February 2025

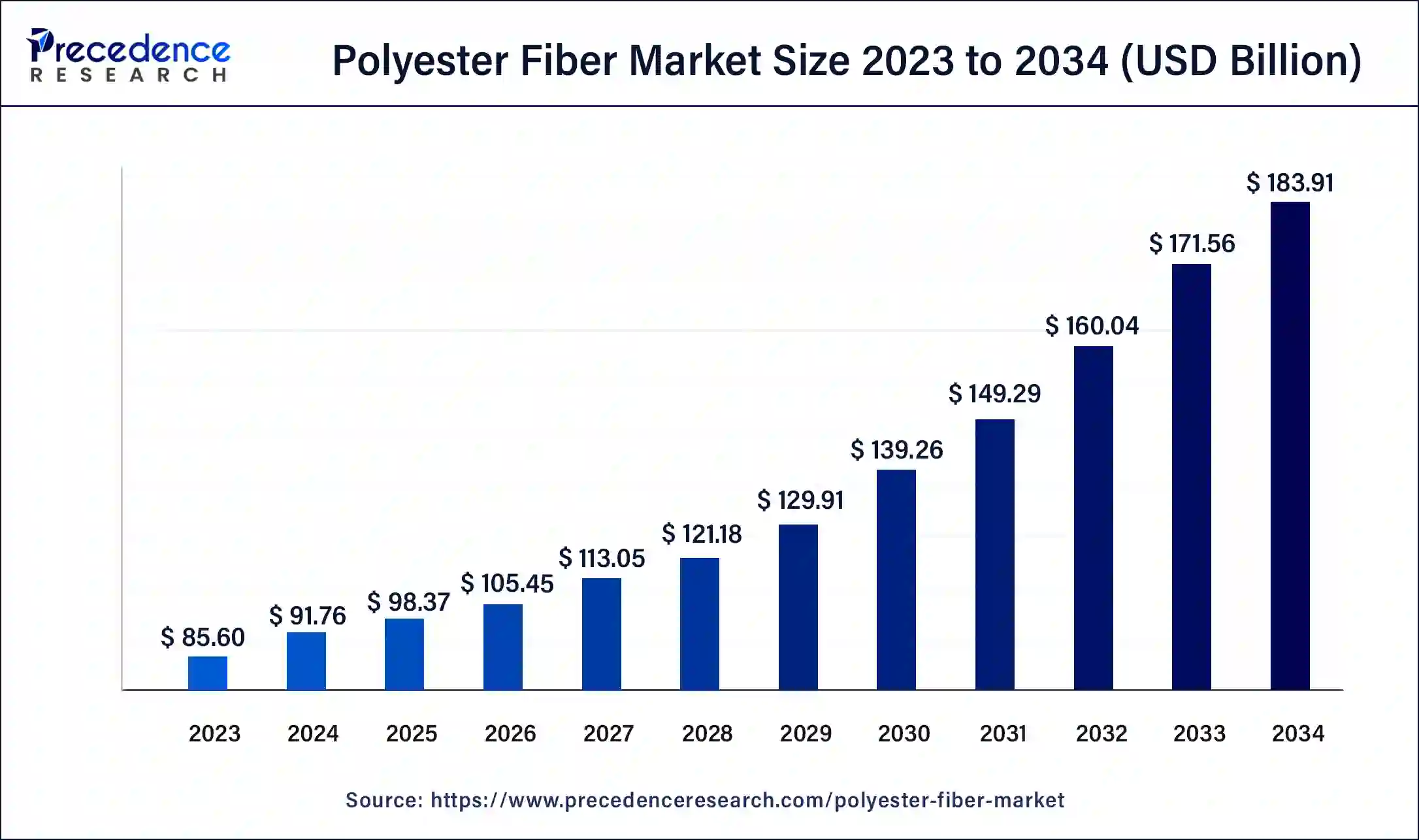

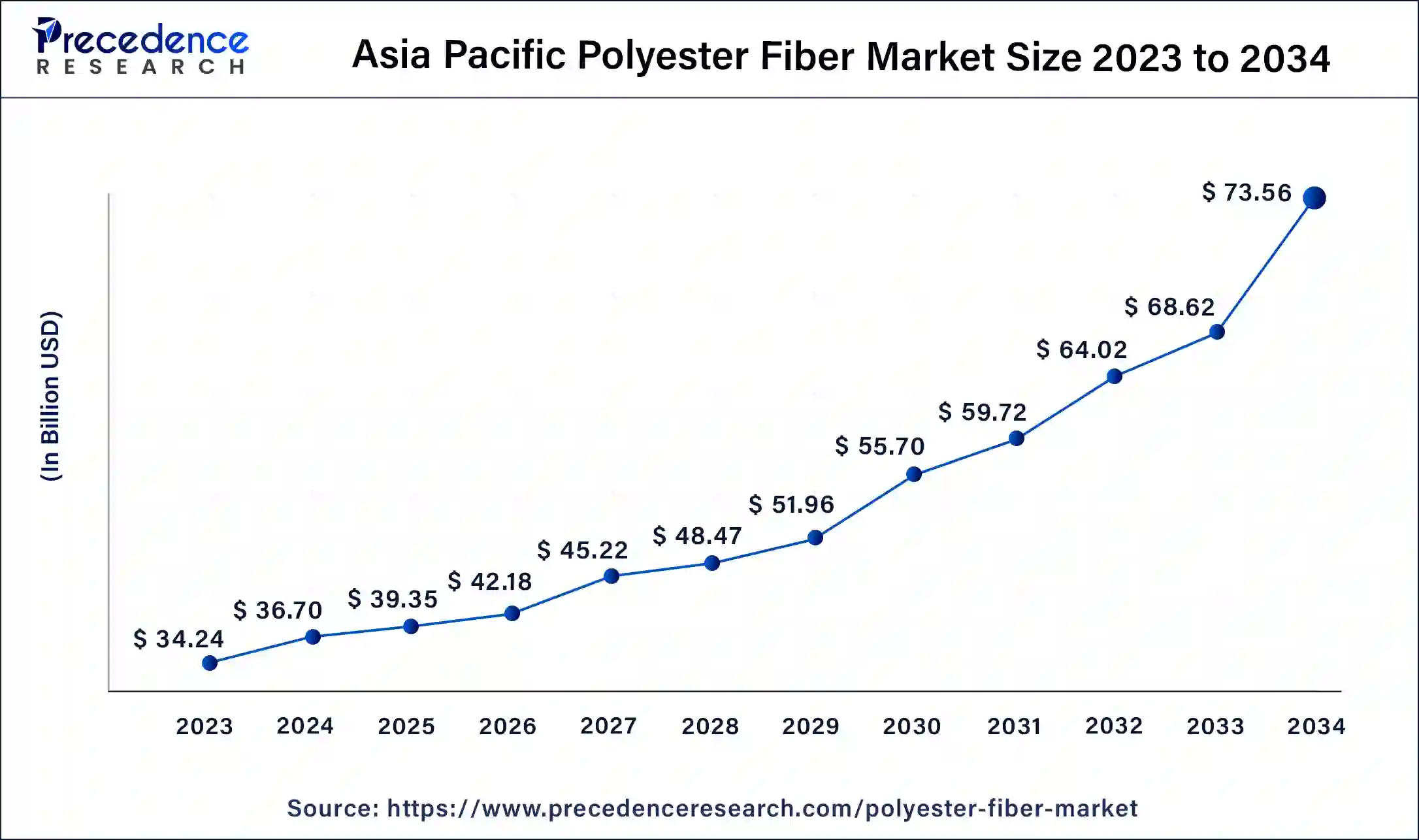

The global polyester fiber market size is calculated at USD 91.76 billion in 2025 and is expected to be worth around USD 183.91 billion by 2034, to expand at 7.2% CAGR from 2025 to 2034. The Asia Pacific market size accounted for USD 36.7 tiillion in 2024 and is expanding at a CAGR of 7.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polyester fiber market size was valued at USD 91.76 billion in 2024 and is anticipated to reach around USD 183.91 billion by 2034, expanding at a CAGR of 7.2% over the forecast period 2025 to 2034.

The Asia Pacific polyester fiber market size is exhibited at USD 39.35 billion in 2025 and is projected to be worth around USD 73.56 billion by 2034, poised to grow at a CAGR of 7.4% from 2025 to 2034.

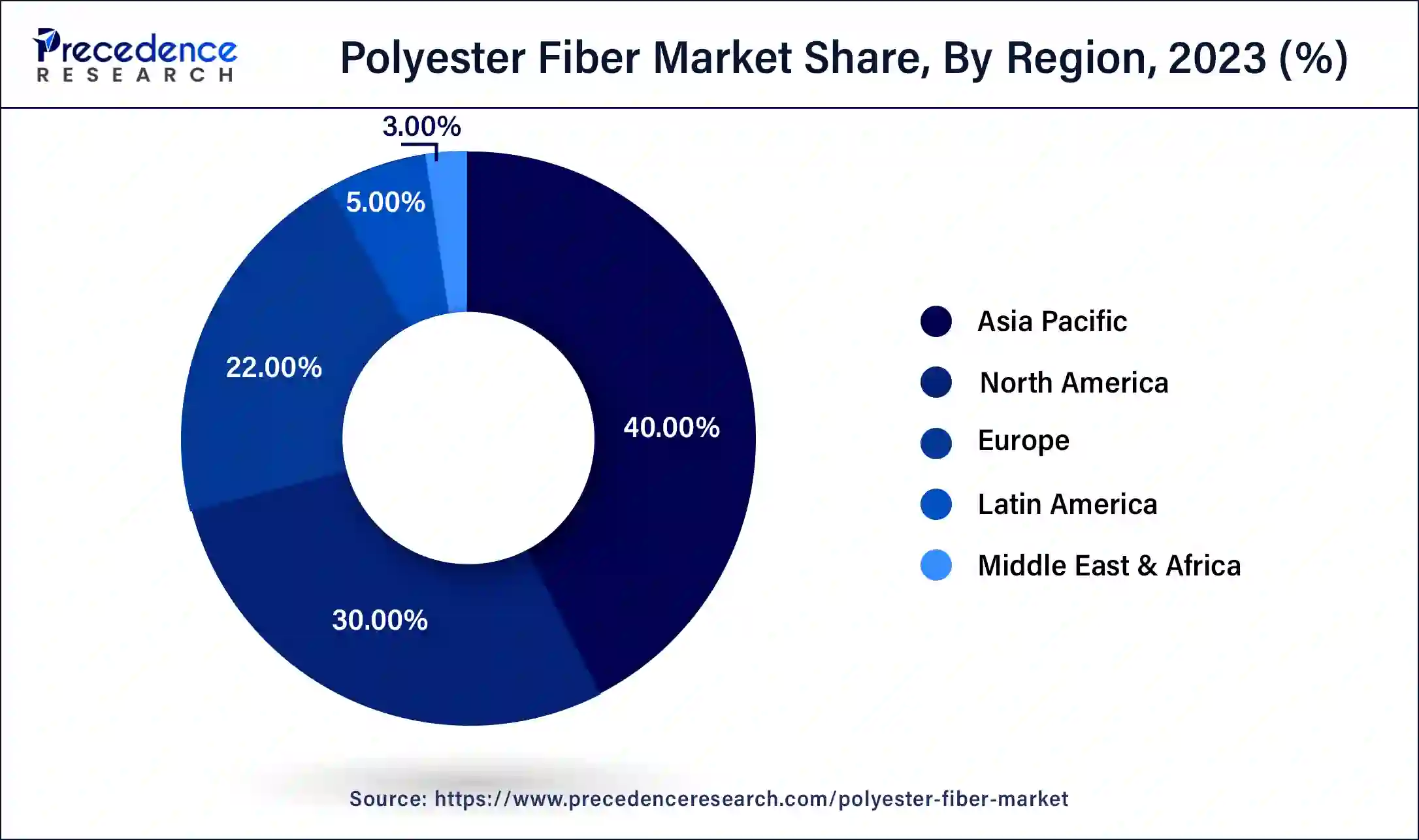

Asia-Pacific has held the largest revenue share of 40% in 2024. Asia-Pacific commands a significant share in the polyester fiber market due to several factors. The region's robust textile industry, rapid urbanization, and a burgeoning middle-class population have fueled the demand for affordable and versatile polyester textiles.

Moreover, Asia-Pacific's manufacturing capabilities and cost-effective production processes make it a hub for polyester fiber production. With a focus on sustainability and the increasing popularity of sportswear and activewear, the region continues to be a key driver of market growth. The presence of established textile manufacturers and a growing focus on innovation further solidify Asia-Pacific's dominance in the polyester fiber market.

Currently, Asia Pacific is dominating the polyester fiber market. Within the region, China holds the largest market share. The rapid growth in industrialization and synthetic textiles contributes to the development of the market in the region. The demand for the polyester fiber in the automotive and home furnishing industries is leveraging the market’s growth factor eventually. The government's initiative and strategy to popularize synthetic textiles is increasing the demand for new businesses approaching this market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the polyester fiber market due to a confluence of factors. The region boasts a robust textile and automotive industry, where polyester fibers are extensively used for their durability and cost-efficiency. Additionally, the growing emphasis on sustainability and the adoption of recycled polyester fibers align with the eco-conscious consumer base.

North America's well-established recycling infrastructure and increasing demand for sustainable textiles contribute to its prominent position in the market. With diverse applications in clothing, home furnishings, and industrial sectors, North America continues to play a pivotal role in shaping the polyester fiber market landscape.

Polyester fiber is a synthetic textile material renowned for its versatility and widespread use in the fashion and textile industry. Crafted from extended polymer chains sourced from petrochemicals, it has earned acclaim for its cost-efficient appeal, rendering it a favored selection in the realms of fashion, home decor, and industrial applications. Polyester's resistance to shrinking, stretching, and fading ensures the longevity of products made with this material.

It can be easily blended with other fibers to enhance specific qualities, such as strength or moisture-wicking abilities. Moreover, polyester's recyclability aligns with sustainability goals in the textile industry. Its affordability, coupled with its impressive performance, renders polyester fiber an enduring choice for an array of applications, from athletic apparel to upholstery.

The technological advancement of the polyester fiber market features microfibers, smart sensors, and specialization. Smart sensors and AI technology are used in the manufacturing process, integrating polyester fiber production. The microfibers' advancement provides unique and fine properties for applications such as technical textiles and apparel. This improves and enhances the production of microfibers.

The specialization is initiated by research institutions and startups to add variety and new techniques in the process to gain recognition in the polyester fiber market, mainly in applications such as technical fabrics and smart sensors. The technologies and innovations also support sustainable manufacturing to minimize environmental impact.

| Report Coverage | Details |

| Market Size by 2034 | USD 183.91 Billion |

| Market Size in 2025 | USD 98.37 Billion |

| Market Size in 2024 | USD 91.76 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Grade, Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Activewear & sportswear and geotextiles

Activewear and sportswear are significant drivers of demand in the polyester fiber market. Polyester's unique properties, such as moisture-wicking capabilities and durability, make it a top choice for these sectors. In activewear, polyester fibers provide wearers with comfort during physical activities by efficiently wicking away sweat and moisture. As the global enthusiasm for fitness and sports continues to grow, the demand for activewear and sportswear, often featuring polyester components, is experiencing a notable surge. This trend is prompting manufacturers to diversify their offerings of polyester-based athletic attire, thereby further stimulating market expansion.

On the other hand, geotextiles hold a critical role in construction and infrastructure projects. Polyester's durability and strength render it a prime material for geotextiles, which are indispensable in tasks related to soil stabilization, erosion control, and drainage. With increasing urbanization and ongoing infrastructure development on a global scale, the need for geotextiles is on the upswing. Polyester-based geotextiles offer a cost-effective and enduring solution for civil engineering endeavors, thus propelling market growth as construction activities continue to proliferate across regions.

Competition from natural fibers and flammability

Competition from natural fibers and flammability concerns present notable restraints on the growth of the polyester fiber market. Natural fibers, including cotton, wool, and hemp, have gained traction due to their eco-friendly and biodegradable characteristics. This surge in demand for sustainable and natural textile alternatives poses a challenge to the dominance of polyester fibers in the market. Consumers, driven by environmental consciousness, are increasingly opting for clothing and products made from these natural fibers, causing a shift in market preferences.

Moreover, the flammability of polyester is a prominent obstacle. Polyester is exceptionally susceptible to catching fire, which raises safety issues, particularly in products like children's sleepwear and upholstery. To comply with rigorous safety regulations, flame retardant chemicals must be incorporated, but this can alter the fundamental characteristics of polyester and impact its cost-efficiency.

This necessitates a careful balance between safety and performance considerations to ensure that polyester remains a viable choice in applications where fire safety is paramount. These measures aim to mitigate the fire risk but can impact the material's performance, limiting its market share in applications that prioritize safety and fire resistance. Thus, addressing flammability concerns is essential for sustaining the growth of the polyester fiber market.

Smart textiles

Smart textiles are creating opportunities in the polyester fiber market. Smart textiles, incorporating advanced materials and technologies, offer unique functionalities such as conductive, sensing, and interactive properties. Polyester's compatibility with these technologies makes it an ideal choice for producing smart textiles. These textiles find applications in diverse sectors, including wearable technology, healthcare, sports, and military, offering growth prospects for the polyester fiber market. As the demand for smart textiles continues to rise, polyester can play a pivotal role in meeting these technological advancements.

In 2024, the solid segment had the highest market share of 56% on the basis of the form. In the polyester fiber market, the solid segment pertains to polyester fibers in their traditional, non-hollow form. Solid polyester fibers are solid throughout their cross-section, offering robustness and durability. Recent trends in this segment reflect the demand for sustainable and recycled solid polyester fibers, aligning with eco-conscious consumers' preferences. The use of solid polyester fibers in fashion, home textiles, and nonwoven applications is on the rise due to their strength and colorfastness, contributing to the continued growth of this segment in the global textile industry.

The hollow segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The hollow segment in the polyester fiber market refers to fibers with a unique hollow or partially hollow cross-sectional structure. This design creates air pockets within the fiber, resulting in enhanced insulation properties and reduced weight compared to solid polyester fibers. Trends in the hollow segment of the polyester fiber market include a growing preference for these fibers in the production of lightweight and thermally efficient textiles. They are commonly used in outdoor clothing, bedding, and technical textiles. With a rising demand for comfort and performance in various applications, hollow polyester fibers continue to gain popularity for their insulating capabilities and reduced environmental impact due to decreased material usage.

According to the grade, the polyethylene terephthalate (pet) polyester segment has held 72% revenue share in 2024. The PET (Polyethylene Terephthalate) polyester segment within the polyester fiber market represents a high-grade category of polyester fibers, celebrated for their exceptional strength, resilience, and resistance to environmental factors. Recent market trends highlight the notable expansion of the PET polyester segment, primarily fueled by the rising demand for sustainable and environmentally friendly textile solutions.

The market has witnessed a surge in the use of recycled PET polyester, aligning with the global emphasis on sustainability. Additionally, the PET polyester segment benefits from its versatility, finding applications in activewear, sportswear, home textiles, and nonwoven products, driven by consumers' preference for durable and high-performance materials in these domains.

The PCDT polyester segment is anticipated to expand fastest over the projected period. In the polyester fiber market, the PCDT polyester segment pertains to fibers crafted from poly-1, 4-cyclohexylene-dimethylene terephthalate, a premium polyester material. These PCDT polyester fibers are celebrated for their robustness, longevity, and resilience against environmental factors, rendering them ideal for diverse applications.

In recent trends, PCDT polyester has gained attention due to its compatibility with eco-friendly production processes, meeting the growing demand for sustainable textiles. Additionally, its versatility and superior properties have positioned it favorably in sectors like technical textiles, automotive components, and geotextiles, contributing to its growth and prominence in the market.

In 2024, the polyester filament yarn (PFY) segment had the highest market share of 70% on the basis of the product type. Polyester filament yarn (PFY) is a key product segment within the polyester fiber market. PFY consists of long, continuous strands of polyester fibers, known for their high strength, durability, and smooth texture. Trends in the PFY segment include a growing demand for the fine denier PFY, suitable for lightweight and high-performance textiles.

Additionally, the rise of sustainable and recycled PFY is gaining momentum in response to environmental concerns. PFY is increasingly used in various applications, including apparel, home textiles, and industrial fabrics, reflecting its versatility and the evolving demands of consumers seeking both performance and sustainability in their textile products.

The polyester staple fiber (PSF) segment is anticipated to expand fastest over the projected period. Polyester staple fiber (PSF) is a crucial segment in the polyester fiber market, known for its short and discrete fibers. It's a versatile material used in various applications, including textiles, nonwovens, and filling materials. One notable trend in the PSF segment is the growing demand for recycled PSF, driven by sustainability concerns. Manufacturers are increasingly focusing on eco-friendly PSF production to reduce the environmental impact. Additionally, the PSF segment is witnessing innovations in flame-resistant and moisture wicking PSF variants, catering to diverse industries, from fashion to automotive, and enhancing its appeal in the market.

In 2024, the textile segment had the highest market share of 28% on the basis of the application. In the polyester fiber market, the textile segment primarily encompasses the production of a wide range of textile products, including clothing, home furnishings, and industrial textiles. It is the largest application sector for polyester fibers. Trends in this segment reflect the demand for sustainable and high-performance textiles. Eco-friendly polyester, made from recycled materials or bio-based sources, is gaining popularity.

Additionally, the textile industry is witnessing a surge in smart textiles that incorporate technology into fabrics, offering features like moisture-wicking and antimicrobial properties. These innovations cater to evolving consumer preferences for comfort, sustainability, and functionality in textile products.

The automotive segment is anticipated to expand fastest over the projected period. Within the polyester fiber market, the automotive segment pertains to the utilization of polyester fibers in various aspects of the automotive industry, including the creation of car interiors, upholstery, and certain exterior components. A notable trend in this domain involves the growing need for lightweight and long-lasting materials in the automotive sector. Polyester fibers align with these demands, contributing to reduced vehicle weight, better fuel efficiency, and improved overall performance. As the automotive industry continues to prioritize these characteristics, the polyester fiber market stands to benefit from the persisting trend toward lighter and more durable materials in car production.

By Form

By Grade

By Product Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

May 2025

September 2024

May 2025