January 2025

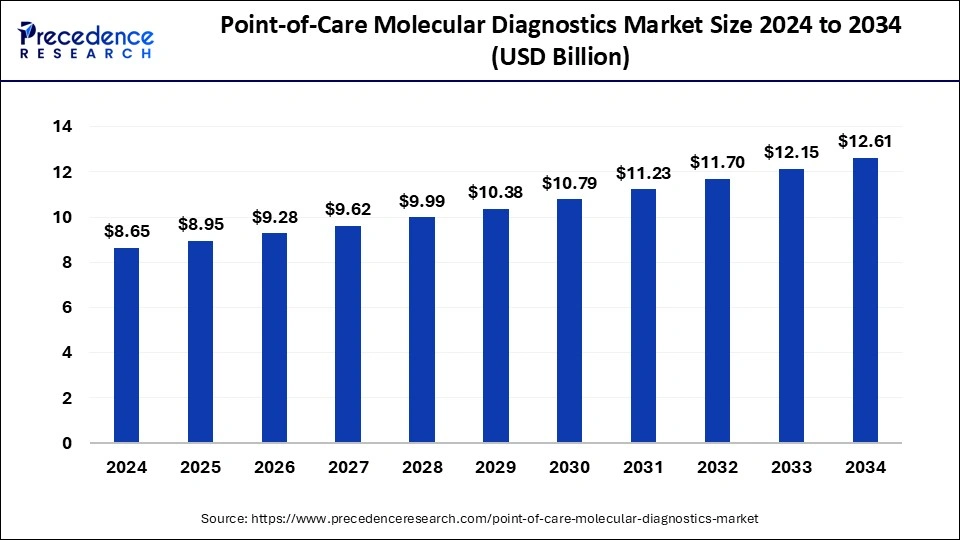

The global point-of-care molecular diagnostics market size is calculated at USD 8.95 billion in 2025 and is forecasted to reach around USD 12.61 billion by 2034, accelerating at a CAGR of 3.87% from 2025 to 2034. The North America market size surpassed USD 3.98 billion in 2024 and is expanding at a CAGR of 3.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global point-of-care molecular diagnostics market size accounted for USD 8.65 billion in 2024 and is predicted to increase from USD 8.95 billion in 2025 to approximately USD 12.61 billion by 2034, expanding at a CAGR of 3.87% from 2025 to 2034.

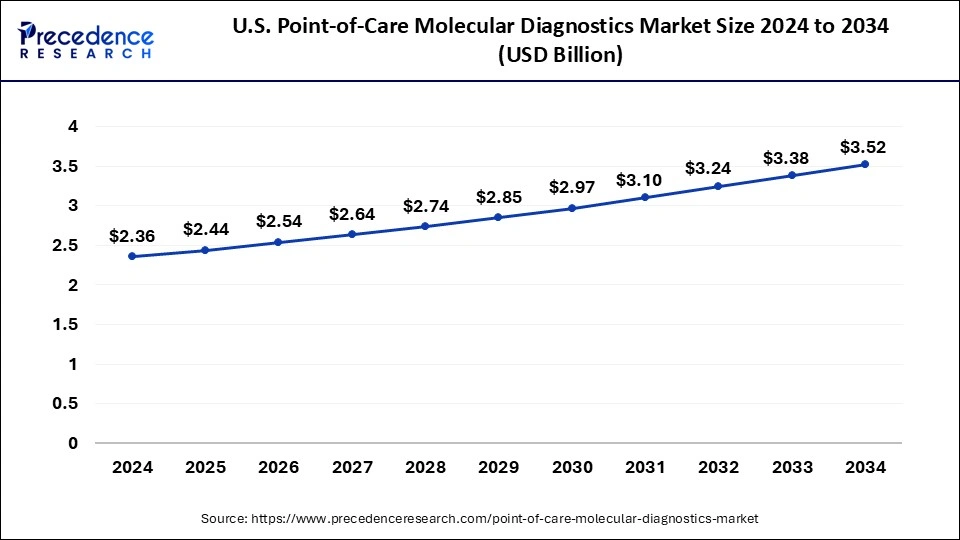

The U.S. point-of-care molecular diagnostics market size was exhibited at USD 2.36 billion in 2024 and is projected to be worth around USD 3.38 billion by 2034, growing at a CAGR of 3.68% from 2025 to 2034.

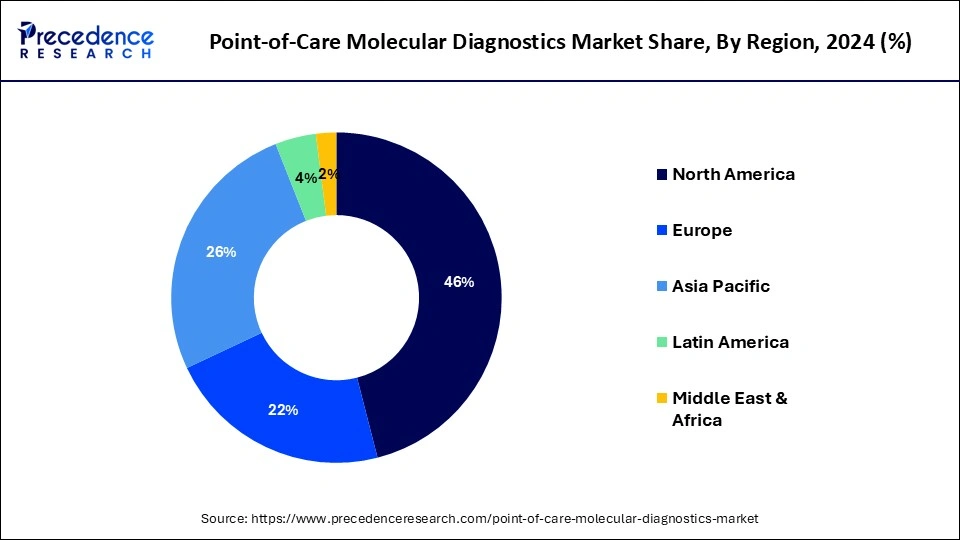

North America has held the largest revenue share 46% in 2024. In North America, the point-of-care molecular diagnostics market is witnessing notable trends. The region has been at the forefront of technological advancements, leading to the development and adoption of innovative molecular diagnostic devices. The COVID-19 pandemic further accelerated the demand for rapid testing solutions. Telehealth integration and the expansion of remote healthcare services have also been significant trends, ensuring access to diagnostics even in remote areas. Regulatory support and robust healthcare infrastructure continue to drive the market's growth in North America.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the point-of-care molecular diagnostics market is witnessing notable trends. The market is growing steadily, driven by increasing healthcare access, rising awareness about early disease detection, and the demand for rapid diagnostics in remote and underserved areas. Government initiatives to improve healthcare infrastructure and the growing prevalence of infectious diseases also contribute to market expansion. Additionally, partnerships with local healthcare providers and technology integration are enhancing the adoption of point-of-care molecular diagnostics in the region.

The point-of-care molecular diagnostics market encompasses the healthcare sector's dynamic involving the development, distribution, and utilization of portable diagnostic devices and assays designed to deliver rapid and accurate molecular-level test results at the point of care. This market addresses the growing demand for immediate and on-site diagnosis, particularly in remote or resource-limited settings. It plays a pivotal role in facilitating timely clinical decision-making, disease management, and monitoring, emphasizing the market's nature as a catalyst for improved patient care and public health outcomes.

The point-of-care molecular diagnostics market represents a transformative segment within the healthcare industry, offering rapid and accurate molecular-level testing at the patient's bedside or in resource-limited settings. This market is marked by significant industry trends, robust growth drivers, unique challenges, and promising business opportunities, positioning it as a critical player in modern healthcare. One prominent trend in the market is the miniaturization and portability of diagnostic devices.

Advancements in technology have led to compact, user-friendly molecular testing tools that can be easily deployed in various clinical settings. Additionally, there's a growing focus on multiplex testing, enabling the simultaneous detection of multiple pathogens or genetic markers in a single assay. Furthermore, the integration of mobile health (mHealth) solutions and cloud-based data management is enhancing accessibility and data sharing, contributing to more efficient patient care.

Several robust growth drivers fuel the expansion of this market. Firstly, the demand for rapid and on-site diagnostics is escalating, driven by the need for immediate clinical decision-making, particularly in emergencies and remote locations. The COVID-19 pandemic underscored the importance of point-of-care molecular testing for infectious diseases. Moreover, the rising prevalence of chronic diseases like cancer and the need for personalized treatment strategies are boosting the adoption of molecular diagnostics.

Additionally, government initiatives and funding for healthcare infrastructure in developing regions are creating new avenues for market growth. Despite its potential, the point-of-care molecular diagnostics market faces challenges. Ensuring the accuracy and reliability of tests in diverse settings is a crucial hurdle. Quality control and standardization are paramount.

Amidst the challenges, promising business opportunities abound. Companies investing in research and development stand to benefit by introducing innovative, user-friendly devices that address unmet diagnostic needs. Strategic partnerships with healthcare providers, clinics, and hospitals can expand market reach and improve access. The integration of artificial intelligence and machine learning for data analysis presents opportunities for enhancing diagnostic accuracy and efficiency. Furthermore, expanding into emerging markets with evolving healthcare infrastructure offers potential growth prospects.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.95 Billion |

| Market Size by 2034 | USD 12.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.87% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Location, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The demand for rapid diagnostic results is a driving force behind the point-of-care molecular diagnostics industry. In critical care settings, immediate access to molecular-level test results enables healthcare providers to make timely and informed clinical decisions, leading to quicker initiation of treatment. This rapid response capability not only enhances patient care but also plays a crucial role in outbreak management and containment of infectious diseases, driving the market's demand for point-of-care molecular diagnostics.

Moreover, the miniaturization of diagnostic devices significantly surges market demand in the point-of-care molecular diagnostics industry. Smaller, portable devices enhance accessibility and versatility, enabling healthcare providers to perform rapid molecular-level tests in various clinical settings, including remote or resource-limited areas. This technological advancement empowers timely diagnostics, particularly in emergencies, and fosters the integration of molecular testing into routine clinical practice, driving the market's growth and expanding its utility in modern healthcare.

Quality control challenges can significantly restrain market demand in the point-of-care molecular diagnostics market. Inconsistent test accuracy and reliability can erode healthcare providers' trust in these diagnostics, limiting their adoption, particularly in critical clinical decision-making scenarios. Manufacturers must prioritize rigorous quality control measures to ensure the dependability of their devices and tests. Addressing these challenges is crucial to maintain the credibility of point-of-care molecular diagnostics and expand their utility in healthcare settings.

Moreover, Cost-effectiveness is a significant restraint on market demand for point-of-care molecular diagnostics. While these tests offer rapid and accurate results, the expenses associated with test kits, devices, and ongoing maintenance can be substantial. In resource-limited healthcare settings, affordability is a concern. Additionally, the cost-effectiveness of point-of-care tests must be carefully evaluated in comparison to traditional laboratory testing, which can sometimes offer more economical options, impacting their adoption and market demand.

Growing infectious disease threats significantly surge the market demand for point-of-care molecular diagnostics. These threats, exemplified by pandemics like COVID-19, highlight the urgency of rapid and accurate diagnostics at the point of care. Point-of-care molecular tests enable swift identification of infectious agents, supporting immediate isolation, treatment, and containment measures. This critical role in outbreak management and disease surveillance elevates their demand, emphasizing the importance of such diagnostics in public health and clinical settings, driving market growth.

Moreover, the integration of mobile health (mHealth) solutions into the point-of-care molecular diagnostics market surge market demand by enhancing accessibility and connectivity. mHealth facilitates the seamless transmission of diagnostic data from point-of-care devices to healthcare providers, enabling remote consultations, real-time monitoring, and prompt clinical decision-making. This connectivity not only expedites patient care but also aligns with the growing demand for telemedicine and remote healthcare services, thus driving the adoption and market demand for point-of-care molecular diagnostics.

According to the Application, the infectious disease segment has held 31% revenue share in 2024. Infectious disease testing within the point-of-care molecular diagnostics market involves the rapid and on-site detection of pathogens, such as viruses and bacteria, directly from patient samples. Recent trends show an increased demand for infectious disease point-of-care testing, driven by the need for quick and accurate diagnosis, especially during disease outbreaks like COVID-19. Technological advancements have given rise to portable devices capable of rapidly identifying infectious agents. These tools have become indispensable for managing and containing infectious diseases, as they provide results within minutes, enabling swift response and intervention.

The oncology segment is anticipated to expand at a significantly CAGR of 4.8% during the projected period. In the point-of-care molecular diagnostics market, oncology refers to the application of molecular diagnostic tests for the rapid and precise detection of cancer-related biomarkers, genetic mutations, and oncogenic pathogens at the point of care. A significant trend in oncology-related point-of-care molecular diagnostics is the development of tests that enable early cancer detection, patient stratification for targeted therapies, and real-time monitoring of treatment responses. These advancements enhance cancer care by facilitating timely interventions and personalized treatment strategies.

Based on the technology, PCR-based segment is anticipated to hold the largest market share of 59% in 2024. Polymerase Chain Reaction (PCR)-based technology in the point-of-care molecular diagnostics market involves amplifying and detecting DNA or RNA sequences. Trends in PCR-based diagnostics include the development of rapid and portable PCR devices, reducing test turnaround times, and improving sensitivity. Miniaturization of PCR equipment, integration with microfluidics, and the use of isothermal amplification techniques are also advancing PCR-based point-of-care diagnostics, making them more accessible and efficient for real-time molecular testing in various healthcare settings.

On the other hand, the genetic sequencing-based segment is projected to grow at the fastest rate over the projected period. Genetic sequencing-based point-of-care molecular diagnostics involve the analysis of DNA or RNA to identify specific genetic sequences, pathogens, or mutations at the point of care. This technology has witnessed growing adoption due to its accuracy and ability to detect various diseases, including infectious diseases and genetic disorders. Trends in this segment include the development of portable sequencing platforms, rapid result turnaround times, and the integration of advanced data analytics for real-time disease monitoring, enhancing its utility in diverse clinical settings.

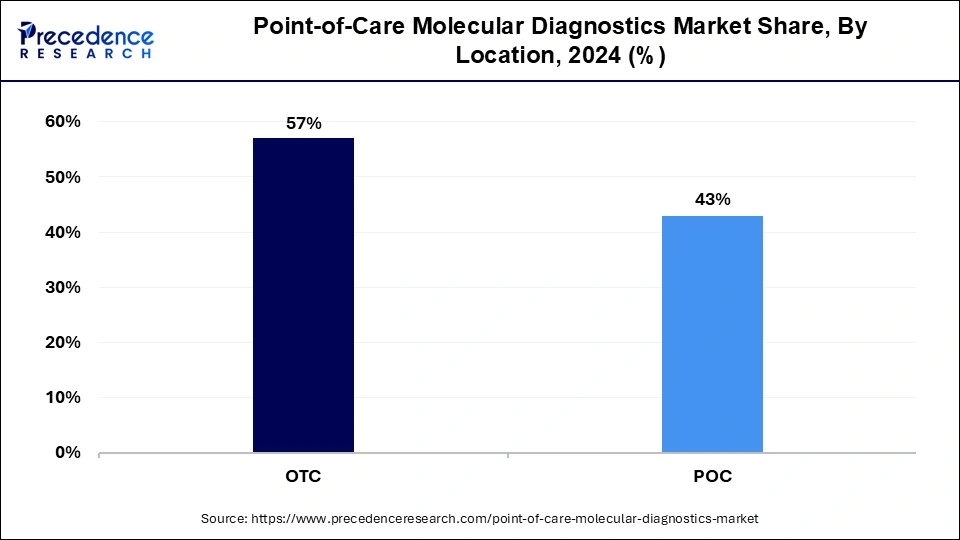

In 2024, the OTC segment had the highest market share of 57% on the basis of the Test Location. The over-the-counter (OTC) segment in the point-of-care molecular diagnostics industry refers to molecular diagnostic tests that consumers can purchase and use without the need for a healthcare provider's prescription or supervision. This segment has seen a growing trend toward increased accessibility and convenience, with the availability of at-home COVID-19 test kits as a notable example. OTC molecular diagnostic tests empower individuals to take control of their health and well-being, aligning with the broader trend of self-care and health monitoring.

The Point of care test location is anticipated to expand at the fastest rate over the projected period. In the point-of-care molecular diagnostics industry, "test location" refers to the specific settings where molecular diagnostic tests are conducted at or near the patient's location, providing rapid results. Trends in this segment include the increasing adoption of point-of-care tests in diverse healthcare settings, such as hospitals, clinics, pharmacies, and even non-traditional locations like airports. The COVID-19 pandemic has accelerated this trend, emphasizing the need for accessible and immediate molecular diagnostics in various test locations.

The decentralized labs segment held the largest revenue share of 45% in 2024. The Decentralized labs in the point-of-care molecular diagnostics industry refer to non-centralized testing facilities located closer to patients' points of care. These labs offer rapid and convenient molecular diagnostics, emphasizing accessibility and timely results. Trends in this sector include the adoption of miniaturized point-of-care devices, the integration of mHealth solutions for data management, and increased testing for infectious diseases such as COVID-19. Decentralized labs are becoming essential in modern healthcare for quick and accurate molecular-level testing.

The Home care segment is anticipated to grow at a significantly faster rate, registering a CAGR of 6.1% over the predicted period. Home care in the point-of-care molecular diagnostics market refers to the use of molecular diagnostic devices and tests in a home-based setting. This trend is driven by the growing preference for decentralized healthcare, allowing patients to monitor chronic conditions, receive rapid test results, and access telehealth services from the comfort of their homes. Advances in user-friendly, portable devices and the integration of telemedicine platforms are making home-based molecular diagnostics increasingly accessible and convenient for patients, reflecting a significant trend in modern healthcare.

By Technology

By Application

By Location

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

October 2024

October 2024