January 2025

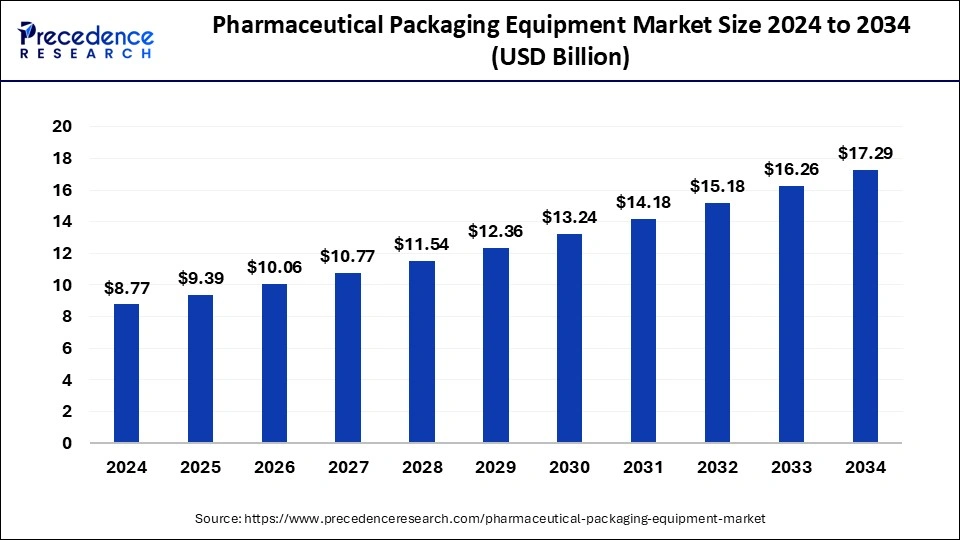

The global pharmaceutical packaging equipment market size is calculated at USD 9.39 billion in 2025 and is forecasted to reach around USD 17.29 billion by 2034, accelerating at a CAGR of 7.02% from 2025 to 2034. The Asia Pacific pharmaceutical packaging equipment market size surpassed USD 3.57 billion in 2025 and is expanding at a CAGR of 7.18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical packaging equipment market size was estimated at USD 8.77 billion in 2024 and is predicted to increase from USD 9.39 billion in 2025 to approximately USD 17.29 billion by 2034, expanding at a CAGR of 7.02% from 2025 to 2034. Pharmaceutical packaging equipment helps reduce the risk of degradation, improve performance, and maintain the potency of the product, which helps the growth of the market.

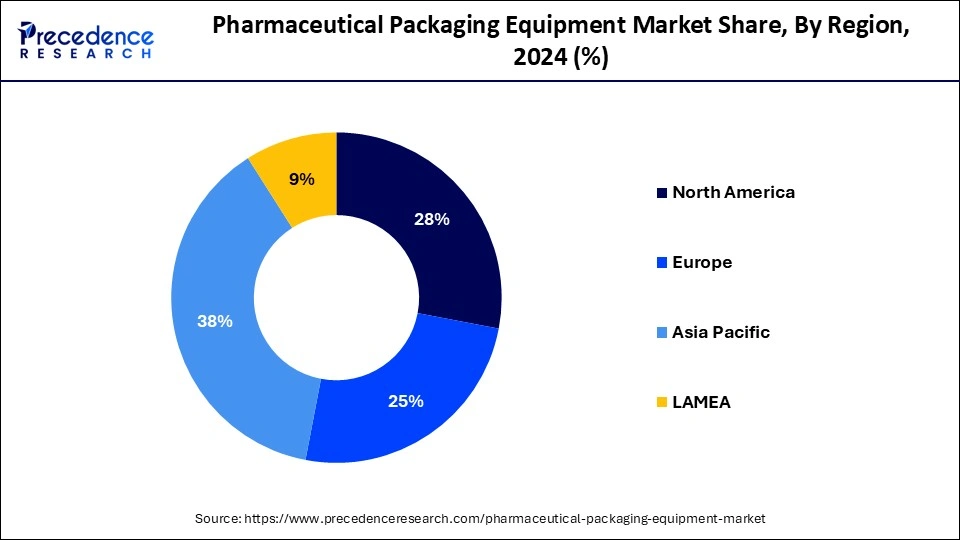

The Asia Pacific pharmaceutical packaging equipment market size surpassed USD 3.33 billion in 2024 and is projected to attain around USD 6.66 billion by 2034, poised to grow at a CAGR of 7.18% from 2025 to 2034.

Asia Pacific dominated the pharmaceutical packaging equipment market in 2024. Increased population, increased healthcare needs, and rising investment in the healthcare sectors contribute to the growth of the market in the Asia Pacific region. This leads to an increase in the production of pharmaceutical products, which needs effective and advanced pharmaceutical packaging equipment that helps the growth of the market. China is the leading country in the market in the Asia Pacific region.

The pharmaceutical packaging equipment market encompasses a wide range of machinery, including blister packaging, labeling, and sterilization systems, catering to the diverse needs of the pharmaceutical industry. Pharmaceutical packaging equipment consists of machines that are used to seal, pack, protect, and label pharmaceutical products.

The pharmaceutical packaging equipment or machines in the pharmaceutical sector include hard films over wrappers, hand-packing stations, cartooning machines and case packers, label applicators, sealers, powder and liquid filling machines, strip packing machines, tablet packaging equipment, blister packing equipment, etc. Pharmaceutical packaging equipment provides an effective solution for preparing nutraceutical and pharmaceutical products for distribution. Packaging equipment is an important component of the pharmaceutical industry that is used to maintain and create high-quality and safe packaging for many products. There are many benefits of using packaging equipment in the pharmaceutical industry, such as reduced labor costs, enhanced compliance with regulatory standards, and increased efficiency. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.29 Billion |

| Market Size in 2025 | USD 9.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.02% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Formulation Type, Automation Type, End-use Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising senior population and chronic & infectious diseases

The rising senior population contributes to an increase in chronic & infectious diseases, which leads to a high demand for packaged medications and helps to the growth of the market. Chronic diseases include diabetes, cardiovascular, and hypertension. To manage these chronic diseases, there is a need for treatments that contribute to the growth of the pharmaceutical packaging equipment market. Pharmaceutical packaging equipment benefits include improved compliance with regulatory standards, increased efficiency, and reduced labor costs that help the growth of the market.

Disadvantages of pharmaceutical packaging equipment

The disadvantages of pharmaceutical packaging equipment include poor capital investment capacities of small manufacturers in developing nations’ industries, increasing demand for new pharmaceutical packaging equipment, increasing demand for new equipment, and variations in raw material prices. These factors can restrict the growth of the market. Some stringent regulations, like government regulations related to plastic use for environmental safety, may hamper the growth of the market. Pharmaceutical packaging equipment or materials play an important role in product stability, and the disadvantages of the commonly used materials include glass bottles may be fragile and bulky and can release alkalis in aqueous preparations, plastic bottles are less resistant to leaching as compared to glass and lower heat resistance and others. These factors may restrict the growth of the pharmaceutical packaging equipment market.

Advanced Technologies

There is an opportunity to use advanced technologies in pharmaceutical packaging equipment. Improving automated packaging technologies in the pharmaceutical industry helps produce multi-dose or unit-dose pharmaceutical packs that allow social distancing capabilities, improved patient adherence, efficiency, and touch-free services, key benefits at the time of the pandemic. These factors help to the growth of the market. The expansion of automation technologies may help the pharmaceutical packaging equipment market grow in the future.

The filling machines segment dominated the pharmaceutical packaging equipment market in 2024. Filling machines are highly used for pharmaceutical packaging purposes due to their benefits, which include increasing production yields and reducing human errors. It also includes a rapid cooling and heating system and can minimize thermal stress, which contributes to overall product safety. It has highly modular systems that allow customized pretreatment needs. Filling machines have automated container transport, filter scans, and filter sterilization to improve efficiency. It helps to give consistent outputs and precise measurements and ensures product uniformity and quality, which results in higher customer satisfaction. These factors help to the growth of the filling machines type segment and contribute to the growth of the market.

The form, fill, and seal machines segment is estimated to be the fastest-growing segment during the forecast period. The form, fill, and seal machines are highly used in pharmaceutical packaging equipment due to their benefits like online film printing facilities providing readable product info and bar code, quick and easy cleanout between the production batches, reduced costs, more time saving, reduced labor requirement, easy cleaning, and maintenance, work with the right team, helping to provide a reduced number of shifts and provide increased production rate. The bags are made from form, fill, and seal machines that are less expensive than the pre-made bags. These factors help the growth of the form, fill, and seal machines type segment and contribute to the growth of the pharmaceutical packaging equipment market.

The liquid packaging equipment segment dominated the pharmaceutical packaging equipment market in 2024. In liquid packaging equipment formulation type, bottles are used commonly. There are many benefits of liquid packaging equipment in pharmaceuticals, including it gives precise dosing by minimizing errors and waste, product integrity, high-speed capabilities, improved production efficiency/quality and rates, reduced product loss, less manual labor, and it has automatic quality control, capping, and labeling. These factors help the growth of the liquid packaging equipment formulation type segment and contribute to the growth of the market.

The semi-solid packaging equipment segment is expected to be the fastest-growing during the forecast period. The semi-solid packaging equipment formulation type of solution is important for pharmaceutical products like soft gelatin capsules, suppositories, ointments, and creams. The benefits of using semi-solid packaging equipment include labor cost reduction, increased efficiency, improved productivity, and quality assurance. It also helps to reduce risks of damage during transportation handling and customization. These factors help the growth of the semi-solid packaging equipment formulation type segment and contribute to the growth of the pharmaceutical packaging equipment market.

The semi-automatic segment dominated the pharmaceutical packaging equipment market in 2024. The semi-automatic automation type of pharmaceutical packaging equipment is helpful for smaller businesses. Semi-automatic packaging equipment is cost-effective and may help SMEs speed up the process of filling. They may help to match the competition without money spending. These factors help the growth of the semi-automatic automation type packaging equipment segment and contribute to the market.

The automatic segment is expected to be the fastest-growing during the forecast period. The automatic automation type of packaging equipment has many benefits, including increased production speed and efficiency compared to manual labor, reduced packaging costs, improved product quality by minimizing human errors, accurate labeling, proper assembly, precise measurements, and improved safety and security. The automatic automation-type packaging equipment helps produce multi-dose and unit-dose pharmaceutical packs, allowing improved patient adherence, efficiency, social distancing capabilities, and key benefits of touch-free service, especially during the pandemic. These factors help the growth of the automatic automation type segment and contribute to the growth of the pharmaceutical packaging equipment market.

The pharmaceutical companies segment dominated the pharmaceutical packaging equipment market in 2024. The pharmaceutical packaging equipment used in pharmaceutical companies has many advantages, including improved compliance with regulatory standards, improved efficiency, improved productivity and stability of products, and reduced labor costs. Pharmaceutical packaging equipment is used to protect, label, seal, and pack pharmaceutical products. The use of pharmaceutical packaging equipment in pharmaceutical industries includes hard film over wrappers, hand packing stations, cartoning machines, case packers, label applicators, sealers, powder and liquid filling machines, strip packing machines, tablet packing equipment, blister packing machines, etc. These factors help to the growth of the pharmaceutical companies' end-use type segment and contribute to the growth of the market.

The contract manufacturing companies segment is expected to be the fastest-growing during the forecast period. In contract manufacturing companies, pharmaceutical packaging equipment is used because they offer flexible solutions and low-cost solutions that permit brand owners to focus on specialties while meeting quality standards. For innovative packaging solutions, pharmaceutical manufacturers partner with contract manufacturing companies. Contract manufacturing companies offer unique packaging solutions, flexibility, and reduced launch times. These factors help the growth of the contract manufacturing companies' end-use type segment and contribute to the growth of the pharmaceutical packaging equipment market.

By Machine Type

By Formulation Type

By Automation Type

By End-use Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

January 2025

January 2025