November 2024

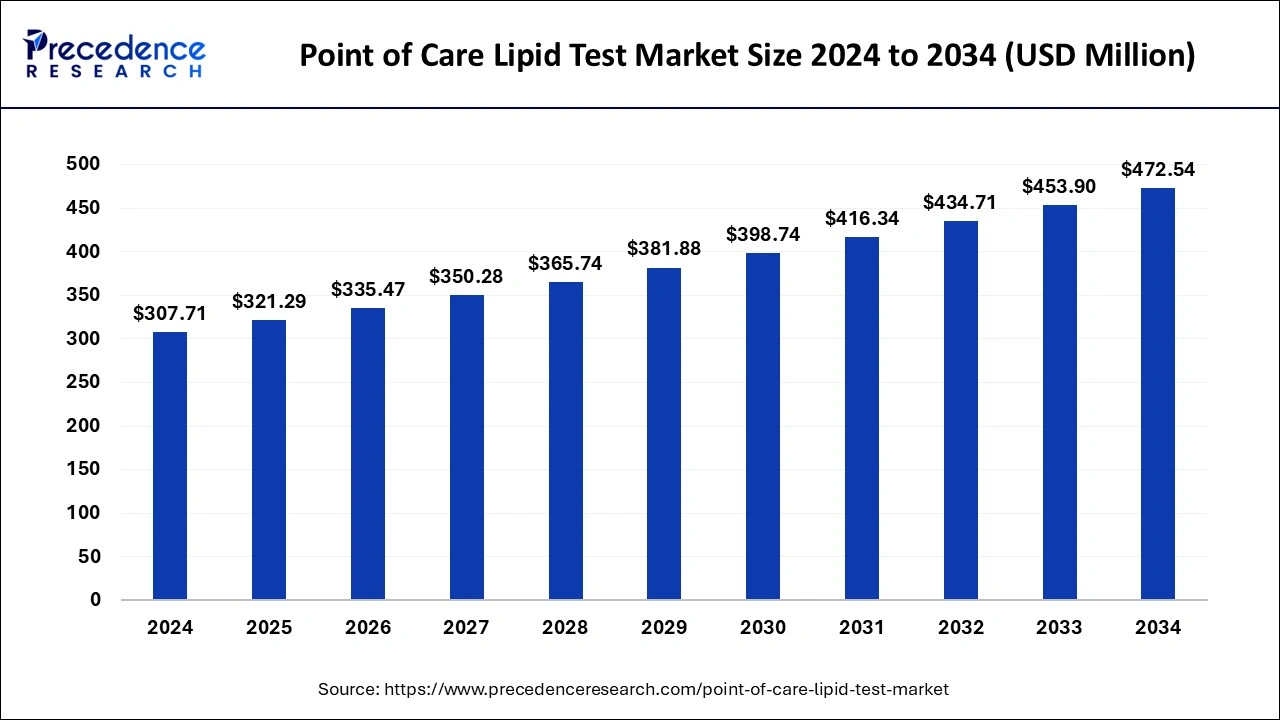

The global point of care lipid test market size is calculated at USD 321.29 million in 2025 and is forecasted to reach around USD 472.54 million by 2034, accelerating at a CAGR of 4.38% from 2025 to 2034. The North America point of care lipid test market size surpassed USD 116.93 million in 2024 and is expanding at a CAGR of 4.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global point of care lipid test market size was estimated at USD 307.71 million in 2024 and is predicted to increase from USD 321.29 million in 2025 to approximately USD 472.54 million by 2034, expanding at a CAGR of 4.38% from 2025 to 2034. The rising prevalence of target diseases such as cardiovascular diseases, diabetes, and dyslipidemia is identified as a key driving factor of the point of care lipid test market.

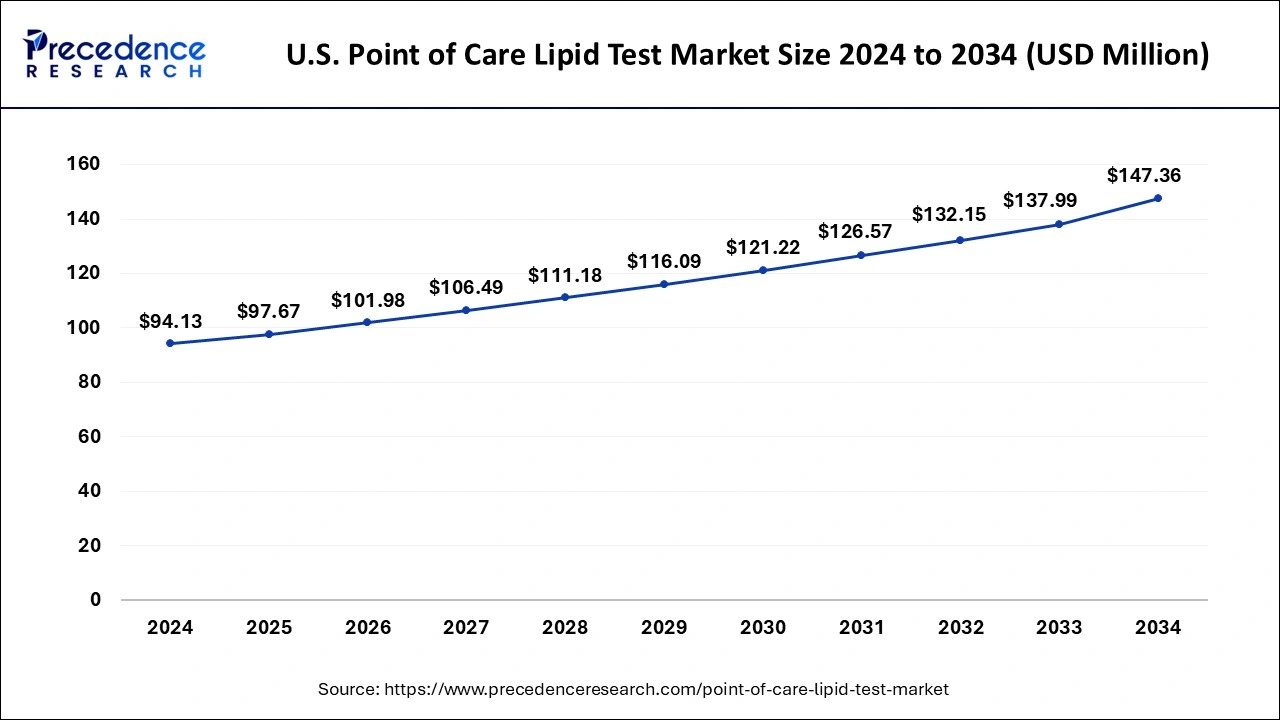

The U.S. point of care lipid test market size was estimated at USD 94.13 million in 2024 and is projected to surpass around USD 147.36 million by 2034 at a CAGR of 4.58% from 2025 to 2034.

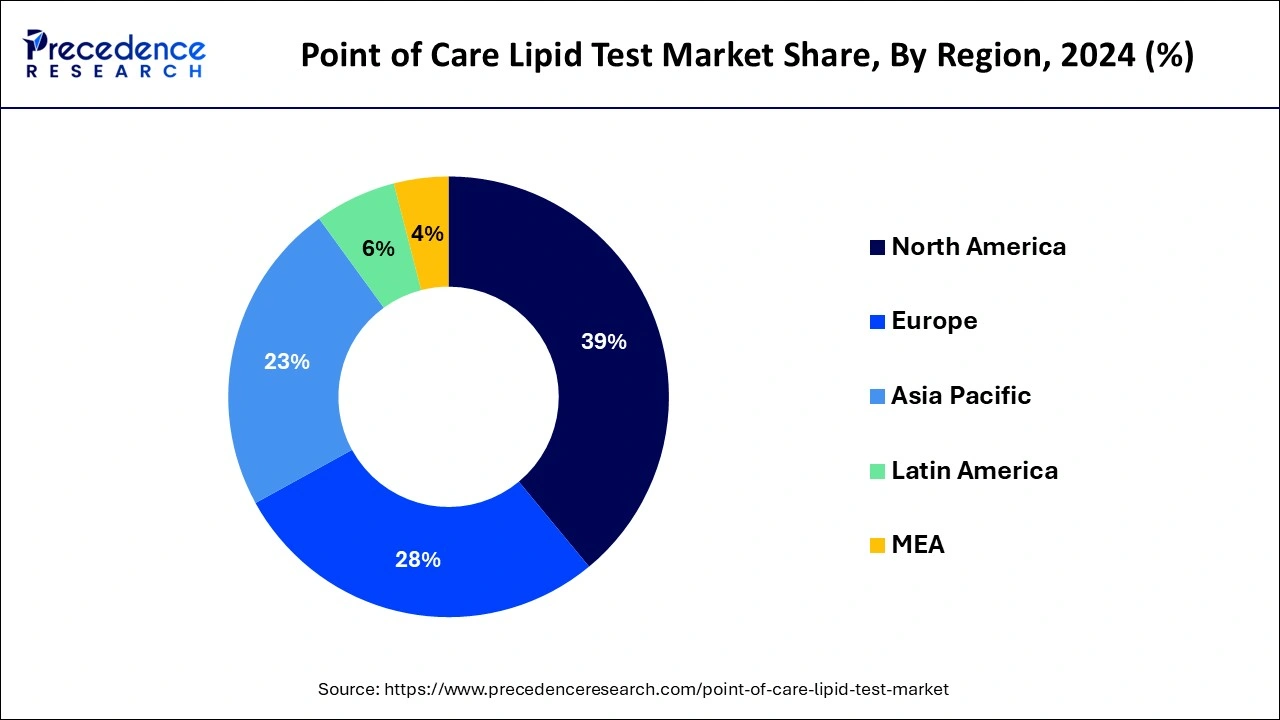

North America held a significant share of the point of care lipid test market in 2024 and is projected to remain dominant during the projected period. This is due to major pharmaceutical and biopharmaceutical companies in the region. Additionally, increasing emphasis on preventive healthcare is expected to drive market growth. Efforts by both government and private sectors to promote healthy lifestyles are likely to contribute to market expansion in the region.

Asia Pacific is anticipated to experience the highest growth in the upcoming years. This is attributed to the increasing prevalence of chronic diseases like diabetes, cardiovascular diseases, and infectious diseases in the region. Point-of-care diagnostics have become crucial for the timely detection and monitoring of these conditions, leading to better disease management outcomes.

Countries across the Asia Pacific are investing significantly in improving their healthcare infrastructure, especially in remote and rural areas. The growing awareness among patients about these diseases and the unmet medical needs in the region are expected to drive the demand for point of care lipid test market.

Point of care testing (POCT) is a type of medical diagnostic testing that allows healthcare professionals to obtain lab-quality diagnostic data quickly and accurately. POCT devices use immunoassays and lateral flow chromatography principles to evaluate whole blood. These tests serve multiple purposes, such as pregnancy testing, blood gas assays, electrolyte analysis, fecal occult blood analysis, drug abuse screening, rapid coagulation testing, and rapid cardiac marker diagnosis.

Point-of-care lipid tests specifically measure triglyceride, lipoprotein, and cholesterol levels in the blood. High cholesterol levels can lead to serious health issues, as they can cause plaque buildup in the arteries, restricting blood flow to the heart and increasing the risk of heart attack. Point-of-care lipid tests help doctors measure and analyze blood fat content quickly and efficiently.

| Report Coverage | Details |

| Market Size in 2025 | USD 321.29 Million |

| Market Size by 2034 | USD 472.54 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.38% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovation in the production of point-of-care lipid test products

The pharmaceutical industry's growth and innovation in manufacturing point-of-care lipid test products, driven by a large pool of health-conscious consumers, presents an opportunity in the market. The expansion of the point-of-care lipid test market is anticipated due to the high potential in untapped emerging markets. These markets benefit from improved healthcare infrastructure, addressing unmet healthcare needs, increasing prevalence of cardiovascular disease, and growing demand for the point of care lipid test market instruments and consumables.

The healthcare industry in emerging economies is progressing rapidly, supported by heightened demand for improved healthcare services, substantial government investments in healthcare infrastructure, and the development of medical tourism. These factors collectively contribute to the growth of the point of care lipid test market.

Challenges in interpreting electronic results can hamper market growth

Long-term challenges related to cost, difficulties in interpreting electronic results, and the requirement for fasting before cholesterol testing may significantly restrict the use of cholesterol and lipid tests in the coming years. Similarly, the absence of LDL and HDL testing features will hinder the growth of the point of care lipid test market.

Understanding the results of some at-home cholesterol test kits can be challenging due to their complexity. Users may not obtain accurate results if the kit is not used correctly. Additionally, electronic testing kits or cholesterol test kits that measure triglycerides, LDL, and HDL levels may be more costly.

Rising prevalence of chronic diseases

The global market for point of care lipid tests is expected to grow due to the increasing prevalence of chronic diseases such as liver and renal diseases, as well as diabetes, during the forecast period. Cardiovascular disease (CVD) is a significant cause of mortality in people with chronic kidney disease (CKD). One of the key factors contributing to CVD in CKD patients is the increased formation of atherosclerotic plaques, likely due to factors such as hyperlipidemia, uremic toxins, inflammation, and endothelial dysfunction.

Opportunities in emerging economies

The demand for point of care lipid test market is seen in developed countries as well as developing nations like China, Brazil, and India, driving market growth. Various key strategies implemented by different players, such as acquisitions, collaborations, product development, and launches, further enhance point-of-care lipid test market growth during the forecast period.

Cardiovascular diseases have emerged as one of the deadliest disorders globally, becoming the leading cause of death worldwide. Over the past three decades, cardiovascular diseases have significantly increased in prevalence and become the most prominent cause of both mortality and morbidity.

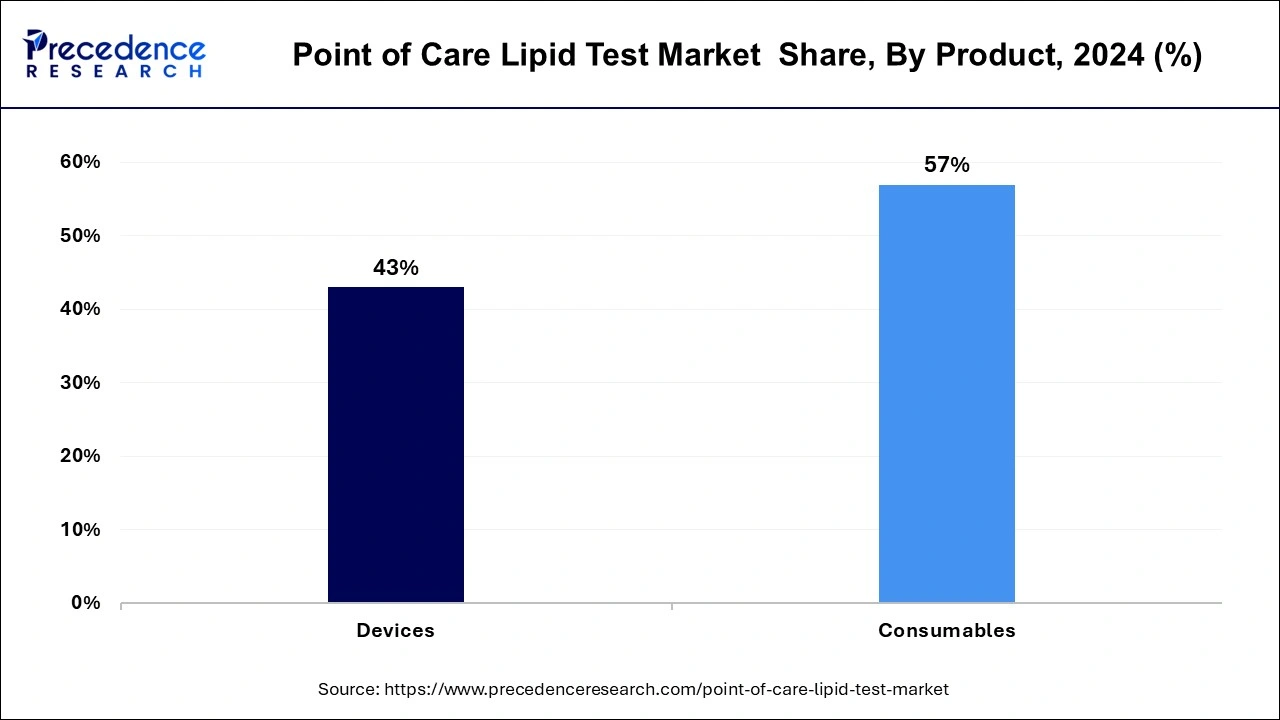

The consumables type segment dominated the global point of care lipid test market in 2024 and is expected to continue doing so throughout the forecast period. This is attributed to the rise in the aging population and awareness of healthcare issues regarding the difficulties and availability of point-of-care lipid test devices in the market by different key players. In addition, it offers benefits such as portability, ease of use, and accuracy.

The endogenous hyperlipidemia segment dominated the point of care lipid test market in 2024 and will maintain its position in the foreseen future. This is linked to the increasing incidence of hyperlipidemia globally. Furthermore, the segment is also driving because of the rising geriatric population, which is more prone to cardiovascular disorders and high cholesterol, fueling the market growth further.

The diagnostic centers segment held the largest share of the point of care lipid test market in 2024 and is expected to witness significant growth in the projected period. These centers are medical facilities where various diagnostic tests and procedures are conducted to identify different medical conditions and illnesses. Diagnostic services aim to provide timely, cost-effective, and high-quality diagnostic care in safe environments. They encompass clinical services such as pathology and laboratory medicine, radiology, and nuclear medicine.

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

June 2024

July 2024

January 2025