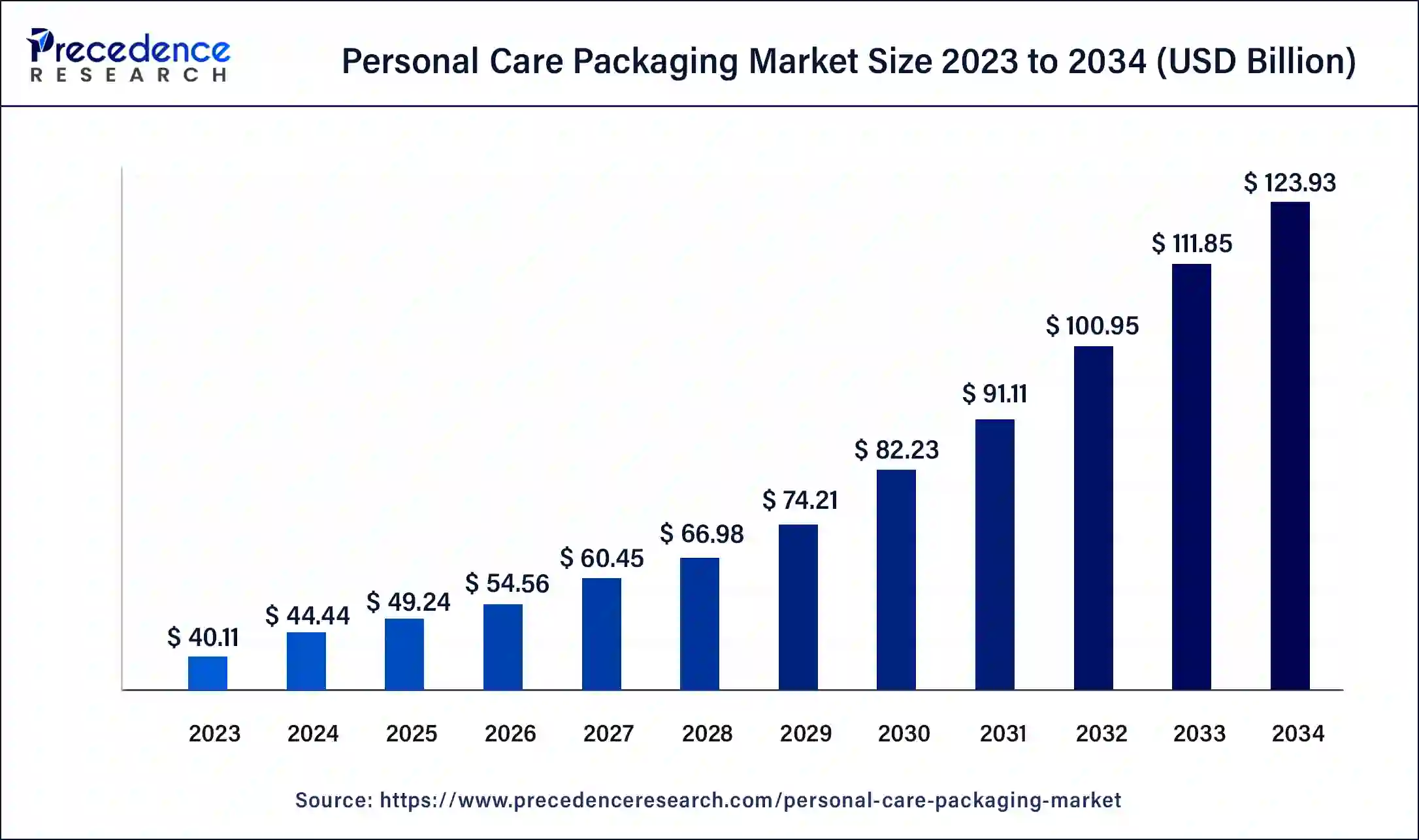

The global personal care packaging market size was USD 40.11 billion in 2023, calculated at USD 44.44 billion in 2024 and is projected to surpass around USD 123.93 billion by 2034, expanding at a CAGR of 10.8% from 2024 to 2034.

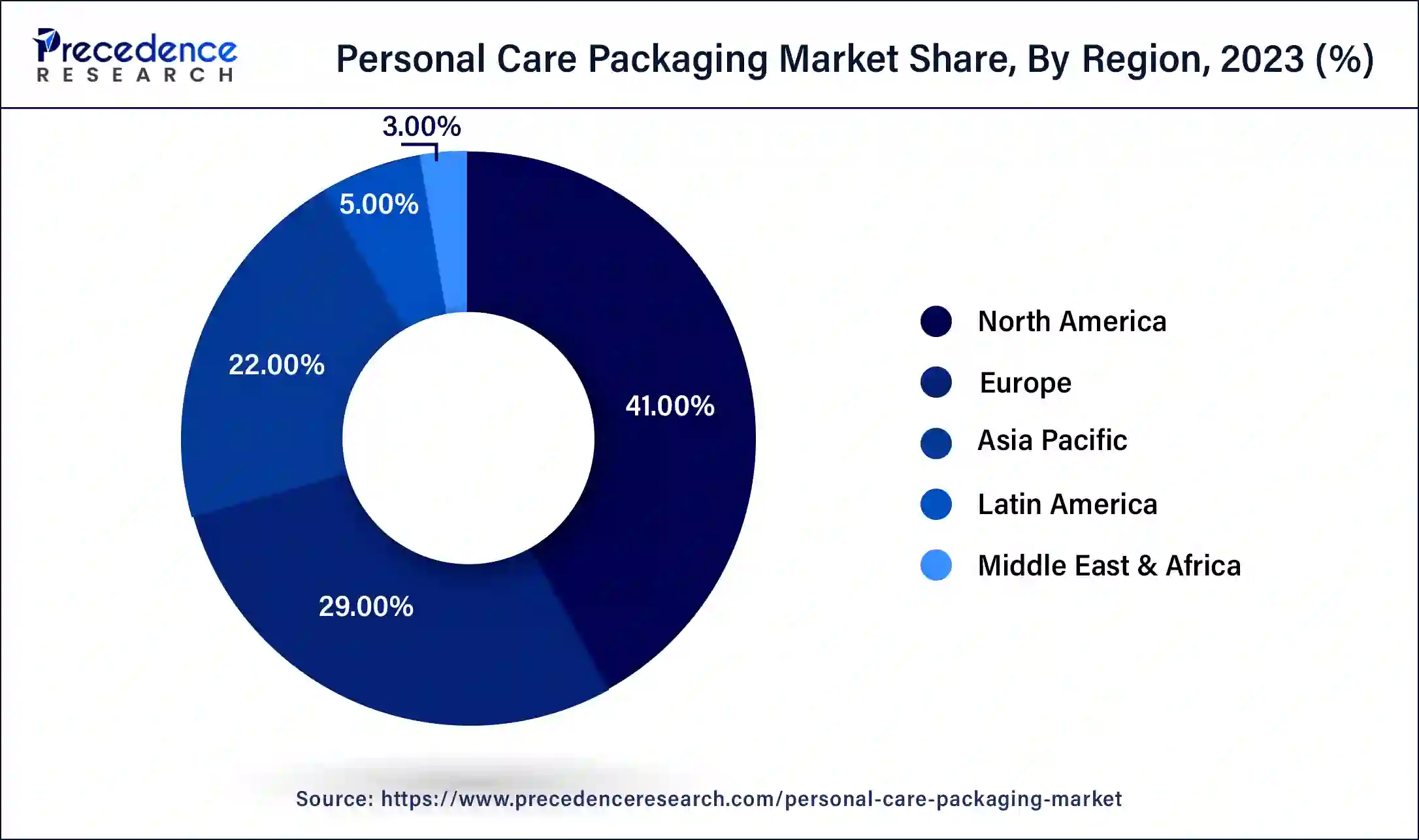

The global personal care packaging market size accounted for USD 44.44 billion in 2024 and is expected to be worth around USD 123.93 billion by 2034, at a CAGR of 10.8% from 2024 to 2034. The North America personal care packaging market size reached USD 16.45 billion in 2023. Emerging economies and rising awareness about sustainability in packaging products are expected to drive the growth of the personal care packaging market.

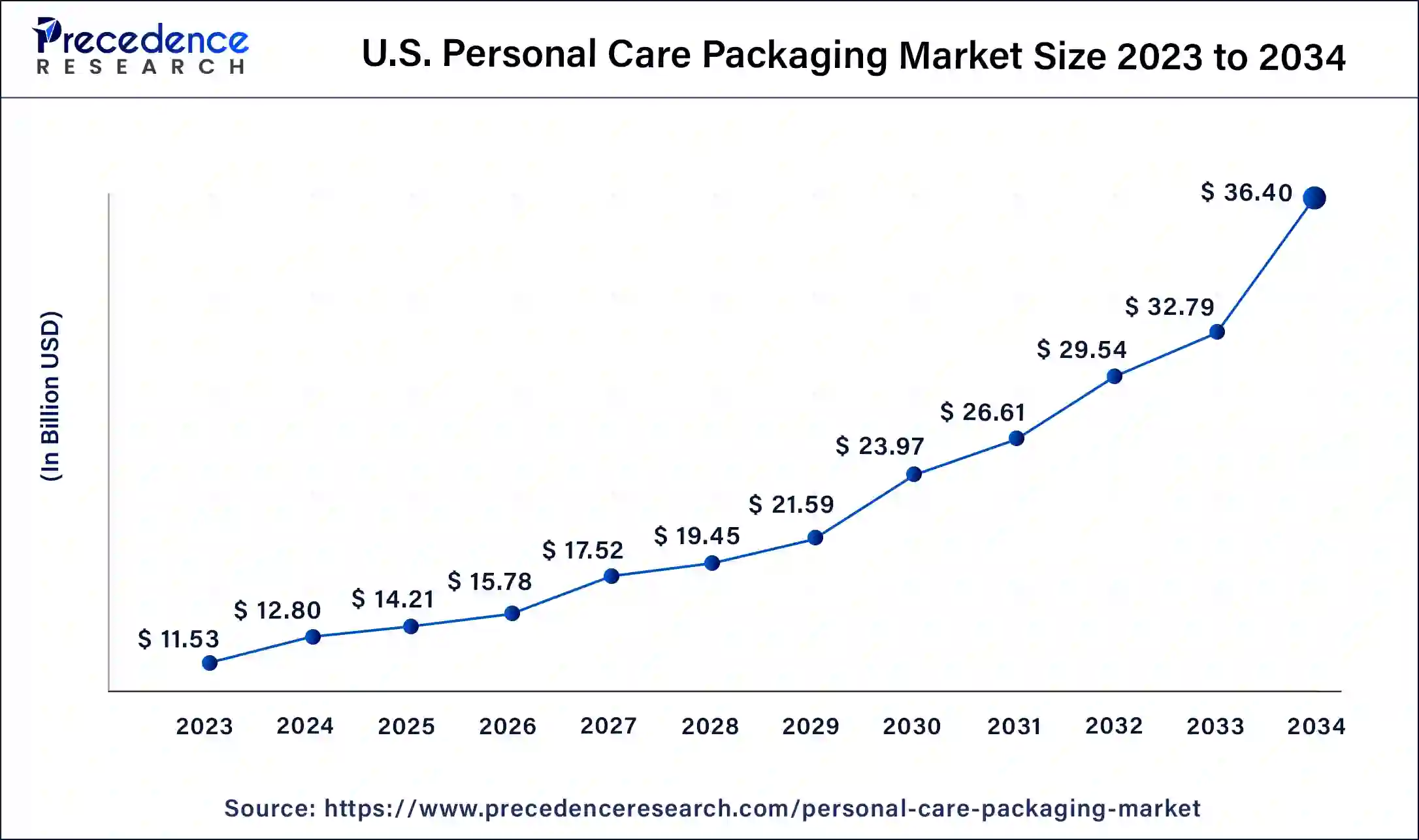

The U.S. personal care packaging market size was estimated at USD 11.53 billion in 2023 and is predicted to be worth around USD 36.40 billion by 2034, at a CAGR of 11% from 2024 to 2034.

North America dominated the global personal care packaging market in 2023 with the largest revenue share. The growth of the market in North America is attributed to the rising disposable income and increased demand for cosmetic products. The United States is the largest market for personal care packaging in North America, owing to the high consumer demand for personal care products and premium packaging solutions. The demand for eco-friendly and sustainable packaging solutions is also increasing in the region, driven by the growing awareness about sustainability and the environment.

Asia Pacific is another significant marketplace for the personal care packaging market. The region is expected to witness significant growth in the coming years due to factors such as increasing population, rising disposable income, and growing consumer awareness about personal hygiene. China, India, Japan, and South Korea are significant marketplaces for personal care packaging solutions in Asia Pacific. The demand for personal care products is increasing rapidly in these countries, driving the demand for personal care packaging solutions. Additionally, the growing middle class in these countries is increasing their purchasing power, leading to a higher demand for premium personal care products and innovative packaging solutions.

The Asia Pacific personal care packaging market is dominated by plastic packaging, owing to its cost-effectiveness and durability. However, there is a growing trend towards using sustainable materials such as bioplastics, paperboard, and glass to reduce environmental impact. The demand for eco-friendly packaging solutions is increasing in the region, driven by the growing awareness about sustainability and the environment.

The personal care packaging market refers to the industry that produces packaging materials for personal care products such as cosmetics, skincare, hair care, and other related items.

Consumers are seeking out products that are not only effective but also environmentally responsible, which has driven demand for packaging materials that are biodegradable, compostable sustainable, or made from recycled materials. With the changing consumer preferences or behavior toward packaging, market players have started focusing on the development of sustainable and eco-friendly packaging solutions.

In March 2023, a leading market player, Quadpack, unveiled its Regula, a mini-sized affordable and convenient jar packaging solution for the personal care and cosmetics industry. The jar packaging is offered in a recycled version with 100% recyclable PET material. The jar packaging is ideal for compact personal care products that come in 15-30ml packaging.

In April 2022, Shiseido announced the launch of its sustainable packaging solutions, specially designed for e-commerce consumers. The new packaging solution includes a transparent, eco-friendly bag made with polyvinyl alcohol, water, glycerin, and starch, which is considered a ‘green bag.’ The brand has also announced replacing the bubble wrap packaging with more environmentally friendly options such as honeycomb paper wrapping.

The personal care industry is experiencing strong growth, driven by factors such as changing consumer preferences, an aging population, and increasing disposable incomes. This drives demand for personal care packaging solutions that protect and preserve these products. Urbanization and changing lifestyle patterns drive demand for convenient, on-the-go personal care products requiring innovative and portable packaging solutions.

The growing popularity of personal care products is driving innovation in packaging materials, focusing on materials that can protect and preserve these products while being environmentally friendly. For example, refillable and compostable plastic or glass packaging are increasingly used in personal care packaging.

The enormous growth of the market is attributed to advancements in technology. Advances in technology are enabling new and innovative packaging solutions that can better protect and preserve personal care products. For example, new materials such as biodegradable plastics and smart packaging solutions can monitor product freshness.

For instance, In January 2023, a South Korea-based company, CJ Biomaterials, announced that it had developed its first consumer brand application using packaging application; the new technology blends PHA and PLA for packaging solutions, which shows significant improvements in mechanical properties such as toughness and ductility.

Personal care packaging is an essential aspect of branding and marketing, with packaging designs and materials often used to differentiate products and create a competitive advantage in the market, the rising requirements for marketing and branding to improve business insights, companies are focusing on packaging solutions. This is another major factor in boosting the growth of the personal care packaging market.

| Report Coverage | Details |

| Market Size in 2023 | USD 40.11 Billion |

| Market Size in 2024 | USD 44.44 Billion |

| Market Size by 2034 | USD 123.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.8% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Packaging Type, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for refillable and economical packaging for personal care products

Consumers are becoming increasingly conscious of the impact of their purchases on the environment and are looking for ways to reduce waste and minimize their carbon footprint. Refillable packaging offers an attractive solution to this problem, allowing consumers to reuse the same container multiple times, reducing the amount of waste generated. By reducing the amount of packaging material used, manufacturers can save on production costs and demonstrate their commitment to sustainability; this can be especially appealing for high-end or luxury personal care products. In addition, refillable packaging can also be more economical for consumers in the long run, as they can purchase refills of their favorite personal care products at a lower cost than buying a new container each time.

In March 2023, Italy-based, Baralan unveiled its new glass and refillable packaging solutions for personal care products, including clean beauty, nail color, and multiple skincare products. The new packaging solutions have been launched as a part of its Cosmopack Bologna participation. The company will provide glass and refillable packaging in various shapes that offer a sleek and modern appearance with an easy grip.

Improper supply chain management

Improper supply chain management can significantly restrain the growth of the personal care packaging market. Personal care packaging materials are often derived from petrochemicals, which can be subject to supply chain disruptions due to political instability, natural disasters, or other factors; this can result in shortages of key raw materials, making it difficult for companies to meet demand. Personal care packaging must meet stringent quality standards to ensure it is safe for consumers. Ensuring consistent quality across multiple suppliers and manufacturing locations can be challenging, especially if there are variations in raw materials or production processes.

Rise of digitization

Digital technologies such as QR codes, NFC tags, and augmented reality can be used to create interactive packaging that engages consumers and provides a more personalized experience. Digitization can help companies to better manage their supply chains and reduce costs. For example, sensors can be used to track inventory levels in real-time, allowing companies to optimize their supply chain and reduce waste.

Digitization will enable companies to collect consumer preferences and behavior data, which can be used to develop new products and packaging solutions that better meet consumer needs. Overall, the rise of digitization presents several opportunities for personal care packaging companies to innovate and differentiate themselves from their competitors.

The bottles segment dominated the market in 2023; the segment is predicted to maintain its dominance during the forecast period due to rising consumption of shower gel and liquid soaps across the globe. Additionally, the convenience, protection, and hygiene assurance offered by bottle packaging have supported the segment’s growth. The versatility of easy customization on bottle packaging is another factor for the adoption of bottle packaging by multiple market players.

The rising awareness about environmental issues has forced market players to adopt innovative ideas associated with bottle packaging. Returning empty bottles to the manufacturers, recycling plastic bottles, and developing biodegradable material and compact-sized bottles are a few innovations the personal care packaging market has witnessed.

The tube segment is expected to register the fastest growth during the forecast period, and the rising consumption of liquid or semi-liquid cosmetics products is expected to boost the development of the tube segment in upcoming years. The increasing consumer preference for tube packaging is attributed to portability, quantity control, cost-effectiveness, and hygiene factors.

The jars segment is predicted to be the most lucrative segment of the personal care packaging market. Aesthetic appeal, product visibility, branding opportunity for companies, reusability, product protection, and durability are a few significant functional benefits that act as driving factors for the growth of the jars packaging segment in the global personal care packaging market.

The cans segment is anticipated to lose its significance during the forecast period due to rising awareness about the harmful effects of toxic materials used in the production of cans. Along with this, the complexity of cans production and the availability of flexible alternatives for cans are affecting the growth of the cans segment.

The rigid plastic segment dominated the global personal care packaging market in 2023; the segment will continue to witness a noticeable rise during the forecast period. The rigid plastic material offers product protection and is comparatively lighter in weight. Additionally, rigid plastic is durable; it can withstand the wear and tear of frequent handling and transport without breaking or leaking. The rising production of recyclable rigid plastic for packaging solutions is expected to supplement the segment’s growth.

The flexible segment for personal care packaging is expected to remain the most attractive segment of the market during the period analyzed. Flexible packaging is easy to use and can be squeezed or twisted to dispense the product quickly; this is beneficial for liquid or semi-liquid personal care products, including cosmetics. Flexible packaging is often more cost-effective than rigid packaging options because it requires fewer materials and less energy to produce. The cost-effective packaging option, along with the durability offered by flexible packaging, is supplementing the growth of the flexible segment.

The skin care segment dominated the personal care packaging market in 2023; the segment is expected to maintain its dominance during the forecast period. Increased consumption of skin care products with rising disposable income has boosted the sales of skin care products. The rising consumer preference for convenient, sustainable, and travel-friendly/portable packaging for skin care products will supplement the segment’s growth during the forecast period.

The bath and shower segment is expected to witness the fastest growth owing to the rising consumption of liquid soaps over the traditional soap types due to hygiene concerns. Manufacturers are developing innovative packaging solutions for shower gels, liquid soaps, and other bath and shower products that cater to the specific needs of skin care products, such as airless dispensers, droppers, and pumps. Such innovations in packaging are supplementing the segment’s growth.

The cosmetic segment shows promising growth during the forecast period. The rising focus on the premiumization of cosmetic product packaging supplements the segment’s growth. As the cosmetics industry continues to grow, there is a corresponding increase in demand for packaging materials.

Segments Covered in the Report

By Packaging Type

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2023

February 2025

May 2025