April 2025

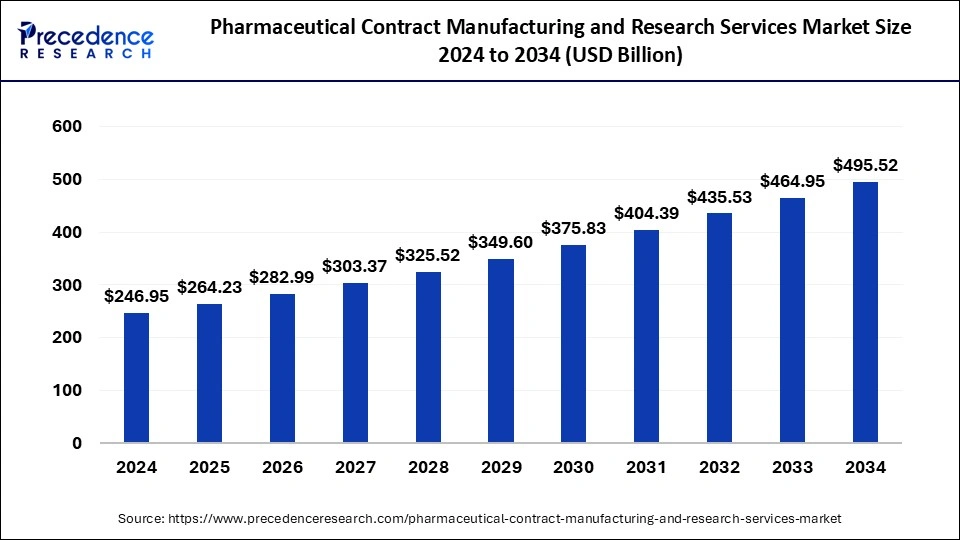

The global pharmaceutical contract manufacturing and research services market size is calculated at USD 264.23 billion in 2025 and is forecasted to reach around USD 495.52 billion by 2034, accelerating at a CAGR of 7.24% from 2025 to 2034. The Asia Pacific market size surpassed USD 102.68 billion in 2024 and is expanding at a CAGR of 6.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical contract manufacturing and research services market size accounted for USD 246.95 billion in 2024 and is predicted to increase from USD 264.23 billion in 2025 to approximately USD 495.52 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034.

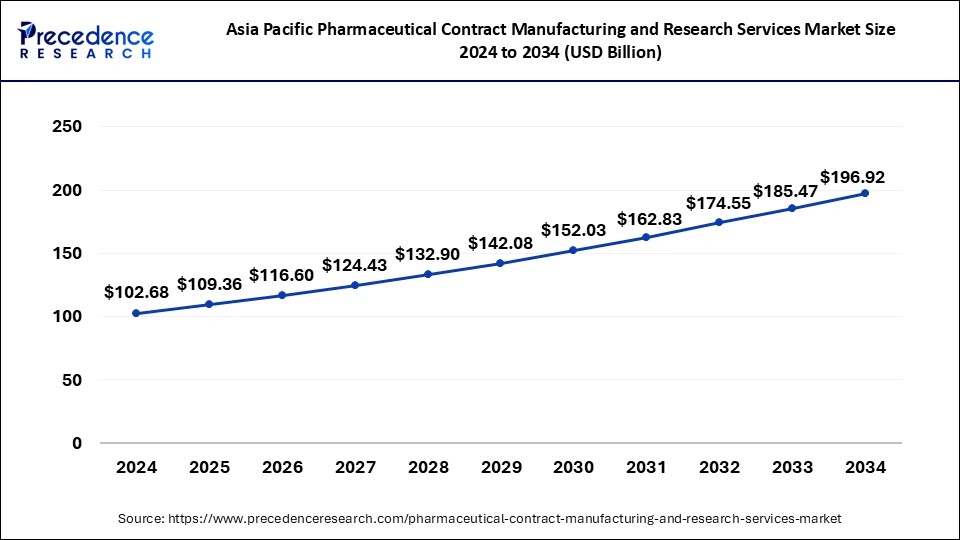

The Asia Pacific pharmaceutical contract manufacturing and research services market size was exhibited at USD 102.68 billion in 2024 and is projected to be worth around USD 196.62 billion by 2034, growing at a CAGR of 6.75% from 2025 to 2034.

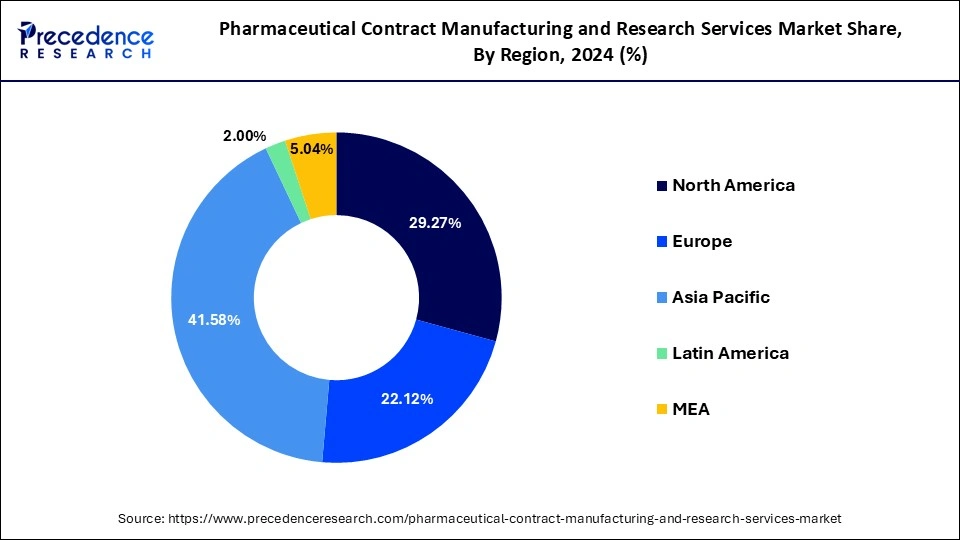

Asia Pacific dominated the pharmaceutical contract manufacturing and research services market in 2024. The growth of the region is attributed to its large base of generic drug manufacturers, growing scientific base and capability, and enhanced manufacturing facilities by major key players in the last two to three years. Additionally, Low labor and manufacturing costs have been the major factor that attracted major investors from pharma companies in developing economies such as China and India.

The North America is estimated to witness extensive growth over the forecast period owing to the high number of clinical trials, broad active pharmaceutical ingredients production base, modern manufacturing capabilities, presence of top pharmaceutical companies, and expansion in the generics industry are all factors that contribute to the North American region’s is estimated to grow at a significant rate over the forecast period.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. Due to a rapidly ageing population, a widening imbalance between demand and supply for pharmaceutical products, the availability of a skilled workforce, and favorable government policies in developing countries in this region.

Pharmaceutical contract manufacturing is a procedure in which pharmaceutical drugs are delivered on a contract basis. Moreover, drug company engages a production company to make their drugs for them, and drug companies are generating a crucial number of products that can frequently simplify their creations by joining a manufacturing company.

In a contract, manufacturing is also referred to as a company’s production of goods under another company’s label or trademark. The contract manufacturers give services to a variety of businesses based on their designs and the requirements of their customers. While a contract research organization is a corporation that provides support to the pharmaceutical and medical device sectors in the form of contract manufacturing and research services.

The contract research organizations are designed to help corporations develop innovative medications and pharmaceuticals in specialized markets by lowering costs. The earlier manufacturer incorporates these into its product manufacturing process. A contract manufacturing organization is a company that offers to the pharmaceutical business and offers a full range of services, from medication discovery to production.

| Report Coverage | Details |

| Market Size in 2025 | USD 264.23 Billion |

| Market Size by 2034 | USD 495.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, and End-User, |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing generics demand, rising pharmaceutical research and development investments, and contract manufacturing and research services investments in advanced manufacturing technologies are driving global pharmaceutical contract manufacturing and research services market growth. The growing demand for biological therapies, a greater emphasis on specialty medicines, expansion in the nuclear medicine sector, and advances in cell and gene therapies are all expected to provide pharmaceutical contract manufacturing and research services market growth opportunities in the coming years.

A significant solution from procurement-based outsourcing is the focus of large pharmaceutical companies on strategically engaging with a small number of preferred providers. This was one of the many business characteristics that this service industry had come to expect. The service providers with the potential to provide cost and quality advantages are ready to make significant inroads and grow rapidly during the forecast period.

Many biotech and pharmaceutical businesses are outsourcing their research development to contract research groups due to increasing technological advancements and expanding globalization. Additionally, increasing investments by major prominent vendors in various clinical and non-clinical research activities outsourced by many contract research organizations services that help in cost-effective options for development products will boost the growth of the global pharmaceutical contract manufacturing and research services market during the forecast period.

The rising need for effective medications and healthcare equipment, as well as the high cost of product development and the growing patient population, are expected to drive the global pharmaceutical contract manufacturing and research services market throughout the forecast period. In addition, the pharmaceutical contract manufacturing and research services market revenue will be driven by the strict medication approval process and expanding strategic collaboration among several prominent vendors throughout the forecast period.

A key factor driving the growth of the pharmaceutical contract manufacturing and research services market is the patent expiration of various medications. Although the downfall of patents has resulted in major income and volume losses for the branded pharmaceutical business, patent expiration allows lots of new cheaper generic alternatives to enter the pharmaceutical contract manufacturing and research services market. As generic organizations outsource their production to contract manufacturing and research services, this is a favorable indicator for the growth of the pharmaceutical contract manufacturing and research services market during the forecast period.

Another key factor driving the growth of the global pharmaceutical contract manufacturing and research services market is the lower cost of producing active pharmaceutical ingredients (API), increased focus on cost reduction, and rising pricing pressure. Additionally, one of the major factors driving the growth of the pharmaceutical contract manufacturing and research services market includes staff, technology, and infrastructure, as well as increased demand as a result of the ongoing biologic drug patent cliff.

On other hand, the pharmaceutical contract manufacturing and research services market’s growth is restrained due to the stringent government regulatory frameworks and their limitations, as well as continuous improvement in the strict laws imposed by governments of emerging nations. Furthermore, due to the highly personalized character of gene and cell treatments, they can meet unmet medical requirements in the treatment of a variety of diseases or illnesses. Many pharmaceutical companies and investors have invested large resources in developing and commercializing these medicines because of their strong therapeutic potential. Thus, the above-mentioned factors are driving the growth of the market.

The increasing number of cell therapy applicants, combined with their rapid progression through the numerous stages of clinical development and their complex manufacturing process, is increased demand for facilities that provide these therapies’ manufacturing services which resulting driving the growth of the market.

The biologics segment dominated the pharmaceutical contract manufacturing and research services market in 2024. The rising demand for vaccines and biosimilars is a crucial factor driving the segment’s growth in the pharmaceutical contract manufacturing and research services market during the forecast period.

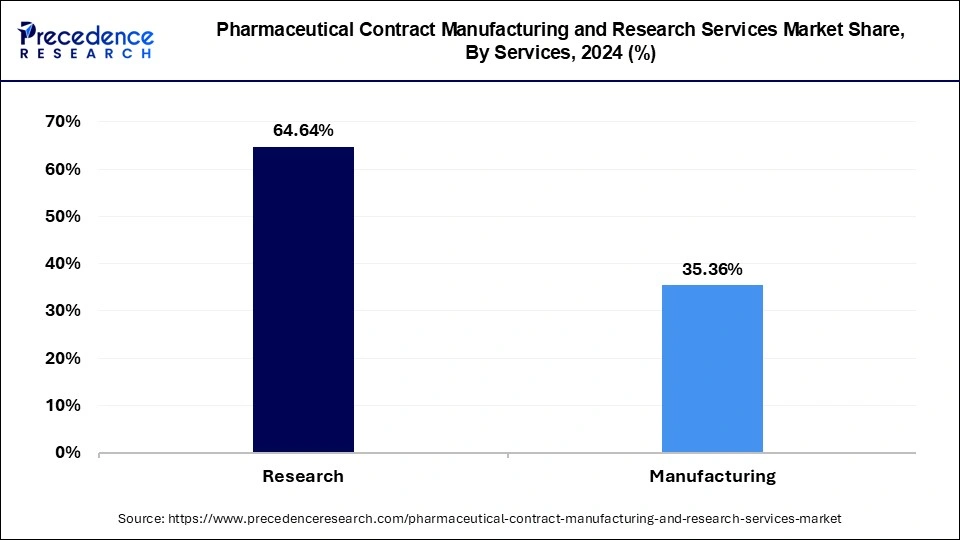

Pharmaceutical Contract Manufacturing and Research Services Market Revenue, By Services 2022-2024 (USD Billion)

| By Services | 2022 | 2023 | 2024 |

| Manufacturing | 137.45 | 148.40 | 159.62 |

| Research | 77.85 | 82.61 | 87.33 |

The big pharmaceutical companies segment dominated the pharmaceutical contract manufacturing and research services market in 2024. The huge share of this end-user category can contribute to the growth of the market such as big pharmaceutical companies’ strong need for end-to-end services, rising pricing pressure and channel issues in their operations, and the growing need to optimize execution costs as bestselling medication patents expire.

Pharmaceutical Contract Manufacturing and Research Services Market Revenue, By End User 2022-2024 (USD Billion)

| By End User | 2022 | 2023 | 2024 |

| Big Pharma | 92.95 | 98.83 | 104.68 |

| Small Pharma |

48.19 | 51.88 | 55.65 |

| Generic Pharma |

40.43 | 43.74 | 47.15 |

| Contract Research Organizations |

33.72 | 36.55 | 39.48 |

By Service

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

February 2025

September 2024