January 2025

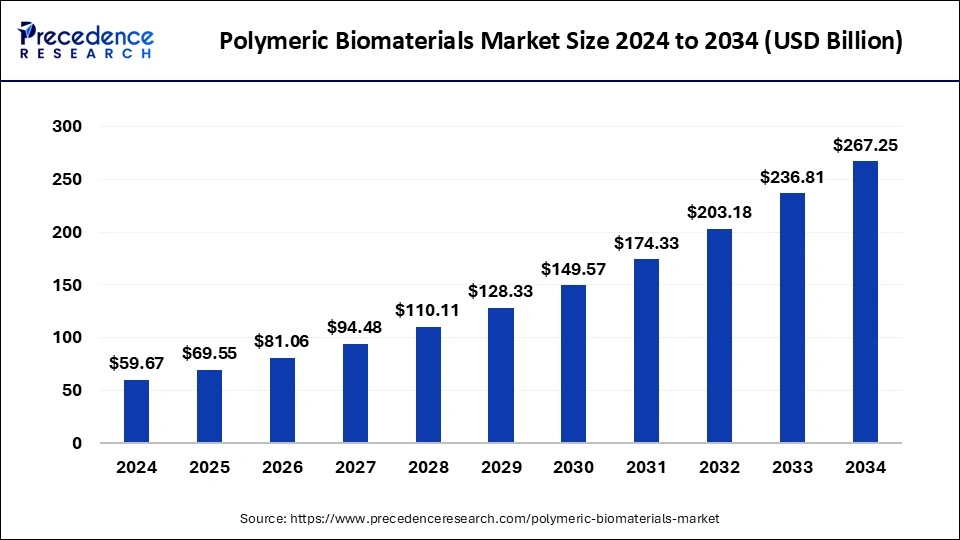

The global polymeric biomaterials market size is calculated at USD 69.55 billion in 2025 and is forecasted to reach around USD 267.25 billion by 2034, accelerating at a CAGR of 16.18% from 2025 to 2034. The North America polymeric biomaterials market size surpassed USD 23.27 billion in 2024 and is expanding at a CAGR of 16.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polymeric biomaterials market size was estimated at USD 59.67 billion in 2024 and is predicted to increase from USD 69.55 billion in 2025 to approximately USD 267.25 billion by 2034, expanding at a CAGR of 16.18% from 2025 to 2034.

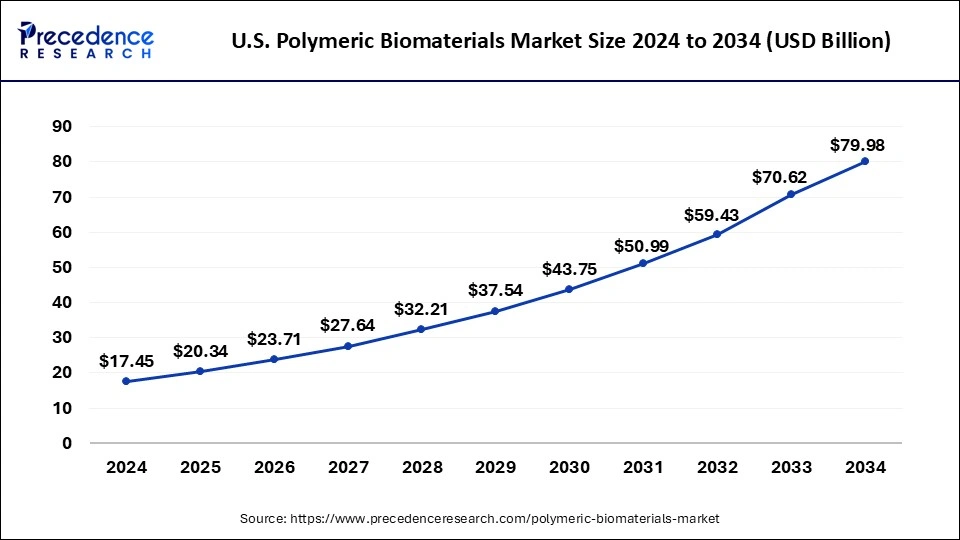

The U.S. polymeric biomaterials market size surpassed USD 17.45 billion in 2024 and is projected to be worth around USD 79.98 billion by 2034, poised to grow at a CAGR of 16.44% from 2025 to 2034.

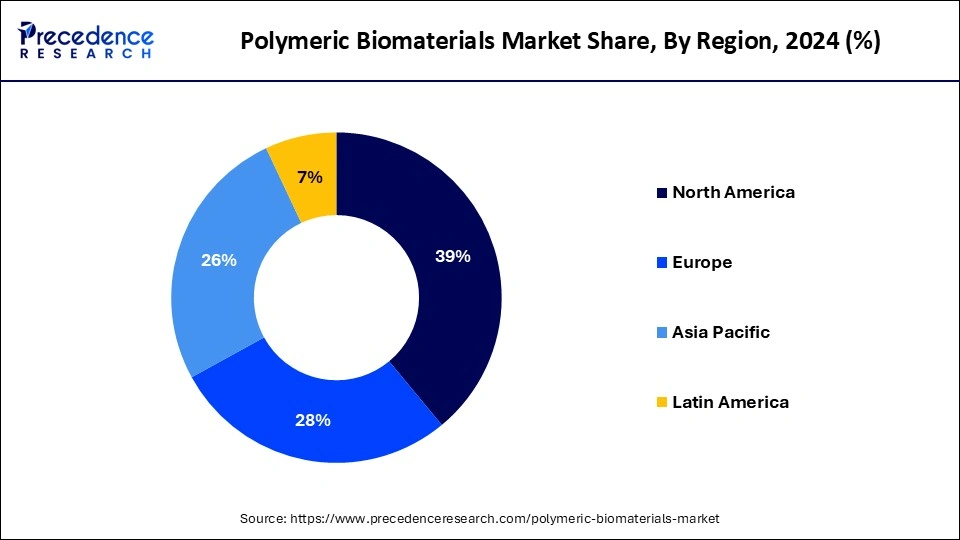

North America held the dominant share of the polymeric biomaterials market in 2024. The region is observed to witness prolific growth during the forecast period owing to the presence of sophisticated healthcare infrastructure, high healthcare expenditure, an increasing number of medical devices manufacturers and biotechnological companies, increasing demand for polymeric biomaterials in surgeries, rising requirement of implantable prostheses, growing demand tissue engineered products, and growing demand for plastic and heart surgeries.

Several prominent players are investing in polymer biomaterials-based research which is expected to drive growth of the polymeric biomaterials market in this region.

In addition, it increases the adoption of polymeric biomaterials-based medical products and therapies due to the rising focus on biodegradable polymers for sustainability, rapid advancement development of 3D printing technologies for customized medical implants, and rising improvements in nanotechnologies for specific drug delivery. Furthermore, the market’s rapid growth is highly influenced by the increasing demand for polymeric biomaterials in various medical applications due to the geriatric population, and the rising prevalence of chronic illnesses such as cardiovascular, neurological, orthopedics, dental, and others.

Asia Pacific is observed to expand at a rapid pace in the polymeric biomaterials market during the forecast period. The region’s growth is driven by the increasing number of cardiology surgeries, the rising aging population, the rising demand for polymeric biomaterials in surgeries, the rise in medical expenditure, the high frequency of chronic disorders, and rising investments in R&D activities to improve the reliability and safety of polymeric biomaterials. Additionally, the key market players involved in the development of groundbreaking solutions for reconstructive surgical procedures are expected to boost the growth of the polymeric biomaterials market in the region.

Polymeric biomaterials are made from polymers and are used for various biological applications. These biomaterials are generally designed for interaction with biological systems for a wide range of medical and biomedical purposes. Polymeric biomaterials tend to duplicate and improve the function of natural tissues and organs in the body. These are gaining immense popularity in numerous sectors such as wound healing, regenerative medicine, medication delivery, medical implants, surgical implants, tissue engineering, and others.

Polymeric biomaterials find application in medical devices owing to their superior properties including easy fabrication, cost-effective in comparison with metal materials, and biocompatibility. It reduces the risk of developing an infection. It is used as implantable to treat several illnesses or injuries to improve human health by regaining the function of tissue and organs in the body.

| Report Coverage | Details |

| Market Size by 2034 |

USD 267.25 Billion |

| Market Size in 2025 | USD 69.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.18% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising aging population

The growing geriatric population across the globe is anticipated to fuel the market’s expansion during the forecast period. The geriatric population is more susceptible to chronic diseases including heart disease, orthopedic problems, dental problems, endovascular disease, and others which increases the demand for polymeric biomaterials. Moreover, the rising number of aging populations suffering from orthopedic problems, such as knee injuries, hip injuries, and arthritis that require surgeries which in turn increases the use of implants made from polymeric biomaterials to replace a particular failed body part, thus assisting elderly patients to restore the function of the affected part and boost the growth of the polymeric biomaterials market.

According to Golden State Orthopedics & Spine 2024, tennis elbow is very common and affects more than 200,000 people in the U.S. annually. Men and women are equally affected and people ages 30 to 50 are most commonly affected.

High cost

The high cost associated with biomaterial-based products is anticipated to hamper the polymeric biomaterials market’s growth. Biomaterial-based implants and devices are more expensive than conventional treatment options. An individual needs to invest high capital to undergo such surgeries. High-cost poses challenges in middle-and lower-income countries with limited healthcare budgets and lower per capita income. In addition, the presence of stringent clinical & regulatory complexities may limit the adoption and restrict the expansion of the global polymeric biomaterials market.

Increasing incidence of chronic diseases

The increasing prevalence of chronic diseases is projected to offer lucrative opportunities to the polymeric biomaterials market during the forecast period. The use of polymeric biomaterials has significantly increased to meet the requirements of biomedical applications. It is widely used as an implanted medical device to treat various wounds and diseases as well as to improve the function of damaged organs and tissues. To improve performance and long-term stability, businesses are spending more on polymeric biomaterial for medical devices. In addition, for medicinal purposes, polymeric biomaterials are used to interact with biological systems for treating various diseases such as cardiovascular neurological, dental, orthopedic, and others. Therefore, the increasing application of polymeric biomaterials is expected to boost the market’s expansion in the coming years.

The polylactic acid segment accounted for the dominating share in the polymeric biomaterials market in 2024. Polylactic Acid (PLA) is extensively used for a wide range of biomedical applications including orthopedics implants, tissue engineering, drug delivery, and others. It is generated from renewable resources. The market has experienced an increasing preference for PLA over metallic implants and increasing emphasis on eco-friendly materials is anticipated to spur the demand for polylactic acid-based products in several industries.

The polytetrafluoroethylene segment is observed to grow at a notable rate in the polymeric biomaterials market during the forecast period. The ongoing advancements in medical technology and the increasing demand for high-performance materials in medical devices drive the growth of the PTFE segment. Innovations in surgical techniques and implantable devices often rely on materials with the unique properties that PTFE offers. PTFE is thermally stable over a wide range of temperatures. This stability is important for sterilization processes, ensuring that the material retains its properties after repeated sterilization cycles.

The orthopedics segment held the largest share of the polymeric biomaterials market in 2024. The segment is expected to sustain the position throughout the forecast period owing to the high frequency of orthopedic diseases. Due to biocompatibility, adaptability, and ongoing improvement in biomaterial technology, polymeric biomaterials are widely used in implants and medical equipment. The versatility offered by polymeric biomaterials facilitates the development of groundbreaking therapies and medical devices to enhance performance and safety. Therefore, increasing cases of orthopedic problems encourage researchers to discover innovative treatment options using polymeric biomaterials. Such factors drive the growth of the segment.

The plastic surgery segment is expected to grow significantly during the forecast period in the polymeric biomaterials market owing to the increasing demand for plastic surgeries including rhinoplasty, breast augmentation, liposuction, facelifts, and others for improving aesthetic appearance standards in society and social media. According to the report fone by the International Society of Aesthetic Plastic Surgery, breast surgeries, especially breast augmentation was observed to be the most common surgical procedure for women with 2.2 million procedures in 2021.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024