April 2025

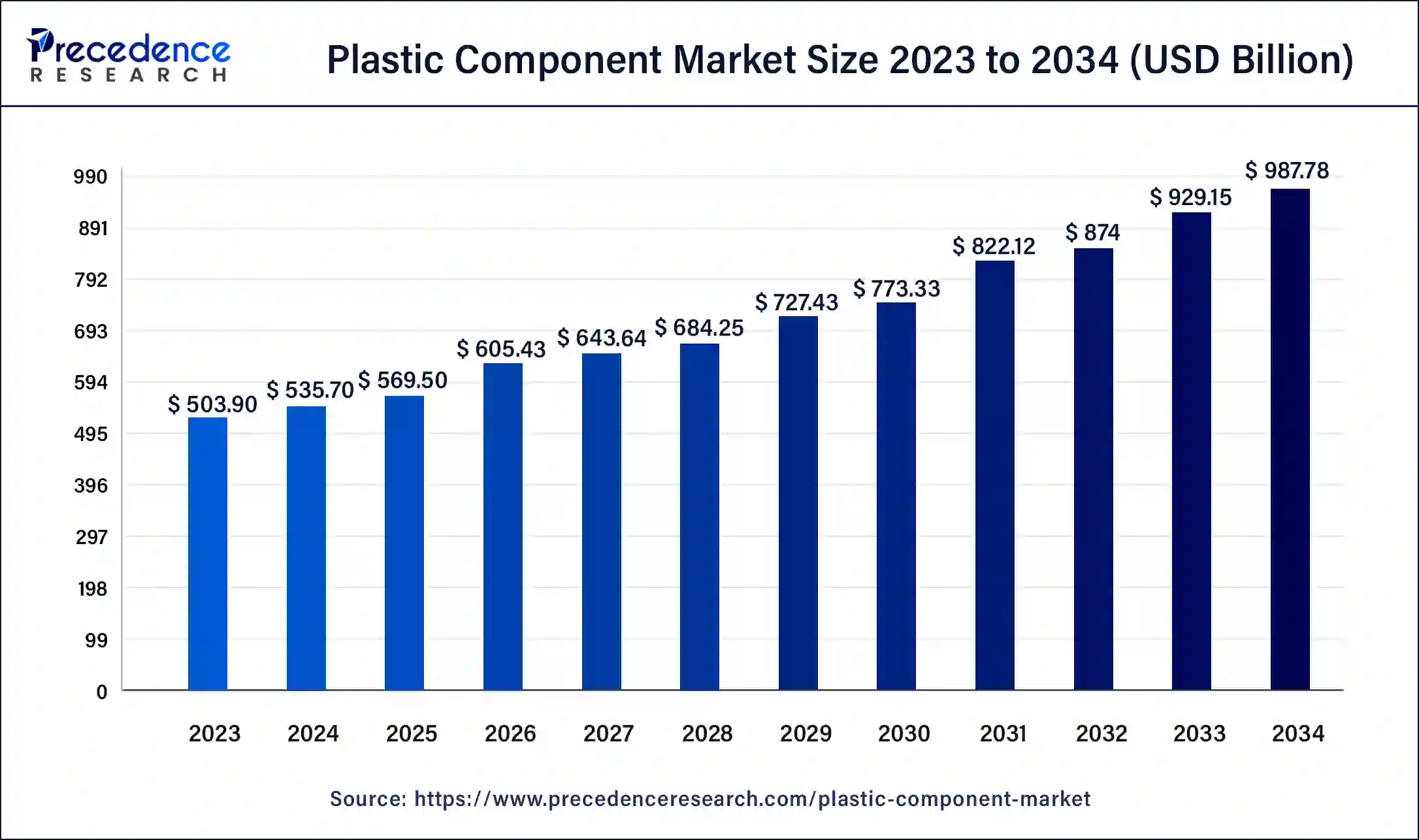

The global plastic component market size was USD 503.90 billion in 2023, calculated at USD 535.70 billion in 2024 and is expected to be worth around USD 987.78 billion by 2034. The market is slated to expand at 6.31% CAGR from 2024 to 2034.

The global plastic component market size is worth around USD 535.70 billion in 2024 and is anticipated to reach around USD 987.78 billion by 2034, growing at a CAGR of 6.31% over the forecast period 2024 to 2034. The rising urbanization in emerging economies, which necessitates the construction of more residential & commercial buildings and improved transport infrastructure, is anticipated to accelerate the adoption of the plastic component market in the coming years.

Plastic is a synthetic or semi-synthetic material that contains polymers as their primary component. Plastic is generally derived from petrochemicals. Petrochemicals are chemicals that are most commonly derived from petroleum or natural gas. Plastics offer ease of fabrication and can be easily molded into solid objects in different shapes and forms using techniques such as extrusion, injection molding, and blow molding. There are several different types of plastics with unique characteristics and properties. Plastic components are widely used across various industries, from automotive to construction and medical devices, owing to their cost-effectiveness, versatility, ease of manufacture, durability, versatility, and lightweight.

| Report Coverage | Details |

| Market Size by 2034 | USD 987.78 Billion |

| Market Size in 2024 | USD 535.70 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.31% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type of Plastic, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for lightweight vehicle

The significantly increasing demand for lightweight vehicles is expected to fuel the growth of the plastic component market. Plastic is most commonly used to make a wide range of automotive components. Plastic components are generally the molded plastic parts used in automotive manufacturing. These include interior trims, exterior body panels, and under-hood components for cars, buses, and trucks. Automotive manufacturers are widely using plastic components in the manufacturing of vehicles and replacing conventional materials owing to the reduced vehicle weight and improved fuel efficiency. Therefore, these factors make plastic components ideal for use in the automotive industry.

Fluctuation in the price of raw materials

The fluctuation in the price of raw materials is anticipated to hinder the plastic component market growth. The raw material prices majorly depend on petrochemical feedstocks, such as crude oil and natural gas, which are often subjected to fluctuation. Such fluctuation in the raw material prices can adversely impact the profitability of manufacturers. Additionally, difficulties in recycling and stringent environmental regulations are observed.

Rise in construction activities

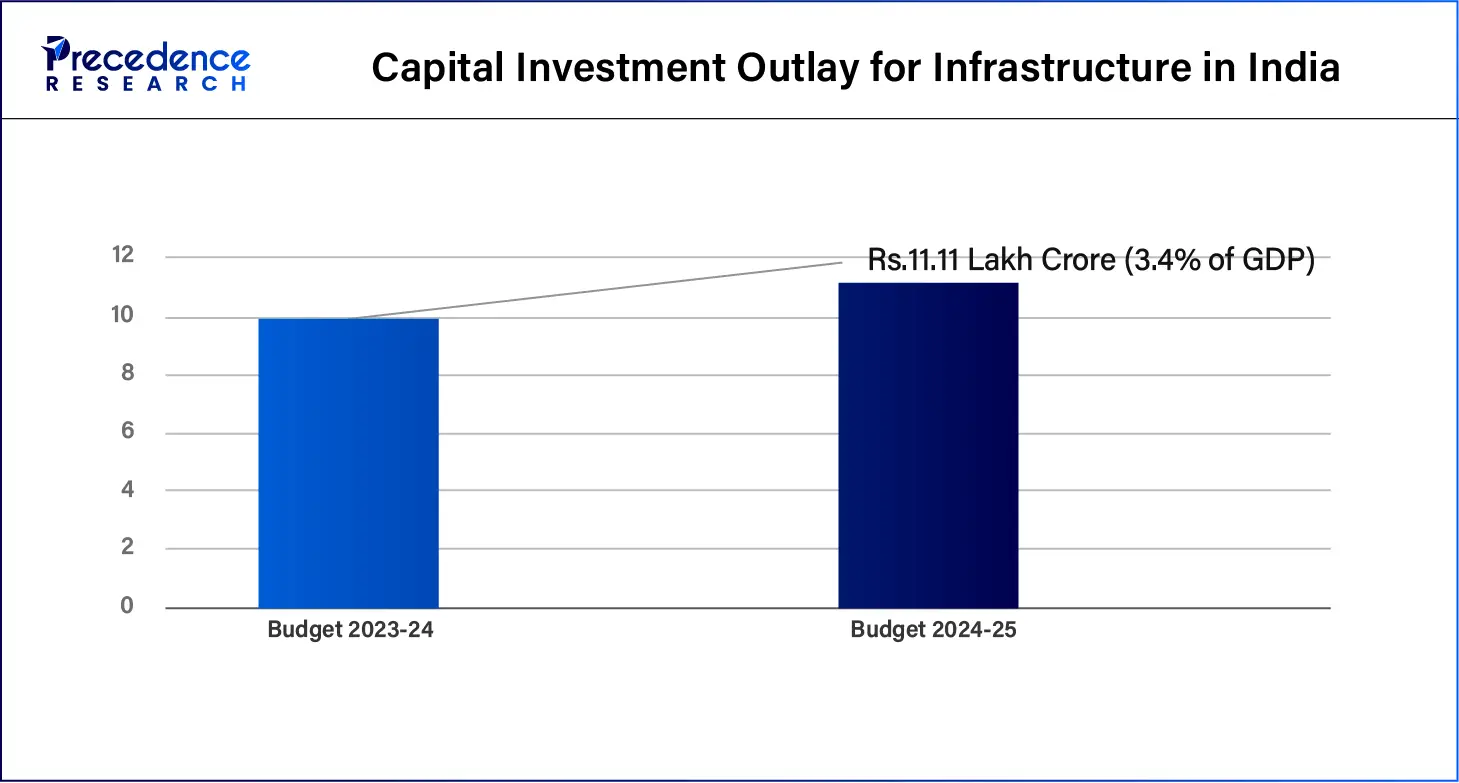

The increasing infrastructural activities and construction projects are projected to create significant growth opportunities for the growth of the plastic component market during the forecast period. The rise of plastic consumption increases with the expansion of the construction industry. Plastic components have a wide range of applications in the construction industry, such as insulation materials, pipes, films, doors, windows, flooring, roofing sheets, and others. The construction industry mainly uses plastic due to its strength-to-weight ratio, versatility, durability, and corrosion resistance. The lightweight plastic makes it easier to transport and shift around sites.

The automotive segment registered its dominance over the plastic component market in 2023. The segment’s growth is majorly driven by the increasing use of plastics in automotive manufacturing. Plastics have become the primary material for vehicles due to their lightweight and fuel efficiency. Modern heavy-duty vehicles such as excavators, loaders, tractors, combine harvesters, buses, and trucks have various plastic content in both interior and exterior. The average automotive vehicle has 30,000 parts, and about â…“ of these parts are made from plastic materials. Plastics are increasingly being used for automotive parts such as fenders, dashboards, carburetors, bumpers, splash guards, engine covers, handles, seating, interior wall panels, cable insulation, and others. In addition, the rapid technological advancement in the plastic industry has brought eco-friendly and lightweight plastics and the increasing production of electric vehicles as well as heavy-duty vehicles.

The electronics segment is projected to expand rapidly in the plastic component market in the coming years. The rapidly evolving electronics industry has led to increased adoption of plastics as it offers several advantages in electronics components manufacturing. Plastic materials are extensively used in the electronic industry as they have invaluable properties that make them a perfect material option. They are lightweight, durable, cost-effective, electrical insulation, heat insulation, easy to design, and others. Plastics in the electronics industry most commonly include switches, connectors, LEDs, wire and cable coating, semiconductors, and others.

The Polypropylene (PP) segment held a significant presence in the plastic component market in 2023. The market has witnessed that Polypropylene (PP) is the most widely used for various applications. Polypropylene is gaining immense popularity due to its lightweight, durability, high resistance to chemicals & corrosion, and flexibility. It can be easily molded into complex shapes without compromising its structural integrity. Polypropylene (PP) finds various applications in the automotive industry, such as interior trim, bumpers, door panels, battery cases, engine covers, and dashboard components, owing to its impact resistance, lightweight, and ease of molding. Moreover, Polypropylene (PP) has an excellent resistance to chemicals and moisture, which makes it a suitable choice for pharmaceutical packaging and chemical storage.

The Acrylonitrile Butadiene Styrene (ABS) segment will witness considerable growth in the plastic component market over the forecast period. Acrylonitrile Butadiene Styrene is widely used in manufactured products due to its durability, ease of mold, good insulating properties, corrosive resistance, cost-effectiveness, and manufacturing simplicity. The most common uses for ABS plastic include pipes, fittings, keyboard keys, 3D building materials, vacuum parts, and refrigeration parts. ABS is the common thermoplastic polymer used for injection molding applications. In the automotive industry, steering, wheel covers, and dashboards are often made of ABS plastic.

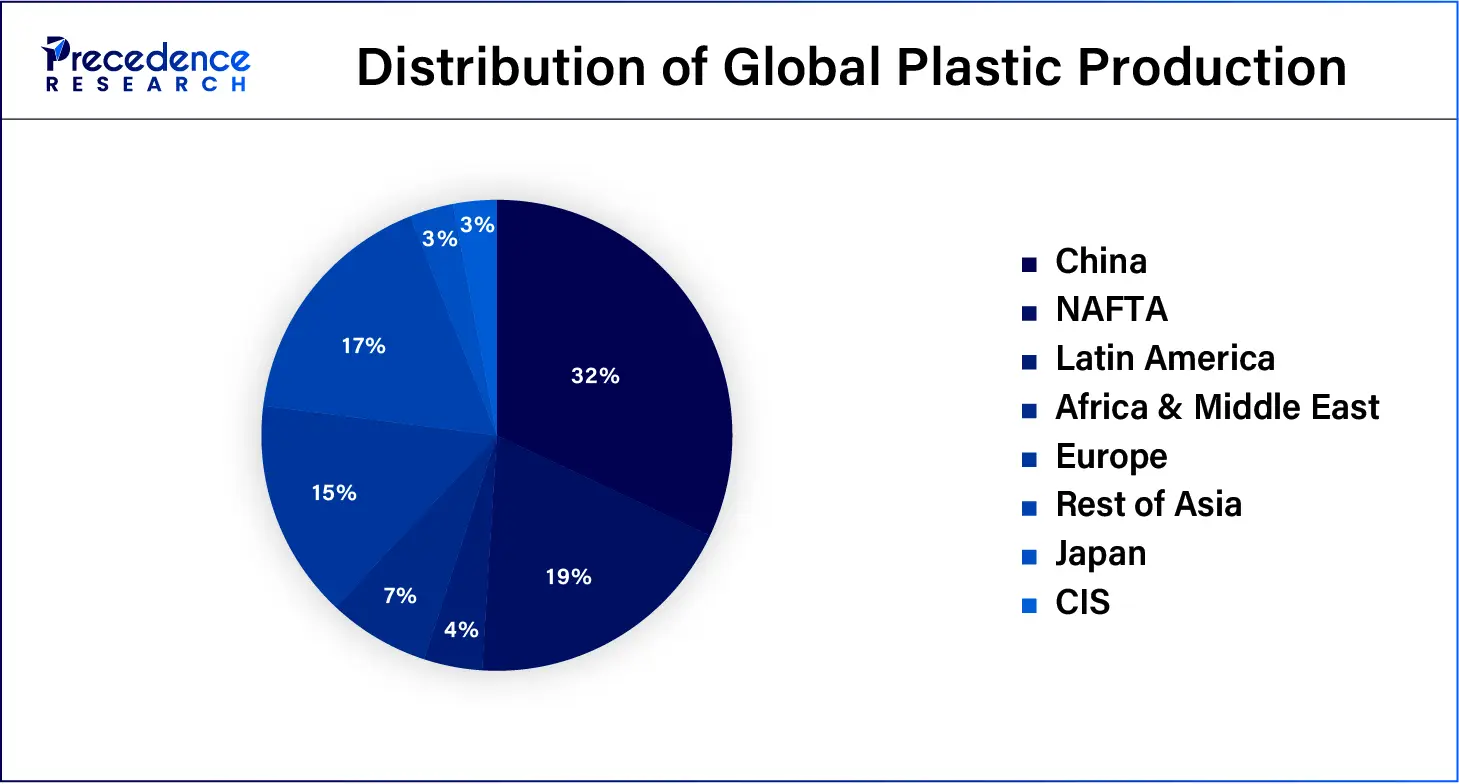

Asia Pacific held the dominant share of the plastic component market in 2023 and is observed to witness prolific growth during the forecast period. The region is expected to experience significant growth during the forecast period. This growth is due to the presence of prominent market players, rapid urbanization, improving economic conditions, increasing demand for medical devices, growing demand from the electrical & electronics industry, rising research and development activities, the increasing trend of replacing glass and metals, expansion of the packaging industries, and rising consumer spending on household products.

Moreover, the rising demand for lightweight vehicles coupled with increasing sales of electric and hybrid vehicles are expected to positively impact the market's expansion in the coming years. India and China are the major contributors to the plastic component market owing to the significantly increasing demand for plastic components from various industries such as automotive, consumer goods, construction, healthcare, packaging, electrical & electronics, and industrial machinery.

The availability of cheap labor and raw materials in countries such as China and India is anticipated to accelerate the regional plastic component market growth during the forecast period. China has a robust presence in the plastic industry to meet the increasing consumer demand and reduce imports. India is also one of the largest producers and manufacturers of plastics.

North America is expected to grow at a rapid pace in the plastic component market during the forecast period. The North American plastic component market is characterized by the penetration of plastics in automotive manufacturing, rising construction & infrastructure activities, rising demand from the packaging industry, rising preference for lightweight components, increasing demand for electric and hybrid vehicles, and modernization in production techniques. In addition, rapid technological advancement, along with rising research and development activities, are expected to result in the development of innovative plastic components to cater to the evolving needs of various industries.

Segments Covered in the Report

By Type of Plastic

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024