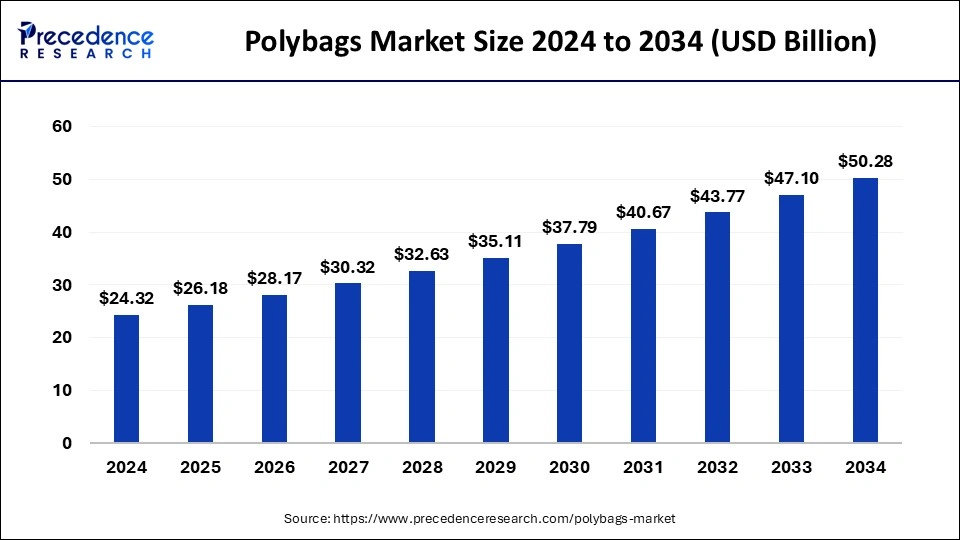

The global polybags market size is accounted at USD 26.18 billion in 2025 and is forecasted to hit around USD xx billion by 2034, representing a CAGR of xx% from 2025 to 2034. The North America market size was estimated at USD xx billion in 2024 and is expanding at a CAGR of xx% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polybags market size accounted for USD 24.32 billion in 2024 and is predicted to increase from USD 26.18 billion in 2025 to approximately USD 50.28 billion by 2034, expanding at a CAGR of 7.53% from 2025 to 2034. The rising packaging industries and the demand from the e-commerce industries drive the growth of the market.

The polybags market deals with the production, distribution, and management of polybags. Polybags are a common type of application that is used in the packaging of several things, from clothes to foods. Polybags are generally made of polyethylene material. Polybags are generally clear and transparent plastic bags. The standard thickness of the polybags is considered to be in the range of 1-6 mils. There are specialty bags that are also available for several other needs and come in thickener and thinner options. Polybags are considered the ideal packaging materials due to their slim body, reflective surface, smooth texture, and flexibility. Polybags are the most efficient for the packaging of various goods and products, including magazines, clothes, types of food, pillows, and other consumer goods. The adoption rate of polybags is continuously rising in popularity in shipping applications, and they will replace corrugated boxes in the upcoming period.

| Report Coverage | Details |

| Market Size by 2034 | USD 50.28 Billion |

| Market Size in 2025 | USD 26.18 Billion |

| Market Size in 2024 | USD 24.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising e-commerce industry

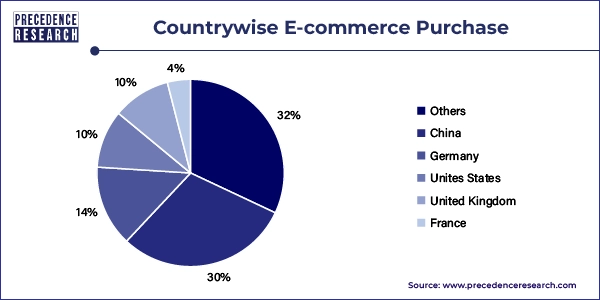

The rapidly growing e-commerce industry around the world is one of the major factors driving the demand for packaging material and the expansion of the market. The rising interest in online shopping in the population due to the heavy discounts, availability, and variety of products that attracts the customer to shop for their comfort.

The E-commerce industry provides efficient packaging for their products to handle shipping defects and hurdles at the time of delivery. The rising number of e-commerce industries around the world, such as Amazon and others, are driving the demand for efficient packaging materials that enhance the growth of polybags in the e-commerce industry, which drives the growth of the polybags market.

Strict environmental regulations

The polybag market is facing challenges due to increasing environmental regulations and the growing demand for sustainable packaging materials such as paper bags. Strict regulations on pollution and sustainability are making it difficult for polybag manufacturers to expand their market. The availability of alternative eco-friendly packaging materials is also contributing to limiting the growth of the polybag market. As a result, companies in the packaging industry are increasingly seeking more sustainable and environmentally friendly solutions to meet the evolving polybags market demands. This shift is influencing the growth trajectory of the polybag market and prompting manufacturers to explore new ways to align with changing regulations and consumer preferences.

Rising investment in the supermarkets and hypermarkets

The evolution of supermarkets and hypermarkets in economically developed and developing countries is expanding the demand for packaging materials for products and other materials that enhance the growth of the market. Additionally, advancements in technologies that cater to the higher demand for sustainability in packaging materials contribute to the growth of the market. Technological advancements are increasing its durability and strength and making it suitable for several uses. Thus, all these factors are collectively contributing to the expansion of the polybags market.

The polyethylene terephthalate (PET) segment dominated the polybags market in 2024. Terephthalic acid and ethylene glycol monomers are combined to form the long chains that makeup PET, a thermoplastic polymer that is commonly used. Its outstanding mechanical qualities, transparency, affordability, and ease of forming intricate shapes using a variety of techniques make it well-known. Its popularity extends to numerous industries. The material exhibits strong tensile strength, good chemical resistance, and ease of processing using methods such as injection molding and extrusion. The remarkable qualities of PET are the product of its distinct and unusual molecular structure. For products like clear plastic bottles and food packaging, it provides outstanding clarity in terms of transparency. This glass clarity cannot be matched by many other materials that are suited for packaging.

The flat polybags segment dominated the polybags market in 2024. Flat poly bags are widely utilized in many different industries and are reasonably priced and adaptable. Several businesses, including retail, medicines, and food and beverage, employ flat poly bags. Products like magazines, books, clothing, and little technological devices are frequently packaged with them. Fruits, vegetables, and meat can also be stored and transported in flat poly bags. They are a great option for companies trying to reduce their packing expenses because they are reasonably priced, lightweight, and manageable. Additionally, they are strong and resilient to rips and punctures, and flat poly bags guarantee that the goods inside stay undamaged.

The e-commerce and shipping segment dominated the polybags market in 2024. The growth of the segment is attributed to the rising development and the increasing number of e-commerce industries globally that drive the demand for packaging materials in the e-commerce industry. The rising adoption of online shopping by the population drives the demand for efficient packaging materials that drive the growth of the market. The rising demand for cost-effective, durable, and effective pacing materials drives the demand for the polybag market.

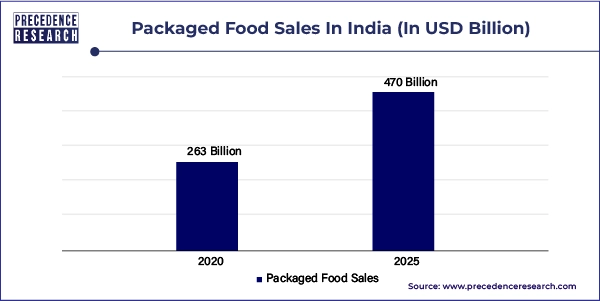

Asia Pacific dominated the polybags market in 2024. The growth of the polybags market is expected to increase due to the rapidly increasing population and the rising demand for the consumer goods industry to cater to the demand for product packaging that drives the growth of the market. The rising younger population that is more likely to use the e-commerce industry for online shopping boosts the demand for packaging materials, which enhances the growth of the market. The rising investments in research and development activities and technological advancements in sustainable polybag materials drive the growth of the polybag market in the region.

The surge in the consumption of packaged food in countries such as India has led to a significant increase in the demand for polybags utilized for packaging various food and beverage products. This rise in demand is directly correlated to the convenience and cost-effectiveness of polybags. As a result, the production and distribution of polybags have grown to meet the needs of the expanding packaged food industry in these countries, which is boosting the polybags market’s growth.

North America is anticipated to grow at the fastest rate during the forecast period. The growth of the market in the region is increasing due to the rising economically developed countries and the rising industrialization that drives the demand for efficient packaging materials, which are cost-effective, durable, and high in strength, driving the demand for the polybags market. The rising e-commerce industries and the rising presence of supermarket chains in countries like the U.S. and Canada drive the demand for packaging materials, which enhances the growth of the polybags market. The research and development activities in the expansion of the market and the sustainable advancements in polybags are contributing to the growth of the polybags market in the region.

By Materials

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client