January 2025

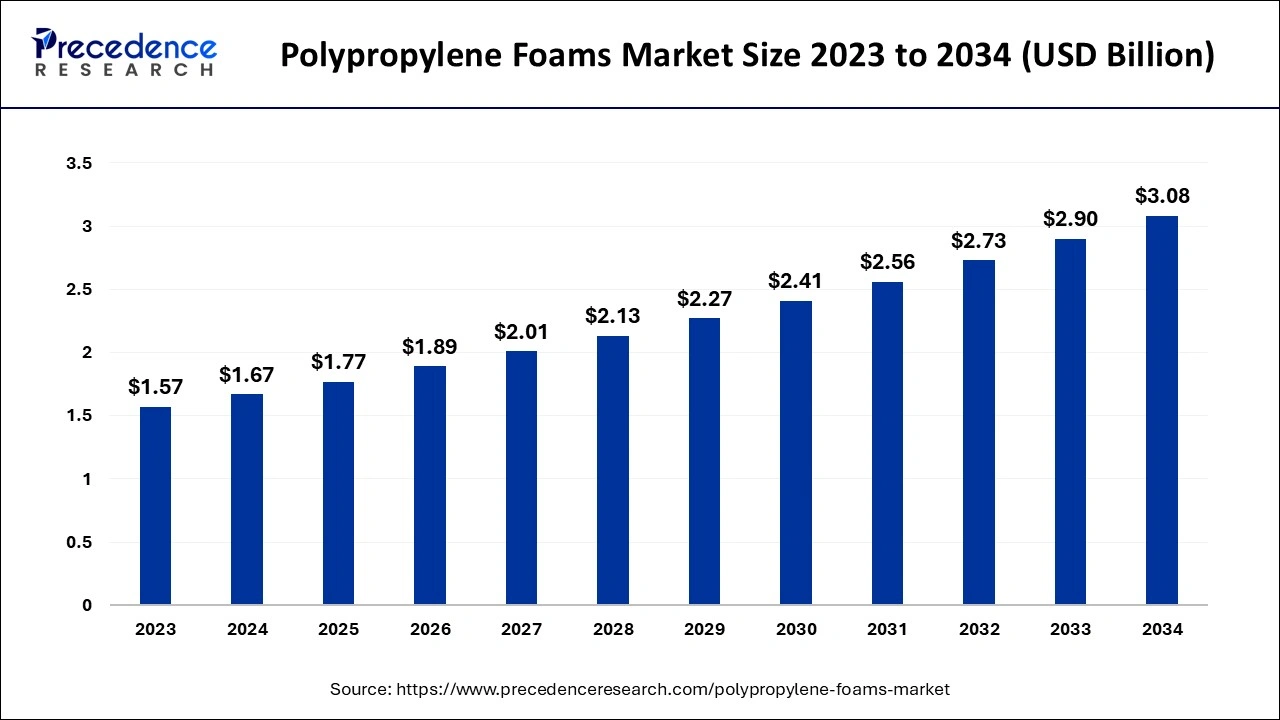

The global polypropylene foams market size accounted for USD 1.67 billion in 2024, grew to USD 1.77 billion in 2025 and is expected to be worth around USD 3.08 billion by 2034, registering a solid CAGR of 6.32% between 2024 and 2034.

The global polypropylene foams market size is calculated at USD 1.67 billion in 2024 and is projected to surpass around USD 3.08 billion by 2034, growing at a CAGR of 6.32% from 2024 to 2034. The rising demand for lightweight automobiles is the key factor that is driving the growth of the global polypropylene foams market.

Polypropylene foams are known for their lightweight, durable, and resilient properties, resisting chemicals and moisture. These foams can endure a wide range of temperatures, which makes them versatile for various applications. The polypropylene foams market products are commonly used in cushioning, automotive parts, packaging, and more. Available in several forms, such as expanded polypropylene and extruded polypropylene, these foams are manufactured using different methods. Beyond their roles in the automotive and packaging sectors, polypropylene foams find applications in consumer products, construction, and other industries. Polypropylene foams are particularly useful for protective packaging, reusable transport containers, and insulation materials.

How is AI Changing the Polypropylene Market?

Technological advancements have significantly transformed the polypropylene foams market, leading to remarkable growth. Innovations such as Artificial Intelligence (AI) and IoT are reshaping the industry by improving operational efficiency and creating new revenue opportunities. AI, for instance, can process vast amounts of data in real-time, analyzing billions of intersecting data points generated during manufacturing. Also, this capability enables AI to identify crucial patterns and insights, which can be directly delivered to frontline teams. As a result, the reliance on intuition and experience for decision-making can be greatly reduced or even eliminated.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.08 Billion |

| Market Size in 2024 | USD 1.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Temperature-controlled packaging for food and beverages

There is a notable surge in the demand for frozen food and cold beverages today. Effective packaging is essential to maintaining the required temperatures for these products, and polypropylene foam is widely favored for this purpose. Additionally, the food and beverage industry is seeing increased demand for items like hot and cold catering boxes, cake rings, synthetic corks, and wine packs, which rely heavily on polypropylene foams. This rising need in the food and beverage sector is significantly driving the polypropylene foams market.

Difficulties in recycling

New materials and technologies are continuously emerging, which could potentially replace polypropylene (EPP) foam in various applications. Although EPP foam is commonly used in certain areas, it may not be as well-known or easily accessible in other regions, which can potentially affect its adoption and growth in those areas. While foam can be recycled, the process requires specialized equipment and facilities, making it more challenging. This difficulty in recycling could limit the amount of PP foam that gets recycled and impact its sustainability. Thus hampering the growth of the polypropylene foams market.

Expanded polypropylene

Expanded polypropylene (EPP) foam is increasingly being adopted in the medical field for both packaging and cushioning applications. Its lightweight nature and impact resistance make it an attractive option for medical device manufacturers who need to protect delicate instruments during shipping. The growing demand for sustainable packaging solutions, driven by companies aiming to reduce their environmental footprint and meet consumer preferences for eco-friendly products, has elevated the appeal of EPP foam. Its recyclability and light weight make it a strong candidate for sustainable packaging. Furthermore, the aerospace industry is progressively incorporating EPP foam for interior components like seating and overhead compartments. This creates opportunities for the key players in the polypropylene foams market.

The expanded polypropylene segment dominated the polypropylene foams market in 2023. Expanded Polypropylene (EPP) is a versatile closed-cell bead foam known for its exceptional properties, such as excellent energy absorption, multiple impact resistance, and thermal insulation. It also offers buoyancy, resistance to water and chemicals, a high strength-to-weight ratio, and is fully recyclable. Due to these performance benefits, including energy management, lightweight nature, enhanced functionality, and durability, EPP is widely used by automotive manufacturers. Its recyclability further adds to its advantage in the industry.

The extruded polypropylene segment is expected to show the fastest growth in the polypropylene foams market over the forecast period. Extruded polypropylene (XPP) foam is made by processing a blend of polypropylene resin through an extrusion process. It boasts a range of impressive properties, including high impact resistance, water and chemical resistance, excellent strength, thermal insulation, and recyclability. These versatile characteristics make XPP foam popular across various industries, such as automotive, construction, and packaging. Its lightweight nature, resistance to moisture, and ability to retain shape also make it a preferred choice for many key applications. Additionally, XPP foam is eco-friendly and recyclable, which improves its appeal for sustainable use.

The packaging segment led the polypropylene foams market in 2023. The growth can be attributed to the use of different packaging materials. Polypropylene film is highly favored for packaging applications that need to meet FDA standards because of its superior chemical resistance, low odor, and inert properties. It is widely used in various products, including shrink wrap, candy wrappers, tape liners, food wraps, cigarette packaging, diapers, and sterile wraps.

The automotive segment is projected to witness the fastest growth in the polypropylene foams market during the forecast period. 0041s consumer products, packaging, and other uses saw increased demand. The rising need for innovative solutions and the drive for expansion in the polypropylene foam market have prompted companies to adopt both organic and inorganic strategies. These efforts aim to enhance their market shares and explore growth opportunities in their respective regions.

Asia Pacific dominated the polypropylene foams market in 2023. Recently, the demand for polypropylene foams has surged in both the packaging and automotive sectors due to the rising population and growing disposable incomes in the region. This increased demand is propelling the polypropylene foams market forward. Polypropylene foams lead the market because they are fully recyclable and contribute to CO2 emissions reduction. Furthermore, due to their excellent mechanical properties, these foams can be used repeatedly over many years, even in harsh environmental conditions. The strong demand for high-quality polypropylene foams in both developing and recovering developed countries in the region is expected to drive market growth throughout the forecast period.

North America is anticipated to grow at a notable rate in the polypropylene foams market over the projected period. This can be attributed to the growing demand for fuel-efficient cars and the rising use of advanced materials in auto parts. Chemically stable EPP foam has become the preferred choice over existing options. The U.S. automotive industry's focus on electric and fuel-efficient vehicles has led to significant breakthroughs and technological advancements, boosting consumer interest in high-end electric cars.

Segments Covered in the Report

By Product Type

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

July 2024