September 2024

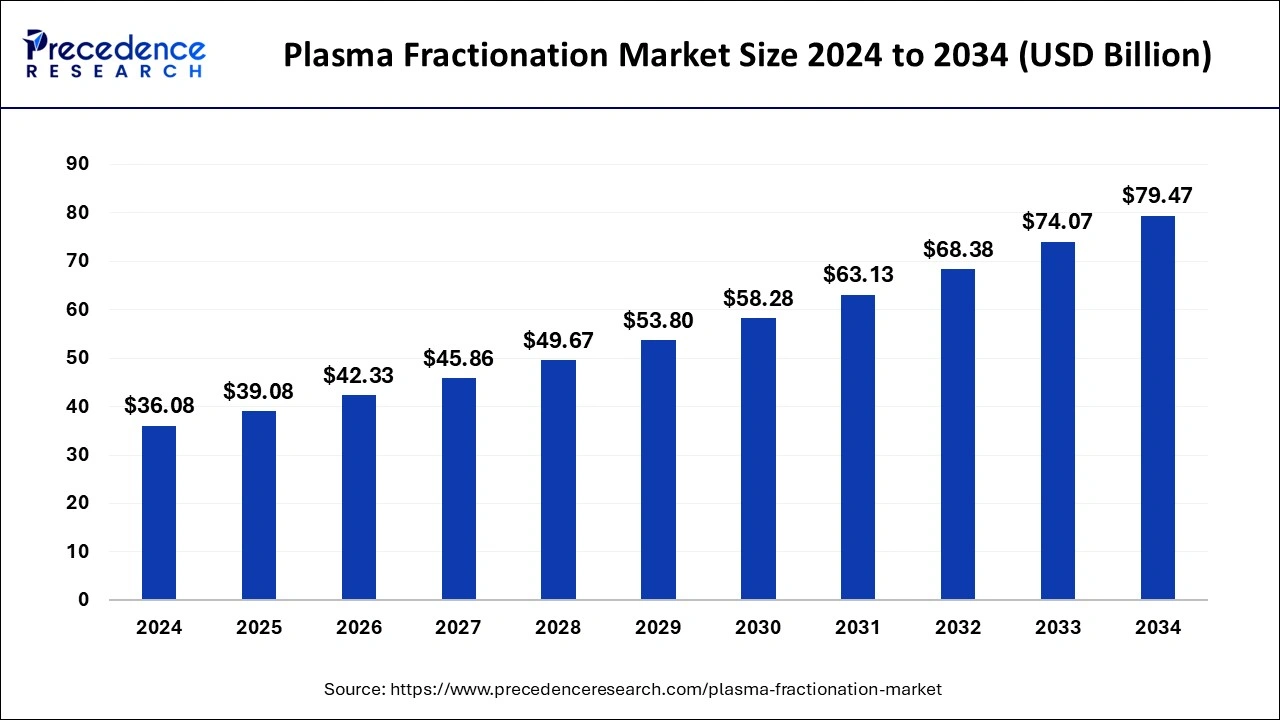

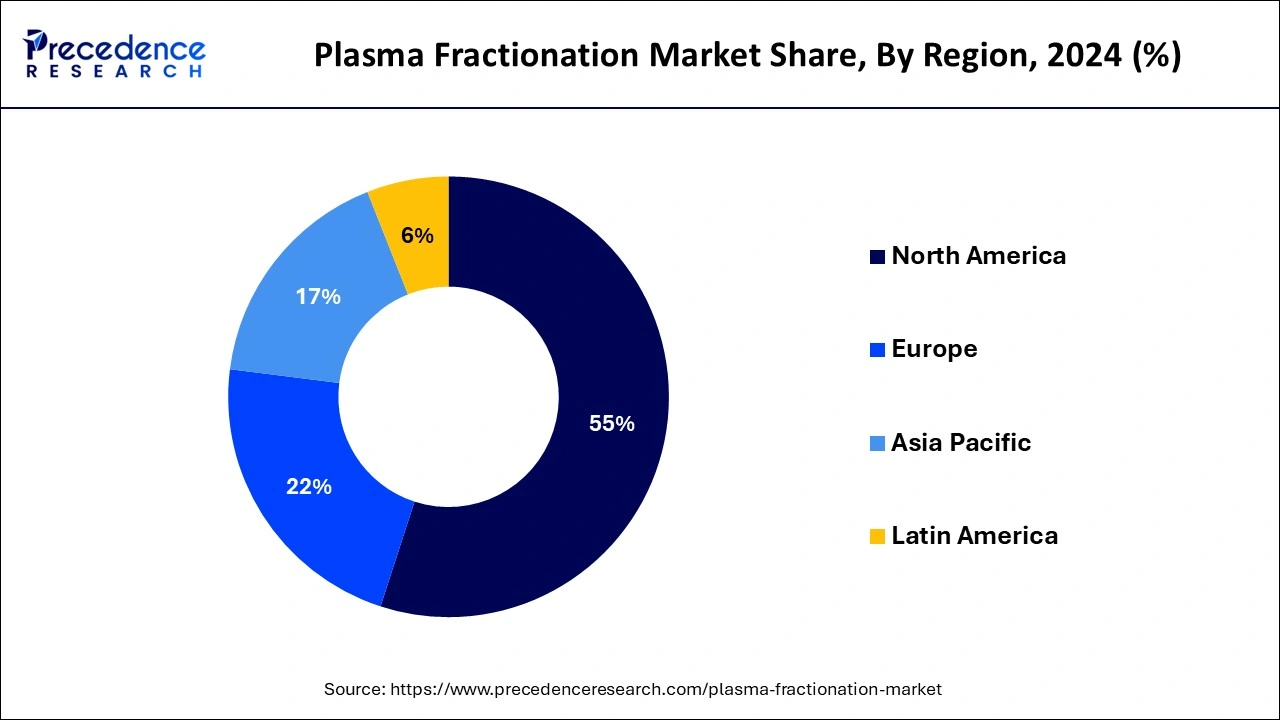

The global plasma fractionation market size is calculated at USD 39.08 billion in 2025 and is forecasted to reach around USD 79.47 billion by 2034, accelerating at a CAGR of 8.22% from 2025 to 2034. The North America plasma fractionation market size surpassed USD 19.84 billion in 2024 and is expanding at a CAGR of 8.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plasma fractionation market size was valued at USD 36.08 billion in 2024 and is anticipated to reach around USD 79.47 billion by 2034, growing at a CAGR of 8.22% from 2025 to 2034. The growing prevalence of genetic diseases across the world is driving the growth of the plasma fractionation market.

The technique of plasma fractionation relies heavily on innovation. Here comes artificial intelligence (AI), which is transforming the process of plasma fractionation. Businesses may improve processes, save operating costs, and minimize human mistakes by using AI and automation in plasma fractionation. Additionally, AI is enabling the enhancement of plasma product production and purity, which will improve patient outcomes. Additionally, AI is assisting businesses in overcoming some of the drawbacks of conventional fractionation techniques by making it easier to isolate a variety of previously challenging-to-extract plasma components. In order to keep plasma components safe and efficient over time, this technical advancement also helps with their long-term storage.

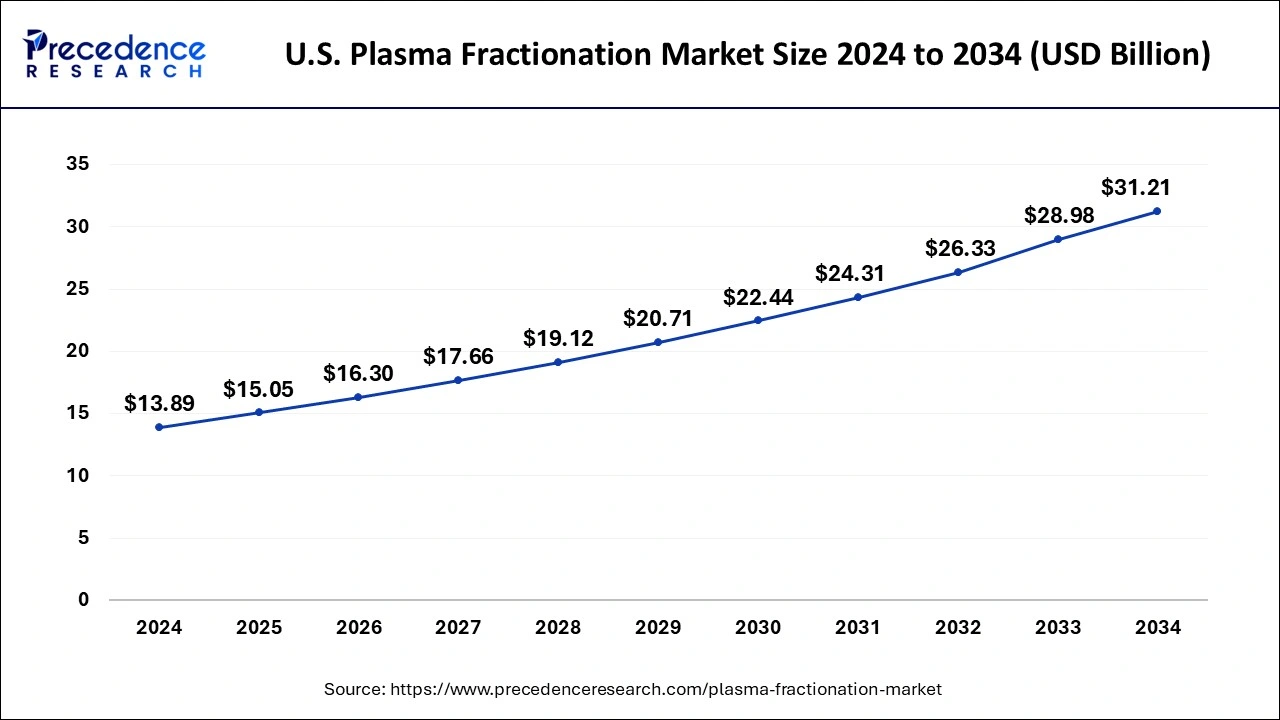

The U.S. plasma fractionation market size was estimated at USD 13.89 billion in 2024 and is predicted to be worth around USD 31.21 billion by 2034 with a CAGR of 8.43% from 2025 to 2034.

North America led the global plasma fractionation market in 2024. The growth of this region is mainly driven by the growing number of plasma research institutes along with a rising number of startup companies related to plasma medicines. Moreover, the growing cases of rare diseases in countries such as Canada and the U.S. have also increased the demand for plasma medicines, thereby driving the market growth of the market. In addition, the growing prevalence of nerve and bone-related issues has also increased the demand for plasma therapies, which, in turn, drives the market growth. Also, the presence of plasma companies such as Baxter, LFB Plasma, Pall Corporation, ADMA Biologics, Inc., and some others also drives the market growth.

Asia Pacific is expected to witness the fastest rate of growth in the plasma fractionation market during the forecast period. The growth of this region is mainly driven by scientific developments and advancements in the healthcare sector in countries such as India, Japan, and China. Also, the rising initiatives from the public and private sectors for research & development related to plasma therapeutics have also boosted the market growth. Moreover, an increase in government initiatives aimed at opening plasma centers also fosters market growth. Furthermore, the presence of biopharma companies such as Grifols, Octapharma, Sanquin, CSL, Eden Biologics, and some others is also driving the growth of the market.

The plasma fractionation industry has experienced rapid developments due to advancements in healthcare sectors. Plasma fractionation is a down-streaming method that deals with separating different components of blood plasma. This process is used to convert human plasma into medicines and therapies for the treatment of different diseases. It uses various separation processes such as depth filtration, precipitation, centrifugation, and chromatography. The application of plasma fractionation has increased rapidly in various domains such as neurology, immunology, hematology, and some others due to the higher efficacy of plasma therapies than conventional medicines.

This plasma fractionation market is fragmented, with the presence of small and large market players. These market players are actively engaged in research and development activities related to plasma fractionation. Some of the most prominent market players include Boccard, Grifols, S.A., Hemarus Therapeutics Limited, ADMA Biologics, Bio Products Laboratory Ltd., Intas Pharmaceuticals Limited, LFB S.A., Merck Group, Octapharma AG, PlasmaGen BioSciences Pvt. Ltd., SK Plasma Co. Ltd, Virchow Biotech Private Limited and some others.

| Report Coverage | Details |

| Market Size in 2025 | USD 39.08 Billion |

| Market Size by 2034 | USD 79.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Method, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing incidences of von willebrand's disease

The rising prevalence of Von Willebrand's disease has increased the demand for plasma therapy. Plasma therapies are found to be highly effective for treating Von Willebrand's disease as they help in blood clots in different parts of the human body. This, in turn, drives the growth of the plasma fractionation market. Also, several plasma-based therapies are approved by government organizations for the treatment of Von Willebrand's disease.

High cost and unavailability of high-quality plasma

There have been several developments in the plasma fractionation industry in recent times. The research and development activities related to plasma-based products come with a high cost. Also, the availability of suitable plasma is very low, and plasma companies import plasma from different parts of the world, which is very costly. Thus, higher costs associated with plasma product manufacturing are expected to restrain the growth of the plasma fractionation market.

Rising investments to develop plasma fractionation

The plasma therapy industry has grown rapidly in recent times due to the rising number of rare diseases across the world. Several plasma therapy companies have started focussing on enhancing their plasma fractionation and collection capabilities. Also, some plasma product companies have started adopting strategies such as business expansions, acquisitions, and the inauguration of R&D facilities related to plasma therapeutics. Thus, growing investment related to plasma fractionation is expected to create ample growth opportunities for the plasma fractionation market players.

The centrifugation segment led the plasma fractionation market in 2024. The growth of this segment is driven by the growing application of this method for the extraction of cells from plasma. Moreover, centrifugation methods can facilitate the separation of red blood cells and white blood cells from one another or from platelets. Thus, the rising application of centrifugation for different applications boosts the growth of the market.

The chromatography will grow rapidly during the forecast period. The growth of this segment can be attributed to the growing application of chromatographic purification in the removal of plasma viruses, along with the rising use of industrial chromatography for plasma fractionation. Also, the rise in research and development activities related to the extraction of pure plasma along with albumin production has further driven the market growth. Moreover, the presence of High-performance liquid chromatography (HPLC) equipment companies such as Agilent Technologies. Welch Materials, Waters Corporation, Thermo Fisher Scientific, Waters Corporation, ArgusEye, Shimadzu Corporation, and PerkinElmer, Inc. also drive the market growth.

The immunoglobins segment dominated the plasma fractionation market in 2024. This segment is mainly driven by the rise in the number of patients suffering from melanoma and prostate cancer around the world. Also, several research and developments related to the innovation of immunoglobulin therapies, along with the rising application of immunoglobin in neurological disorders, are driving the market growth. Moreover, the presence of immunoglobins companies such as CSL Behring, Kedrion S.p.A., Takeda, Octapharma, Baxter International Inc., Biotest AG, and some others boosts the market growth.

The coagulation factors segment is projected to witness the fastest growth in the plasma fractionation market during the forecast period. The growth of this segment is mainly due to the growing application of plasma coagulation for stopping blood losses during endoscopy and treatment of gastrointestinal diseases. Moreover, the growing cases of sickle cell anemia have increased the demand for plasma coagulation, thereby driving the growth of the market.

The neurology segment dominated the plasma fractionation market in 2024. This segment is generally driven by the rise in the number of nerve patients across the world. Plasma-based medications are found to be highly effective against nervous disorders, which in turn boosts the market growth. Also, the research and advancements related to neurological sciences, along with the rising adoption of plasma therapies for the treatment of nerve problems, accelerate the growth of the market.

The oncology segment will grow at a considerable rate in the plasma fractionation market during the forecast period. The growth of this segment is generally driven by the rise in government initiatives towards cancer along with the growing application of plasma therapies for treating cancer. Moreover, the growing prevalence of cancer around the world also drives the market growth. Also, the growing adoption of plasma-assisted cancer immunotherapy and the use of cold atmospheric plasma (CAP) for treating cancer patients has also boosted the growth of the market.

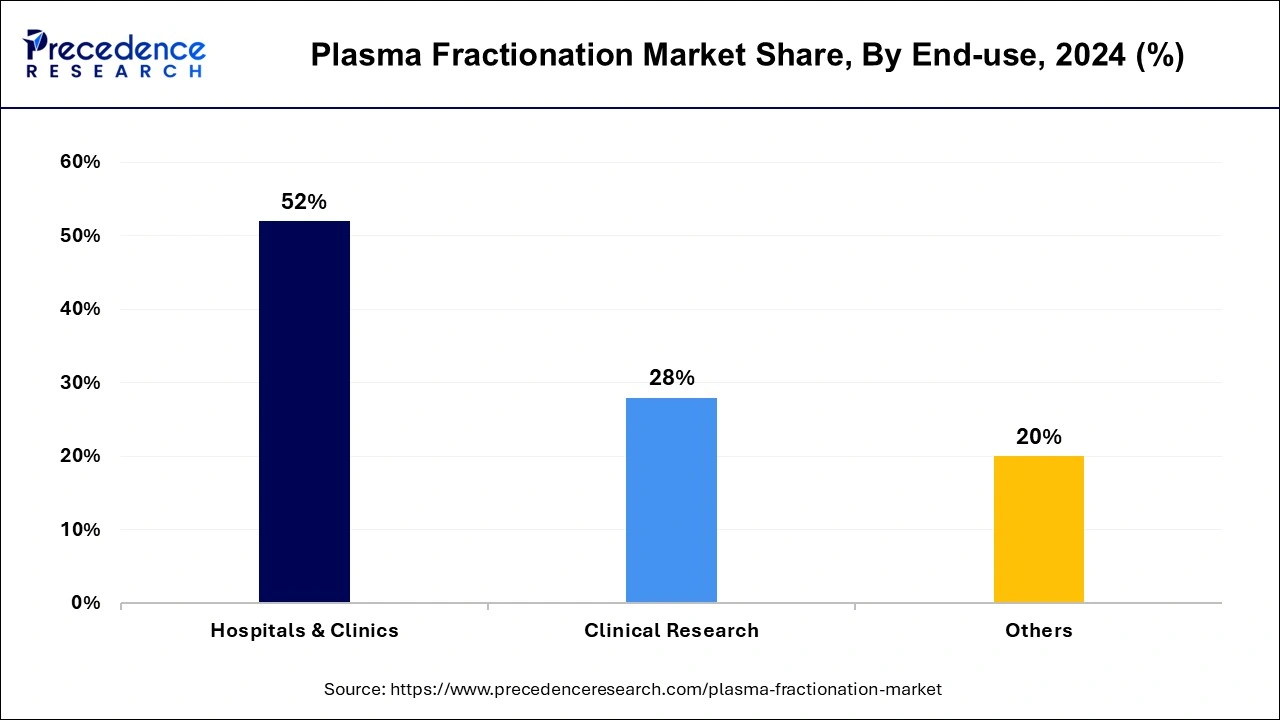

The hospitals & clinics segment held the largest share of the plasma fractionation market in 2024. The growth of this segment is generally driven by the growing number of hospitals and clinics across the world. Also, growing advancements in hospital infrastructure for the treatment of auto-immune diseases drive the growth of the market. Moreover, the availability of experienced doctors in clinical settings has also increased the demand for plasma therapies for the treatment of cancer, heart diseases, and some others, thereby driving the market growth.

The clinical research segment is projected to grow rapidly in the plasma fractionation market during the forecast period. The growth of this segment can be attributed to the rising adoption of plasma therapy for the treatment of rare diseases. Moreover, rising research and development activities for the production of plasma-based therapeutics also drive the growth of the market.

By Product

By Method

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

November 2024

September 2024