April 2025

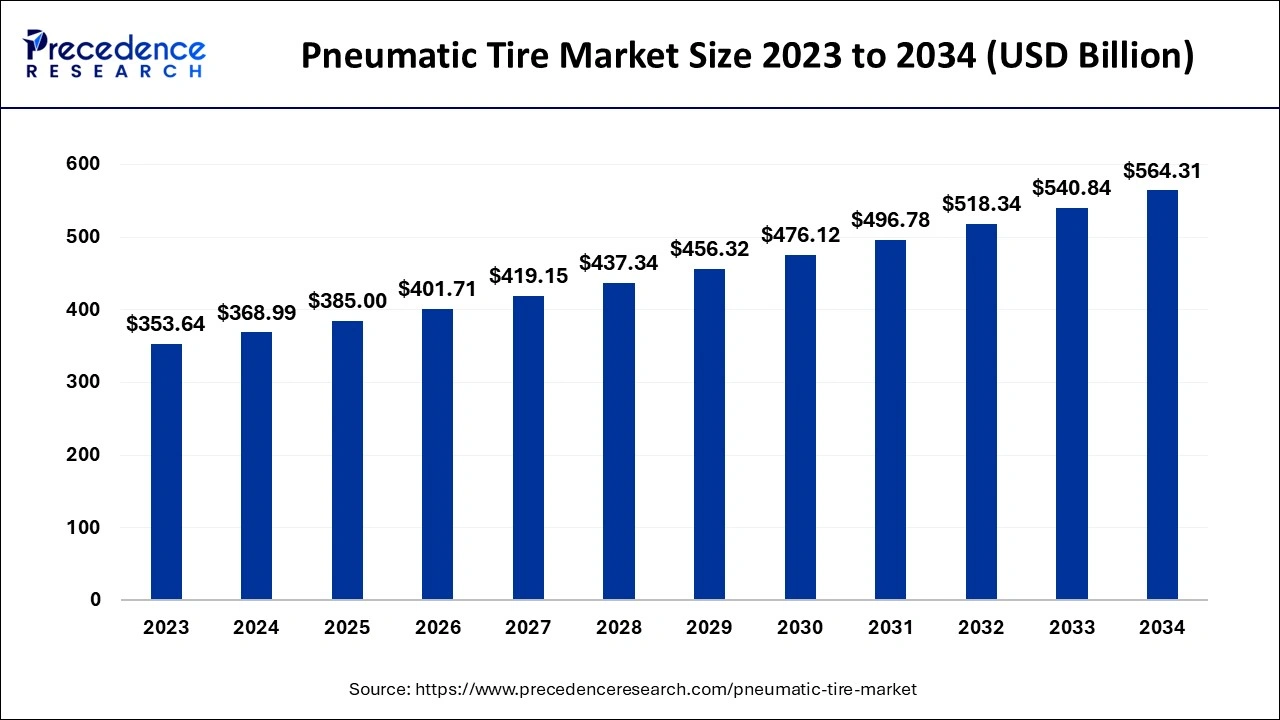

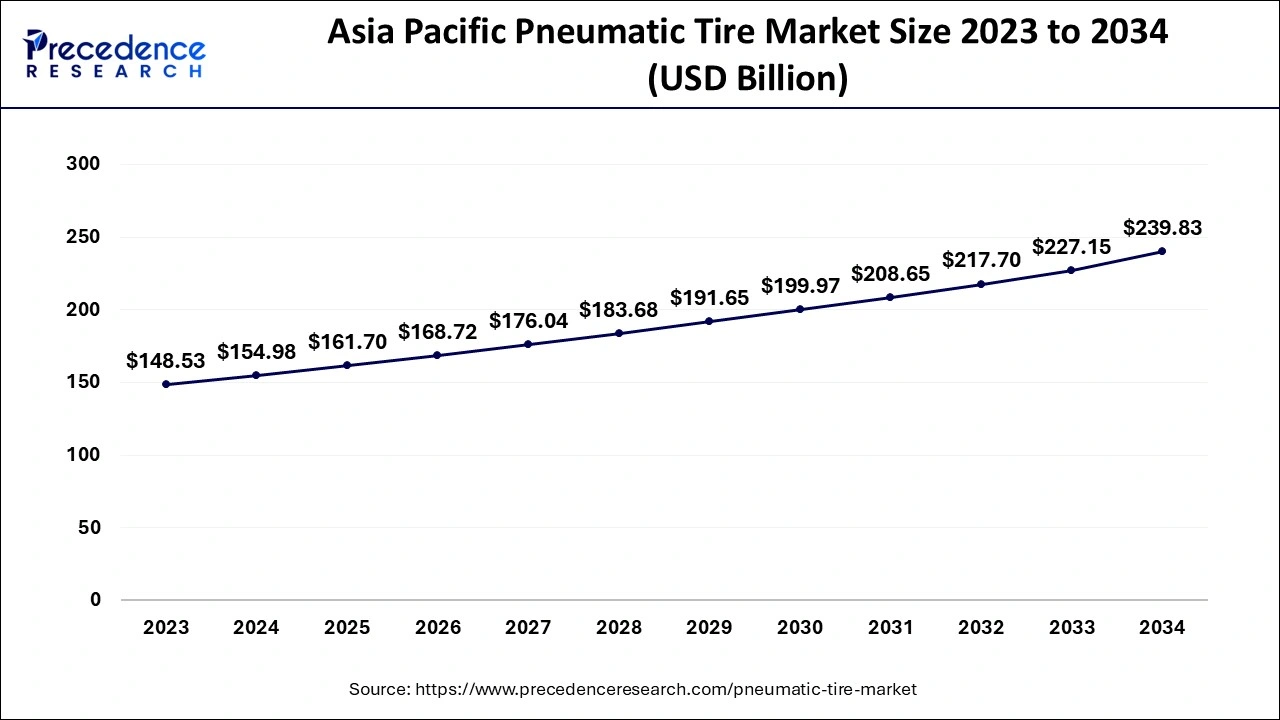

The global pneumatic tire market size is evaluated at USD 368.99 billion in 2024, grew to USD 385.00 billion in 2025 and is expected to be worth around USD 564.31 billion by 2034. The market is expanding at a CAGR of 4.34% between 2024 and 2034. The Asia Pacific pneumatic tire market size is calculated at USD 154.98 billion in 2024 and is expected to grow at a CAGR of 4.45% during the forecast year.

The global pneumatic tire market size is worth around USD 368.99 billion in 2024 and is anticipated to reach around USD 564.31 billion by 2034, growing at a CAGR of 4.34% from 2024 to 2034. The pneumatic tire market growth is attributed to increasing vehicle production and rising consumer demand for fuel-efficient and high-performance tires.

Predictive analytics within manufacturing plants and premises help the end-user better forecast the pneumatic tire market for goods and make optimum decisions on inventory and production, thus cutting down the costs involved. Sophisticated statistical methods are then used to examine large volumes of data, and the fidelity of the tire designs increases, fuel economy improves, and the general performance of the vehicle improves.

Smart tires are embedded with AI-integrated sensors that regularly record the pressure, temperature, and wear of the tires and present their data to consumers and fleet managers. Furthermore, due to AI-integrated marketing, campaigns are also made more personalized by using buying patterns and preferences, thus increasing brand commitment.

The Asia Pacific pneumatic tire market size is exhibited at USD 154.98 billion in 2024 and is projected to be worth around USD 239.83 billion by 2034, growing at a CAGR of 4.45% from 2024 to 2034.

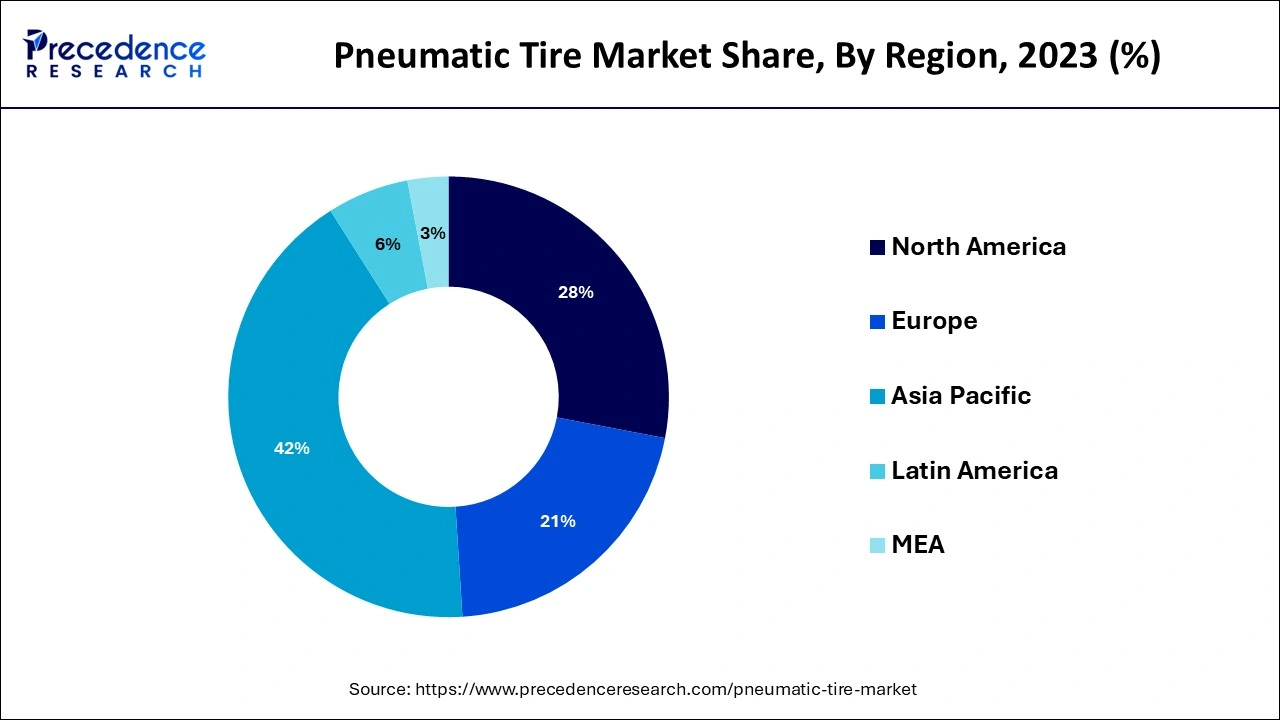

Asia Pacific held the largest share of the pneumatic tire market in 2023, owing to its stronger vehicle manufacturing, a larger automotive population, and growing urbanization. A report produced by the International Organization of Motor Vehicle Manufacturers (OICA) showed that China continued to dominate as the leading manufacturer and user of tires, manufacturing more than 30 million vehicles yearly. Additionally, the growth in the automotive industry has been observed due to local production and growth in exports, with a subsequent increase in the demand for tires.

North America is projected to host the fastest-growing pneumatic tire market in the coming years due to the growth in vehicle population and shift towards SUVs and light trucks that mostly use a larger and differentiated type of tires. Furthermore, the rising adoption of electric vehicles (EVs) in the region would also support the growth of certain tire technologies that are required for enhancing energy efficiency, safety, and performance.

The global pneumatic tire market is anticipated to grow rapidly due to rising demand for electric vehicles (EVs) across the globe, especially the clean and sustainable transportation system. Government regulations are to be backed by the higher demand for stricter emissions and growing incentives for EV production and sales. This is further supported by economic recovery and sane consumer demand for vehicles across the world. This further facilitates and creates demand or advances new tire technologies, such as pneumatic tires.

| Report Coverage | Details |

| Market Size by 2034 | USD 564.31 Billion |

| Market Size in 2024 | USD 368.99 Billion |

| Market Size in 2025 | USD 385.00 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.34% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Vehicle, Sales, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing vehicle production and sales

Increasing vehicle production and sales are anticipated to drive significant demand for the pneumatic tire market. New entrants such as India, Thailand, and Indonesia have also reported increased sales of electric vehicles. This growth in the production of vehicles, along with the enlarging demand for long-lasting energy-efficient tires suitable for EVs, also anticipates a new groundbreaking pneumatic tire technological advancement.

The new tread patterns and compounds with low rolling resistance are said to be in harmony with the global prospects of environmental sustainability and fuel conservation. Such development fulfills the requirements of conventional vehicles and also addresses the requirements of new energy vehicles, including energy saving and safety performance.

Cost-efficiency due to rising raw material prices

Rising raw material prices, particularly for natural and synthetic rubber, are anticipated to hamper cost efficiency in the pneumatic tire market. Volatility in the price of crude oil, which is used in the manufacture of synthetic rubber and tires, raises operating costs and hampers the ability of manufacturers to offer reasonable prices.

The global natural rubber market is impacted by supply limitations for similar reasons, as well as reduced plantation productivity due to climatic shifts, especially in the pneumatic tire market in Thailand and Indonesia. These conditions produce some unreliable supply chain systems and high production costs, limiting market growth and profitability. Furthermore, even transport and trading issues also increase the costs related to material procurement and affect the production system.

Increasing adoption of advanced manufacturing technologies

Increasing adoption of advanced manufacturing technologies is anticipated to create immense opportunities for the players competing in the pneumatic tire market. There is a continuously growing uptake of sophisticated manufacturing technologies, which offers a large and almost untapped ready-made market with massive potential for improving both productivity and product development. Manufacturing industries have been transformed by modern technologies, such as 3D printing, automated production, and manufacturing digital twins.

Bridgestone use of simulation technologies in developing superior tires is one of the highlights of this industry’s technology orientation. Based on the study by the National Institute of Standards and Technology NIST, smart manufacturing is one of the significant components of this transition and is expected to make a huge impact on the efficiency and growth of the industrial sector with support from the government through its White House Critical and Emerging Technologies Report.

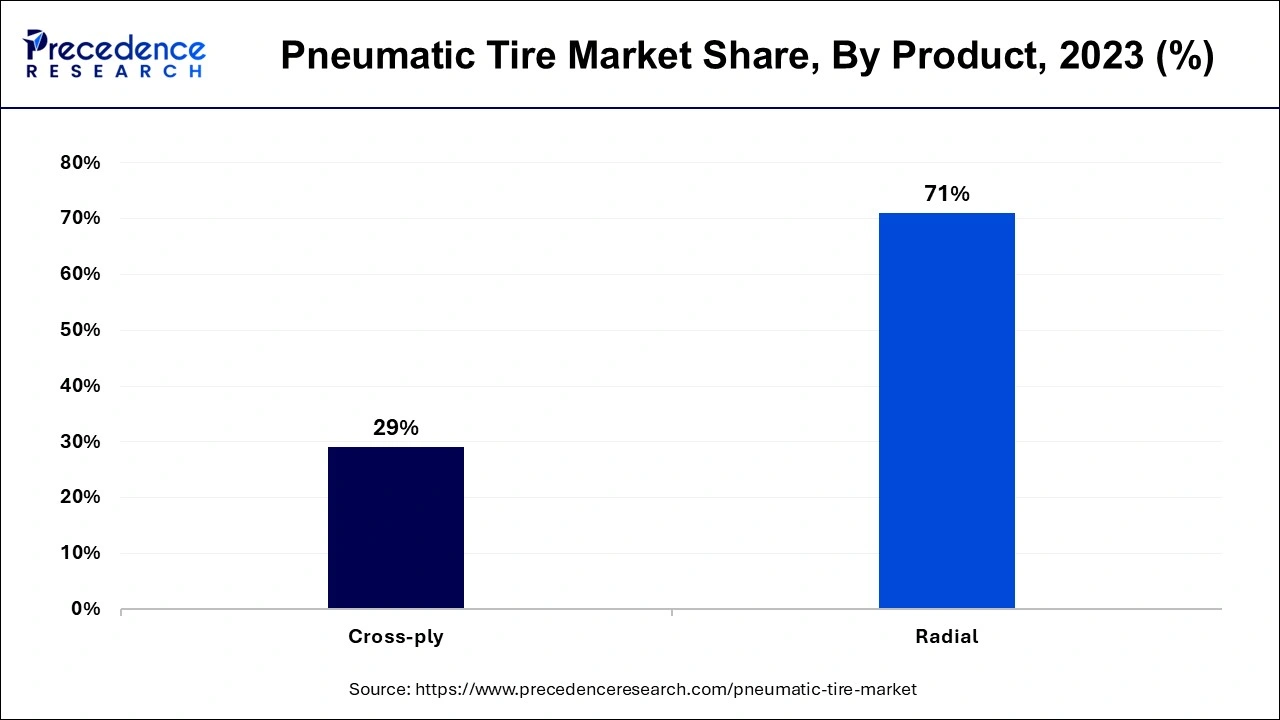

The radial segment held a dominant presence in the pneumatic tire market in 2023. Radial tires, which have located cord plies crossing the direction of travel, have considerably lower rolling resistance, tending to increase fuel efficiency and tire durability. They are also great at providing comfort and stability for cars and trucks, and these are mostly appropriate for passenger cars and commercial trucks. Furthermore, the segment is fueled by radial tire advancement in areas such as North America and Europe due to increased government regulations on the use of fuel-efficient products.

The cross-ply segment is expected to grow at the fastest rate in the pneumatic tire market during the forecast period of 2024 to 2034, owing to their construction, which offers increased sidewall construction and is hence appropriate for rough terrains and heavy loads. Furthermore, the construction and mining vehicles that will be funded by government programs in areas such as Africa and parts of South and Central America are expected to contribute to the increased market for cross-ply tires.

The four-wheelers segment accounted for a considerable share of pneumatic tire market market in 2023. Increased purchasing power and increased population density ensure that the company initiates owning automobiles as transport options, including in India and Brazil. It also owes its strength to the increasing market share of electric vehicles (EVs) as manufacturers develop dedicated tires that improve battery performance. Moreover, the shift towards using bigger cars such as SUVs and premium vehicles in developed countries continues to strengthen the leadership of four-wheeler tires in the tire sector.

The two-wheeler segment is anticipated to grow with the highest CAGR in the pneumatic tire market during the studied years. Growing traffic in cities and the need to conserve space and reduce costs pushed for motorcycle and scooter sales. Furthermore, the rising consumer awareness of the performance and safety features of car tires further boosts the market for pneumatic tires.

The replacement segment led the global pneumatic tire market due to the growing necessity of tire servicing. It is worn out when in use for long durations, and replacement ensures that the vehicle responds to the driver’s commands and is a safe road. The increase in vehicle aging, coupled with evolving consumer concern with tires’ health, provides the backdrop for this segment’s growth.

The OEM segment is projected to expand rapidly in the pneumatic tire market in the coming years. The conversion towards battery electric vehicles is expected to further result in the need for tires with efficient battery consumption, low rolling resistance, and overall vehicle performance. The tire makers are adapting their strategies to meet the requirements of several automobile models, especially self-driving vehicles, durable tires of automobiles of self-driving cars, and automobiles. Additionally, governments in Europe and North America have put into practice high fuel efficiency standards that are expected to create demand for better tires, which improve the overall performance of new vehicles.

By Product

By Vehicle

By Sales

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

December 2024

April 2025