List of Contents

Polycrystalline Solar Cell Market Size and Forecast 2025 to 2034

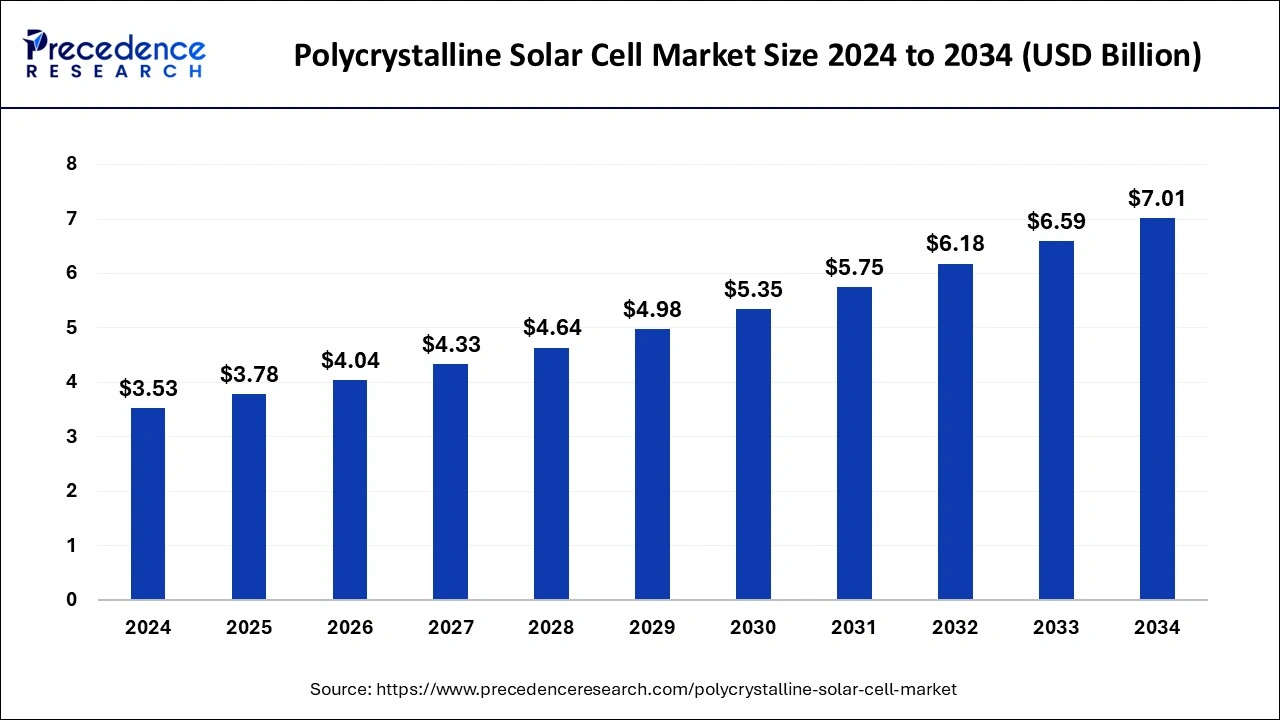

The global polycrystalline solar cell market size was estimated at USD 3.53 billion in 2024 and is anticipated to reach around USD 7.01 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The polycrystalline solar cell market is driven by the rising demand for electricity worldwide. Moreover, the rapid shift toward renewable energy sources contributes to market expansion.

Polycrystalline Solar Cell Market Key Takeaways

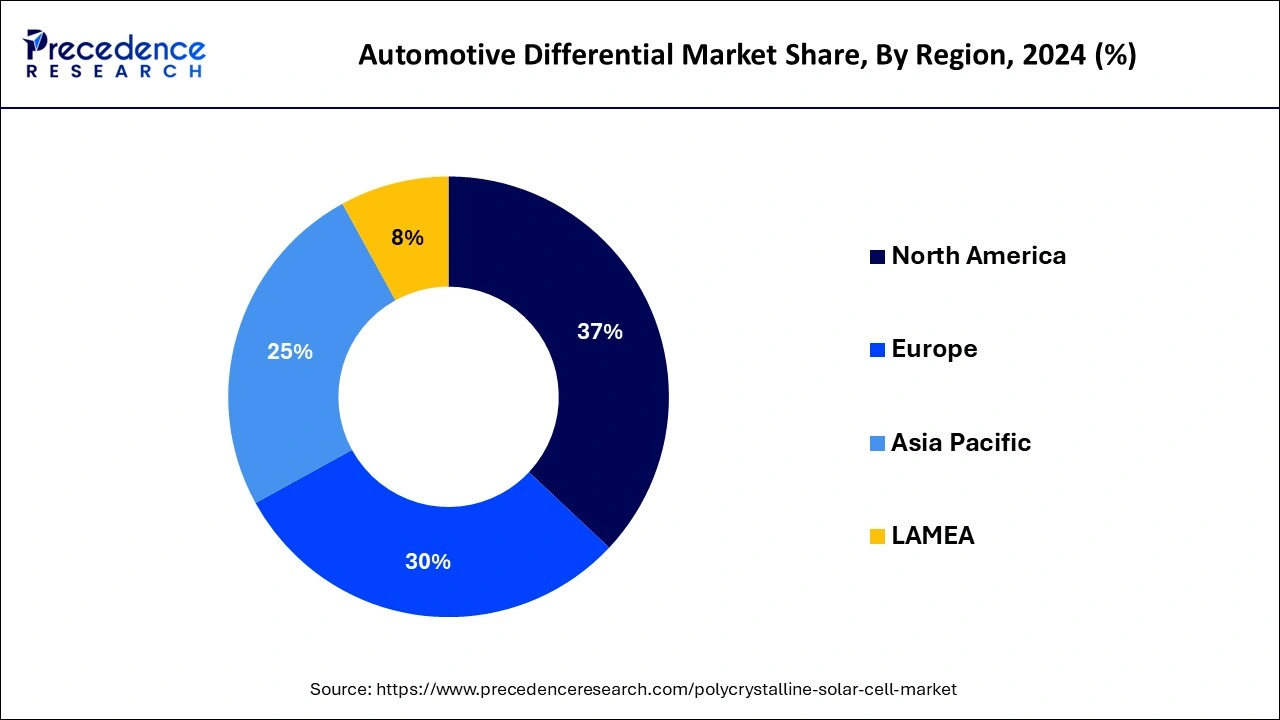

- North America led the global polycrystalline solar cell market with the largest market share of 37% in 2024.

- Asia Pacific is predicted to expand at the fastest CAGR during the forecast period.

- By technology, the crystalline silicon cells segment contributed the biggest market share of 43% in 2024.

- By technology, the thin film cells segment is expected to grow at a solid CAGR during the forecast period.

- By application, the commercial segment recorded the highest market share of 50% in 2024.

- By application, the residential segment is estimated to expand at the fastest CAGR over the projected period.

Impact of AI on the Polycrystalline Solar Cell Market

Artificial intelligence (AI) is transforming the production process of solar modules. This complex process involves multiple steps, from the production of solar cells to their assembly into panels. Integrating AI-driven systems in the production process monitors machinery in real time, ensuring the production line runs smoothly. Moreover, AI can predict potential issues before they occur, reducing downtime and ensuring consistent output quality. Ensuring the high quality of the final product is a major challenge in solar panel production, as a small defect can affect its efficiency. However, AI technologies optimize the quality control process, ensuring solar panels meet the highest standards.

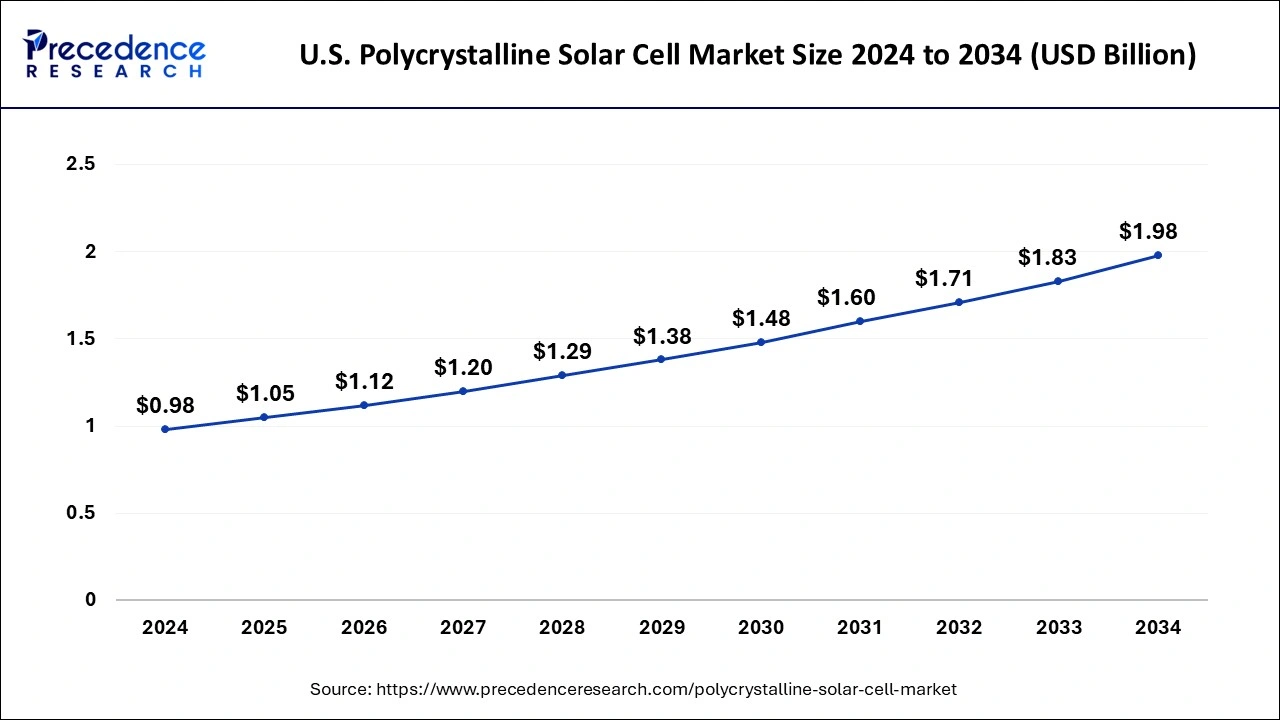

U.S. Polycrystalline Solar Cell Market Size and Growth 2025 to 2034

The U.S. polycrystalline solar cell market size was evaluated at USD 0.98 billion in 2024 and is predicted to be worth around USD 1.98 billion by 2034, rising at a CAGR of 7.28% from 2025 to 2034.

North America led the global polycrystalline solar cell market with the largest market share of 37% in 2024. The market is characterized by the increasing integration of solar energy into the commercial and industrial sectors, driven by the cost-effectiveness of polycrystalline panels. The United States has emerged as a significant catalyst for this trend, marked by a notable increase in residential solar installations. Additionally, the adoption of advanced energy storage solutions has synergized with the widespread use of polycrystalline solar cells, guaranteeing a dependable energy supply, even during cloudy periods. Collectively, these factors have propelled the steady expansion of the polycrystalline solar cell market in North America.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific dominates the global polycrystalline solar cell market, driven by China and India's massive solar energy initiatives. Both countries are investing heavily in solar power projects, spurring demand for polycrystalline panels. A notable trend is the integration of bifacial solar panels in utility-scale projects, enhancing energy production. Moreover, technological advancements and reduced manufacturing costs have made solar energy more affordable, propelling its adoption across residential and industrial sectors in the Asia-Pacific, and further solidifying the region's leadership in the global solar market.

In Europe, the polycrystalline solar cell market has gained traction as countries strive to meet renewable energy targets. Governments incentivize solar adoption, driving both residential and commercial installations. Additionally, technological advancements have improved the efficiency of polycrystalline panels, bolstering their appeal. As the region embraces sustainable energy sources, the polycrystalline solar cell market in Europe continues to evolve, contributing to the continent's clean energy transition.

Market Overview

Polycrystalline solar cells are a type of photovoltaic technology used to convert sunlight into electricity. They are made from multiple silicon crystal structures, with grains of various sizes and orientations, giving them a distinctive blue or speckled appearance. The production process for polycrystalline solar cells involves melting raw silicon and pouring it into molds. As the silicon cools and solidifies, it forms multiple crystals within the material. These crystals are then sliced into thin wafers, which serve as the basis for the solar cells.

Polycrystalline Solar Cell Market Growth Factors

- The polycrystalline solar cell market holds a significant position within the renewable energy sector, providing an economical solution for harnessing solar energy. These solar cells are composed of multiple silicon crystals, a manufacturing process that ensures cost-effectiveness when compared to their monocrystalline counterparts, albeit at a slightly lower efficiency level.

- The cost-efficiency of polycrystalline solar cells broadens the accessibility of solar energy adoption, appealing to a wider spectrum of consumers and businesses. This factor contributes to the global upswing in solar power adoption.

- Ongoing research and development endeavors are continually improving the efficiency of polycrystalline solar cells, steadily bridging the performance gap with monocrystalline cells.

- Hybrid solar panels are gaining traction. These panels combine different solar cell technologies, such as polycrystalline and monocrystalline cells within the same panel, to optimize energy output.

- Bifacial solar panels, which capture sunlight from both sides, are also becoming more prevalent, boosting energy generation.

- Rising government initiatives to reduce carbon emissions and promote renewable energy sources further boost the growth of the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Market Size in 2025 | USD 3.78 Billion |

| Market Size by 2034 | USD 7.01 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing solar adoption and technological advancements

The market demand for cells is surging due to the combined forces of increasing solar adoption and remarkable technological advancements. There is a global push for renewable energy sources has led to a substantial increase in solar power adoption. Polycrystalline solar cells, renowned for their cost-effectiveness, play a pivotal role in meeting this surging demand. As more homeowners, businesses, and governments prioritize clean energy, the affordability of polycrystalline cells makes them an attractive choice, thus driving market growth.

Moreover, continuous research and development efforts have resulted in significant technological advancements within the polycrystalline solar cell sector. These improvements have notably enhanced the efficiency of these cells, narrowing the performance gap compared to their monocrystalline counterparts. As efficiency levels rise, the overall appeal of polycrystalline solar cells strengthens, further accelerating their adoption.

As these efficiency levels rise, polycrystalline solar cells find an expanded range of applications, from residential rooftops to commercial installations and industrial settings. This versatility further amplifies the demand for polycrystalline solar cells. In essence, the intersection of increasing solar adoption and ongoing technological progress positions polycrystalline solar cells as a pivotal player in the global transition towards sustainable energy solutions, across a diverse spectrum of applications.

Restraint

Lower efficiency and space requirements

The polycrystalline solar cell market faces certain constraints that can impact its market demand. The lower efficiency of polycrystalline solar cells compared to their monocrystalline counterparts. Polycrystalline cells typically have a slightly lower energy conversion efficiency, which means they can capture and convert a smaller percentage of incoming sunlight into electricity. While this efficiency gap has been narrowing due to technological advancements, it still affects the competitiveness of polycrystalline cells, especially in applications where maximizing energy production in limited space is crucial.

Another restraint is the space requirement associated with polycrystalline solar panels. Due to their lower efficiency, a larger surface area is often needed to generate the same amount of electricity as monocrystalline panels. This space constraint can be a significant drawback when space is limited, such as residential rooftops or urban environments. It may necessitate the installation of additional panels, increasing the overall system cost and making alternative solutions more appealing.

While polycrystalline solar cells offer cost advantages, these constraints related to lower efficiency and space requirements highlight the importance of carefully evaluating the suitability of these cells for specific applications and project requirements. In situations where space is abundant and budget considerations are paramount, polycrystalline cells remain a viable and cost-effective choice for solar energy generation.

Opportunity

Residential solar and bifacial panels

The surge in residential solar installations is a significant driver of demand for the polycrystalline solar cell market. As homeowners increasingly seek to reduce their reliance on traditional grid electricity and embrace sustainable energy solutions, polycrystalline solar panels offer a cost-effective choice. Polycrystalline solar cell affordability makes solar power accessible to a broader range of households, accelerating the adoption of residential solar systems.

Moreover, bifacial solar panels, capable of capturing sunlight from both sides, have ushered in a new era of energy generation efficiency. This innovation has significantly boosted the demand for polycrystalline solar cells. Bifacial panels complement the attributes of polycrystalline technology, offering cost-efficiency alongside enhanced energy capture. Their ability to generate electricity from both direct sunlight and reflected light off surfaces like the ground or nearby structures makes them particularly attractive. As businesses and homeowners seek to maximize energy production and make the most of available space, the combination of bifacial panels and polycrystalline solar cells has become a compelling solution, further propelling market demand.

Technology Insights

The crystalline silicon cells segment contributed the biggest market share of 43% in 2024. This includes monocrystalline and polycrystalline varieties, dominating the polycrystalline solar cell market. These cells are characterized by their use of high-purity silicon wafers, offering a well-established and highly efficient technology. The trend includes the continuous improvement of silicon cell efficiency and affordability, driven by advancements in silicon wafer quality and manufacturing processes. As a result, crystalline silicon cells, including polycrystalline ones, remain the preferred choice for many solar installations due to their proven performance and cost-effectiveness.

The thin film cells segment is expected to grow at a solid CAGR during the forecast period. Thin film technology is gaining traction in specific applications. Thin film solar cells utilize a thinner semiconductor material layer, making them lightweight and flexible. The trend here revolves around enhancing the efficiency and durability of thin film cells, making them suitable for various applications such as building-integrated photovoltaic and portable solar devices. The technology's flexibility and potential for cost savings in large-scale solar projects are driving research and development efforts to improve its performance and competitiveness within the polycrystalline solar cell market.

Application Insights

The commercial segment recorded the highest market share of 50% in 2024. Commercial applications in the polycrystalline solar cell market involve the strategic integration of solar panels into the energy infrastructure of large corporations and commercial real estate. This trend is motivated by a multifaceted approach that includes reducing operational energy expenses, minimizing carbon emissions to align with sustainability objectives, and meeting ambitious environmental goals. Furthermore, businesses are recognizing the financial potential of solar investments, as they can generate revenue by either feeding excess energy back into the grid or through power purchase agreements (PPAs). This synergy of environmental responsibility and economic viability is driving the growing adoption of polycrystalline solar cells within the commercial sector.

The residential segment is projected to grow at the fastest rate over the projected period. Residential applications of polycrystalline solar cells pertain to solar panel installations on homes and residential properties. A prominent trend in this segment is the growing adoption of solar energy by homeowners. Factors driving this trend include government incentives, decreasing solar panel costs, and heightened environmental awareness.

Energy storage solutions, such as home batteries, are also becoming more common in residential solar setups, allowing homeowners to store excess energy for use during peak periods or emergencies. Overall, the residential segment is witnessing sustained growth as more households seek to harness the benefits of clean and renewable energy sources.

Polycrystalline Solar Cell Market Companies

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

- Canadian Solar Inc.

- JA Solar Holdings Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- Risen Energy Co., Ltd.

- GCL System Integration Technology Co., Ltd.

- SunPower Corporation

- REC Group

- First Solar, Inc.

- Yingli Green Energy Holding Company Limited

- ET Solar Group

- Neo Solar Power Corporation

- Hareon Solar Technology Co., Ltd.

Recent Developments

- In January 2025, Chinese solar module manufacturer JinkoSolar Holding Co Ltd announced that it has achieved a conversion efficiency of 33.84% for its N-type TOPCon-based perovskite tandem solar cell, surpassing the previous record of 33.24%.

- In January 2025, ITI Limited issued a tender for the establishment of a 500 MW fully automated solar photovoltaic (SPV) module manufacturing line on a turnkey basis.

- In November 2023, LONGi Green Energy Technology Co., Ltd. announced that it has set a new world record of 33.9% for the efficiency of crystalline silicon-perovskite tandem solar cells.

Segments Covered in the Report

By Technology

- Crystalline Silicon Cells

- Thin Film Cells

- Ultra-thin Film Cells

By Application

- Residential

- Commercial

- Utility

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client