January 2025

The global pharmacy management system market size is calculated at USD 30.88 billion in 2025 and is forecasted to reach around USD 69.31 billion by 2034, accelerating at a CAGR of 9.40% from 2025 to 2034. The North America pharmacy management system market size surpassed USD 10.73 billion in 2024 and is expanding at a CAGR of 9.42% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmacy management system market size was calculated at USD 28.23 billion in 2024 and is predicted to surpass around USD 69.31 billion by 2034, expanding at a CAGR of 9.40% from 2025 to 2034.

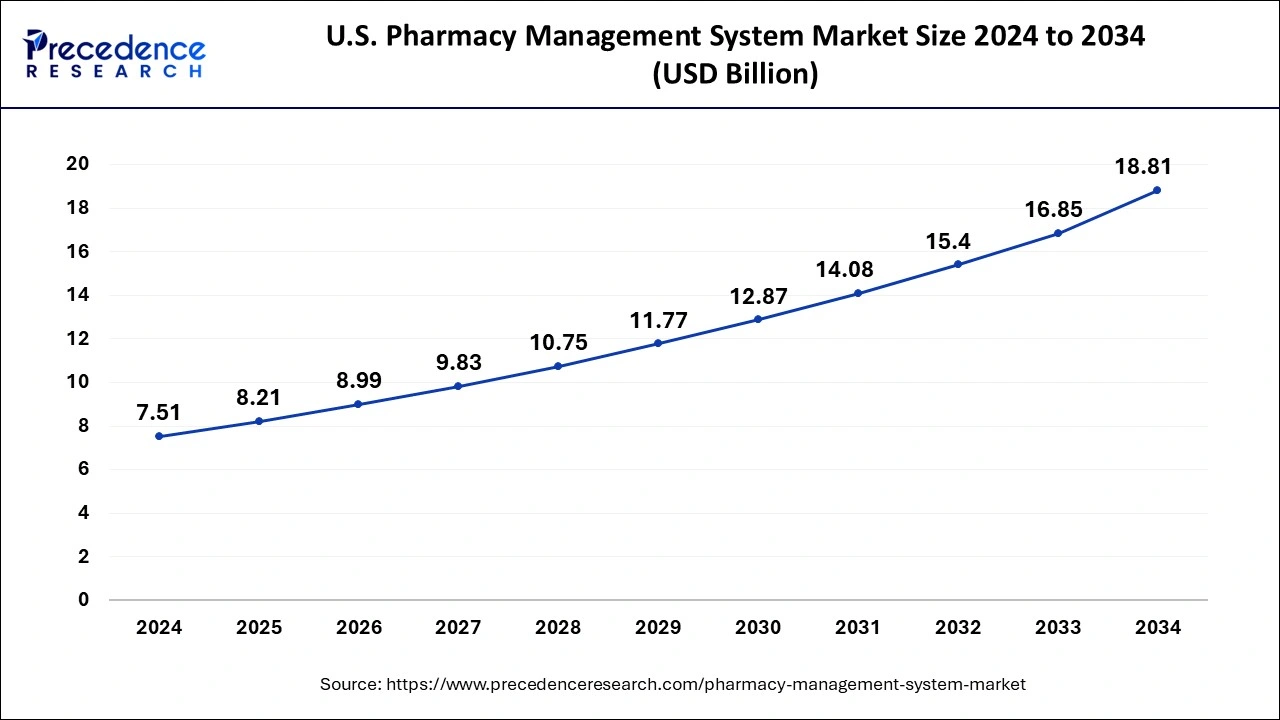

The U.S. pharmacy management system market size surpassed USD 7.51 billion in 2024 and is expected to be worth around USD 18.81 billion by 2034, rising at a CAGR of 9.62% from 2025 to 2034.

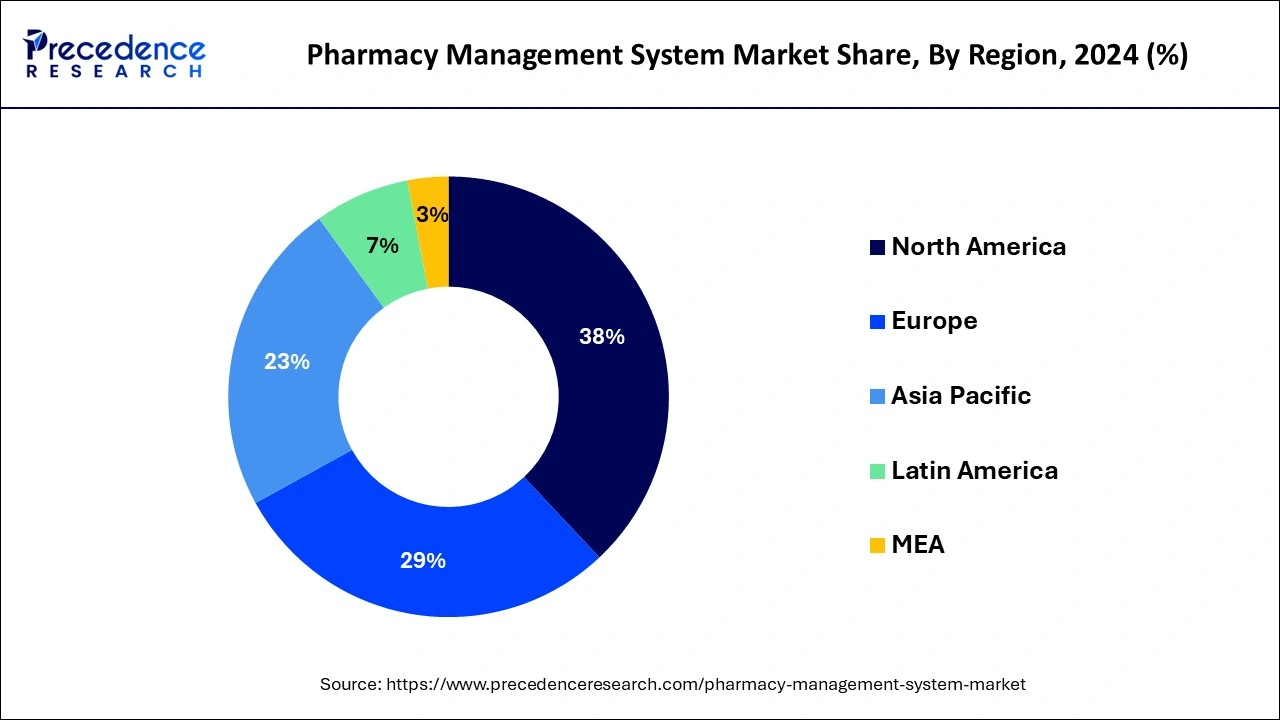

North America has the largest industry shares for pharmaceutical management systems due to the presence of key players there. Europe maintains the second-highest market share due to pharmacies in this region using IT solutions.

Over the forecast period, Asia Pacific is expected to have the greatest CAGR of any region. This region will expand significantly as agreements and partnerships grow. Africa and the Middle East have always had the lowermost markets because of their limited access to healthcare.

An essential tool that offers extremely user-friendly and effective organization is a pharmaceutical management solution. These systems aid pharmacists in handling challenging duties like inventory control, medication dispensing, and sales operations. The use of a worldwide pharmacy management system enables pharmacists to provide expert treatment depending on patients' needs. The expansion of pharmacists, the medical IT sector, and improvements in the healthcare system are all contributing factors to the industry growth for pharmacy management system. The procedure in the medicinal industry has grown during the last several years. As a result, the advantages that medications provide to users are very advantageous.

The pressure of handling a rising number of treatments is being placed on pharmacies, which will encourage the use of involuntary explanations to manage the pharmaceutical industry. Small, intermediate, and big pharmacies can all benefit from the autonomous computer solutions provided by pharmacy management system. Governing and agreement data, stock restraint organization record control, and administration performance represent the majority of solutions. By mechanizing reorganization, increasing efficiency, improving finish date chasing, and using progressive rulers to fulfill pharmaceutical needs, the system for pharmacy management also reduces the cost of inventory.

The expansion of the medication management equipment market is being driven by an increase in the number of major pharmaceutical companies using it for better administration in pharmacies. As a consequence, the market players have created a large number of apps, greatly expanding the IT sector. The size of the market for pharmaceutical management systems is growing as a result. To enhance health services, several different solutions have been proposed. Organizations can run their businesses more successfully by utilizing the pharmacy management program. The system aids in the day-to-day operation of the company.

An essential instrument with strong, user-friendly pharmaceutical management systems is a pharmacy management solution. The pharmacist management system helps pharmacists navigate the complexity of managing drug stocks, point-of-sale operations, and medication delivery. Additionally, it helps handle, track, and dispense prescribed medications with greater accuracy, security, and efficiency. The development of healthcare IT is credited with the rise of the medication management equipment market, and over time, it is anticipated that the expansion of chemists everywhere in the world will further increase market development. But in the upcoming years, the market's expansion is probably going to be negatively impacted by the shortcomings of pharmacy management solutions.

Medication that is in the inventory stage till it expires or slow-moving inventory can wind up costing significantly more than the retail value. Major pharmacies employ software supported by medication management systems to maintain drug inventory at current levels to avoid such situations. The pharmacy management system gets significant openness with the exchange by integrating analytical tools. A pharmacy management system's adoption also increases visibility and offers careful monitoring of inventory purchase and administration. These programs assist in increasing inventory turns by up to 35% and reducing losses from unserviceable returns by up to 25%.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.31 Billion |

| Market Size in 2024 | USD 28.23 Billion |

| Market Size in 2025 | USD 30.88 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution Type, Component, Deployment Modem, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of automated methods in the operation of pharmacies globally

Electronic prescription implementation

A barcode digital scanner, an automated inventory procedure, accounting, warehousing, restocking, and other features are all included in the pharmacy inventory-management system. The customer retention rates, reaction times, spending patterns, and prescription waste rates are all addressed by the pharmacy information management system.

The findings of the numerous clinical trials were produced with cost-effective designs and strategies thanks to the pharmacy compounding software system. Insurance verification, prior authorization, claims processing, mitigation techniques, and many other things are handled by the pharmaceutical revenue cycle administration system.

Programs for hospital security and protection are included in the software. Computers, video conferencing equipment, and high-tech mobile phones are examples of hardware. Services are provided to provide support and results. An internal server is unnecessary with cloud-based systems. Computing experts from the company are used on-site. In 2023, the cloud-based service market was dominant and held a 57.8% revenue share.

Demand for available commercial cloud services is most likely to be significantly influenced by the ease with which information may be accessed in remote areas to use such solutions. Additionally, the market is projected to grow in the next years due to the focus on client data privacy and the development of regulations related to it. Due to several security flaws in web-based as well as on deployment, cloud-based technology deployment is getting a lot of popularity. Providers of cloud services do provide services that address different threats and protect protection against information loss and theft. As a result, this segment of the market accounts for a sizeable portion of the market. The market for medication management systems has the second-largest share of web-based options in 2022. This can be linked to doctors increasingly favoring web-based solutions over cloud-based ones because they are more affordable.

The largest market share for pharmacy management system is held by inpatient pharmacies. The sector with the fastest growth is an outpatient pharmacy.

By Solution Type

By Component

By Deployment Mode

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

July 2024

July 2024