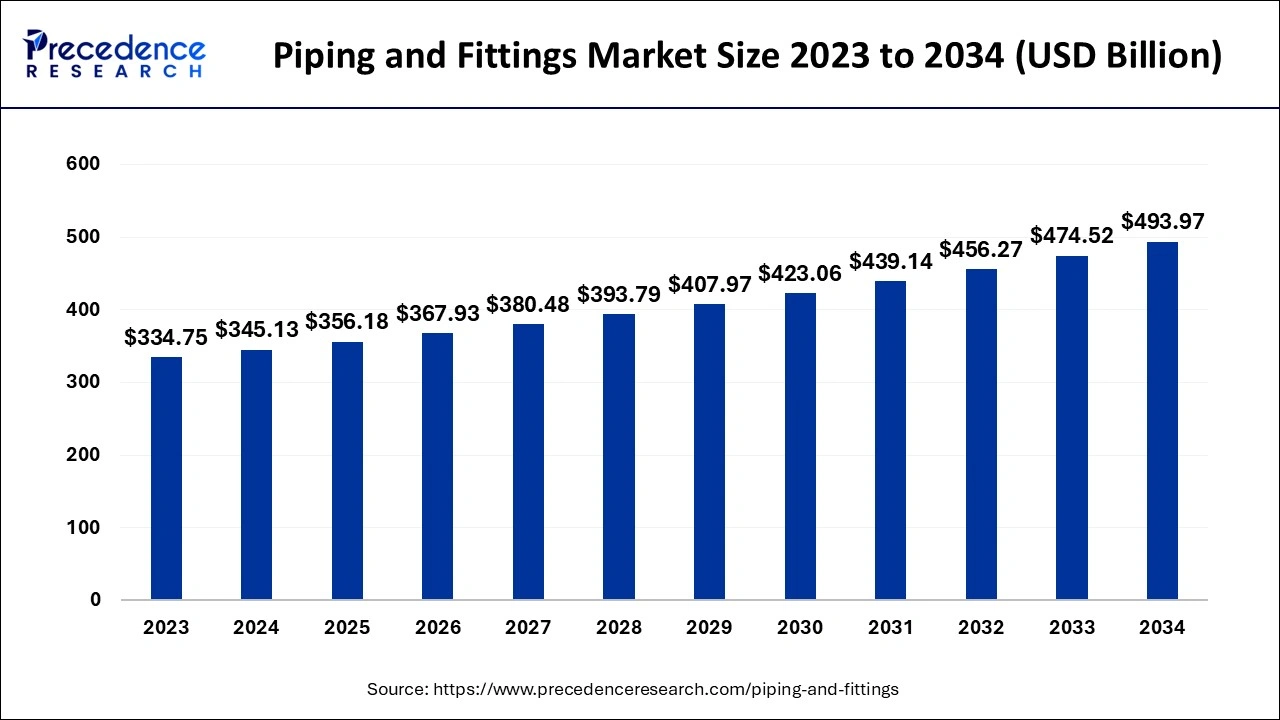

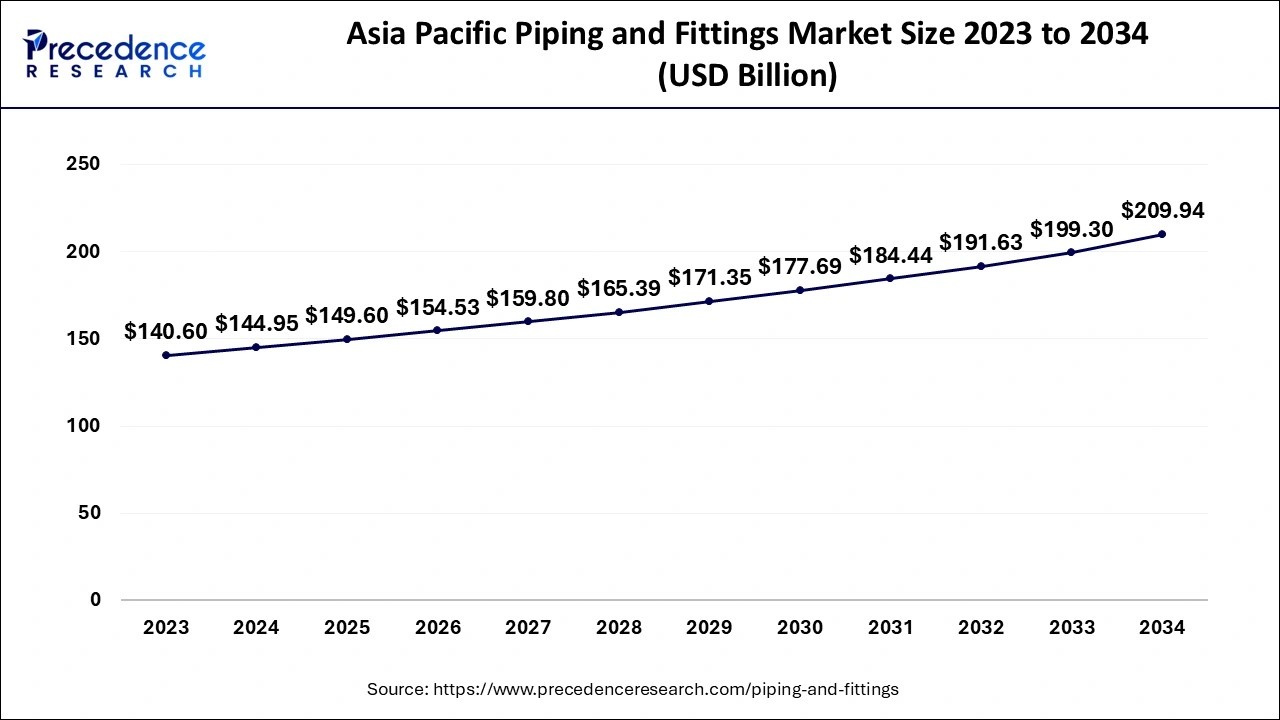

The global piping and fittings market size is calculated at USD 345.13 billion in 2024, grew to USD 356.18 billion in 2025 and is projected to reach around USD 493.97 billion by 2034. The market is expanding at a CAGR of 3.70% between 2024 and 2034. The Asia Pacific piping and fittings market size is evaluated at USD 144.95 billion in 2024 and is poised to grow at a CAGR of 3.71% during the forecast period.

The global piping and fittings market size is accounted for USD 345.13 billion in 2024 and is predicted to surpass around USD 493.97 billion by 2034, representing a CAGR of 3.70% from 2024 to 2034. The increasing demand for efficient drainage and water supply in urban areas and other parts of the country is driving the growth of the market.

The Asia Pacific piping and fittings market size is exhibited at USD 144.95 billion in 2024 and is projected to be worth around USD 209.94 billion by 2034, with a CAGR of 3.71% from 2024 to 2034.

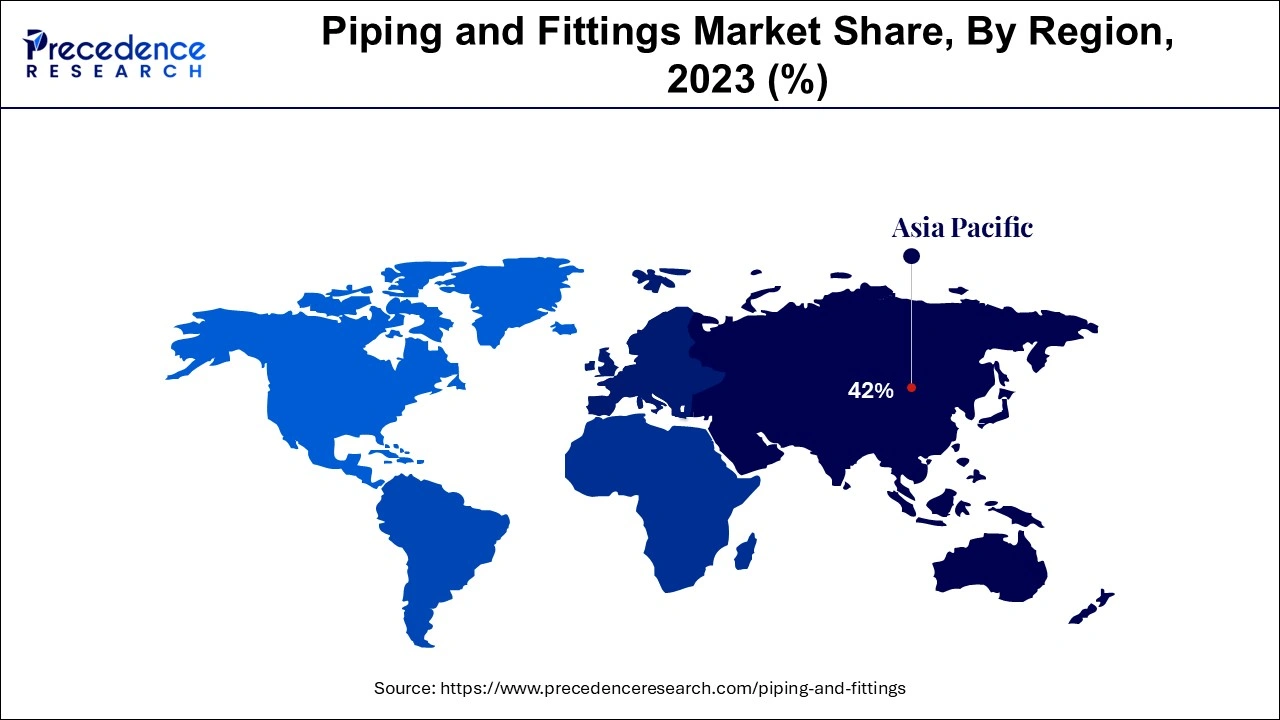

Asia Pacific dominated the piping and fittings market in 2023. The growth of the market is attributed to the rising population and urbanization across regional countries like China, India, Japan, and South Korea, which is driving the demand for rapid growth in residential and commercial properties to cater to the demand for rising population and foreign investment in the development in the industrialization is contributing in the demand for the piping and fittings market. Additionally, the rising government interventions in the development of commercial buildings and the development of efficient drainage systems in the rural and urban areas of the country are driving the growth of the piping and fittings market across the region.

North America anticipates significant growth in the market during the forecast period. The growth of the market is attributed to the availability of well-developed economies in countries such as the U.S. and Canada and the rising urbanization in the countries and the rising construction industry and the enhancements in residential and commercial buildings are driving the demand for efficient piping and fittings in the industry for the efficient water supply and drainage system in the buildings are accelerating the growth of the piping and fittings market in the region.

The piping and fittings are the most efficient and essential material or type of product in the buildings that provide the water and energy supply and are essential for the drainage system from the buildings and cities that drive the growth of the market. The piping system is an essential element that helps in flowing any type of fluid or gas. The piping helps in various applications such as in irrigation, swage management, and water supply in the different end-use industries such as chemicals, pharmaceuticals, oil and gas, energy, and others are driving the demand for the piping and fittings market.

Sustainable Piping Solution News:

How Can AI Impact the Piping and Fittings Market?

The integration of artificial intelligence into pipe fitting manufacturers helps transform industrial operations. AI helps the pipe fitting manufacturer in processes like quality control, and it is used to maintain the quality of pipe fittings during the production process. Predictive maintenance, with this AI, helps monitor the status of the machinery and predict maintenance if required. AI can optimize the best combination of temperature, speed, and pressure for required output. And AI can efficiently manage supply chain management by predicting demand and inventory levels. Thus, all these advancements help in the growth of the piping and fittings market.

| Report Coverage | Details |

| Market Size by 2034 | USD 493.97 Billion |

| Market Size in 2024 | USD 345.13 Billion |

| Market Size in 2025 | USD 356.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

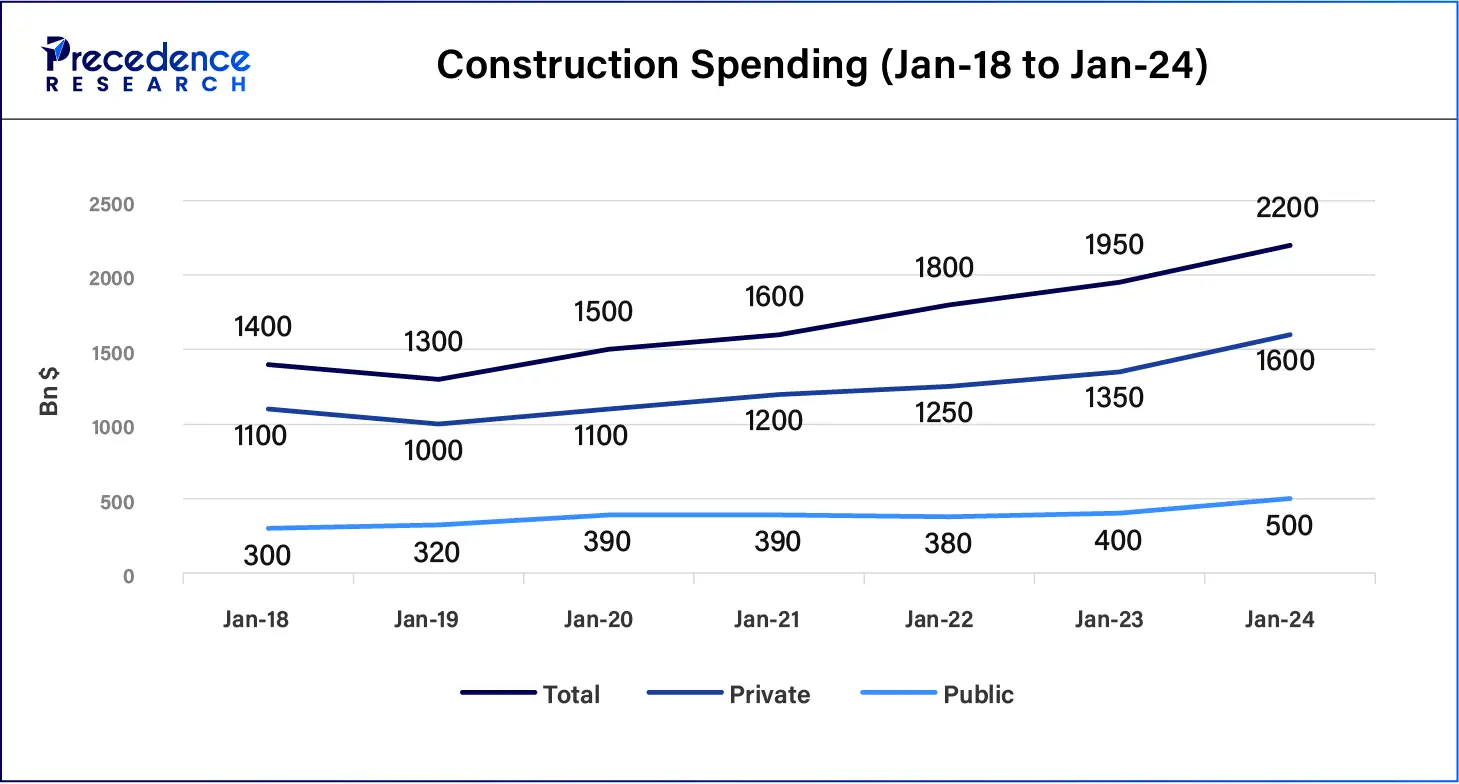

The rise in the construction industry

The rising construction industry across the world due to the increasing population and the rapidly growing demand for residential and commercial buildings are driving the growth of the piping and fittings market. The rising industrialization and foreign investment in the development of the industries caused the increased demand for water supply and drainage systems, which contributed to the demand for piping and fittings. Additionally, the rising evaluation in the renovation of houses and buildings is also highly contributing to the expansion of the piping and fittings market.

Limited strength and durability

The pipe fittings' strength and durability completely depend upon the material of the pipe and generally have limitations in the lifespan of pipes due to corrosion, temperature, and other factors restraining the growth of the piping and fittings market.

Advancements in the pipe fittings manufacturing process

The adaptation of the new technologies in pipe fittings manufacturing offers greater efficiency and productivity in the line of operations. Technological advancements such as robotics and automation, 3D printing, and smart manufacturing are driving the enhancements in operations. Additionally, sustainability in the piping and fittings, such as the use of eco-friendly materials, waste reduction, and energy efficiency in manufacturing, are collectively driving the expansion in the piping and fittings market.

The steel pipe segment registered its dominance over the piping and fittings market in 2023. The increasing construction industry is driving the demand for the piping industry. The rise in the demand for steel pipes from the construction industry, like in the residential and commercial sectors, has several benefits, including higher strength, durability, heat resistance, applications, cost efficiency, versatility, and sizing. The steel pipes are more prone to changing climatic conditions. Its corrosion resistance properties make them live a longer lifecycle. It can be used in different applications, including sewer and drainage purposes. It has a low maintenance cost, and the recyclability of the products is one of the main properties of the steel pipes, which makes them ideal for use in the different applications of the buildings.

The plastic/PVC segment is predicted to witness the fastest growth in the market over the forecast period. The higher prevalence in the acceptance of plastic and polyvinyl pipes due to their lower cost, lightweight, and other benefits are driving the growth of the segment. Plastic pipes are known for their sustainability and cost-effectiveness; they are recyclable and reusable and have higher durability, longer lifecycle, and higher corrosion resistance. Plastic pipes help in energy savings, decreased risk of leakage, and easier installation, which makes them offer higher efficiency and productivity, driving the growth of the segment.

The residential segment held a dominant presence in the piping and fittings market in 2023. The rising population and the economic growth in various countries are driving industrialization, and the rise in the construction industry and the rise in the real estate industry are driving the development and growth of residential and commercial buildings to cater to the demand of the rising population. The rising urbanization in developing countries due to the shifting and migrating of people from rural to urban areas for employment, studies, economic development, lifestyle standards, and others are driving the residential sector. Piping and fittings are essential elements in the housing sector for providing water in areas like kitchens, bathrooms, washing areas, and others.

The commercial segment will gain a significant market share over the studied period of 2023 to 2034. The rising demand for commercial buildings like hospitals, malls, corporate offices, government offices, shopping complexes, and other commercial plots is driving the demand for the market. The rising development in the regional countries is causing the growth in urbanization, and industrialization is driving the demand for commercial buildings, which is anticipated in the higher demand for the piping and fittings market.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client