Pharmaceutical CRO Market Size and Forecast 2025 to 2034

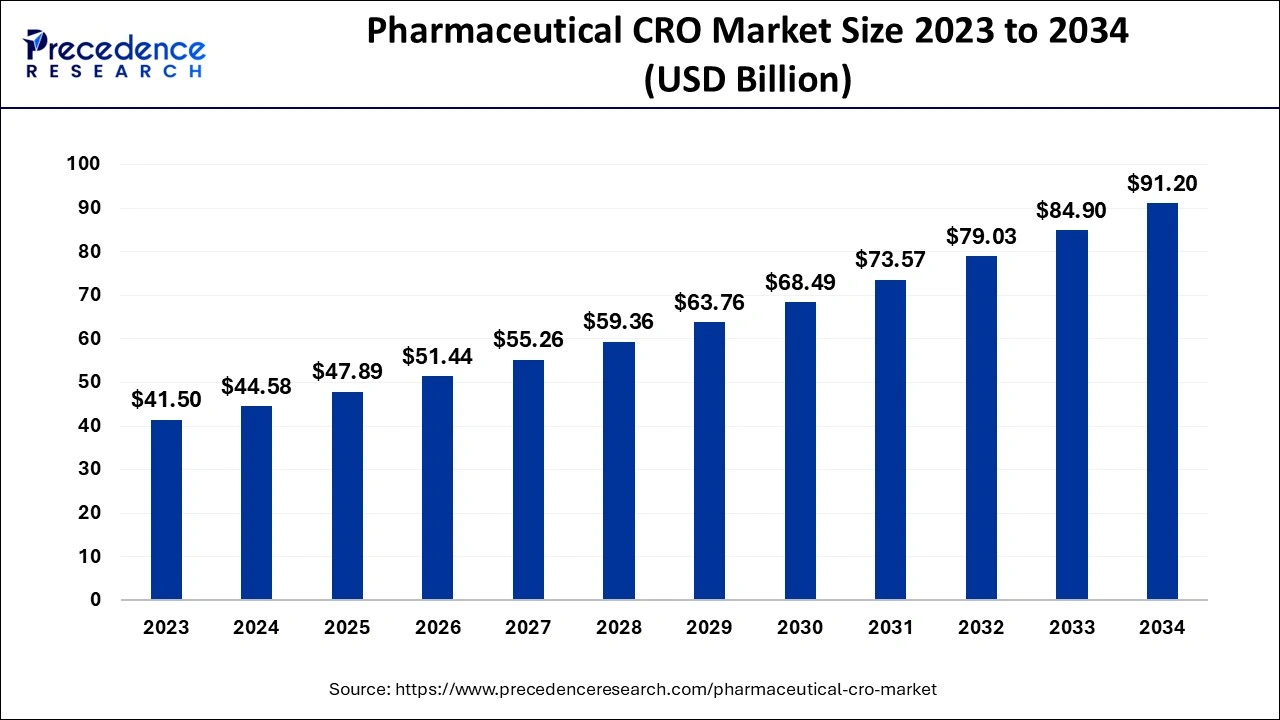

The global pharmaceutical CRO market size was calculated at USD 44.58 billion in 2024 and is anticipated to reach around USD 91.20 billion by 2034, expanding at a CAGR of 7.42% from 2025 to 2034. The increasing burden of chronic disease in the worldwide population is driving the demand for the research and development process for drug discovery and development that is driving the growth of the market.

Pharmaceutical CRO Market Key Takeaways

- In terms of revenue, the pharmaceutical CRO market is valued at $47.89 billion in 2025.

- It is projected to reach $91.20 billion by 2034.

- The pharmaceutical CRO market is expected to grow at a CAGR of 7.42% from 2025 to 2034.

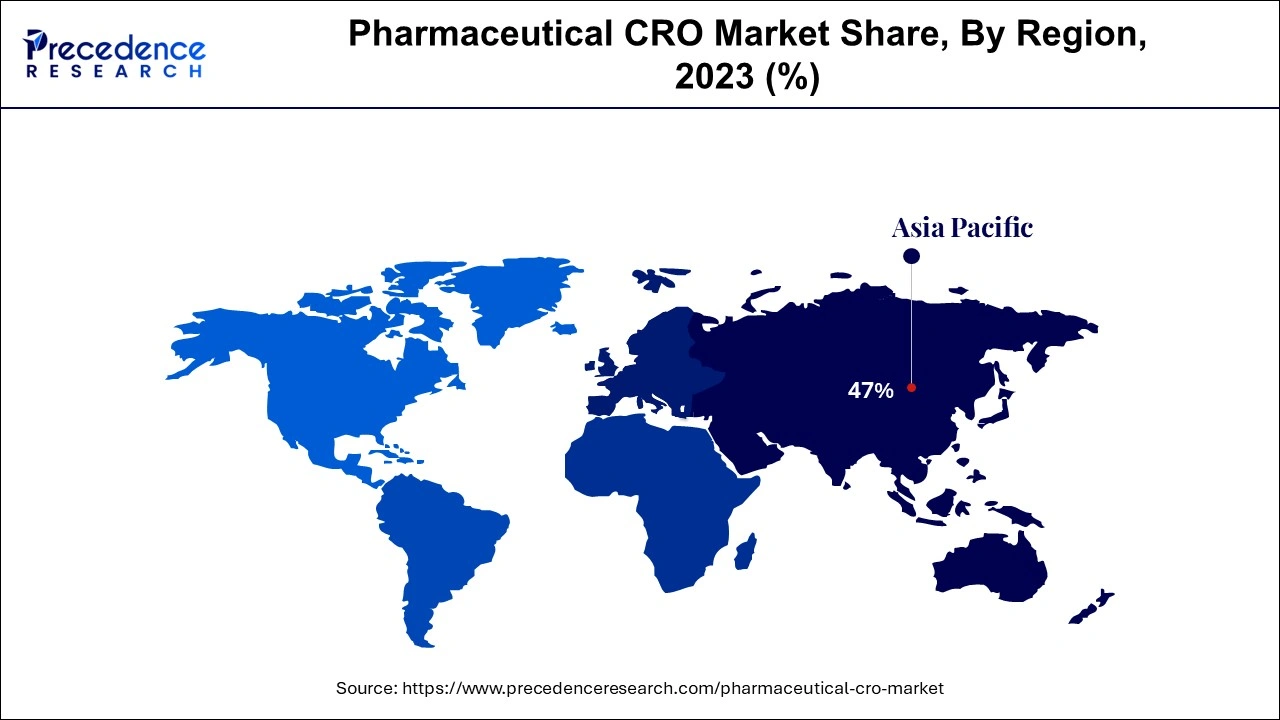

- Asia Pacific dominated the pharmaceutical CRO market with the largest market share of 47% in 2024.

- North America expects the fastest growth during the forecast period.

- By type, the clinical segment contributed the biggest market share of 76% in 2024.

- By type, the pre-clinical segment is expected to have the fastest growth in the market during the forecast period.

- By molecule type, the small molecule segment led the market in 2024.

- By molecule type, the large molecule segment is predicted to grow at a significant CAGR of 8.01% over the forecast period.

- By service, the clinical monitoring segment accounted for the largest share of the pharmaceutical CRO market in 2024.

- By service, the regulatory/medical affairs segment is expected to have substantial growth in the market during the predicted period.

- By therapeutic areas, the oncology segment accounted for the largest market share of 31% in 2024.

- By therapeutic areas, the immunology segment expected significant growth in the market during the predicted period.

How Can AI Impact the Pharmaceutical CRO Market?

Artificial Intelligence (AI) plays an important role in the enhancement of the efficiency of pharmaceutical CROs in clinical trials and clinical research. AI and machine learning help in limiting the cost of operations associated with clinical research and drug development. It assists the pharmaceutical, CROs, and medical device companies in increasing the speed of the drug development process, enhancing clinical trial efficiency, enhancing data analysis, enhancing test automation, enhancing test automation, and management and collection accuracy.

- In July 2024, Fortrea launched research and development activities for creating AI-driven clinical trial technologies that make trials faster, more efficient, and safer.

Asia Pacific Pharmaceutical CRO Market Size and Growth 2025 to 2034

The Asia Pacific pharmaceutical CRO market size was exhibited at USD 20.95 billion in 2024 and is projected to be worth around USD 43.32 billion by 2034, growing at a CAGR of 7.54% from 2025 to 2034.

Asia Pacific dominated the pharmaceutical CRO market in 2024. The growth of the market is attributed to the rising development in the healthcare infrastructure, the rising population, and the prevalence of chronic illness in the population, which are collectively driving the demand for robust medicinal and healthcare services and the innovations in the drugs and treatment are driving the demand for the pharmaceutical CROs for the research and development activities in the pharmaceuticals. Additionally, the increasing investment in pharmaceutical companies and healthcare growth is contributing to the expansion of the pharmaceutical CRO market across the region.

Asia Pacific has emerged as the dominant region in the pharmaceutical CRO market, largely due to low-cost trial operations, access to diverse patient pools, and a growing number of regulatory harmonizations with international standards. Countries such as China, India, Japan, and South Korea are key contributors to this growth, particularly China. For instance, through robust reforms in clinical trial regulations and government-led innovation programs, China is encouraging CRO market development with initiatives like Made in China 2025 and international collaboration frameworks. The major growth factors in this region include increasing investments in healthcare infrastructure, a rising burden of chronic and infectious diseases, and a growing trend of global pharma companies outsourcing clinical research to leverage regional cost benefits and skilled scientific resources.

India ranked third in pharmaceutical production by volume, with continued growth in the industry. As per the recent EY FICCI report, the Indian Pharmaceutical market is expected to reach US$ 130 billion by the end of 2030. India supplies over 50% of the global demand for various vaccines, and the global demand for 40% of the generic medicines in the US and 25% demand in the UK. India has the highest number of pharmaceutical manufacturing facilities, which is associated with the US Food and Drug Administration (USFDA), and has 500 API producers, which make up 8% of the global API market overall.

North America expects the fastest growth in the market during the forecast period. The growth of the market is increasing due to the higher presence of the leading healthcare institutes and pharmaceutical companies, causing the higher demand for the pharmaceutical CROs to outsource the research and development activities in the innovations and manufacturing of drugs and treatment for the various types of diseases that are collectively driving the growth of the pharmaceutical CRO market in the region.

North America, particularly the United States and Canada, is witnessing accelerated growth in the CRO market, driven by the region's leadership in pharmaceutical innovation and regulatory reforms. The market here is benefiting from the emergence of advanced technologies, especially in virtual trials, AI-assisted data analytics, and real-world evidence platforms. For instance, ICON plc unveiled its virtual trial toolkit, integrating remote diagnostics, wearable monitoring, and an electronic consent platform for phase III global studies. These initiatives reflect technological sophistication, strategic mergers, and venture partnerships that are driving North America's ascent in the CRO ecosystem. The region's strong regulatory environment, early adoption of decentralized clinical models, and investment in biological and mRNA research continue to fuel its rapid expansion.

- In the U.S., there are 4,232 CRO businesses as of 2023, with a 3.6% increase from 2022. California (1,180 businesses), Massachusetts (571 businesses), and New Jersey (359 businesses) are some of the states with the highest number of CRO businesses in the U.S.

Market Overview

Pharmaceutical CROs are companies that provide outsourced research and development programs for the innovation of novel drugs and treatments. The rising economic stability in the countries and the spending on healthcare are driving the healthcare infrastructure. The increasing healthcare costs, research and development costs, and increasing demand for clinical trials for drug discovery and development are driving the demand for the pharmaceutical CRO market.

The pharmaceutical CRO market is evolving rapidly, driven by a confluence of technological integration, demand for cost-effective research solutions, and an increasing reliance on outsourcing by pharma and biotech firms. A major trend shaping the industry is the outsourcing of clinical trials to specialized CROs to reduce in-house infrastructure costs and expedite time-to-market.

Decentralized clinical trials, driven by digital health platforms and AI-powered patient monitoring tools, are revolutionizing how trials are conducted globally. Data-centric approaches are now being embedded into preclinical and clinical research stages, allowing for more accurate trial design and risk analysis. Additionally, there is a growing emphasis on precision medicine and biosimilars, pushing CROs to adopt niche expertise and personalized trial models.

Pharmaceutical CRO Market Growth Factors

- Increasing healthcare infrastructure: The rising healthcare infrastructure and the development in the pharmaceutical companies drive the demand for pharmaceutical CROs to outsource the research and development activities for the innovation and launch of new drugs.

- Rising burden of disease: The increasing prevalence of chronic illnesses in the population, such as diabetes, cancer, respiratory illness, and others, causes the continuous demand for drug development for better treatment and diagnosis that boosts the demand for the pharmaceutical CRO.

- Technological advancements in pharmaceuticals: The technological shift in the pharmaceuticals and healthcare institutions in terms of drug discovery and development and in research and development programs that enhance the growth of the market.

- Government support: Various regional governments support the infrastructural development of healthcare, pharmaceutical, drug discovery, and development that further drives the growth of the pharmaceutical CRO market.

Technological Advancements Transforming CRO Services

- On 15 March 2025, there have been notable technological developments in the pharmaceutical CRO sector, especially in the areas of artificial intelligence (AI) and decentralized clinical trial (DCT) approaches. Drug development timelines are being expedited by these innovations, which are improving trial efficiency, patient recruitment, and data accuracy. As the industry moves toward more patient-centric methods, CROs are progressively implementing digital platforms to enable remote monitoring and real-time data analysis.

Emerging Trends Emphasize Expansion

- On 5 April 2025, to take advantage of their combined resources and experience, CROs, pharmaceutical companies, and academic institutions are increasingly forming strategic partnerships. To access a variety of patient demographics and affordable trial locations, CROs are increasing their footprint in emerging markets, where this trend is especially noticeable. Furthermore, functional service provider (FSP) models that offer specialized services catered to client needs, improving flexibility and operational efficiency, are becoming more and more popular.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 91.20 Billion |

| Market Size in 2024 | USD 44.58 Billion |

| Market Size in 2025 | USD 47.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Molecule Type, Therapeutic Areas, Service, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Rising demand for personalized medicines

The increasing healthcare infrastructure and the rise in genetic disorders are driving the demand for personalized medication. The inclination towards biologics and personalized medicines is contributing to the expansion of pharmaceutical CROs. The rising demand for personalized medicines is driving the demand for the research and development program for clinical trials, and drug development for personalized medicines is driving the growth of the pharmaceutical CRO market.

Restraint

High Cost

The increased cost associated with clinical trials and drug development due to the strong quality assurance, advanced technology, and adherence to international standards limits the adoption of pharmaceutical CROs in small and medium healthcare institutions and restrains the growth of the pharmaceutical CRO market.

Opportunity

Emergence of technologies in CRO

The technological adoption of the pharmaceutical CRO for transforming the industrial process and clinical research, the technological adoption is creating opportunities for the expansion of the pharmaceutical CRO market. Technologies such as decentralized and remote trials, wearable technology, biosimulation, tech-enabled patient recruitment, and management are helping revolutionize the pharmaceutical CRO process.

Type Insights

The clinical segment dominated the pharmaceutical CRO market in 2024. The rising demand for clinical trials is driving the demand for pharmaceutical CROs. The CROs efficiently provide clinical trial management services in the different healthcare institutes like biotech, pharmaceutical, and medical device industries. In the clinical trial, the CRO is sponsored to perform a number of tasks, including planning, coordinating, executing, and supervising. The CROs help enhance technologies and methodologies, which increase patient engagement.

- In May 2024, Innovation Clinical Research Partners, a Cannabis-Based CRO for drug and product development, announced the official launch and marking a milestone in biotech and pharmaceutical innovations.

The pre-clinical segment is expected to grow at the fastest rate in the market during the forecast period. CROs help in preclinical research for drug development and manufacturing. Preclinical CROs perform several operations, including laboratory testing, safety assessment, drug formulation, regulation compliance, drug screening or design control, toxicology, biocompatibility, maximum dosage studies, and species expertise.

Molecule Type Insights

The small molecule segment led the pharmaceutical CRO market in 2024. The increasing demand for small molecule drug development for the treatment and diagnosis of common health conditions drives the growth of the segment. The significant demand for molecule drugs owing to the rise in diseases in the population, such as diabetes, migraine, fever, cancer, and others, contributes to the development of molecule drugs.

The large molecule segment is predicted to witness significant growth in the market over the forecast period. The rising prevalence of chronic diseases in the population and the rise in infectious disease cases are driving the demand for the large molecule segment. Additionally, further investment in CROs for development and innovations in drug discovery and development are driving the growth of the segment.

Service Insights

The clinical monitoring segment accounted for the largest growth in the pharmaceutical CRO market in 2024. The contract research organization (CRO) is the company responsible for providing clinical trial research to pharmaceuticals, which further includes clinical monitoring. Clinical monitoring is the responsible process for maintaining the integrity of clinical trial data and patient safety. CRO helps in the clinical monitoring process to maintain the protection of participants, ensure data accuracy, identify and analyze issues, plan for risks, and enhance the trials.

The regulatory affairs or medical affairs segment is expected to grow substantially during the predicted period. The CRO is the company that provides research and development processes in biotech, medical devices, and pharmaceuticals. It plays an essential part in the regulatory or medical affairs in the pharmaceutical and helps the client with several processes such as regulatory compliance, data management, clinical trial design and execution, statistical analysis, and regulatory consulting.

Therapeutic Areas Insights

The oncology segment dominated the market in 2024. The rising prevalence of cancer worldwide due to changing lifestyles and environment drives the demand for continuous research and development activities for the innovations and launch of the treatment, medicines, and diagnostic procedures, which boosts the growth of the CRO in the oncology segment. The increasing demand for better treatment procedures for cancer patients' outcome rate is increasing the research and development activities in oncology and boosting the growth of the pharmaceutical CRO market.

- In November 2023, Crown Bioscience, a globally recognized contract research organization (CRO) and JSR Life Sciences Company, launched its OrganoidXploreTM revolutionary offering, which provides a large-scale organoid panel screening platform that promises reproducible, robust, and clinically relevant output at record speed, increasing preclinical oncology drug discovery by reshaping the cancer treatment procedures.

The immunology segment is expected to grow significantly in the market during the predicted period. The increasing prevalence of chronic and common diseases in the population due to the lowered immune system boosts the demand for CROs for research and development activities in the development and manufacturing of immunology drugs. Additionally, the research and development for biologics and gene therapies are driving the growth of the market.

Pharmaceutical CRO Market Companies

- Thermo Fisher Scientific Inc.

- Medpace

- IQVIA

- CTI Clinical Trial & Consulting

- Parexel International (MA) Corporation.

- ICON plc

- Laboratory Corporation of America Holdings

- WuXi AppTec

- Veeda Clinical Research

Recent updates on pharmaceutical CRD

Technological Advancements Transforming CRO Services

- On 15 March 2025, there have been notable technological developments in the pharmaceutical CRO sector, especially in the areas of artificial intelligence (AI) and decentralized clinical trial (DCT) approaches. Drug development timelines are being expedited by these innovations, which are improving trial efficiency, patient recruitment, and data accuracy. As the industry moves toward more patient-centric methods, CROs are progressively implementing digital platforms to enable remote monitoring and real-time data analysis.

Emerging Trends Emphasize Expansion

- On 5 April 2025, to take advantage of their combined resources and experience, CROs, pharmaceutical companies, and academic institutions are increasingly forming strategic partnerships. To access a variety of patient demographics and affordable trial locations, CROs are increasing their footprint in emerging markets, where this trend is especially noticeable. Furthermore, functional service provider (FSP) models that offer specialized services catered to client needs, improving flexibility and operational efficiency, are becoming more and more popular.

Latest Announcements by Industry Leaders

- In April 2024, Thermo Fisher Scientific, the PPD clinical research business and the world leader in serving science has been awarded the two Best Clinical Trials Supplier Awards in the categories of Site Innovation and Supply Chain Management at the 2024 Asia-Pacific Biopharma Excellence Awards ceremony held in Singapore.

- In June 2024, Medpace, a worldwide full-service clinical research organization (CRO), sustained its leading position and was awarded the CRO Leadership Awards presented by Life Science Leader and Clinical Leader. They receive five awards in all the categories, including expertise, compatibility, reliability, quality, and capabilities.

Recent Developments

- On 10 January 2025, Eli Lilly announced a substantial investment in an eight-year research partnership with Purdue University, aiming to enhance drug discovery and development processes. This collaboration focuses on leveraging AI and advanced technologies to streamline clinical trials and foster innovation.

- On 21 February 2025, IQVIA completed the acquisition of MCRA, a renowned provider of regulatory and reimbursement services. This strategic move aims to strengthen IQVIA's service offerings in regulatory consulting and expand its global footprint in the CRO market.

- On 25 March 2025, TFS Health Science highlighted the increasing adoption of AI-driven clinical trials and patient-centric approaches in their latest industry report. The report emphasizes the role of AI in optimizing trial designs, enhancing patient engagement, and improving data quality, marking a significant shift in CRO operational models.

- In May 2024, Enzene Biosciences launched the new drug discovery division and increased the CDMO's breadth of services to the biotech industry. The launch will provide the end-to-end combined discovery service to cater to the growing industry demand.

- In April 2024, Goldman Sachs increased its coverage in India CRO/CDMO (contract research organization/contract development and manufacturing organization) for supplying the diversification in the global pharmaceutical industry picks up.

Segments Covered in the Report

By Type

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Molecule Type

- Small Molecules

- Large Molecules

By Service

- Project Management/Clinical Supply Management

- Data Management

- Regulatory/Medical Affairs

- Medical Writing

- Clinical Monitoring

- Quality Management/ Assurance

- Biostatistics

- Investigator Payments

- Laboratory

- Patient And Site Recruitment

- Technology

- Others

By Therapeutic Areas

- Oncology

- Cns Disorders

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Disease

- Respiratory Diseases

- Diabetes

- Ophthalmology

- Pain Management

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting