January 2025

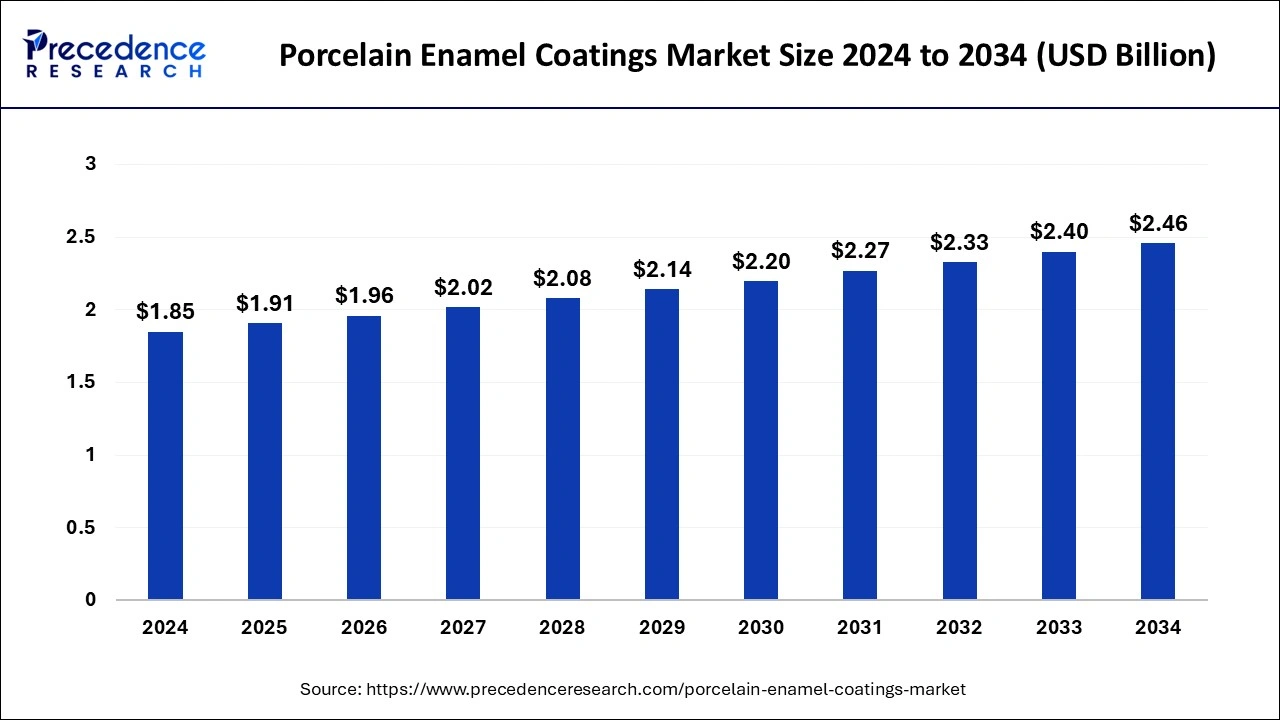

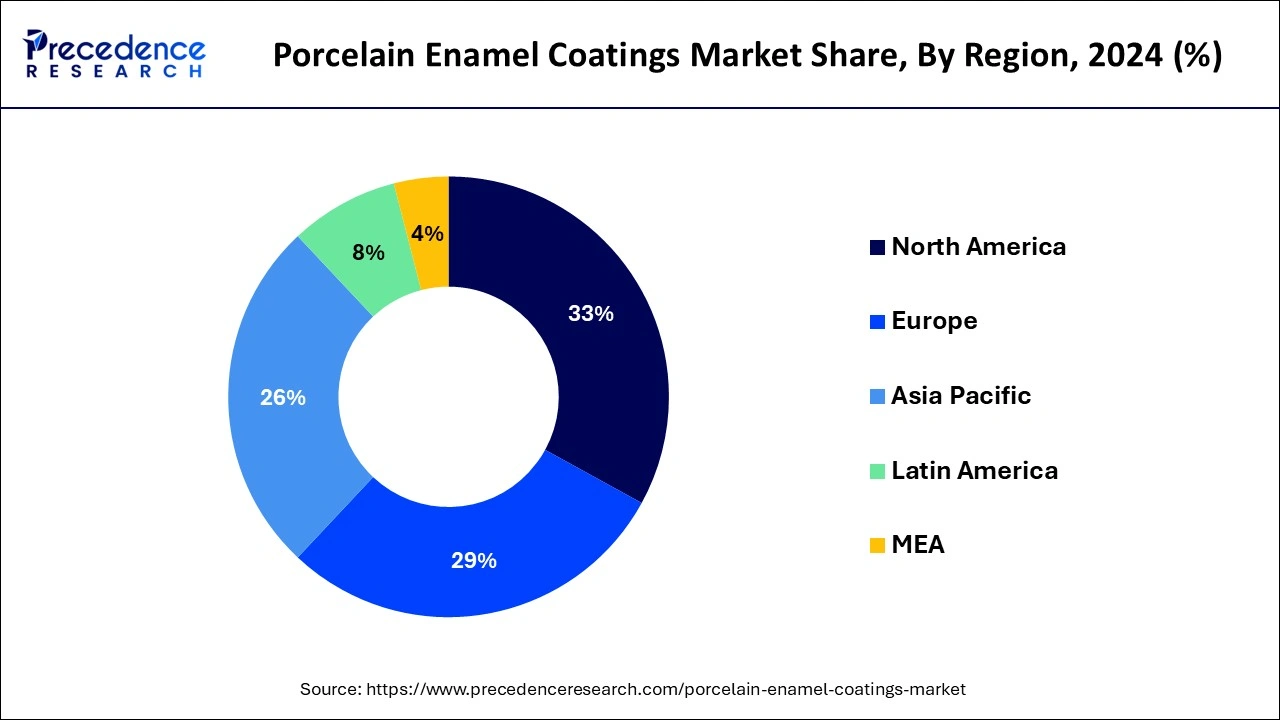

The global porcelain enamel coatings market size is calculated at USD 1.91 billion in 2025 and is forecasted to reach around USD 2.46 billion by 2034, accelerating at a CAGR of 2.89% from 2025 to 2034. The North America porcelain enamel coatings market size surpassed USD 610 million in 2024 and is expanding at a CAGR of 2.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global porcelain enamel coatings market size was estimated at USD 1.85 billion in 2024 and is predicted to increase from USD 1.91 billion in 2025 to approximately USD 2.46 billion by 2034, expanding at a CAGR of 2.89% from 2025 to 2034. Advances in porcelain enamel formulations and application processes have been made possible by ongoing research and development activities, which have improved performance attributes like adherence, flexibility, and resilience to thermal shock.

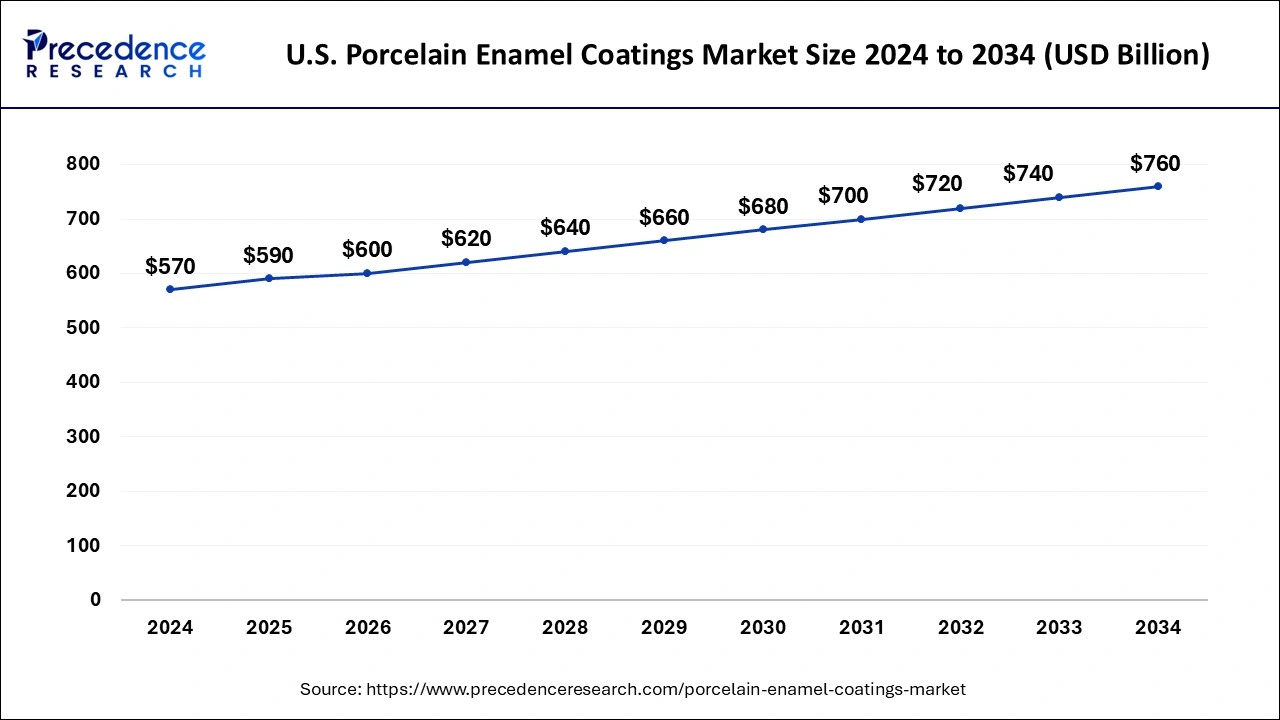

The U.S. porcelain enamel coatings market size surpassed USD 570 million in 2024 and is expected to be worth around USD 760 million by 2034 at a CAGR of 2.92% from 2025 to 2034.

North America held the largest share of the porcelain enamel coatings market in 2024 and is expected to maintain its position throughout the forecast period. The growing demand from end-use sectors, including appliances, automobiles, and construction, has propelled the market in North America in recent years. Applications for porcelain enamel coatings are numerous due to their strength, resistance to corrosion, and visual appeal.

Consumer trends favoring durable, high-quality items have an impact on the North American porcelain enamel coatings market. As a result, producers have been investing in research and development to enhance the performance and adaptability of porcelain enamel coatings. Furthermore, businesses have created eco-friendly formulas as a result of strict environmental protection legislation.

Asia Pacific is expected to witness significant growth during the forecast period. A number of reasons have contributed to the region's porcelain enamel coatings market's notable expansion. Rapid industrialization and urbanization in nations like China, India, and South Korea have increased demand for long-lasting and visually beautiful materials across a range of industries, including home appliances, automobiles, and construction.

Due to their many benefits, including resistance to heat, corrosion, and easy maintenance, porcelain enamel coatings are highly valued in these sectors. Because of their strength and resilience to weather, porcelain enamel-coated steel panels are utilized in the building industry for cladding and roofing. Similar to this, porcelain enamel coatings are used in the automotive sector to coat car parts in order to improve their appearance and prevent corrosion.

Within the more significant coatings business, the porcelain enamel coatings market is a subset that focuses on offering long-lasting, visually appealing, and corrosion-resistant coatings for a range of substrates, such as ceramics, glass, and metal. Because of reasons like growing demand from end-use industries like appliances, cookware, sanitaryware, and architectural applications, the market for porcelain enamel coatings has been increasing steadily.

The degree of industrialization, consumer tastes, and regional economic conditions all influence the market's size and growth trajectory. The durability of porcelain enamel coatings makes them valuable for applications requiring long-term protection. These circumstances include dampness, chemicals, and abrasion. Thus, the market is growing because of ongoing research and development initiatives that are producing improvements in coating formulations, application strategies, and surface preparation processes.

The smooth and glossy finish provided by the coatings amplifies the products' visual attractiveness and drives up demand for them in markets that include kitchenware, bathroom fixtures, and architectural elements. Demand for sustainable porcelain enamel coatings that adhere to environmental rules is rising as there is a greater focus on eco-friendly coatings and restrictions that limit the use of certain chemicals.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.91 Billion |

| Market Size by 2034 | USD 2.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Resin, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Long-term cost savings

The longevity and resilience of porcelain enamel coatings against abrasion, corrosion, and wear are well-known factors driving the growth of the porcelain enamel coatings market. When compared to other types of coatings, products coated with porcelain enamel often have a longer lifespan, meaning fewer replacements or repairs are required more frequently. Excellent thermal insulation is a feature of certain porcelain enamel coatings, which can help reduce energy use in appliances and cookware.

Over the course of the coated product's lifespan, lower operating expenses may result from reduced energy use. In order to guarantee consistent performance and lifespan, porcelain enamel coatings are frequently subjected to stringent quality control techniques during manufacturing. This quality control can lead to fewer flaws and malfunctions, which lowers warranty claims and related costs.

Competition from alternatives

Powder coatings come in a variety of colors and finishes, are very durable, and are resistant to chemicals. They are heated to create a hard, protective covering after being applied as a dry powder. Ceramic coatings offer superior resistance to corrosion and high temperatures. They are frequently utilized in harsh environments, like industrial equipment and automobile exhaust systems.

In the porcelain enamel coatings market, paints and varnishes are examples of organic coatings that provide versatility in terms of color and finish choices. They are extensively utilized in many different industries, including as consumer products, construction, and automotive. Glass coatings offer a non-porous, easy-to-clean, and easily maintained surface. Architectural applications including windows, doors, and facades frequently use them.

Renewable energy infrastructure

Infrastructure for renewable energy is frequently subjected to challenging environmental factors, such as dampness, salt spray, and chemical exposure. Excellent corrosion resistance is offered by porcelain enamel coatings, which prolongs the life of important sections including frames, support systems, and other metallic components. In comparison to alternative coating solutions, porcelain enamel coatings are often easier to clean and maintain because of their smooth, non-porous surfaces that resist the accumulation of dirt and grime.

Numerous porcelain enamel coatings are devoid of heavy metals and volatile organic compounds (VOCs), making them environmentally benign. This helps renewable energy projects achieve their sustainability objectives by reducing their environmental impact and guaranteeing regulatory compliance. This creates various opportunities in the porcelain enamel coatings market.

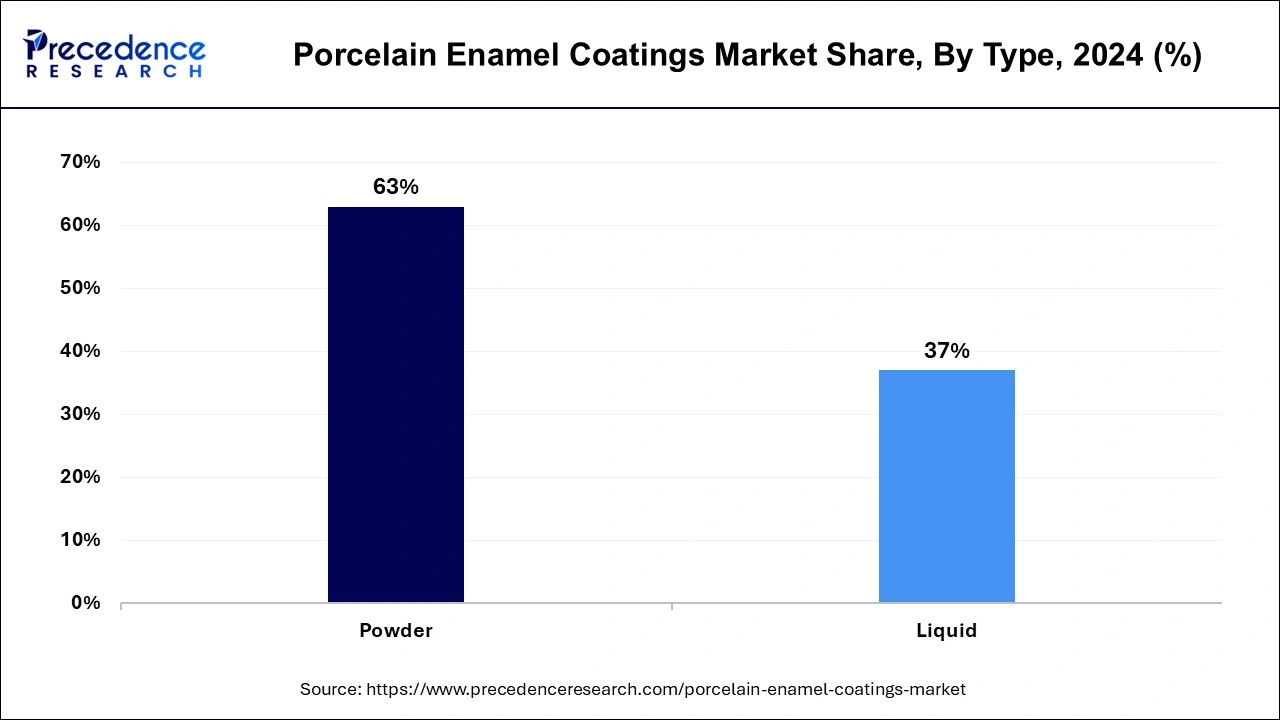

The powder segment dominated the porcelain enamel coatings market in 2024 and is expected to continue this dominance during the forecast period. The way that these coatings are applied is referred to as the powder segment in the market. To satisfy the varied needs of different sectors and applications, the powder segment of the market may vary in terms of formulas, colors, and specialized qualities.

Powder coatings are evolving along with technology, providing better performance qualities and more application options. Finely powdered pigment and resin particles are electrostatically charged and sprayed onto a surface to create powder coatings, a dry finishing technique. After adhering to the surface, the charged particles are heated to form a rigid, long-lasting finish.

The liquid segment has generated market share of around 37% in 2024 and is expected to grow at a notable CAGR over the forecast period. Coatings with longevity and resistance to chemicals, abrasion, and corrosion are sought after by both consumers and industries. These characteristics make liquid porcelain enamel coatings popular options for a variety of applications. The demand for eco-friendly coatings is driven by rising emissions and hazardous substance use rules.

Producers are creating formulations for liquid enamel that are both environmentally friendly and functional. Liquid coatings are excellent for a variety of architectural surfaces, including panels, facades, and cladding, due to their aesthetic appeal and versatility. High-quality coatings for automotive components are in greater demand as the automotive industry grows due to growing consumer demand and technical improvements.

The cookware and bakeware segment held the largest share of the porcelain enamel coatings market in 2024. To generate a non-stick cooking surface, porcelain enamel coatings are frequently added to the interior surfaces of skillets and frying pans. They are, therefore, well-liked for cooking delicate meals like fish and eggs. The adaptability of porcelain enamel-coated Dutch ovens is highly valued. Their capacity to hold heat evenly makes them suitable for frying, baking, stewing, and braising.

Baking sheets coated with porcelain enamel provide a long-lasting, non-stick surface for cookies, pastries, and other baked products. They are resistant to warping and scratching under extreme temperatures, for baking savory foods like lasagna, casseroles, and gratins, casserole dishes with porcelain enamel coverings are perfect. Food does not stick to the non-porous surface, making cleanup easy.

The appliances segment is projected to witness substantial growth during the forecast period. Cookware with a porcelain enamel coating is widely used because it is easy to clean and has non-stick qualities. Pots, pans, and skillets are among the many items that porcelain enamel is used to cover. The interiors of many ovens and stoves have porcelain enamel coatings for simple cleaning and heat resistance. The drums of washing machines and dryers have porcelain enamel coatings that prevent rust and corrosion.

Due to their long lifespan and attractive appearance, porcelain enamel-coated sinks and bathtubs are frequently seen in kitchens and bathrooms. Porcelain enamel coatings, which offer resistance to rust and corrosion, are commonly seen on the cooking surfaces of outdoor grills and barbecues. Certain lighting fixtures, especially those used outside, may be coated with porcelain enamel to fend off corrosion and weathering.

The epoxy resin coatings segment holds a significant share of the global porcelain enamel coatings market. A wide range of industries, including construction, cookware, appliances, and automotive, use porcelain enamel coatings because of their remarkable qualities, which include toughness, resistance to chemicals, and aesthetic appeal.

Epoxy resin coatings are frequently used to improve the functionality and aesthetics of porcelain enamel items, either as a base or topcoat. Excellent adherence to metal substrates is a critical component of epoxy resin-based coatings, assuring the durability and dependability of the enamel coating system. Epoxy resin coatings are perfect for applications where the coated items are subjected to hostile conditions or regular wear and tear because they offer high resistance to corrosion, abrasion, and chemicals.

The acrylic resin coating segment is projected to grow at a substantial rate during the forecast period. Acrylic resin coatings offer exceptional resilience against a range of environmental elements, including moisture, ultraviolet light, and chemicals. They are, therefore, appropriate for uses where the coating must endure challenging circumstances. Compared to other resin systems, they are less likely to yellow or discolor. Thus, the coated surface will keep its original appearance and color for a more extended amount of time.

Acrylic resin coatings are easy to deal with during the production process since they may be applied in a variety of ways, such as spray, brush, or dip coating. Additionally, they dry relatively quickly, which can increase production effectiveness, when compared to alternative coating alternatives, acrylic resin coatings are frequently preferred for their low volatile organic compound (VOC) content and environmental friendliness.

By Type

By Resin

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025