January 2024

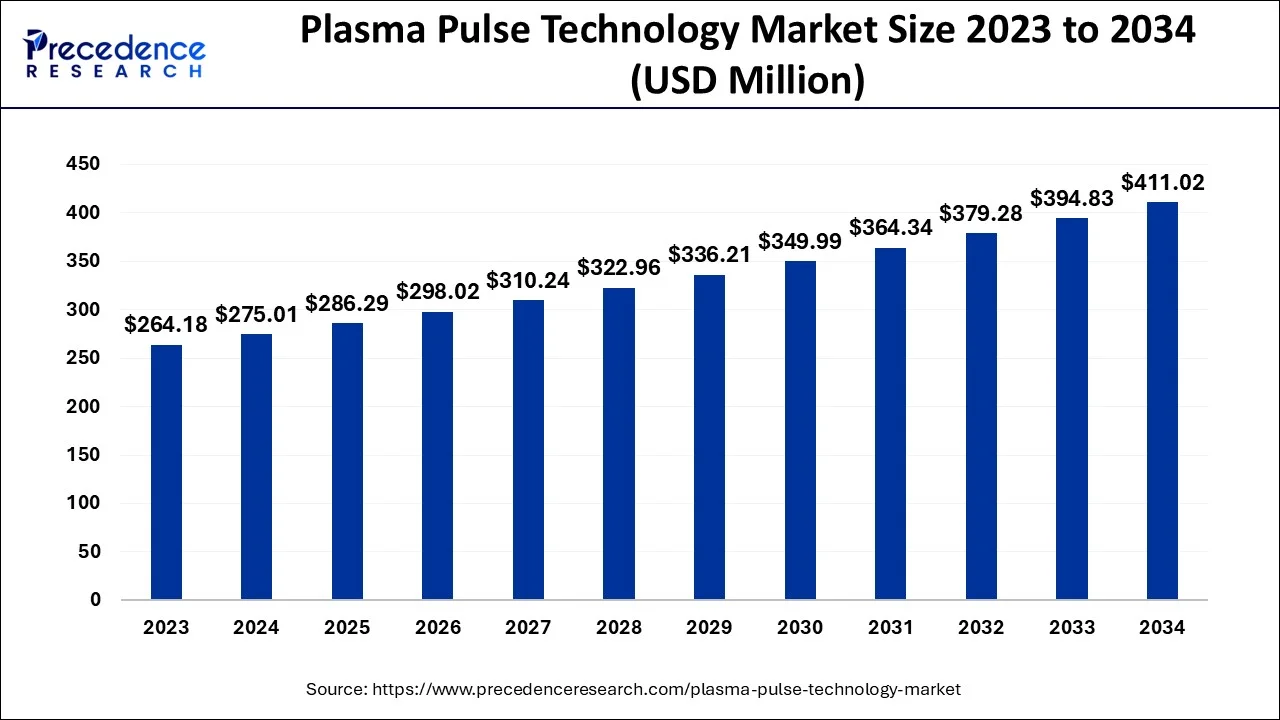

The global plasma pulse technology market size accounted for USD 275.01 million in 2024, grew to USD 286.29 million in 2025 and is predicted to surpass around USD 411.02 million by 2034, representing a healthy CAGR of 4.10% between 2024 and 2034.

The global plasma pulse technology market size is estimated at USD 275.01 million in 2024 and is anticipated to reach around USD 411.02 million by 2034, expanding at a CAGR of 4.10% from 2024 to 2034.

The plasma pulse technology is administered by utilizing an e-wireline tubing carrying a plasma pulse generator that is played in the well and is positioned together with the perforations. In addition, by utilizing the energy stored in the generator’s capacitors, the wire is further super ionized while creating a cold plasma, a non-linear acoustical wave. This in return wipes out the near well-bore skin damage and perforations. Furthermore, these waves endure resonating deeper into the reservoir, while exciting the molecules fluid in nature and increasing the natural resonance of the reservoirs to the degree it increases the mobility of hydrocarbons and creates nano fractures. Thus, this surge resonance lasts for up to a year just after the treatment and thus affects the reservoir up to a distance of 1500 meters.

The plasma pulse technology (PPT) is an eco-friendly technology that enables farmers to consistently increase the production of their wells. In order to optimize efficiency, the oil and gas sector has consistently been able to build and put knowledge into the practice of innovative technology in up cycles and down cycles. Operators must immediately use innovative technology to improve the recovery of hydrocarbons from existing wells in the oil and gas sector. The plasma pulse operation is a much smaller, less invasive method of oil extraction than methods such as refracting. The situation is reflected in a typical wire-line vehicle operating a 275-pound tool that can be carried by two people on their own. Additionally, the process of generating underground pulses that might affect oil in the rock which appears to be difficult.

| Report Coverage | Details |

| Market Size in 2024 | USD 275.01 Million |

| Market Size by 2034 | USD 411.02 Million |

| Growth Rate from 2024 to 2034 | CAGR of 4.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | North America |

| Fastest Growing | Asia Pacific |

| Segments Covered | Technology, Application, Product, and Geography |

Plasma pulse technology (PPT) backed EOR treatment is managed via an electric wireline which conveys a plasma pulse inventor tool that's run in the well and deposited alongside the perforations. Using energy stored in the creator's capacitors, a tube bow is created that emits a tremendous quantum of heat and pressure for a bit of an alternative. Therefore, this in turn creates a huge hydraulic impulse aural swell band that is important enough to cleanse near-wellbore and perforations damage. These swells continue to reverberate deep into the force, instigative instigating the fluid motes and adding the budgets budget’s natural resonance to the degree that it can break larger hydrocarbon notes to lower ones and contemporaneously reduce adhesion pressure which results in increased mobility of hydrocarbons. This technology has been effectively utilized in injection wells and products. Furthermore, it has been utilized frequently as a remedial procedure to enhance the well's productivity, which has been on the product for a period, propelling its market growth.

The ongoing COVID-19 pandemic has impacted the oil & gas industry encyclopedically. Owing to the ongoing situation, various oil and gas companies across the world shut down their manufacturing installations and services as countries rehearsed full or partial strategies of lockdown to deal with the pandemic. The key players across the region also further delayed or suspended primary and major oil & gas systems. Likewise, the pandemic has further impacted the prices of crude, drilling of wells and product conditioning, and the force chain of oil & gas. In addition, the drop in product conditioning has further adversely impacted the market in the short/ medium term.

There are various methods to extract the enhanced oil recovery which are available and will raise production from the existing wells. These involve injecting steam, water, gas, or chemicals to sweep or flush the residual oil from the oil reservoir. However, all this process thus requires fluid mobilization along with expensive downhole and pump tools with which it is injected into the wells and gradually into the hydrocarbon reservoirs. Moreover, plasma pulse technology is a substitute for the other costly methods which further require a negligible capital outlay, does not involve any water or chemicals, is environmentally safe, has been proven in over 400 wells globally, and will not damage the wellbore or formation. Plasma Pulse Technology has, on average, experienced 100% incremental over the last two years.

Companies all across the world are working to create new and improved technology. Ultrasonic and plasma pulses are two of them. The strength of ultrasound is decreased to the well's bottom with ultrasonic technology. It can be done for a brief treatment or a long-term installation for irregular use. Up to 50% more oil is produced by this treatment. To increase production rates in wells with limited permeability, ultrasonography is used in combination with chemical flooding.

Plasma Pulse Technology uses hydraulic fracturing methods. The process starts with the plasma waves' resonance inside an oil reservoir. Through tiny gaps and to the earth's surface, the oil may travel more fluidly owing to these waves. EOR is a dependable method for recovering oil from old wells despite rising demand and shifting oil processes.

The market for plasma pulse technology has been hampered by factors such as oil price volatility and the high cost of oil well exploration. The profitability of oil corporations has been declining as a result of the recent substantial increases in oil prices. In addition, political unrest in key oil-producing nations like Iran, Venezuela, and Russia are making matters worse for oil and gas businesses, which are now focusing on more money to increase their production capacity. These elements are delaying plans for making improvements and impeding the development of the plasma pulse technology market.

Covid-19 Impact on the Plasma Pulse Technology Market

The growing COVID-19 outbreak has reduced oil and gas industry exploration and production. Additionally, as a result of the lockdown in many nations, the transportation industry and its associated conditioning have decreased and disturbed the supply chain management which results in many problems. Similarly, several oil firms are delaying liquefied natural gas (LNG) design construction as a protective measure against oversupply. The market for plasma pulse technology is faced with a difficult environment.

By technology, the thermal EOR segment is expected to hold the largest market share in the plasma pulse technology market during the forecast period. In addition, in thermal EOR, steam is infused to improve the mobility of oil via the reservoir and lower the viscosity. It is majorly utilized in oil reservoirs that are heavy to recover billions of barrels of heavy crude oil. Furthermore, the thermal EOR is classified further based on the type which includes steam, in-situ combustion, and others. The fastest growing segment is steam which is having a faster CAGR. Due to the growth of mature oilfields and the development of shale gas discoveries in the Gulf of Mexico are likely to drive the steam market.

By application, the onshore segment is expected to grow at the fastest CAGR during the forecast period. Owing to a larger number of mature oil fields located in North America, the Middle East & Africa it is experiencing a high growth rate during the forecast period. The onshore oil fields in these regions are mature and are on the edge of depletion containing billions of barrels of additional oil confined. Such an amount of oil can be recovered through EOR services. Therefore, increasing production activities onshore are driving the plasma pulse technology market.

By product, the surfactants segment holds the largest market share in 2021. Due to the increasing use of surfactants for cleaning purposes. The polymers segment has the fastest growth due to the pandemic the demand for PPE kits increased and the alternative products made by polymers are cheaper, long-lasting, and easily available in the market. Moreover, the increasing use of vehicles growing the petroleum industry, which is results in the crude oil demand.

The Asia Pacific is likely to be the fastest-growing region during the forecast period, with China comprising the largest market share across the region. Rising oil and gas demand from the major economies including India & China along with the augmented deployment of EOR in aged wells in order to meet the targets are likely to augment the market growth in the region of Asia Pacific. However, North America, Europe, South America, Asia Pacific, the Middle East, and Africa are the major regions considered for the study of the plasma pulse technology market. North America is estimated to be the largest market from 2024 to 2034, driven by the growth in unconventional resources in the Gulf of Mexico. Also, nonstop development in shale reserves in the US is anticipated to drive market growth for plasma pulse technology.

Europe is a major producer and consumer of oil and gas, although the region's move toward renewable energy has led to a reduction in oil consumption globally. The enhanced oil recovery market in North America is now being entered by Plasma Pulse Technology. The innovators claim that the technology can access previously untapped oil reserves through a process that is less expensive and more environmentally friendly than current hydraulic fracking techniques.

By Technology

By Application

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2024

July 2024